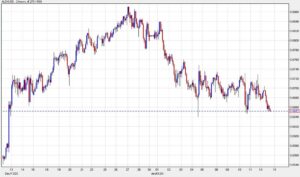

USDCAD daily chart

The weather is cooling off in Canada but the currency has heated up.

USD/CAD fell to a four-month low today despite some US dollar strength elsewhere. Bank of Canada governor Tiff Macklem helped along the move as he pushed back against rate cut talk.

"We have not started having that discussion (about cutting rates), because it's too early to have that discussion. We're still discussing whether we raised interest rates enough and how long they need to stay where they are," he said.

He did offer a nod that "conditions increasingly appear to be in place to get us (to 2% inflation" but the loonie stayed strong.

Housing is a big risk to the Canadian economy in the months ahead as mortgages continue to renew but market-driven rates are down significantly and that diminishes the odds of a hard landing while also putting some money back in Canadians' pockets.

This week, RBC released its monthly spending tracker that showed Black Friday holiday spending was up 7% from year-ago levels. In November as a whole, they noted strong sales at clothing stores and an increase in retail sales overall, even after adjusting for inflation.

A potential tailwind for the loonie next year would be a soft landing combined with stimulus from China. That could meaningfully push up commodity prices and improve Canada's terms of trade.

For now, I don't think you can fight the momentum in the Canadian dollar. It rose on Friday despite softness in equities and a general 'risk off' trade. Flows are going to dominate into year end but economic sentiment is improving and that should send USD/CAD down to 1.32.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexlive.com/news/usdcad-falls-to-the-lowest-since-august-whats-next-20231215/

- :has

- :is

- :not

- :where

- $UP

- 1

- 2%

- 2% Inflation

- 32

- a

- About

- adjusting

- After

- against

- ahead

- along

- also

- an

- and

- appear

- ARE

- AS

- At

- AUGUST

- back

- Bank

- bank of canada

- Bank of Canada governor

- BE

- because

- Big

- Black

- Black Friday

- but

- CAN

- Canada

- Canadian

- Canadian Dollar

- Canadians

- China

- Clothing

- combined

- commodity

- commodity prices

- conditions

- continue

- could

- Currency

- Cut

- cutting

- daily

- Despite

- DID

- discussing

- discussion

- Dollar

- dominate

- don

- down

- Early

- Economic

- economy

- elsewhere

- end

- enough

- Equities

- Ether (ETH)

- Even

- Falls

- fight

- Flows

- For

- Friday

- from

- General

- get

- going

- Governor

- Hard

- Have

- having

- he

- helped

- Holiday

- How

- HTTPS

- i

- improve

- improving

- in

- Increase

- increasingly

- inflation

- interest

- Interest Rates

- into

- IT

- jpg

- landing

- levels

- Long

- Low

- lowest

- Macklem

- Momentum

- money

- monthly

- months

- Mortgages

- move

- Need

- next

- noted

- November

- now

- Odds

- of

- off

- offer

- on

- overall

- Place

- plato

- Plato Data Intelligence

- PlatoData

- pockets

- potential

- Prices

- Push

- pushed

- Putting

- raised

- Rate

- Rates

- rbc

- RE

- retail

- Retail Sales

- Risk

- ROSE

- s

- Said

- sales

- send

- sentiment

- should

- showed

- significantly

- since

- Soft

- some

- Spending

- started

- stay

- stayed

- Still

- stimulus

- stores

- strength

- strong

- T

- Tailwind

- Talk

- terms

- that

- The

- they

- think

- Tiff Macklem

- to

- today

- too

- trade

- us

- US Dollar

- USD/CAD

- was

- we

- Weather

- week

- What

- whether

- while

- whole

- with

- would

- year

- you

- zephyrnet