Costanoa: Insurtech Investment Themes and Opportunities

Costanoa | Jared Franklin | Jan 17, 2023

Image: Costanoa

It’s a really exciting time in the world of insurance. As in many sectors, COVID-19 accelerated the sector’s digital transformation as many insurers stepped up to the plate and faced the unprecedented challenges the pandemic posed.

- Market opportunity: Insurance is BIG business, with nearly $7 trillion in gross written premiums in 2022. But what gets VCs like me even more excited: $1 trillion more of premiums should have been purchased, but weren’t. So, over the next decade, we expect consumers and companies to spend at least $80 trillion globally on insurance. That’s 40 Apple’s, the highest valued public company in the world.

See: Growing Trends: Insurtech and AI

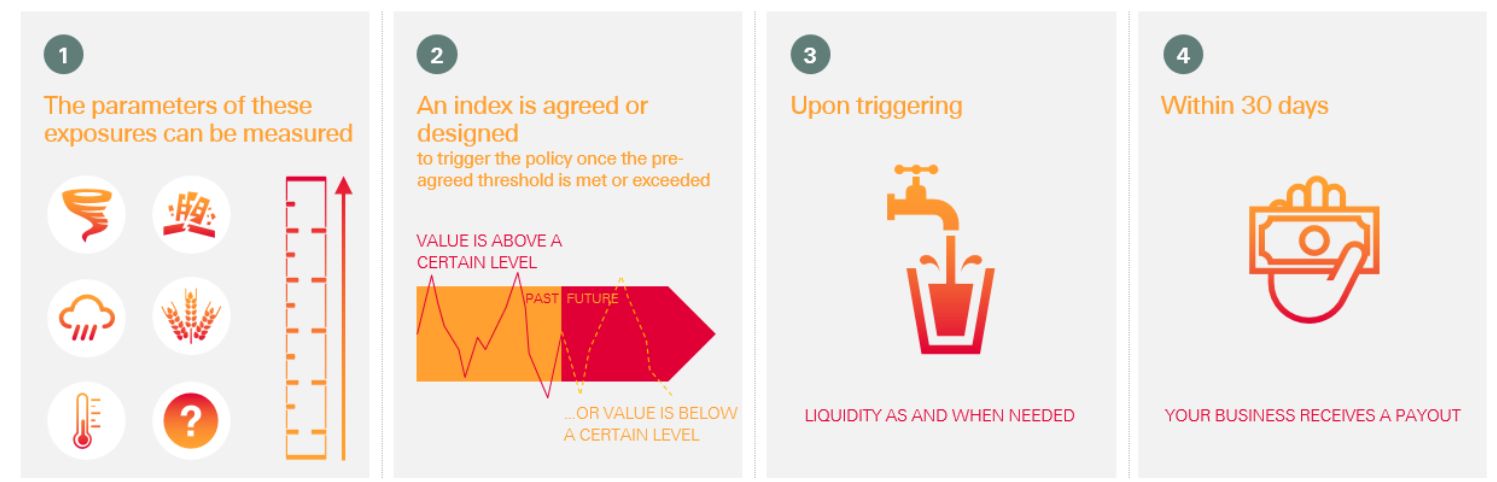

- Parametric insurance: It’s a transparent solution where the payable amount is pre-calculated, and payment is sent immediately following a triggering event.

- Climate change and digitization are two long-term trends that create a unique set of challenges (and opportunities) in the future. Companies must be armed with alternative approaches to traditional underwriting and coverage. Parametric insurance is flexible and precise, remaining a massive opportunity over the next decade.

- With parametric, a payout can take place regardless of the magnitude of physical loss, often even when there’s no physical loss at all. Parametric insurance reduces claim management costs, and is useful for policyholders because it:

- Is highly customized.

- Provides immediate payouts.

- Complements traditional insurance policies, filling gaps and exclusions.

- Is transparent and confidence-inspiring, removing the need for a long, uncertain investigation. There’s far less fine-print.

See: Here is why InsurTech is heating up as an investment category

- Through embedding and personalizing, insurers can improve their operational efficiency and customer experiences by going beyond risk-transfer obligations.

- Simon Torrance estimates embedded insurance could grow from 1% today to 16% of the total global insurance distribution (~$1.5t of gross written premium) over the next ten years – $500b in the US alone, $200b in Europe. Even more interesting, it could contribute to growing market’s overall size, adding another $1t in net new gross written premium.

- Big tech and product manufacturers have recently begun selling embedded insurance products.

- Revolut has been offering insurance through partnerships with Chubb and Allianz.

- Amazon ran a trial with Next to offer quotes and the ability to purchase SMB insurance for Amazon Business Prime members.

- Insurify and Toyota Insurance Management Solutions partnered to provide drivers with a frictionless way to compare and buy insurance when purchasing or leasing a Toyota vehicle.

Continue to the full article --> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/costanoa-insurtech-investment-themes-and-opportunities/

- 2018

- 2022

- 39

- a

- ability

- accelerated

- affiliates

- AI

- All

- Allianz

- alone

- alternative

- Amazon

- amount

- and

- Another

- approaches

- armed

- article

- Assets

- because

- become

- Beyond

- Big

- blockchain

- business

- buy

- cache

- Canada

- Category

- challenges

- change

- Chubb

- claim

- closely

- community

- Companies

- company

- compare

- Consumers

- contribute

- Costs

- could

- coverage

- COVID-19

- create

- Crowdfunding

- cryptocurrency

- customer

- customized

- decade

- decentralized

- digital

- Digital Assets

- Digital Transformation

- distributed

- distribution

- drivers

- ecosystem

- Education

- efficiency

- embedded

- engaged

- entry

- estimates

- Ether (ETH)

- Europe

- Even

- Event

- excited

- exciting

- expect

- Experiences

- faced

- finance

- financial

- fintech

- following

- frictionless

- from

- full

- funding

- future

- get

- Global

- global insurance

- Globally

- going

- Government

- gross

- Growing

- helps

- here

- highest

- highly

- HTTPS

- immediate

- immediately

- improve

- in

- industry

- information

- Innovation

- innovative

- insurance

- insurers

- Insurtech

- Intelligence

- interesting

- investigation

- investment

- IT

- Jan

- leasing

- Long

- long-term

- Long-Term Trends

- loss

- management

- Manufacturers

- many

- Market

- massive

- max-width

- member

- Members

- more

- nearly

- Need

- net

- networking

- New

- next

- obligations

- offer

- offering

- operational

- opportunities

- Opportunity

- overall

- pandemic

- partnered

- partners

- partnerships

- payment

- payments

- payouts

- peer to peer

- perks

- physical

- Place

- plato

- Plato Data Intelligence

- PlatoData

- please

- Premium

- Prime

- Product

- Products

- projects

- provide

- provides

- public

- purchase

- purchased

- purchasing

- recently

- reduces

- Regardless

- Regtech

- remaining

- removing

- Sectors

- Selling

- Services

- set

- should

- Size

- SMB

- So

- solution

- spend

- stakeholders

- Stewardship

- Take

- tech

- ten

- The

- The Future

- the world

- their

- thousands

- Through

- time

- Title

- to

- today

- Tokens

- Total

- toyota

- traditional

- Transformation

- transparent

- Trends

- trial

- triggering

- Trillion

- Uncertain

- underwriting

- unique

- unprecedented

- us

- valued

- VCs

- vehicle

- vibrant

- What

- works

- world

- written

- years

- zephyrnet