Open Finance Report | Nov 23, 2023

‘Open Finance’ is at the forefront of financial innovation, promising to redefine how we interact with financial data.

The recent OECD report on “Open Finance Policy Considerations” offers a comprehensive analysis of this paradigm shift, highlighting its potential benefits, inherent risks, and the critical considerations for successful implementation.

What is Open Finance

Open Finance extends the principles of Open Banking with broader access to and sharing of financial data beyond mere payment information. This expansion paves the way for improved financial products and services, fostering an environment of customer empowerment, innovation, and heightened competition. The consumer, now at the center, gains unprecedented control and choice over their financial data, enabling personalized financial solutions tailored to individual needs.

With Great Data Comes Great Responsibility

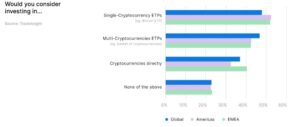

The OECD report underscores significant concerns regarding security and privacy in Open Finance. A notable percentage of respondents in a European Commission survey expressed apprehensions about the risks associated with granting service providers access to their data. This highlights a crucial aspect of Open Finance – the need for robust consent mechanisms and transparent data sharing practices.

See: 3 examples of what open finance can do right now

The success of Open Finance hinges on user uptake, which in turn is dependent on the trust consumers place in these new frameworks. Aligning with the G20/OECD High-Level Principles on Financial Consumer Protection, Open Finance must ensure adequate consumer protection and trust-building measures. Moreover, achieving interoperability across sectors and geographies is vital for the seamless exchange and utilization of financial data.

Policy Considerations

- Embracing technology neutrality ensures that the same rules apply across the board, irrespective of the technological means.

- The implementation of comprehensive privacy and data protection safeguards is non-negotiable, as these are the bedrock of consumer trust and the overall efficacy of Open Finance systems.

- Clear role definitions, in line with data protection regulations, are essential to maintain clarity and accountability within the ecosystem.

See: Open data for finance as an emerging source of GDP growth

Conclusion

The report emphasizes the need for careful consideration of various factors in implementing Open Finance, including customer trust, data protection, interoperability, and policy frameworks that support innovation while safeguarding consumer interests.

Download the 48 page PDF report –> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/oecd-2023-key-insights-on-open-finance-policies/

- :is

- 150

- 2018

- 2023

- 23

- 250

- a

- About

- access

- accountability

- achieving

- across

- affiliates

- aligning

- alternative

- alternative finance

- an

- analysis

- and

- Apply

- ARE

- artificial

- artificial intelligence

- AS

- aspect

- Assets

- associated

- At

- Banking

- become

- benefits

- Beyond

- blockchain

- board

- broader

- cache

- CAN

- Canada

- careful

- Center

- choice

- clarity

- closely

- comes

- commission

- community

- competition

- comprehensive

- Concerns

- consent

- consideration

- considerations

- consumer

- Consumer Protection

- Consumers

- control

- create

- critical

- Crowdfunding

- crucial

- cryptocurrency

- customer

- data

- data protection

- data sharing

- decentralized

- definitions

- digital

- Digital Assets

- distributed

- do

- ecosystem

- Education

- efficacy

- emerging

- emphasizes

- empowerment

- enabling

- engaged

- ensure

- ensures

- Environment

- essential

- Ether (ETH)

- European

- european commission

- examples

- exchange

- expansion

- expressed

- extends

- factors

- finance

- financial

- financial data

- financial innovation

- financial products

- fintech

- For

- forefront

- fostering

- frameworks

- from

- funding

- funding opportunities

- Gains

- GDP

- gdp growth

- geographies

- get

- Global

- Government

- granting

- great

- Growth

- heightened

- helps

- High

- high-level

- highlighting

- highlights

- hinges

- How

- http

- HTTPS

- implementation

- implementing

- improved

- in

- Including

- individual

- industry

- information

- inherent

- Innovation

- innovative

- insights

- Insurtech

- Intelligence

- interact

- interests

- Interoperability

- investment

- irrespective

- ITS

- Jan

- jpg

- Key

- Line

- maintain

- Market

- max-width

- means

- measures

- mechanisms

- member

- Members

- mere

- more

- Moreover

- must

- Need

- needs

- networking

- New

- notable

- nov

- now

- OECD

- of

- Offers

- on

- open

- open banking

- open data

- opportunities

- or

- over

- overall

- page

- paradigm

- partners

- paves

- payment

- payments

- peer to peer

- percentage

- perks

- Personalized

- Place

- plato

- Plato Data Intelligence

- PlatoData

- please

- policies

- policy

- potential

- principles

- privacy

- Products

- Products and Services

- projects

- promising

- protection

- providers

- provides

- recent

- redefine

- regarding

- Regtech

- report

- respondents

- right

- risks

- robust

- Role

- rules

- s

- safeguarding

- same

- seamless

- Sectors

- security

- service

- service providers

- Services

- sharing

- shift

- significant

- Solutions

- Source

- stakeholders

- Stewardship

- success

- successful

- support

- Survey

- Systems

- tailored

- technological

- that

- The

- their

- These

- this

- thousands

- to

- today

- Tokens

- transparent

- Trust

- TURN

- underscores

- unprecedented

- uptake

- User

- various

- vibrant

- Visit

- vital

- Way..

- we

- What

- which

- while

- with

- within

- works

- zephyrnet