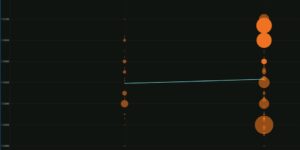

The major US stock indices have turned back into negative territory after extending higher after the favorable inflation and growth numbers from the University of Michigan sentiment survey.

For the

- Dow Industrial Average it traded as high asup 144.6 points. It is currently trading down 10 points or -0.03% at 36107.

- The S&P index traded as high as +20.73 points. It is currently down -4.6 points or -0.10% at 4581.50.

- Finally, the Nasdaq index traded as high as 75.90 points. It is currently down -6.2 points or -0.04% at 14333.74.

The high price for the NASDAQ today reached 14415. That took the price above the highest closing level for 2023 at 14358.02. However, like last week’s high, the break failed. The prices back below that high closing level for the year.

For the trading week:

- Dow Industrial Average is down -0.36%

- S&P index is down -0.27%

- Nasdaq index is still clinging to a 0.19% gain

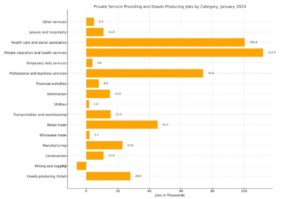

Today, the US jobs report was stronger, but so was wage inflation. The Michigan consumer sentiment showed stronger sentiment, current conditions, and expectations but also showed lower inflation expectations for one and five years. That Goldilocks scenario initially took stocks higher, but we are seeing some reluctance as rates move back toward highs for the day and European traders look toward the exits.

- The 2-year yield is up 14.5 basis points at 4.725%.

- The 10-year yield is up 13.1 basis points at 4.260%

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexlive.com/technical-analysis/not-so-fast-sp-and-dow-indices-turn-back-in-the-red-for-the-dayweek-20231208/

- :is

- :not

- ][p

- $UP

- 1

- 10

- 13

- 14

- 2023

- 50

- 73

- 75

- 90

- a

- above

- After

- also

- and

- ARE

- AS

- At

- average

- back

- basis

- below

- Break

- but

- closing

- conditions

- consumer

- consumer sentiment

- Current

- Currently

- day

- dow

- down

- European

- exits

- expectations

- extending

- Failed

- FAST

- favorable

- five

- For

- from

- Growth

- Have

- High

- higher

- highest

- Highs

- However

- HTTPS

- in

- index

- Indices

- industrial

- inflation

- Inflation expectations

- initially

- into

- IT

- Jobs

- jobs report

- jpg

- Last

- Level

- like

- Look

- lower

- major

- Michigan

- move

- Nasdaq

- negative

- negative territory

- numbers

- of

- ONE

- or

- plato

- Plato Data Intelligence

- PlatoData

- points

- price

- Prices

- Rates

- reached

- Red

- reluctance

- report

- s

- S&P

- scenario

- seeing

- sentiment

- showed

- So

- some

- Still

- stock

- Stocks

- stronger

- Survey

- territory

- that

- The

- to

- today

- took

- toward

- traded

- Traders

- Trading

- TURN

- Turned

- university

- University of Michigan

- us

- US Jobs Report

- wage

- was

- we

- week

- year

- years

- Yield

- zephyrnet