Payment Trends: Opportunities and Risks Shaping 2023

Capgemini | Nilesh Vaidya | Jan 30, 2023

Image: Capgemini

Top Trends in Payments 2023 contains Capgemini’s perspectives on the top 10 trends for the months ahead

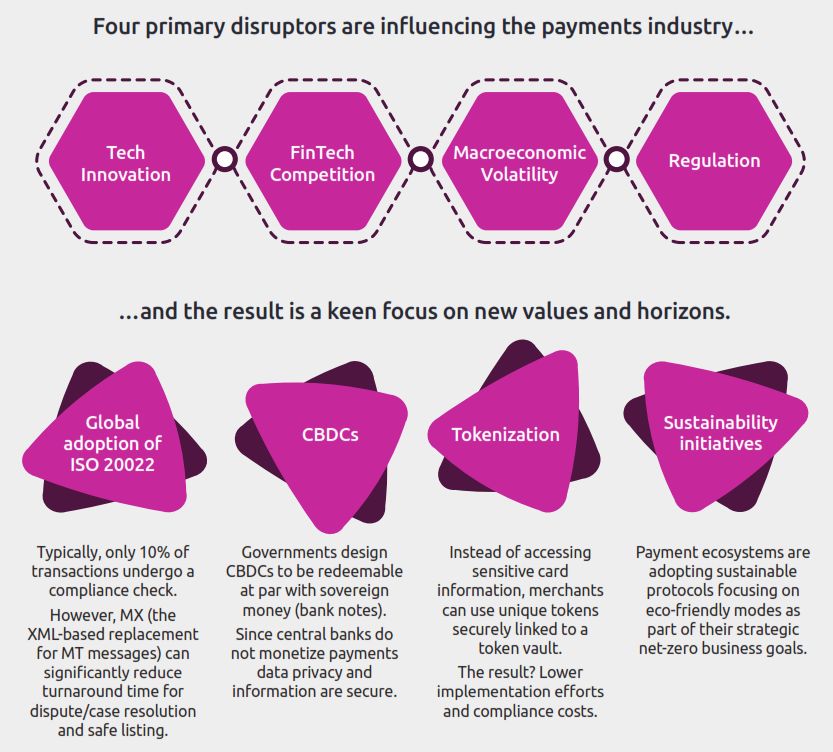

We anticipate widespread opportunity for innovation and growth. Trends include payment providers’ customer-centricity strategies such as buy-now/pay-later and embedded finance, data-safeguarding tokenization, and sustainability protocols focused on eco-friendly payment modes. Also on the radar screen are changing industry dynamics brought on by composable architecture and payment hub modernization, among other actions.

See: Payments Canada Report: Rebound & Grow – Payment Methods and Trends in 2021

Included Trends

- BNPL momentum continues despite post-pandemic macroeconomics

- Embedded finance is leveraging customer data to find new use cases

- Global adoption of ISO 20022 opens doors to data modernization

- Central banks gearing up to pilot and implement CBDCs

- Composable architecture leads to competitive efficiencies

- Real time cross border payments will improve speed and volume of regional trade

- End-to-end ecosystems are simplifying payment moderatization

- Paytech innovation and partnerships seeking to revamp SMB payments

- Tokenization for scalable and secure payment infrastructure

- Eco-friendly cards, digital payments, and cloud-based payment hubs will boost sustainability

Image: Capgemini

Continue to the full article --> here

Download the 34 page PDF --> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/payment-trends-opportunities-and-risks-shaping-2023/

- 10

- 2018

- 2021

- 2023

- 39

- a

- actions

- Adoption

- affiliates

- alternative

- among

- and

- anticipate

- architecture

- article

- Assets

- Banks

- become

- blockchain

- boost

- border

- brought

- cache

- Canada

- Capgemini

- Cards

- Category

- changing

- closely

- community

- competitive

- contains

- continues

- create

- Cross

- Crowdfunding

- cryptocurrency

- customer

- customer data

- data

- decentralized

- Despite

- digital

- Digital Assets

- Digital Payments

- distributed

- doors

- dynamics

- ecosystem

- Ecosystems

- Education

- embedded

- Embedded Finance

- engaged

- entry

- Ether (ETH)

- finance

- financial

- Find

- fintech

- focused

- from

- full

- funding

- gearing

- get

- Global

- Government

- Grow

- Growth

- helps

- HTTPS

- Hub

- implement

- improve

- in

- include

- industry

- information

- Innovation

- innovative

- Insurtech

- Intelligence

- investment

- ISO

- Jan

- Leads

- lending

- leveraging

- Market

- max-width

- member

- Members

- methods

- modernization

- modes

- Momentum

- months

- more

- networking

- New

- online

- opens

- opportunities

- Opportunity

- Other

- partners

- partnerships

- payment

- payment methods

- payments

- peer to peer

- perks

- perspectives

- pilot

- plato

- Plato Data Intelligence

- PlatoData

- please

- post-pandemic

- projects

- protocols

- provides

- radar

- rebound

- regional

- Regtech

- report

- risks

- scalable

- Screen

- Sectors

- secure

- seeking

- Services

- shaping

- simplifying

- SMB

- speed

- stakeholders

- Stewardship

- strategies

- such

- Sustainability

- TAG

- The

- thousands

- time

- Title

- to

- today

- Tokenization

- Tokens

- top

- Top 10

- transfers

- Trends

- use

- vibrant

- volume

- widespread

- will

- works

- zephyrnet