- WTI Oil trades near $70 and briefly broke below it on Wednesday and Thursday.

- Oil outlook supports more downside as recent API and EIA data revealed substantial exports from the US

- The US Dollar (Index) dropped Thursday as Yen soared 4% at one point against the Greenback.

Oil prices are staying steady for now this Friday, around $70, after their decline throughout this week. When looking at the Oil price and events at hand, it all boils down to simple supply and demand. At the moment there is too much supply, which OPEC+ looks unable to control or limit. Meanwhile the United States is dumping every barrel available on the market to take the wind out of the sales of Russia and locally trying to push gasoline prices lower with a presidential election coming up in 2024.

Meanwhile, the US Dollar (USD) got a kick in the back from the Japanese Yen which weighed on the US Dollar Index (DXY). The Yen was up 4% in value against the US Dollar, on the back of comments from the Bank of Japan that alluded to the end of decades of negative yields. With that substantial shift in monetary policy from the Bank of Japan, traders are braced this Friday for the delayed US Jobs Report where any number below expectations might trigger another substantial amount of weakness for the US Dollar and the DXY.

Crude Oil (WTI) trades at $70.96 per barrel and Brent Oil trades at $75.65 per barrel at the time of writing.

Oil news and market movers: Supply too big

- Traders remain sceptical of the promised supply cuts from OPEC+ as these promises remain non-binding and are not obliged.

- The International Energy Agency (IEA) remains bearish on its outlook for Oil, pointing to still muted demand from China.

- Meanwhile US Shale production has been growing substantially and is one of the main reasons for the massive number in exports from the country on the Oil market.

- Markets and traders need to be on the lookout for any emergency meetings taking place by OPEC or OPEC+, and where more severe measures could be outlined that might trigger a substantial turnaround in the price action.

- Closing off Friday will be with the Baker Hughes US Oil Rig Count near 18:00 GMT. Previous was 505 with no forecast foreseen.

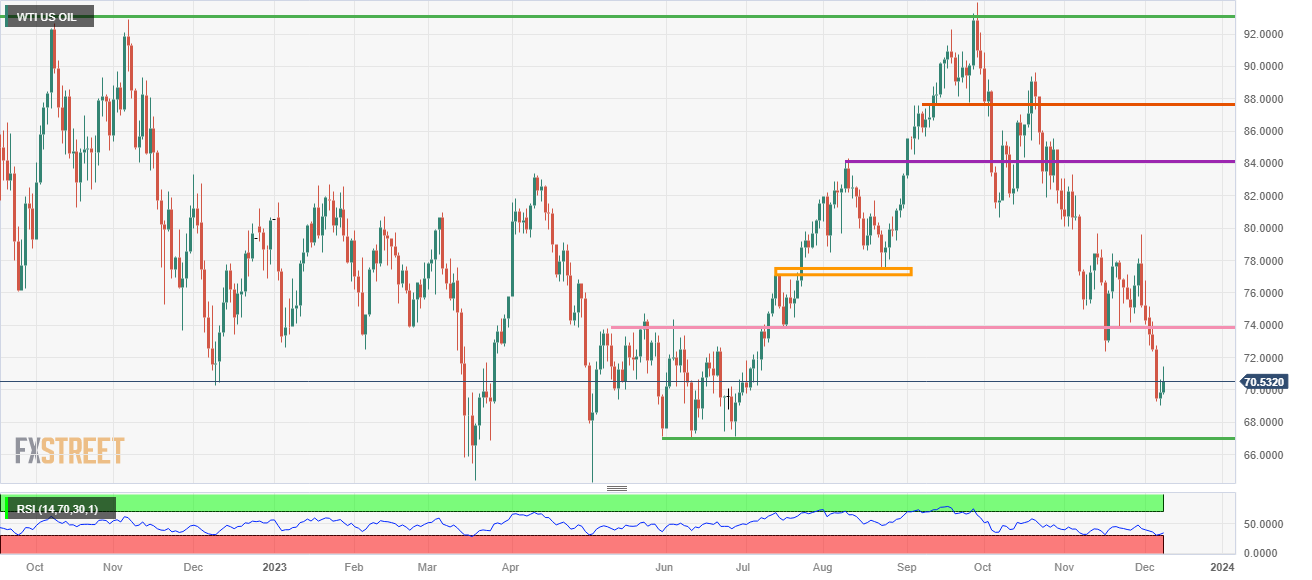

Oil Technical Analysis: OPEC+ image dented

Oil prices are facing issues, image issues to be precise. Traders are placing further bearish bets on Oil prices after OPEC+ was unable to put firm measures in place that could support the Oil prices and rather move the needle upwards instead of downwards. As long as OPEC+ can not make a united front, more downside is the only outcome with arch nemesis, the US, dumping millions of barrels per day in an already flooded Oil market.

On the upside, $80.00 is the resistance to watch out for. Should crude be able to jump above that again, look for $84.00 (purple line) as the next level to see some selling pressure or profit taking. Should Oil prices be able to consolidate above there, the topside for this fall near $93.00 could come back into play.

On the downside, the soft floor near $74.00 got broken and is gone for now. For now, $70.00 is trying to salvage the situation, though it has been breached already on Thursday and Wednesday. Watch out for $67.00, which aligns with a triple bottom from June, as the next support level to trade at.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 13 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fxstreet.com/news/oil-gets-a-breather-for-now-despite-relentless-downside-risk-202312081201

- :has

- :is

- :not

- :where

- $UP

- 13

- 2024

- 32

- 60

- a

- Able

- above

- Action

- affordable

- After

- again

- against

- agency

- Aligns

- All

- already

- also

- American

- amount

- an

- analysis

- and

- Animate

- Another

- any

- api

- ARE

- around

- AS

- Assets

- At

- available

- back

- baker

- Bank

- bank of japan

- barrels

- BE

- bearish

- because

- been

- below

- Benchmark

- Bets

- Bottom

- brent

- briefly

- Broke

- Broken

- by

- CAN

- Changes

- Chart

- China

- collectively

- come

- coming

- comments

- considered

- consolidate

- content

- control

- could

- countries

- country

- Crossroads

- crude

- Crude oil

- cuts

- daily

- data

- day

- decades

- decide

- decisions

- Decline

- Delayed

- Demand

- Disrupt

- distributed

- Dollar

- dollars

- down

- downside

- DOWNTURN

- driver

- drivers

- Drop

- dropped

- Dubai

- Dxy

- each

- easily

- effect

- EIA

- Election

- emergency

- end

- ends

- energy

- events

- Every

- expanded

- expectations

- exports

- extra

- Face

- facing

- Fall

- Falling

- FAQ

- Firm

- flooded

- Floor

- For

- Forecast

- frequently

- Friday

- from

- front

- further

- gasoline

- Global

- GMT

- gone

- got

- Government

- gravity

- Greenback

- Group

- Growing

- Growth

- hand

- High

- higher

- HTTPS

- Hub

- IEA

- if

- image

- Impact

- in

- includes

- Including

- increased

- Increases

- index

- indicate

- information

- instability

- instead

- Institute

- Intermediate

- International

- into

- inventory

- issue

- issues

- IT

- ITS

- Japan

- Japanese

- Japanese Yen

- Jobs

- jobs report

- jump

- june

- Key

- kick

- Level

- LIMIT

- Line

- locally

- Long

- Look

- looking

- LOOKS

- Low

- lower

- Main

- major

- make

- Market

- Markets

- massive

- Meanwhile

- measures

- Media

- meetings

- member

- Members

- might

- millions

- module

- moment

- more

- most

- move

- Movers

- much

- Nations

- Near

- Need

- negative

- news

- next

- no

- notable

- now

- number

- obliged

- of

- off

- often

- Oil

- oil price

- on

- ONE

- only

- opec

- opposite

- or

- organization

- Other

- out

- Outcome

- outlined

- Outlook

- per

- Petroleum

- pipeline

- Place

- placing

- plato

- Plato Data Intelligence

- PlatoData

- Play

- Point

- political

- precise

- predominantly

- presidential

- presidential election

- pressure

- previous

- price

- PRICE ACTION

- Prices

- Production

- Profit

- promised

- promises

- published

- Push

- Pushing

- put

- quality

- rather

- reasons

- recent

- referred

- refers

- refined

- reflect

- relatively

- reliable

- remain

- remains

- report

- Reports

- Resistance

- respectively

- Results

- Revealed

- rig

- Russia

- sales

- Sanctions

- see

- Selling

- severe

- Shale

- shift

- should

- Shows

- similar

- Simple

- since

- situation

- soared

- Soft

- sold

- some

- sourced

- stands

- starts

- States

- staying

- steady

- Still

- substantial

- substantially

- such

- supply

- Supply and Demand

- support

- support level

- Supports

- Take

- taking

- Technical

- Technical Analysis

- ten

- texas

- that

- The

- their

- There.

- These

- this

- this week

- though?

- three

- thursday

- Thus

- tighten

- time

- to

- too

- trade

- traded

- Traders

- trades

- trigger

- Triple

- trying

- Tuesday

- type

- types

- unable

- United

- United States

- Upside

- upwards

- us

- US Dollar

- US Dollars

- US Jobs Report

- US oil

- USD

- usually

- value

- via

- vice

- was

- Watch

- weaker

- weakness

- Wednesday

- week

- weekly

- West

- when

- which

- WHO

- will

- wind

- with

- within

- writing

- WTI

- WTI Crude

- Yen

- yields

- zephyrnet