Overview

Tianmei

Beverage Group Corporation Limited is a Chinese company based in Guangzhou with

two arms to the business. The

first is as a distributor and promoter of packaged food products, placing

different suppliers’ goods at convenience stores and supermarkets. The second

is a bottled water company that sells water produced by a Chinese water

processing plant they have a contract with. They are using the Prospectus to

raise 10 million dollars, selling 25% of the company in the process. The money will be used to buy the

water bottling plant they currently source their water from and to start

importing Australian food products to China

and promoting it at their contracted stores.

Beverage Group Corporation Limited is a Chinese company based in Guangzhou with

two arms to the business. The

first is as a distributor and promoter of packaged food products, placing

different suppliers’ goods at convenience stores and supermarkets. The second

is a bottled water company that sells water produced by a Chinese water

processing plant they have a contract with. They are using the Prospectus to

raise 10 million dollars, selling 25% of the company in the process. The money will be used to buy the

water bottling plant they currently source their water from and to start

importing Australian food products to China

and promoting it at their contracted stores.

Valuation

From

a pure valuation perspective, Tianmei China is a fantastic deal. According to

the Prospectus they made a profit of over 4.3 million dollars in the first half

of 2016, and the IPO values the company at 34 million, meaning the Price to

Earnings (P/E) ratio is well under five if you annualised those earnings. On

top of this, both arms of the business are in massive growth areas: The bottled

water market in China has seen double digit annual growth due to pollution

concerns and the growth in demand for Australian food and health products in

China has been astronomical. You can see this in the impressive premiums that

the market places on any Australian company that is exposed to Chinese

consumers: Bellamy’s was trading at a P/E of 40 a little while ago, and even

after sacking their CEO and concerns about their accounting, the share price

has only shrunk to a P/E of 10. The A2 Milk company is trading at a massive P/E

ratio of 68 and Blackmores is trading at a P/E of 20 largely thanks to growth

potential in China.

a pure valuation perspective, Tianmei China is a fantastic deal. According to

the Prospectus they made a profit of over 4.3 million dollars in the first half

of 2016, and the IPO values the company at 34 million, meaning the Price to

Earnings (P/E) ratio is well under five if you annualised those earnings. On

top of this, both arms of the business are in massive growth areas: The bottled

water market in China has seen double digit annual growth due to pollution

concerns and the growth in demand for Australian food and health products in

China has been astronomical. You can see this in the impressive premiums that

the market places on any Australian company that is exposed to Chinese

consumers: Bellamy’s was trading at a P/E of 40 a little while ago, and even

after sacking their CEO and concerns about their accounting, the share price

has only shrunk to a P/E of 10. The A2 Milk company is trading at a massive P/E

ratio of 68 and Blackmores is trading at a P/E of 20 largely thanks to growth

potential in China.

It’s

basically impossible to come up with a valuation that isn’t higher than

Tianmei’s listing price using a discounted cash flow analysis. Even if you put

a ridiculously high discount rate of 20% and assume a conservative growth rate

of 6% for the next 8 years before levelling off to 1%, you still end up with a

company value of over $40 million. The way I see it then, if you are evaluating

this stock, investigating the exact growth rate of the bottled water market or

Chinese supermarket conditions is a waste of time, as whatever you come up with

is going to show the stock is a good buy. Instead, the simple question for any

potential investor is can we trust this company? As a

relatively unknown company operating in a country that doesn’t exactly have a

spotless reputation for good corporate governance, it is hard not to be

suspicious. The story they are selling through their accounts is one that

anyone would want to invest in. The question is, is this story true?

basically impossible to come up with a valuation that isn’t higher than

Tianmei’s listing price using a discounted cash flow analysis. Even if you put

a ridiculously high discount rate of 20% and assume a conservative growth rate

of 6% for the next 8 years before levelling off to 1%, you still end up with a

company value of over $40 million. The way I see it then, if you are evaluating

this stock, investigating the exact growth rate of the bottled water market or

Chinese supermarket conditions is a waste of time, as whatever you come up with

is going to show the stock is a good buy. Instead, the simple question for any

potential investor is can we trust this company? As a

relatively unknown company operating in a country that doesn’t exactly have a

spotless reputation for good corporate governance, it is hard not to be

suspicious. The story they are selling through their accounts is one that

anyone would want to invest in. The question is, is this story true?

Personnel

According

to John Hempton, a role model of mine and someone who inspired me to start this

blog, the best way to find out if a company is dodgy is to look at the history

of the key management personnel. Hempton’s hedge fund Bronte Capital does just

that, following people who they believe have been involved with companies that

were fraudulent for potential targets to short sell.

to John Hempton, a role model of mine and someone who inspired me to start this

blog, the best way to find out if a company is dodgy is to look at the history

of the key management personnel. Hempton’s hedge fund Bronte Capital does just

that, following people who they believe have been involved with companies that

were fraudulent for potential targets to short sell.

Unfortunately,

it’s hard to find nearly any English information on most of the key people in

the company and I don’t speak Mandarin, so the only person I can really look

into is the chairman, an Australian guy called Tony Sherlock. Tony Sherlock has

been around for a long time in the M & A and finance world. He was the

chairman of Australian Wool Corporation, worked at PWC in the risk division for

ten years and co-founded Bennelong capital, a boutique corporate advisory firm. Judging by his Linkedin profile

he looks like he is in his late sixties at the youngest, as he finished a

Bachelor of Economics in 1969. Would a guy nearing the end of a successful

career working risk his reputation promoting a company that wasn’t above board?

It seems unlikely. He’s built up a solid reputation for himself over the years

and it would be strange for him to risk it that late in his career. Of course

nothing is certain, and it’s possible he’s got some secret gambling condition

that makes him desperate for cash or simply doesn’t know that the company is

fraudulent, but overall it seems like a positive sign that he is the Chairman.

it’s hard to find nearly any English information on most of the key people in

the company and I don’t speak Mandarin, so the only person I can really look

into is the chairman, an Australian guy called Tony Sherlock. Tony Sherlock has

been around for a long time in the M & A and finance world. He was the

chairman of Australian Wool Corporation, worked at PWC in the risk division for

ten years and co-founded Bennelong capital, a boutique corporate advisory firm. Judging by his Linkedin profile

he looks like he is in his late sixties at the youngest, as he finished a

Bachelor of Economics in 1969. Would a guy nearing the end of a successful

career working risk his reputation promoting a company that wasn’t above board?

It seems unlikely. He’s built up a solid reputation for himself over the years

and it would be strange for him to risk it that late in his career. Of course

nothing is certain, and it’s possible he’s got some secret gambling condition

that makes him desperate for cash or simply doesn’t know that the company is

fraudulent, but overall it seems like a positive sign that he is the Chairman.

History

One

of the initial things that made me suspicious of Tianmei is its age, as

according to the prospectus the

company only started in 2013. Trying to unpick the exact history of Tianmei

China is a painstaking undertaking, as there are a ridiculous amount of holding

companies that have been created along with business name changes. As far as I can

understand it though, it looks like the Tianmei business was created in 2013 by

Guangdong Gewang, a Guangzhou based business started in 2010 that sells

supplements of selenium, a chemical element that Guangdong Gewang claim is

vital to human health. While I was initially suspicious of a company selling a

supplement that I’d never heard of, after doing some research it actually looks

legitimate. Although selenium deficiency is very rare in the West, apparently

it is a problem in some parts of China due to crops being grown in selenium

deficient soil. During a restructure in 2015 Guangdong Gewang separated the

selenium supplement business from the water and FMCG businesses, and as a

result created Tianmei. Interestingly enough, Guangdong Gewang is applying for

admission to the Nasdaq for their own IPO currently. Guangdong Gewang still

hold 22.5% of Tianmei through Biotechnlogy Holding Ltd, a company incorporated

in the British Virgin Islands. (Both these companies seem to have a real love

of the British Virgin Islands, Tianmei’s ownership also is funnelled through a

British Virgin Islands company.) While the history isn’t exactly stable, there

are no obvious red flags I could find to turn me off investing in Tianmei.

of the initial things that made me suspicious of Tianmei is its age, as

according to the prospectus the

company only started in 2013. Trying to unpick the exact history of Tianmei

China is a painstaking undertaking, as there are a ridiculous amount of holding

companies that have been created along with business name changes. As far as I can

understand it though, it looks like the Tianmei business was created in 2013 by

Guangdong Gewang, a Guangzhou based business started in 2010 that sells

supplements of selenium, a chemical element that Guangdong Gewang claim is

vital to human health. While I was initially suspicious of a company selling a

supplement that I’d never heard of, after doing some research it actually looks

legitimate. Although selenium deficiency is very rare in the West, apparently

it is a problem in some parts of China due to crops being grown in selenium

deficient soil. During a restructure in 2015 Guangdong Gewang separated the

selenium supplement business from the water and FMCG businesses, and as a

result created Tianmei. Interestingly enough, Guangdong Gewang is applying for

admission to the Nasdaq for their own IPO currently. Guangdong Gewang still

hold 22.5% of Tianmei through Biotechnlogy Holding Ltd, a company incorporated

in the British Virgin Islands. (Both these companies seem to have a real love

of the British Virgin Islands, Tianmei’s ownership also is funnelled through a

British Virgin Islands company.) While the history isn’t exactly stable, there

are no obvious red flags I could find to turn me off investing in Tianmei.

Ownership

One

of the things I like about this IPO is that the initial listing at least isn’t

just a way for the owners to cash in. As a jaded, though still cautious

believer in the theoretical benefits of capitalism, it’s nice to see an IPO

doing what a stock market is meant to do; allocating capital to a business that

wants to grow.

of the things I like about this IPO is that the initial listing at least isn’t

just a way for the owners to cash in. As a jaded, though still cautious

believer in the theoretical benefits of capitalism, it’s nice to see an IPO

doing what a stock market is meant to do; allocating capital to a business that

wants to grow.

A

strange thing about the ownership structure is that the equal largest

shareholder with 22.5% ownership is a woman called Han Xu, an Executive Director who from her photo

looks to be in her mid-twenties. How does someone who finished their bachelor’s

degree in 2011 and a Masters of International Finance in 2013, afford 7.2

million dollars’ worth of shares in the company? Perhaps a more basic question

is how can someone who left university three years ago and never studied law

end up as the ‘legal expert’ and executive director of a soon to be publicly

listed entity, when fully qualified lawyers of her age are still working 70

hour weeks as Junior Associates? The most obvious explanation would be she is

the daughter of someone important. After doing some digging around I found that

one of the co-founders of the original Selenium supplement company was a guy

called Wei Xu. While I don’t know how common the Xu last name is in China, it

seems reasonable to assume that they could be related.

strange thing about the ownership structure is that the equal largest

shareholder with 22.5% ownership is a woman called Han Xu, an Executive Director who from her photo

looks to be in her mid-twenties. How does someone who finished their bachelor’s

degree in 2011 and a Masters of International Finance in 2013, afford 7.2

million dollars’ worth of shares in the company? Perhaps a more basic question

is how can someone who left university three years ago and never studied law

end up as the ‘legal expert’ and executive director of a soon to be publicly

listed entity, when fully qualified lawyers of her age are still working 70

hour weeks as Junior Associates? The most obvious explanation would be she is

the daughter of someone important. After doing some digging around I found that

one of the co-founders of the original Selenium supplement company was a guy

called Wei Xu. While I don’t know how common the Xu last name is in China, it

seems reasonable to assume that they could be related.

Is

this potential Nepotism enough to be a concern? I don’t really think so. While

she might not be the most qualified person for the job, If anything it’s

reassuring that the co-founders of the company are maintaining their holdings.

The third largest shareholder of Tianmei is a guy called Mengdi Zhang, whose

father Shili Zhang was another initial co-founder of the Selenium business

according to Guangdong Gewang’s filings for their Nasdaq IPO.

this potential Nepotism enough to be a concern? I don’t really think so. While

she might not be the most qualified person for the job, If anything it’s

reassuring that the co-founders of the company are maintaining their holdings.

The third largest shareholder of Tianmei is a guy called Mengdi Zhang, whose

father Shili Zhang was another initial co-founder of the Selenium business

according to Guangdong Gewang’s filings for their Nasdaq IPO.

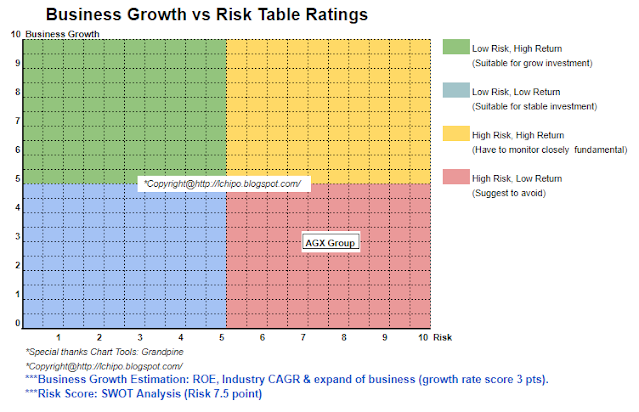

Verdict

Overall

I think this looks to be a pretty good IPO. While of course there are always

risks with investing in a company this young and especially one operating in a

foreign country, the price is low enough to make it worthwhile. It seems the

listing is about both raising capital as well as creating a link with Australia

so they can start importing Australian foods, which perhaps explains why they

have listed at such a low price; the benefits for them isn’t just the capital

they intend to raise. If the market gains confidence that Tianmei is

legitimate, the company could well double its market capitalization in the next 12 months

and I will definitely be along for the ride.

I think this looks to be a pretty good IPO. While of course there are always

risks with investing in a company this young and especially one operating in a

foreign country, the price is low enough to make it worthwhile. It seems the

listing is about both raising capital as well as creating a link with Australia

so they can start importing Australian foods, which perhaps explains why they

have listed at such a low price; the benefits for them isn’t just the capital

they intend to raise. If the market gains confidence that Tianmei is

legitimate, the company could well double its market capitalization in the next 12 months

and I will definitely be along for the ride.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://theiporeview.blogspot.com/2017/01/tianmei-beverage-group-corporation_25.html

- :has

- :is

- :not

- $10 million

- $UP

- 10

- 12

- 12 months

- 20

- 2010

- 2011

- 2013

- 2015

- 2016

- 22

- 40

- 7

- 70

- 8

- a

- About

- above

- According

- Accounting

- Accounts

- actually

- After

- age

- ago

- along

- also

- Although

- always

- amount

- an

- analysis

- and

- annual

- Another

- any

- anyone

- anything

- Applying

- ARE

- areas

- arms

- around

- AS

- associates

- assume

- At

- Australia

- Australian

- Australian company

- based

- basic

- Basically

- BE

- been

- before

- being

- believe

- believer

- benefits

- BEST

- BEVERAGE

- Blog

- Blue

- board

- both

- bottling

- British

- British Virgin

- British Virgin Islands

- built

- business

- businesses

- but

- buy

- by

- called

- CAN

- capital

- capitalism

- Career

- Cash

- cash flow

- cautious

- ceo

- certain

- chairman

- Changes

- chemical

- China

- chinese

- claim

- clear

- Co-founder

- co-founders

- color

- COM

- come

- Common

- Companies

- company

- Concern

- Concerns

- condition

- conditions

- confidence

- conservative

- Consumers

- contract

- convenience

- convenience stores

- Corporate

- corporate governance

- CORPORATION

- could

- country

- course

- created

- Creating

- crops

- Currently

- deal

- definitely

- Degree

- Demand

- different

- Digit

- Director

- Discount

- distributor

- Division

- do

- does

- Doesn’t

- doing

- dollars

- Dont

- double

- due

- during

- Earnings

- Economics

- element

- end

- English

- enough

- entity

- equal

- especially

- Ether (ETH)

- evaluating

- Even

- exactly

- executive

- Executive Director

- Explains

- explanation

- exposed

- fantastic

- far

- filings

- finance

- finance world

- Find

- First

- five

- flags

- flow

- fmcg

- following

- food

- foods

- For

- foreign

- found

- fraudulent

- from

- fully

- fund

- Gains

- Gambling

- going

- good

- goods

- got

- governance

- Group

- Grow

- grown

- Growth

- Guangdong

- Guangzhou

- Guy

- Half

- Hard

- Have

- he

- Health

- heard

- hedge

- hedge fund

- her

- High

- higher

- him

- himself

- his

- history

- hold

- holding

- Holdings

- hour

- How

- http

- human

- i

- if

- important

- importing

- impossible

- impressive

- in

- Incorporated

- information

- initial

- initially

- inspired

- instead

- intend

- International

- into

- Invest

- investing

- investor

- involved

- IPO

- Islands

- IT

- ITS

- Job

- John

- just

- Key

- Know

- largely

- largest

- Last

- Late

- Law

- Lawyers

- least

- left

- legitimate

- like

- Limited

- LINK

- LinkedIn profile

- Listed

- listing

- little

- Long

- long time

- Look

- LOOKS

- love

- Low

- Ltd

- M & A

- made

- maintaining

- make

- MAKES

- management

- mandarin

- Margin

- Market

- massive

- me

- meaning

- meant

- might

- Milk

- million

- million dollars

- mine

- model

- money

- months

- more

- most

- name

- Nasdaq

- nearing

- nearly

- never

- next

- nice

- no

- normal

- nothing

- obvious

- of

- off

- on

- ONE

- only

- operating

- or

- original

- out

- over

- overall

- own

- owners

- ownership

- packaged

- parts

- People

- perhaps

- person

- Personnel

- perspective

- photo

- Places

- placing

- plant

- plato

- Plato Data Intelligence

- PlatoData

- Pollution

- positive

- possible

- potential

- pretty

- price

- Problem

- process

- processing

- Produced

- Products

- Profile

- Profit

- promoting

- prospectus

- publicly

- put

- PWC

- qualified

- question

- raise

- raising

- raising capital

- RARE

- Rate

- ratio

- real

- really

- reasonable

- reassuring

- Red

- Red Flags

- related

- relatively

- reputation

- research

- restructure

- result

- Ride

- Risk

- risks

- Role

- Second

- Secret

- see

- seem

- seems

- seen

- sell

- Selling

- Sells

- Share

- shareholder

- Shares

- she

- Short

- show

- sign

- Simple

- simply

- So

- soil

- solid

- some

- Someone

- Soon

- Source

- speak

- stable

- start

- started

- Still

- stock

- stock market

- stores

- Story

- strange

- structure

- studied

- successful

- such

- supplement

- supplements

- suspicious

- targets

- ten

- than

- thanks

- that

- The

- The Capital

- The West

- their

- Them

- then

- theoretical

- There.

- These

- they

- thing

- things

- think

- Third

- this

- those

- though?

- three

- Through

- time

- to

- Tony

- top

- Trading

- trebuchet

- true

- Trust

- trying

- TURN

- under

- understand

- university

- unknown

- unlikely

- used

- using

- Valuation

- value

- Values

- very

- Virgin

- vital

- want

- wants

- was

- Waste

- Water

- Way..

- we

- Weeks

- WELL

- were

- West

- What

- whatever

- when

- which

- while

- white

- WHO

- whose

- why

- will

- with

- woman

- worked

- working

- world

- worth

- worthwhile

- would

- years

- you

- young

- Youngest

- zephyrnet

- zhang