Will today be Day One of the LIBOR end game?

It should be, according to the latest “Dear CEO” letter from David Bailey, Sarah Breeden and the FCA: ‘Transition from LIBOR to Risk Free Rates’. The end of Q1 2021 is meant to have signaled the last day for business as usual linear GBP derivatives trading.

Today we will be looking through the data to see if this has come to fruition. Is GBP LIBOR still trading in linear derivatives markets?

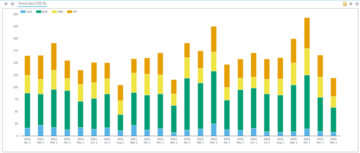

April So Far in Clearing

Thanks to the Easter weekend, we are already on the 6th day of the quarter! Have we seen any GBP LIBOR trades already reported?

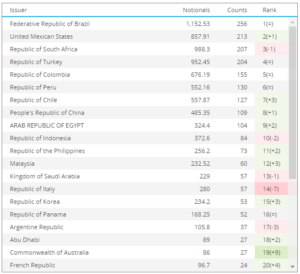

Looking at CCPView, with data up to the end of last week, we can already see some GBP LIBOR cleared activity.

Over £21bn of GBP-LIBOR linked FRAs and IRS have already been reported. Look at that split of activity though!

- 79% of GBP-LIBOR linked activity at CCPs in April has been due to Client activity!

- This increases to 86% client-activity if we exclude FRAs.

Do we think all of that activity was really tied to legacy or transition business?

This data does not include this week’s data, which is the first “real” trading week of the quarter. Let’s look at some fresh data.

April 1st-5th

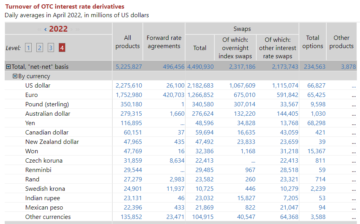

Turning to SDRView Pro shows the following:

- £6.4bn in GBP LIBOR linked IRS was reported to SDRs from 1st to 5th April.

- Even vanilla 10Y IRS traded 49 times, totaling £920m.

- There were 182 trades in total.

- This drops to 132 trades if we exclude “backstarting” trades, which can at least firmly be recognised as legacy positions!

Hmmmm, 132 trades already….Let’s compare this to reported SONIA activity for the 1st-5th April period:

- SONIA saw 253 trades.

- A huge £28.7bn in notional.

- A ratio of 4.5x SONIA to LIBOR activity.

- Pretty good signs from a transition perspective.

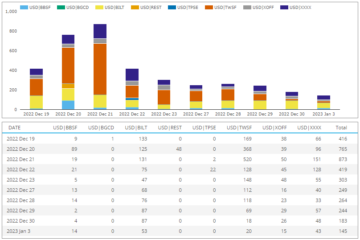

April 6th 11:00 London

Turning our attention to today, we can still see some GBP LIBOR-linked activity being reported:

Showing;

- There have been 28 GBP LIBOR trades already today.

- £1.7bn in notional.

- Only three of these were legacy trades:

So whilst it is disappointing that GBP LIBOR activity continues to drip through, we must put it in perspective.

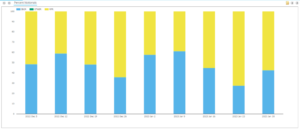

Therefore, we note how active SONIA markets have been already today:

Showing;

- 42 trades in total

- £3.3bn in notional

- Importantly, a whole load of activity across the entirety of the curve. This is no longer a short-dated market only.

- Plenty o f activity in benchmark tenors such as 5Y and 10Y.

On a DV01 basis you can see that 5Y was the most active tenor:

So far there has been around 1.6 times as much activity in SONIA than LIBOR in GBP markets today. Not bad. Where will it end up today? Stay tuned for some near-live updates today.

April 6th 14:30 London

Scores on the doors halfway through the trading day. First up, the “naughty” LIBOR trades:

- 71 trades totaling £4bn.

- By my reckoning, every single trade has a LIBOR reset after the end of 2021.

- 5Y and 10Y continue to be the most active tenors. That type of pattern doesn’t fit with all of these being transition trades, surely?

However, to be fair to the GBP market, SONIA activity is continuing at a much higher rate.

- 128 trades for £8.7bn in notional. Or £6.6bn excluding the short-dated stuff.

- £3.6m DV01 traded in SONIA, 1.91 times the amount of risk traded versus LIBOR indices.

And again, let’s take the chance to highlight that the GBP SONIA activity is across the whole curve, with 5Y and 10Y the “benchmark” tenors:

April 6th 15:30 London

Aside from simple derivatives, we still see GBP LIBOR-based cross currency swaps and swaptions being reported to SDRs.

Today has seen £1.3bn in cable (GBP vs USD) XCCY for example:

Whilst I would consider XCCY as a largely linear derivative product, they are subject to a different timeline according to the UK RFR-working group. I guess this is due to the presence of the USD LIBOR leg as well ¯_(ツ)_/¯?

So given the typical pace of transition, I guess we will be looking for GBP LIBOR to largely disappear from XCCY swaps on 1st October 2021.

Similarly for Swaptions, it looks like 1st July 2021 will be the date to look out for to see more SONIA swaptions. We’ve at least seen a decent chunk of SONIA activity in 3m10Y Swaptions today:

But we have seen more variety in LIBOR-linked swaptions:

- active

- April

- around

- Benchmark

- business

- ccp

- continue

- continues

- contract

- Currency

- curve

- data

- day

- dead

- Derivatives

- fair

- First

- fit

- Free

- fresh

- game

- good

- Group

- Highlight

- House

- How

- HTTPS

- huge

- image

- interest

- IRS

- IT

- July

- latest

- load

- Market

- Markets

- move

- moves

- Newsletter

- Pattern

- performance

- perspective

- Product

- Profit

- Q1

- Risk

- Signs

- Simple

- So

- split

- stay

- trade

- trades

- Trading

- Uk

- Updates

- USD

- value

- Versus

- week

- weekend