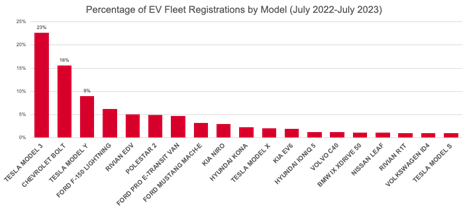

With consumer demand for electric vehicles appearing to reach a plateau for the moment, automakers are finding new customers for their EV stock: daily rental, corporate, and government fleets. And the top seller into those fleets is Tesla — constituting nearly one-third of fleet purchases of EVs over the trailing 13 months.

This makes a certain sense, as Tesla is building EVs at volumes unmatched by any other OEM. But other brands are joining the fleet fray as well. Exposing consumers to EV technology via rental cars and corporate fleets can be seen as a savvy marketing move — especially for a legacy OEM trying to nibble away at Tesla's dominant market share.

As for individual models, the Tesla Model 3 is the No. 1 EV nameplate sold into fleets. The Tesla sedan is a key element of an ongoing deal between Tesla and Hertz for the automaker to supply 100,000 units to the rental car company.

Recent S&P Global Mobility registration data show the Tesla Model 3, Chevrolet Bolt, and Tesla Model Y as the three highest registered EVs for fleet use for the trailing 13 months through July 2023. Fleet sales are often sporadic and timed to certain buying cycles. For instance, Tesla sold more than 13,500 Model 3s into fleets in December 2022 and January 2023 combined and had spikes of about 4,300 units in both July and October 2022, but otherwise, fleet sales have been relatively low-key.

Similarly, the Chevrolet Bolt has seen significant year-over-year increases in fleet sales in 2023, while both the Hyundai Kona and Polestar 2 showed fleet spikes in June 2023.

Note: Graphic shows only the top 20 models

Source: S&P Global Mobility new vehicle registrations to fleets, July 2022-July 2023

©2023 S&P Global Mobility

Offering EVs as rentals doesn't just benefit automakers. There is growing popularity among rental fleet firms to offer trendy new vehicles to their customers. An EV rental offers a novel experience instead of the standard sedan, crossover, or minivan. It provides a way for renters, who might be EV intenders, to experience the EV lifestyle before fully committing to acquiring an EV. This could be especially true in courting women buyers, who vastly trail men in crossing the chasm to EV ownership, according to S&P Global Mobility analysis.

As such, the potential customer can sample the instant torque and one-pedal driving, as well as the real-world range of the EV, separate from a dealership test-drive. Additionally, customers can experience the public charging infrastructure. For example, the difference in Level 2 vs Level 3 charging, charging speed, Tesla vs CCS (Combined Charging Standard) charging, as well as downloading the various phone apps to access chargers — all of which have significant learning curves compared to the familiar gas station model.

Top 10 models sold to fleets | Fleet New EV Registrations |

TESLA MODEL 3 | 28,252 |

CHEVROLET BOLT | 19,502 |

TESLA MODEL Y | 11,149 |

FORD F SERIES | 7,718 |

RIVIAN EDV | 6,390 |

POLESTAR 2 | 6,128 |

FORD TRANSIT VAN | 5,929 |

FORD MUSTANG MACH-E | 3,992 |

KIA NIRO | 3,712 |

HYUNDAI KONA | 2,896 |

Source: S&P Global Mobility new vehicle registrations to fleets, July 2022-July 2023

©2023 S&P Global Mobility

Commercial and Government Fleets

Corporate and government fleets are also demonstrating the implementation of electrification initiatives to reduce their carbon footprint and align with sustainability goals by acquiring EVs. The increase in EV registrations indicates a commitment to transitioning their vehicle fleets to more environmentally friendly options.

The Chevrolet Bolt alone represents 39% of government EV fleet registrations for the trailing 13 months as of July 2023. That is as much as the entire Ford brand's government EV fleet contributions of the F-150 Lightning, Ford Transit, and Ford Mustang Mach-E.

Source: S&P Global Mobility new vehicle registrations to fleets, July 2022-July 2023

©2023 S&P Global Mobility

Automakers and fleet owners have been collaborating to ensure they provide EVs designed to meet the specific needs of fleet use — such as range, charging time, and passenger capacity. This collaboration has led to the development of products such as the Rivian EDV (electric delivery van), GM's BrightDrop, and Ford Transit EV. The US Postal Service also has a purpose-built EV on order from Oshkosh Defense.

The commitment of fleet companies and automakers to collaborate on specialized EV models reflects a collective effort towards a greener and more sustainable future. As the EV market continues to evolve, these initiatives mark a pivotal moment in the transition towards cleaner transportation solutions.

LEARN MORE ABOUT ELECTRIC VEHICLE TRENDS FROM OUR LATEST INSIGHTS AND SOLUTIONS

WILL THERE BE TOO MANY EVS ON THE SHELF?

SUBSCRIBE TO OUR TOP 10 INDUSTRY TRENDS NEWSLETTER

THE EVOLUTION OF THE EV CONSUMER

WHEN WILL THE HEARTLAND EMBRACE ELECTRIC VEHICLES?

FOR MORE AUTOMOTIVE PLANNING AND FORECASTING INSIGHTS

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/tesla-is-most-popular-ev-brand-for-us-fleet-companies-.html

- :has

- :is

- :not

- ][p

- 000

- 1

- 10

- 100

- 11

- 13

- 20

- 2022

- 2023

- 225

- 30

- 300

- 500

- 7

- 8

- 9

- a

- About

- access

- According

- acquiring

- Additionally

- align

- All

- alone

- also

- among

- an

- analysis

- and

- any

- apps

- ARE

- article

- AS

- At

- automakers

- automotive

- away

- BE

- been

- before

- benefit

- between

- Bolt

- both

- brand

- brands

- Building

- but

- buyers

- Buying

- by

- CAN

- Capacity

- car

- carbon

- carbon footprint

- cars

- certain

- charging

- chasm

- Chevrolet

- chevrolet bolt

- cleaner

- collaborate

- collaborating

- collaboration

- Collective

- combined

- commitment

- committing

- Companies

- company

- compared

- consumer

- Consumers

- continues

- contributions

- Corporate

- could

- crossing

- customer

- Customers

- cycles

- daily

- data

- deal

- December

- Defense

- delivery

- Demand

- demonstrating

- designed

- Development

- difference

- Division

- doesn

- dominant

- driving

- effort

- Electric

- electric vehicle

- electric vehicles

- element

- embrace

- ensure

- Entire

- environmentally

- environmentally friendly

- especially

- EV

- evolution

- evolve

- evs

- example

- experience

- familiar

- finding

- firms

- FLEET

- Footprint

- For

- Ford

- friendly

- from

- fully

- future

- GAS

- Global

- GM

- Goals

- Government

- graphic

- greener

- Growing

- had

- Have

- Heartland

- hertz

- highest

- HTML

- HTTPS

- Hyundai

- implementation

- in

- Increase

- Increases

- indicates

- individual

- industry

- initiatives

- insights

- instance

- instant

- instead

- into

- IT

- January

- joining

- July

- june

- just

- Key

- latest

- learning

- Led

- Legacy

- Level

- lifestyle

- lightning

- MAKES

- managed

- many

- mark

- Market

- Marketing

- Meet

- might

- mobility

- model

- models

- moment

- months

- more

- most

- Most Popular

- move

- much

- nearly

- needs

- New

- no

- novel

- october

- of

- offer

- Offers

- often

- on

- One-third

- ongoing

- only

- Options

- or

- order

- Other

- otherwise

- our

- over

- owners

- ownership

- phone

- pivotal

- planning

- plato

- Plato Data Intelligence

- PlatoData

- Popular

- popularity

- postal

- potential

- Products

- provide

- provides

- published

- purchases

- range

- ratings

- reach

- reduce

- reflects

- registered

- Registration

- relatively

- rentals

- renters

- represents

- rivian

- ROW

- s

- S&P

- S&P Global

- sales

- savvy

- seen

- sense

- separate

- service

- Shelf

- show

- showed

- Shows

- significant

- sold

- Solutions

- specialized

- specific

- speed

- spikes

- sporadic

- standard

- station

- stock

- such

- supply

- Sustainability

- sustainable

- sustainable future

- T

- table

- Technology

- Tesla

- than

- that

- The

- their

- There.

- These

- they

- this

- those

- three

- Through

- time

- Timed

- to

- too

- top

- Top 10

- towards

- trail

- transit

- transition

- transitioning

- transportation

- Trends

- true

- trying

- units

- unmatched

- us

- use

- various

- vehicle

- Vehicles

- via

- volumes

- vs

- was

- Way..

- WELL

- which

- while

- WHO

- will

- with

- Women

- XML

- zephyrnet