Overview

Sienna Cancer

Diagnostics are seeking to raise 6 million dollars, with an indicative market capitalization

based on full subscription of just under 37.5 million. Shares are being offered

at 20 cents each.

Diagnostics are seeking to raise 6 million dollars, with an indicative market capitalization

based on full subscription of just under 37.5 million. Shares are being offered

at 20 cents each.

Sienna

was originally founded in 2002. The company’s focus is the development of

diagnostic tools for cancer, and more specifically using tests that look at

levels of Telomarese in the body to aid in diagnosis. I spent around 10 minutes

clicking on links on Wikipedia trying to understand what exactly Telomarese is,

but I quickly realised it goes well beyond whatever I can remember from year 10

science. Instead, as usual I will do my best to evaluate the Sienna IPO using the tools available to an average investor.

was originally founded in 2002. The company’s focus is the development of

diagnostic tools for cancer, and more specifically using tests that look at

levels of Telomarese in the body to aid in diagnosis. I spent around 10 minutes

clicking on links on Wikipedia trying to understand what exactly Telomarese is,

but I quickly realised it goes well beyond whatever I can remember from year 10

science. Instead, as usual I will do my best to evaluate the Sienna IPO using the tools available to an average investor.

IPO’s in the

biotechnology space can be broadly broken down into two categories:

Pre-revenue, where all the company has is an idea and maybe some patents, and

post-revenue, where the company has a proven method of generating revenue, and

is now looking to ramp things up. Sienna Cancer Diagnostics falls awkwardly

somewhere in the middle. While technically Sienna has been receiving revenue

from product sales since 2015, if you exclude research and development

expenses, revenue for the first six months of FY2017 was $291,588. There are

small café’s that turn over more money than that. It’s an unusual time to list,

as the immediate question is why Sienna didn’t hold off until the listing until they had demonstrated their growth potential.

biotechnology space can be broadly broken down into two categories:

Pre-revenue, where all the company has is an idea and maybe some patents, and

post-revenue, where the company has a proven method of generating revenue, and

is now looking to ramp things up. Sienna Cancer Diagnostics falls awkwardly

somewhere in the middle. While technically Sienna has been receiving revenue

from product sales since 2015, if you exclude research and development

expenses, revenue for the first six months of FY2017 was $291,588. There are

small café’s that turn over more money than that. It’s an unusual time to list,

as the immediate question is why Sienna didn’t hold off until the listing until they had demonstrated their growth potential.

Background

Like many companies,

Sienna’s past does not seem to be as straightforward and linear as the

Prospectus would like you to believe.

Sienna’s past does not seem to be as straightforward and linear as the

Prospectus would like you to believe.

In January 2015, Sienna Cancer Diagnostics announced

their first sales agreements with a Major American pathology company. Kerry

Hegarty, the CEO at the time gave an interview to The Age, where she explained that “ …Sienna has succeeded where other cancer

diagnostic ventures have failed because it has been able to stay an unlisted

company so far.” Hegarty goes on to talk about the flexibility of being an

unlisted company when you are still in a pre-revenue stage.

their first sales agreements with a Major American pathology company. Kerry

Hegarty, the CEO at the time gave an interview to The Age, where she explained that “ …Sienna has succeeded where other cancer

diagnostic ventures have failed because it has been able to stay an unlisted

company so far.” Hegarty goes on to talk about the flexibility of being an

unlisted company when you are still in a pre-revenue stage.

4 months after giving

this interview Hegarty left Sienna Cancer Diagnostics. Later that same year in

September, Street Talk reported the

company was planning a 10 million-dollar IPO with Pac Partners as lead manager.

Did Hegarty leave because she felt that the company’s decision to list was

premature? I have no idea.

this interview Hegarty left Sienna Cancer Diagnostics. Later that same year in

September, Street Talk reported the

company was planning a 10 million-dollar IPO with Pac Partners as lead manager.

Did Hegarty leave because she felt that the company’s decision to list was

premature? I have no idea.

For whatever reason, the 10

million-dollar IPO with Pac Partners did not eventuate, and the company is now

listing 18 months later raising only 6 million with the much smaller lead

manager Sequoia

Corporate Finance. A CEO leaving a company and an IPO being

delayed aren’t exactly unusual occurences, but it would be interesting to get

some background on why both these events happened.

million-dollar IPO with Pac Partners did not eventuate, and the company is now

listing 18 months later raising only 6 million with the much smaller lead

manager Sequoia

Corporate Finance. A CEO leaving a company and an IPO being

delayed aren’t exactly unusual occurences, but it would be interesting to get

some background on why both these events happened.

Financials

As mentioned earlier,

Sienna has largely relied on government rebates and Australia’s very generous

research and development tax incentive program for revenue. I take the view that

if the company is going to achieve long term success, it will need to

eventually stop relying on government handouts and therefore these

revenue streams should be excluded from any analysis.

Sienna has largely relied on government rebates and Australia’s very generous

research and development tax incentive program for revenue. I take the view that

if the company is going to achieve long term success, it will need to

eventually stop relying on government handouts and therefore these

revenue streams should be excluded from any analysis.

The worrying thing is though, once you take this money

out revenue has gone backwards from 2016 to 2017. In 2016, Sienna’s first full

year of receiving product revenue, the company had annual revenue of $640,664

excluding government rebates, or $320,332 every six months. The first six

months of FY17 saw revenue of only $291,588, a pretty sizeable decrease at a time you would naturally expect revenue to grow.

out revenue has gone backwards from 2016 to 2017. In 2016, Sienna’s first full

year of receiving product revenue, the company had annual revenue of $640,664

excluding government rebates, or $320,332 every six months. The first six

months of FY17 saw revenue of only $291,588, a pretty sizeable decrease at a time you would naturally expect revenue to grow.

While there may be

legitimate reasons for the decline in revenue, it is not addressed anywhere in

the Prospectus that I could find. The decline in revenue also puts into

question Sienna’s chosen listing date. August is an interesting time to

list, as it means the prospectus does not include the full FY17 numbers, even

though the financial year is over by the time the offer closes. The cynic in me

says that if the FY17 numbers were any good the IPO would be delayed a couple

of months, as strong FY17 numbers would make the IPO a much more

straightforward process.

legitimate reasons for the decline in revenue, it is not addressed anywhere in

the Prospectus that I could find. The decline in revenue also puts into

question Sienna’s chosen listing date. August is an interesting time to

list, as it means the prospectus does not include the full FY17 numbers, even

though the financial year is over by the time the offer closes. The cynic in me

says that if the FY17 numbers were any good the IPO would be delayed a couple

of months, as strong FY17 numbers would make the IPO a much more

straightforward process.

To further illustrate

the odd timing of the listing, the balance sheet as of January 2017 showed over

1.5 million dollars in cash, vs annual expenses of around $570,000. Whatever was

behind the decision to list before FY17 numbers were available, it wasn’t because

the company was about to run out of money.

the odd timing of the listing, the balance sheet as of January 2017 showed over

1.5 million dollars in cash, vs annual expenses of around $570,000. Whatever was

behind the decision to list before FY17 numbers were available, it wasn’t because

the company was about to run out of money.

Shareholders

Sienna have not put

any voluntary escrow arrangements in place, so a key question for any potential

investor is who the existing shareholders are, and how likely they would be to

dump their shares as soon as the company lists.

any voluntary escrow arrangements in place, so a key question for any potential

investor is who the existing shareholders are, and how likely they would be to

dump their shares as soon as the company lists.

Earlier articles

about Sienna mention the ex-CEO of Macquarie Allan Moss as one of the main

shareholders and backers. Interestingly enough, his name does not appear in the

current prospectus, so either he has sold out completely, or now holds less

than 5% of the company. Why a shrewd investor like Moss would sell-out before

an IPO is another question a prospective investor should probably think about.

about Sienna mention the ex-CEO of Macquarie Allan Moss as one of the main

shareholders and backers. Interestingly enough, his name does not appear in the

current prospectus, so either he has sold out completely, or now holds less

than 5% of the company. Why a shrewd investor like Moss would sell-out before

an IPO is another question a prospective investor should probably think about.

Instead, the current

largest shareholder is now someone called David Neate, who owns just over 10%

of the company. I was immediately curious about who this person was, as I could

not find him listed on the board or the senior management team of the company.

After digging around online, the only information I could find on him was in

regards to Essential Petroleum Resources Limited, a now delisted oil and gas

exploration company that someone called David Neate (and I’m aware it might not

be the same guy) held 12.6% of in October 2007.

largest shareholder is now someone called David Neate, who owns just over 10%

of the company. I was immediately curious about who this person was, as I could

not find him listed on the board or the senior management team of the company.

After digging around online, the only information I could find on him was in

regards to Essential Petroleum Resources Limited, a now delisted oil and gas

exploration company that someone called David Neate (and I’m aware it might not

be the same guy) held 12.6% of in October 2007.

There

is an October 2008 Hot

Copper thread where someone wondered why Neate

was unloading so many shares in Petroleum Resources Limited. A few months after

the post in January 2009, shares fell to below 1 cent following unfavourable

drilling announcements and the company delisted later that year.

is an October 2008 Hot

Copper thread where someone wondered why Neate

was unloading so many shares in Petroleum Resources Limited. A few months after

the post in January 2009, shares fell to below 1 cent following unfavourable

drilling announcements and the company delisted later that year.

Of course, there are

perfectly reasonable explanations for a major investor deciding to offload

shares, but it’s not really the sort of information you want to find when you

start googling the major shareholder of a potential investment.

perfectly reasonable explanations for a major investor deciding to offload

shares, but it’s not really the sort of information you want to find when you

start googling the major shareholder of a potential investment.

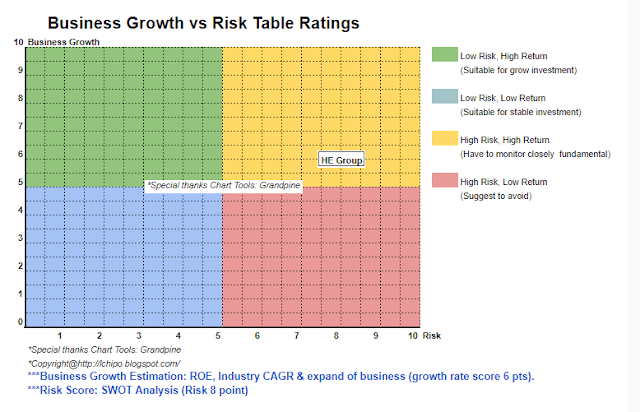

Verdict

As this is an IPO in an area where I have no

technical knowledge, I am acutely aware that I could be completely off the mark

with my analysis. If using Telomarese to diagnose cancer proves to be the next

big breakthrough, this could easily be the IPO of the year. However, if I’m

going to invest in a company that’s actual product revenue is less than one

fiftieth of the indicative market capitalisation, I would at least want to see

revenue growth, not revenue going backwards. Furthermore, the small amount

being raised does make me wonder if the IPO is more about existing shareholders

unloading stock than actually raising capital. Contributed equity is listed on

the balance sheet as only 16.6 million, which means at least some initial

investors would still be making significant profits if they unload their shares well below the initial listing price.

technical knowledge, I am acutely aware that I could be completely off the mark

with my analysis. If using Telomarese to diagnose cancer proves to be the next

big breakthrough, this could easily be the IPO of the year. However, if I’m

going to invest in a company that’s actual product revenue is less than one

fiftieth of the indicative market capitalisation, I would at least want to see

revenue growth, not revenue going backwards. Furthermore, the small amount

being raised does make me wonder if the IPO is more about existing shareholders

unloading stock than actually raising capital. Contributed equity is listed on

the balance sheet as only 16.6 million, which means at least some initial

investors would still be making significant profits if they unload their shares well below the initial listing price.

While I may well live to regret it, this is one IPO I will not be taking part in.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://theiporeview.blogspot.com/2017/07/sienna-cancer-diagnostics.html

- :has

- :is

- :not

- :where

- $UP

- 000

- 1

- 10

- 12

- 13

- 16

- 20

- 2015

- 2016

- 2017

- a

- Able

- About

- Achieve

- actual

- actually

- addressed

- After

- agreements

- Aid

- All

- also

- am

- American

- amount

- an

- analysis

- and

- announced

- annual

- ANNUAL REVENUE

- Another

- any

- anywhere

- appear

- ARE

- AREA

- around

- arrangements

- articles

- AS

- At

- AUGUST

- available

- average

- aware

- backers

- background

- Balance

- Balance Sheet

- based

- BE

- because

- been

- before

- behind

- being

- believe

- below

- BEST

- Beyond

- Big

- biotechnology

- board

- body

- both

- breakthrough

- broadly

- Broken

- but

- by

- called

- CAN

- Cancer

- capital

- Capitalisation

- capitalization

- Cash

- categories

- cent

- ceo

- chosen

- clear

- Closes

- color

- COM

- Companies

- company

- Company’s

- completely

- contributed

- Copper

- Corporate

- could

- Couple

- course

- curious

- Current

- Date

- David

- Deciding

- decision

- Decline

- decrease

- Delayed

- demonstrated

- Development

- diagnosis

- diagnostic

- diagnostics

- DID

- do

- does

- dollars

- down

- drilling

- dump

- each

- Earlier

- easily

- either

- enough

- equity

- escrow

- essential

- evaluate

- Even

- events

- eventually

- Every

- exactly

- excluded

- excluding

- existing

- expect

- expenses

- explained

- exploration

- Failed

- Falls

- far

- felt

- few

- financial

- Find

- First

- Flexibility

- Focus

- following

- For

- Founded

- from

- full

- further

- Furthermore

- GAS

- gave

- generating

- generous

- get

- Giving

- Goes

- going

- gone

- good

- Government

- Grow

- Growth

- growth potential

- Guy

- had

- happened

- Have

- he

- Held

- him

- his

- hold

- holds

- How

- However

- HTML

- http

- HTTPS

- i

- idea

- if

- illustrate

- immediate

- immediately

- in

- Incentive

- include

- indicative

- information

- initial

- instead

- interesting

- Interview

- into

- Invest

- investment

- investor

- Investors

- IPO

- IT

- January

- just

- Key

- knowledge

- large

- largely

- largest

- later

- lead

- least

- Leave

- leaving

- left

- legitimate

- less

- levels

- like

- likely

- Limited

- links

- List

- Listed

- listing

- Lists

- live

- Long

- Look

- looking

- Main

- major

- make

- Making

- management

- Management Team

- manager

- many

- mark

- Market

- Market capitalisation

- Market Capitalization

- May..

- maybe

- me

- means

- mention

- mentioned

- method

- Middle

- might

- million

- million dollars

- minutes

- money

- months

- more

- moss

- much

- my

- name

- Need

- next

- no

- None

- normal

- now

- numbers

- october

- of

- off

- offer

- offered

- Oil

- Oil and Gas

- on

- once

- ONE

- online

- only

- or

- originally

- Other

- out

- over

- owns

- part

- partners

- past

- Patents

- pathology

- perfectly

- person

- Petroleum

- Place

- planning

- plato

- Plato Data Intelligence

- PlatoData

- Post

- potential

- Premature

- pretty

- price

- probably

- process

- Product

- profits

- Program

- prospective

- prospectus

- proven

- proves

- put

- Puts

- question

- quickly

- raise

- raised

- raising

- raising capital

- Ramp

- really

- reason

- reasonable

- reasons

- rebates

- receiving

- regards

- regret

- relying

- remember

- Reported

- research

- research and development

- Resources

- revenue

- revenue growth

- Run

- sales

- same

- saw

- says

- Science

- see

- seeking

- seem

- senior

- September

- Sequoia

- shareholder

- Shareholders

- Shares

- she

- sheet

- should

- showed

- significant

- since

- SIX

- Six months

- small

- smaller

- So

- so Far

- sold

- some

- Someone

- somewhere

- Soon

- Space

- specifically

- spent

- Stage

- start

- stay

- Still

- stock

- Stop

- straightforward

- streams

- strong

- subscription

- success

- Take

- taking

- Talk

- tax

- team

- Technical

- technically

- term

- tests

- than

- that

- The

- their

- There.

- therefore

- These

- they

- thing

- things

- think

- this

- though?

- time

- timing

- to

- tools

- trebuchet

- trying

- TURN

- two

- under

- understand

- until

- unusual

- using

- usual

- Ventures

- very

- View

- voluntary

- vs

- want

- was

- WELL

- were

- What

- whatever

- when

- which

- while

- white

- WHO

- why

- Wikipedia

- will

- with

- wonder

- worrying

- would

- year

- you

- zephyrnet