Note: This article was first published on 19 Aug 2020 on the OpenNodes blog, republished here with permission.

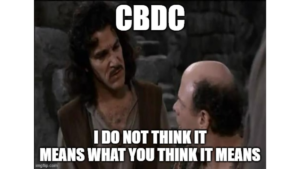

The greatest trick played on modern society is calling a whole bunch of different instruments with different credit ratings and characteristics “money”, and conflating them. It is a neat trick, and very useful in some situations, for instance when businesses invoice each other and make payments.

It is much more convenient to say “Please send me money” than to say “Can you tell your bank to reduce its debt to you, such that my bank increases its debt to me?” But by using these more accurate words, we can already get a sense that no asset, or instrument, moves all the way from end to end, but rather there are some coordinated accounting adjustments that make the appearance of an asset moving.

Conflating these different instruments and bundling them into one called “money” has enormous positive effects – it has reduced friction and created a common language which is used across the world to enhance trade.

Yet, calling everything “money” can sometimes be unhelpful when we start thinking more deeply about money. So in these cases, it is helpful to think about two things:

- The asset itself

- The medium of record

The asset itself

First let’s think about the asset, or instrument, itself. The “asset” that is being transacted (I use this word with caution, as in some contexts the word asset is typically used to mean something which precisely isn’t money – stocks, bonds etc… but not in this context). The asset itself is the IOU or the promise to repay, issued by an issuer: a central bank, a commercial bank, an e-money wallet, or other actor. It carries an inherent risk – the risk that the issuer won’t or can’t repay.

These IOU promises differ from each other – the assets are different; the money is different.

In the case of your commercial bank, the promise is that it will (usually) pay, upon your instruction, into the accounts of beneficiaries you specify – whether that’s the local supermarket, or your supplier in a foreign land.

In the case of a central bank, well, they don’t typically make commitments to an individual as to what happens if you knock on their doors with a fistful of banknotes. Perhaps they will give you newly created notes in return for your old ones. But there is certainly no commitment to make a payment on your behalf or to return you any pro-rated share of their balance sheet, and certainly not any gold.

The government, by designating some of these instruments as legal tender, has made these instruments useful for paying debts, including tax.

The instrument of money is hence characterised by the issuer and their promise. And the value of that asset is influenced by the issuer’s credit rating and users’ confidence in them.

The medium of record

The medium of record is where the money/asset/IOU is recorded. It can be recorded on paper and distributed physically; it can be recorded on paper in leather-bound journals held centrally; it can be recorded in databases unilaterally controlled by the issuer; it can be on private blockchains controlled by a known and whitelisted set of participants; or it can be on public blockchains where the record keepers are unrelated to the issuer.

And, of course, the medium of record makes a huge difference.

Consider two banks, bank Byzantine and bank Whizzy. Byzantine uses leather-bound journals for its record keeping of client accounts, Whizzy uses databases. Let’s assume that in all other respects Byzantine and Whizzy are the same – they have the same balance sheets, are the same size, have the same clients, they are both connected to the global financial system in the back end, they are both equally financially sound, and they have the same credit rating. The only difference is the way they record customer accounts.

Which bank would you rather bank at? Byzantine can probably cope with 1 transaction every second but Whizzy can handle thousands of transactions a second. Whizzy probably also has a smartphone app.

So, although the instruments are practically the same in terms of credit risk, you’d probably hold an IOU from Whizzy instead of Byzantine.

And we know this intuitively from real life. For household amounts, we might prefer one bank over another because of the user experience.

So: the medium makes a difference to the usefulness and convenience of the money.

Programmable money and CBDC

So by separating the instrument from the medium of record, we can think more clearly about this.

Programmable money is money that can be wrapped in rules that constrain general purpose money in certain ways – whether that’s only allowing it to be sent to a limited set of recipients, or perhaps holding it in escrow until a certain time has elapsed or a certain condition has been met. It may seem ironic that the ability to constrain money makes it more useful – but it’s true. Constraints are the building blocks of more transactions. For example an atomic bilateral exchange of one currency for another can be built from money that is constrained from changing hands until another condition (the other payment leg) is met.

Programmable money is dependent on the medium of record, not on the issuer. And (you guessed it) blockchains are a great medium for recording money, because blockchains allow for programmability.

Yes, yes – you don’t need a blockchain. You can do it in other ways. Actually, banks have been creating programmed money ever since I can remember – for example, a time deposit. That’s general purpose money that has been programmed in a way that allows you spend it only after the term (eg 6 months) is over. But until blockchains came along, technology has limited us to those schemes created unilaterally by individual banks, on their own terms. This has hampered the pace of financial innovation – or the pace at which money can be made more useful for the users. Blockchains can allow for a wider range of parties to program money, which can unlock further innovation. If you are unconvinced by this, look towards the innovations happening in DeFi (decentralised finance).

So the medium of record is what determines the programmability of the money – irrespective of the issuer or instrument. You can have programmable central bank money, programmable commercial bank money, programmable e-money (sometimes called stablecoins), programmable any type of money. All of these instruments can exist in non-programmable form – inert and recorded in databases – or in a programmable form.

It’s important not to conflate retail CBDC with programmable money! CBDC is an existing instrument with respect to credit risk – it is an IOU from the central bank, the least risky issuer of money in their own currency. It is for use by households, although it is recorded in a new way (using computers) instead of printed and distributed physically as banknotes.

And CBDC can be programmable, or not, depending on how it is recorded. Perhaps it can be more useful if it’s programmable, due to the new possibilities that programmability can present.

All types of money, irrespective of the issuer, is more useful if it’s programmable.

- Bitcoin

- Bits on Blocks

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Uncategorized

- W3

- zephyrnet