The week ended with a bang as the US jobs data came much stronger than expectations.

- Non-farm payroll rose by 353K much higher than the 180K estimate (and the ADP rise of 107K released earlier this week). T

- Unemployment rate came in at 3.7% versus 3.8% expected

- Average yearly earnings rose by 0.6% versus 0.3% expected MoM

- Average yearly earnings rose by 4.5% versus 4.1% expected YoY

- The average workweek in hours and fall to 34.1 hours from 34.3 hours last month (that was the estimate too).

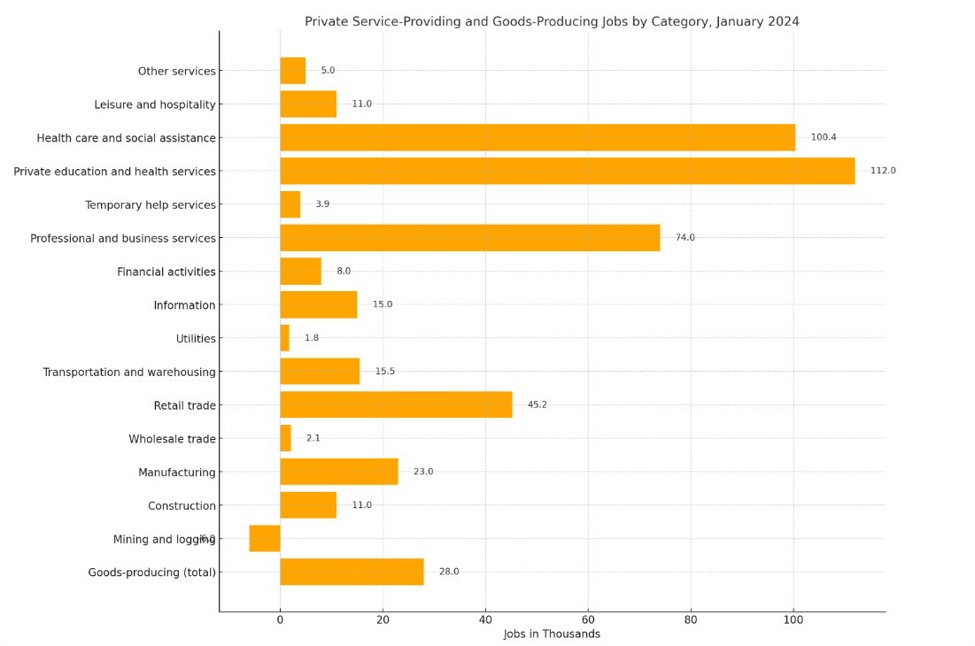

Looking at the jobs by sectors, Private education and health services led the way with a gain of 112K. Professional and business services rose by 74K. Both sectors, are relatively high-paying jobs . Manufacturing advanced by a solid 23K (another high paying sector). Leisure and hospitality - a proxy for service economy - was relatively subdued at 11.0K

Jobs by sectors

The stronger-than-expected jobs data put the wheels in motion in all markets:

The US bond yields moved higher:

Looking at the yield curve for the day:

- 2- year yield 4.372% +17.8 basis points.

- 5-year yield 3.985% +18.9 basis points.

- 10-year yield 4.023% +16.1 basis points

- 30-year yield 4.223% +12.0 basis points

Those are big moves to the upside, but for the week yields were moving lower until today and apart from the two year yield for the other part of the yield curve moved lower. That included a Fed which said a March cut was not likely and an non farm payroll that surges 353K (with large revisions too). For the week, the:

- 2-year yield rose 1.9 basis points

- 5-year yield fell -5.2 basis points

- 10-year yield fell -11.5 basis points

- 30-year yield fell -14.7 basis points

The USD surged to the upside.

Looking at the strongest to the weakest of the major currencies, the USD was the runaway winner in the rankings. The JPY was the weakest followed by the NZD.

The strongest to the weakest of the major currencies

The US stocks moved higher:

Stocks were a different story. Normally, you might expect stocks to move lower given the surge in yields and the higher USD. However, stocks moved sharply to the upside helped by

- A feeling that a strong economy is good for earnings. Who cares if the Fed holds off on lowering rates, if inflation can remain steady/not move higher/move marginally lower, that is good for stocks.

- Meta and Amazon earnings were gangbuster good. Microsoft earnings earlier this week were also good but the market still sold off their shares. For Meta, their shares rose over 20% on the day. Amazon shares were up nearly 8% but had to take a backseat.

For the day,

- Dow industrial average rose 134.58 points or 0.35% at 38654.43

- S&P index rose 52.44 points or 1.07% at 4958.62

- NASDAQ index rose 267.30 points or 1.74% at 15628.94.

For the trading week, the gains today in the index turned a negative weed into a positive week. The major indices rose for the fourth consecutive week:

- Dow Industrial Average +1.43%

- S&P index +1.38%

- NASDAQ index +1.12%

Looking at some of the other markets:

- Crude oil fell $-1.40 percent or -1.95% to $72.38. The price decline despite the strong economy, concerns about the breakdown of the cease-fire rumors in the Middle East, and also the story of retaliatory bombings by the US in response to the killing of US servicemen.

- Gold prices moved sharply lower by -$15.01 or -0.73% to $2039.54 as it reacted to higher rates and the higher USD.

- Bitcoin is trading at $42,987.

Over the weekend, an interview with Fed Chair Powell will be broadcast on the Sunday evening news program 60-Minutes. The comments will be the first from the chair after the FOMC rate decision. It is unsure if the interview was before the stronger jobs data was reported.

On Tuesday morning in Australia (evening on Monday in the US), the RBA will announce its most recent rate decision. The expectations are for no change in policy 4.35%. Also on Tuesday Cleveland Fed Pres. Mester will be speaking.

On Wednesday, Feds Kugler and Barkin will both be speaking. On Wednesday the morning in New Zealand, employment statistics for the quarter will be released

China CPI will be released on Thursday morning in China (Tuesday night in the US).

Canada employment statistics will be released on Friday.

On the earnings calendar next week:

Monday:

- Caterpillar

- McDonald's

- Palantie

Tuesday:

- Lilly

- BP

- Toyota

- Ford

- Chipotle

- Fortinet

Wednesday:

- Alibaba

- Uber

- CVS Health

- Paypal

- Disney

Thursday:

- Conoco Phillips

- Expedia

Friday:

Thank you for all your support. Have a good and safe weekend.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexlive.com/news/forexlive-americas-fx-news-wrap-2-feb-super-duper-jobs-report-sends-yields-and-stocks-up-20240202/

- :is

- :not

- ][p

- $UP

- 01

- 1

- 11

- 2%

- 23K

- 26

- 30

- 34

- 35%

- 4

- 40

- 5

- 52

- 54

- 58

- 7

- 8

- 9

- 95%

- a

- About

- adp

- advanced

- After

- All

- also

- Amazon

- Americas

- an

- and

- Announce

- Another

- apart

- ARE

- AS

- At

- Australia

- average

- bang

- basis

- BE

- before

- Big

- bond

- Bond yields

- both

- Breakdown

- broadcast

- business

- but

- by

- Calendar

- came

- CAN

- Chair

- change

- China

- cleveland

- comments

- Concerns

- consecutive

- CPI

- currencies

- curve

- Cut

- data

- day

- decision

- Decline

- Despite

- different

- Earlier

- Earnings

- East

- economy

- Education

- employment

- ended

- estimate

- evening

- expect

- expectations

- expected

- Fall

- farm

- Feb

- Fed

- Fed Chair

- Fed Chair Powell

- Feds

- feeling

- First

- followed

- FOMC

- FOMC rate decision

- For

- Fourth

- Friday

- from

- FX

- Gain

- Gains

- given

- good

- had

- Have

- Health

- health services

- helped

- High

- higher

- holds

- hospitality

- HOURS

- However

- HTTPS

- if

- in

- included

- index

- Indices

- industrial

- inflation

- Interview

- into

- IT

- ITS

- Jobs

- jobs report

- jpg

- JPY

- killing

- large

- Last

- Led

- Leisure and Hospitality

- likely

- lower

- lowering

- major

- manufacturing

- March

- marginally

- Market

- Markets

- Meta

- Microsoft

- Middle

- Middle East

- might

- Monday

- Month

- morning

- most

- motion

- move

- moved

- moves

- moving

- much

- nearly

- negative

- New

- New Zealand

- news

- next

- next week

- night

- no

- normally

- NZD

- of

- off

- Oil

- on

- or

- Other

- over

- part

- paying

- Payroll

- percent

- plato

- Plato Data Intelligence

- PlatoData

- points

- policy

- positive

- Powell

- price

- Prices

- private

- professional

- Program

- proxy

- put

- Quarter

- Rate

- Rates

- RBA

- recent

- relatively

- released

- remain

- report

- Reported

- response

- revisions

- Rise

- ROSE

- Rumors

- safe

- Said

- sector

- Sectors

- sends

- service

- Services

- Shares

- sold

- solid

- some

- speaking

- statistics

- Still

- Stocks

- Story

- strong

- stronger

- strongest

- sunday

- support

- surge

- Surged

- Surges

- Take

- than

- that

- The

- the Fed

- their

- this

- this week

- thursday

- to

- today

- too

- Trading

- Tuesday

- Turned

- two

- until

- Upside

- us

- US bond yields

- US stocks

- USD

- Versus

- was

- Way..

- Wednesday

- weed

- week

- weekend

- were

- which

- WHO

- will

- winner

- with

- wrap

- year

- yearly

- Yield

- yield curve

- yields

- you

- Your

- Zealand

- zephyrnet