News: Optoelectronics

21 August 2023

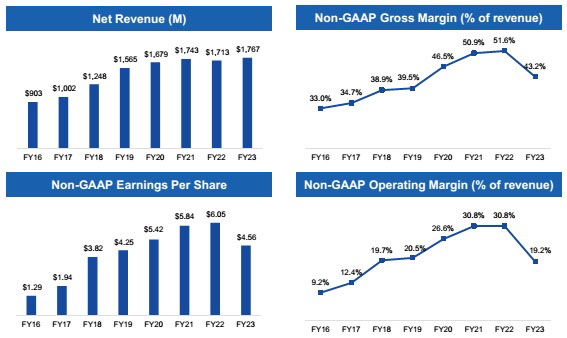

Lumentum Holdings Inc of San Jose, CA, USA (which designs and makes optical and photonic products for optical networks and lasers for industrial and consumer markets) has reported full-year revenue growth of 3.2% from $1712.6m in fiscal 2022 to $1767m for fiscal 2023 (ended 1 July).

Specifically, the Optical Communications segment grew by 2.6% from $1518.5m to $1557.8m, while the Commercial Lasers segment grew by 7.8% from $194.1m to $209.2m.

This was despite fiscal second-half 2023 (and the rest of calendar 2023, it is expected) being impacted by customers digesting large stocks of inventory that they had built up during IC component supply shortages that have since eased.

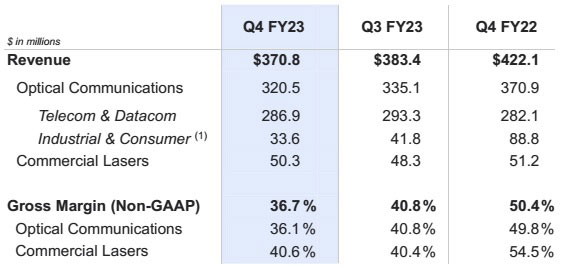

Fiscal fourth-quarter 2023 revenue was hence $370.8m, down 3.3% on $383.4m last quarter and 12.3% on $422.1m a year ago, although this was above the midpoint of the $350–380m guidance.

The Commercial Lasers segment contributed $50.3m (13.6% of total revenue), down 1.8% on $51.2m a year ago but up 4.1% on $48.3m last quarter. Specifically, sequential revenue growth was 35% in ultrafast lasers (driven particularly by new applications in solar cell processing, leading to market share gain) and over 25% in fiber lasers, offset partially by lower solid-state laser shipments for mainly semiconductor applications.

The Optical Communications segment contributed $320.5m (86.4% of total revenue), down 4.4% on $335.1m last quarter and 13.6% on $370.9m a year ago. Of this:

- Industrial & Consumer revenue of $33.6m was down on $41.8m last quarter and $88.8m a year ago, as expected, due to smartphone seasonality and end-market demand. Full-year revenue fell by 54% year-on-year due to market share normalization in 3D sensing as a result of an additional competitor joining the market.

- Telecom & Datacom revenue of $286.9m was down 2% on $293.3m last quarter (due to customer inventory digestion) but up 2% on $282.1m a year ago. Full-year revenue grew by 31%. Although revenue for tunable access modules was down sequentially as expected, strength in metro access and fiber-deep applications drove revenue up 57% to a new record in full-year 2013 (during which manufacturing capacity has been doubled to address the expected return to quarterly growth in fiscal 2014 as the customer base expands and existing customers complete near-term transitions from 10G to the firm’s new 25G tunable access module).

There was sequential growth in quarterly revenue for narrow-linewidth tunable lasers and reconfigurable optical add/drop multiplexers (ROADMs) across several leading customers and across all major categories of ROADMs, including low-port-count, high-port-count and contentionless MxN platforms. With fiscal Q4 revenue for ROADMs up 30% sequentially and 21% year-on-year, full-year ROADM revenue grew 22%, driven by the adoption of these advanced ROADM architectures. “Our ultranarrow-linewidth tunable lasers and our advanced ROADMs are key enablers of our customers’ next-generation network architectures that are just starting to be deployed,” notes president & CEO Alan Lowe.

During fiscal Q4, there were three greater-than-10% customers (all in the Telecom market, with no 10% customers in the Consumer market).

Due primarily to the lower revenue, the product mix and the factory under-utilization, on a non-GAAP basis quarterly gross margin has fallen further, from 50.4% a year ago and 40.8% last quarter to 36.7% in fiscal Q4 (dragging full-year gross margin down from 51.6% to 43.2%). By segment:

- Optical Communications gross margin has fallen further, from 49.8% a year ago and 40.8% to 36.1%, due mainly to the lower revenue and the impact of product margins from NeoPhotonics Corp (acquired in August 2022).

- Commercial Lasers gross margin was 40.6%, down from 54.5% a year ago but up slightly from 40.4% last quarter.

Operating expenses were $102.4m (27.6% of revenue), cut from $104.9m (27.4% of revenue) last quarter. “In the near-term, we are focused on expense controls while maintaining crucial R&D to continue to drive the forefront of innovation as we partner with our customers,” says Lowe.

Quarterly operating margin has fallen further, from 28.8% of revenue a year ago and 13.4% margin last quarter to 9.1% margin. Full-year operating income fell from 30.8% margin to 19.2% margin.

Likewise, net income has fallen further, from $105m ($1.47 per diluted share) a year ago and $51.8m ($0.75 per diluted share) last quarter to $40.2m ($0.59 per diluted share), although this is above the midpoints of the $0.45–0.65 guidance. Full-year net income fell from $449.2m ($6.05 per diluted share) in fiscal 2022 to $315.3m ($4.56 per diluted share) for fiscal 2023.

Cash from operations for full-year fiscal 2023 was $179.8m, of which $49.2m was generated in fiscal Q4.

In June, Lumentum issued $603.7m worth of convertible notes due in 2029. Of the net proceeds of $599.4m (after deducting $4.3m of net issuance costs), Lumentum used $132.8m to repurchase $125m of its convertible notes due in 2024 and $125m to repurchase common stock.

During the quarter, total cash, cash equivalents and short-term investments hence rose by $346.4m, from $1667.2m to $2013.6m.

“As we make progress on the integration of NeoPhotonics products into our global manufacturing footprint and attain synergies without impacting customer deliveries, we plan to carry elevated inventories over the short-term,” says chief financial officer Wajid Ali. “However, we expect inventories to decline by approximately $30m exiting calendar year 2023 as we continue to focus on cash generation,” he adds.

“The current customer inventory correction cycle will continue through the balance of the calendar year and, therefore, our shipments will be below end-market demand,” believes Lowe. “During this transition period, we are tracking ahead of our previously announced synergy plans, while we continue to deliver on our new product and technology roadmaps.”

For its fiscal first-quarter 2024 (to end-September 2023), Lumentum expects revenue to fall to $300–325m, with Telecom & Datacom and Commercial Lasers down sequentially due primarily to customer inventory reductions.

“We expect overall Commercial Lasers demand to be softer over the next several quarters due to customer inventory digestion and macro factors impacting end markets,” says Lowe. “We expect continued rapid growth in new applications for our ultrafast lasers to partially offset these near-term headwinds [e.g. in fiber lasers],” he adds.

In what have historically been strong quarters seasonally, Industrial & Consumer is expected to be roughly flat sequentially (and down more than 60% year-on-year) in both the September and December quarters, due to lower revenue for 3D sensing applications as a result of the current end-market demand environment, pricing, and the impact of the additional competitor on a certain socket opportunity.

Telecom customers are saying that they want to reduce inventory to normal levels. “The confidence that they have in our ability to produce what they need when they need it, and that the component suppliers — including semiconductors — are going to be there when they need it, gives them confidence that they can live with even less inventory than originally anticipated,” notes Lowe. “We are shipping into our customers less than they are shipping out to the carriers which, in turn, should take care of that problem and more normalize as we get into calendar 2024 [after “depressed” shipments during second-half 2023].”

After entering its inventory-correction phase earlier (in the September 2022 quarter), Datacoms should return to sequential growth in the September 2023 quarter. “We probably ratcheted back our capacity more than we should have on Datacom. That’s now in full force to accelerate the output of our Datacom chips,” says Lowe. “We expect to see sequential growth in our Datacom chip business through the balance of this year as well as into calendar 2024… as hyperscale customers prepare to ramp artificial intelligence (AI) capacity,” he adds. “Within the next eight quarters, could we get back to $240–260 annually [for Datacoms revenue]? We are putting capacity in place to do that… We are in the midst of going to larger wafers to address the demand we have seen in the long-term.”

With factory under-utilization lingering through calendar second-half 2023, September-quarter operating margin is expected to be just 1–4%. Diluted earnings per share should fall to $0.20–0.35.

“We do expect a return to growth in Telecom & Datacom shipments in calendar 2024 compared to calendar 2023, as customer inventory levels are reduced and our shipment rate is more in sync with end-market demand,” says Ali.

“Our synergy plan that we communicated at our March investor event at OFC [the Optical Fiber Communication conference] is proceeding ahead of schedule in terms of operating expense reductions,” notes Ali. “We will exit certain manufacturing facilities at the end of this calendar year [in November–December], which will deliver significant cost-of-goods-sold synergies over the subsequent quarters [from the January timeframe]. Overall, we remain on track to the total synergy plan of $80m in annualized savings that we articulated previously [over the next 18 months], and we have achieved over half of the savings in fiscal year 2023,” he adds.

“With generational upgrades in the backbone of the network and increased customer activity for AI in the data center, we expect year-over-year Telecom and Datacom growth in calendar 2024,” says Lowe.

“Our focus is on serving a hyperscale cloud market, primarily to our transceiver customers that we supply to also certainly supply into the enterprise end-markets,” says Chris Coldren, senior VP & chief strategy & corporate development officer. “So, again, we’re supplying EMLs [externally modulated lasers] as the largest product line, and that’s primarily playing now into the transition to 800G,” he adds. During fiscal Q4/2023, Lumentum demonstrated the industry’s first 800G ZR module technology. “We will also have 200G-per-lane EML shipments ramping up in calendar 2024 ramping [since internal qualification has now been completed], and that’s for a next generation of 800G transceivers and then the eventual transition to 1.6 terabits per second [with customer qualifications currently underway].”

Lumentum is seeing strong demand for its high-power continuous wave (CW) lasers for customers utilizing silicon photonic to build 800G transceivers. To further address the connectivity requirements for AI and machine learning clusters, Lumentum has also started to deliver high-speed vertical-cavity surface-emitting lasers (VCSELs) for short-reach connections between servers and switches in these systems, and it expects to ramp up these shipments meaningfully in calendar 2024.

“We highlighted the VCSELs ramping so that we have a broader product portfolio as well as CW lasers to intersect the 800G and 1.6-terabit silicon photonic based approaches,” Coldren says.

“Mid- to long-term fundamentals are solid for our business as we serve the exponential growth in network bandwidth in the artificial intelligence, machine learning, mobile, carrier and cloud computing markets,” summarizes Lowe. “New industrial applications are emerging for our imaging and sensing products, and our commercial lasers are expanding into high-growth applications beyond our traditional markets,” he adds.

“We are confident we can get back to the levels of revenue we have had in the past,” says Lowe. “With our model, the operating leverage is pretty immense. We should see significant bounce back when we get up to that $400–450m, even $500m in revenue. That’s doable in the not-too-distant future,” he believes.

Lumentum upsizes convertible notes offering from $500m to $525m

Lumentum’s quarterly revenue falls 24.2% sequentially due to customer inventory digestion

Lumentum reduces March-quarter revenue guidance from $430-460m to $380-384m

Lumentum’s quarterly revenue up 13.3% year-on-year to $506m

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.semiconductor-today.com/news_items/2023/aug/lumentum-210823.shtml

- :has

- :is

- $UP

- 1

- 12

- 13

- 19

- 1M

- 2%

- 2013

- 2014

- 2022

- 2023

- 2024

- 24

- 27

- 28

- 30

- 35%

- 36

- 3d

- 40

- 49

- 50

- 51

- 65

- 7

- 75

- 9

- a

- ability

- above

- accelerate

- access

- achieved

- acquired

- across

- activity

- Additional

- address

- Adds

- Adoption

- advanced

- After

- again

- ago

- ahead

- AI

- Alan

- All

- also

- Although

- an

- and

- announced

- annualized

- Annually

- Anticipated

- applications

- approaches

- approximately

- ARE

- artificial

- artificial intelligence

- AS

- At

- attain

- AUGUST

- back

- Backbone

- Balance

- Bandwidth

- base

- based

- basis

- BE

- been

- being

- believes

- below

- between

- Beyond

- both

- Bounce

- broader

- build

- built

- business

- but

- by

- CA

- Calendar

- CAN

- Can Get

- Capacity

- care

- carriers

- carry

- Cash

- categories

- cell

- Center

- ceo

- certain

- certainly

- chief

- Chief Financial

- chief financial officer

- chip

- Chips

- Chris

- Cloud

- cloud computing

- commercial

- Common

- common stock

- communicated

- Communication

- Communications

- compared

- competitor

- complete

- Completed

- component

- computing

- Conference

- confidence

- confident

- Connections

- Connectivity

- consumer

- consumer market

- continue

- continued

- continuous

- contributed

- controls

- Corp

- Corporate

- Costs

- could

- crucial

- Current

- Currently

- customer

- customer base

- Customers

- Cut

- cycle

- data

- Data Center

- December

- Decline

- deliver

- Deliveries

- Demand

- demonstrated

- deployed

- designs

- Despite

- Development

- do

- doubled

- down

- drive

- driven

- due

- during

- e

- Earlier

- Earnings

- elevated

- emerging

- end

- entering

- Enterprise

- Environment

- equivalents

- Ether (ETH)

- Even

- Event

- eventual

- existing

- Exit

- Exiting

- expanding

- expands

- expect

- expected

- expects

- expenses

- exponential

- Exponential Growth

- externally

- facilities

- factors

- factory

- Fall

- Fallen

- Falls

- financial

- First

- Fiscal

- flat

- Focus

- focused

- Footprint

- For

- Force

- forefront

- from

- full

- Fundamentals

- further

- future

- Gain

- generated

- generation

- generational

- get

- gives

- Global

- going

- grew

- gross

- Growth

- guidance

- had

- Half

- Have

- he

- headwinds

- hence

- high-growth

- Highlighted

- historically

- Holdings

- http

- HTTPS

- Imaging

- immense

- Impact

- impacted

- impacting

- in

- Including

- Income

- increased

- industrial

- industry’s

- Innovation

- integration

- Intelligence

- internal

- into

- inventory

- Investments

- investor

- issuance

- Issued

- IT

- items

- ITS

- January

- joining

- jpg

- July

- june

- just

- Key

- large

- larger

- largest

- laser

- lasers

- Last

- leading

- learning

- less

- levels

- Leverage

- Line

- live

- long-term

- lower

- machine

- machine learning

- Macro

- mainly

- maintaining

- major

- make

- MAKES

- manufacturing

- March

- Margin

- margins

- Market

- market share

- Markets

- Metro

- mix

- Mobile

- model

- module

- Modules

- months

- more

- Need

- net

- network

- networks

- New

- next

- next-generation

- no

- normal

- Notes

- now

- of

- offering

- Officer

- offset

- on

- operating

- Operations

- Opportunity

- originally

- our

- out

- output

- over

- overall

- particularly

- partner

- past

- per

- period

- phase

- Place

- plan

- plans

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- playing

- portfolio

- Prepare

- president

- president & CEO

- pretty

- previously

- pricing

- primarily

- probably

- Problem

- proceeds

- processing

- produce

- Product

- Products

- Progress

- Putting

- qualification

- qualifications

- Quarter

- R&D

- Ramp

- ramping

- rapid

- Rate

- record

- reduce

- Reduced

- reduces

- reductions

- related

- remain

- Reported

- Requirements

- REST

- result

- return

- revenue

- revenue growth

- roadmaps

- ROSE

- roughly

- San

- San Jose

- Savings

- saying

- says

- schedule

- Second

- see

- seeing

- seen

- segment

- semiconductor

- Semiconductors

- senior

- September

- serve

- serving

- several

- Share

- Shipping

- short-term

- shortages

- should

- significant

- Silicon

- since

- smartphone

- So

- solar

- solid

- specifically

- started

- Starting

- stock

- Stocks

- Strategy

- strength

- strong

- subsequent

- suppliers

- supply

- supplying

- synergy

- Systems

- Take

- Technology

- telecom

- terms

- than

- that

- The

- Them

- then

- There.

- therefore

- These

- they

- this

- this year

- three

- Through

- timeframe

- to

- Total

- track

- Tracking

- traditional

- transition

- transitions

- TURN

- Underway

- upgrades

- USA

- used

- Utilizing

- vp

- want

- was

- Wave

- we

- WELL

- were

- What

- when

- which

- while

- will

- with

- without

- worth

- year

- zephyrnet