Fleets of electric vehicles that not only plug into a charger to sip power but also to feed power back to an electric grid or building are mostly a thing of the future.

However, now is a good time to consider the reduced costs, emissions reductions and potential revenue streams that vehicle-to-grid (V2G) systems could bring your corporate fleet, according to advocates of V2G technology speaking at the Electrify 23 virtual event produced in August by GreenBiz. In addition, they say, V2G fleets can provide low-carbon energy to utilities when they need it most.

There are only 128 V2G projects to date across 127 countries, representing some 6,700 chargers, according to a crowdsourced database at V2G Hub. V2G technology developer Fermata Energy expects between 10 to 20 percent of U.S. fleets to adopt V2G by 2027. The market for V2G technology is expected to climb to $20 billion by the end of 2031 from $2.78 billion in 2021, according to Transparency Market Research.

What could V2G offer your fleet?

Should your business seriously consider V2G technology right now? “I would say it’s definitely something you should explore as a fleet operator,” said Adam Langton, who has worked on connected e-mobility at BMW for eight years. “There’s potential to reduce your energy costs for your facilities and reduce your fueling costs for your vehicles.”

V2G — forms of which include V2H for vehicle-to-home or V2B for vehicle-to-building — typically describes the technologies that enable electricity to flow to and from a vehicle, along with the structure or electrical grid to which it’s tethered.

For Sarah Swickard, the vehicle grid integration manager at Pacific Gas and Electric (PG&E), vehicle-grid integration means “anything that can shift electric vehicle loads, either when they’re charging or discharging.”

One aspect of that is managed charging by utilities, a service that could reduce costs because vehicles can be directed to charge when the price of electricity is low, she said. Expanding from that into V2H or V2B services unlocks the benefit of resiliency because fleet vehicles can help to power a building during an electric grid outage, Swickard added.

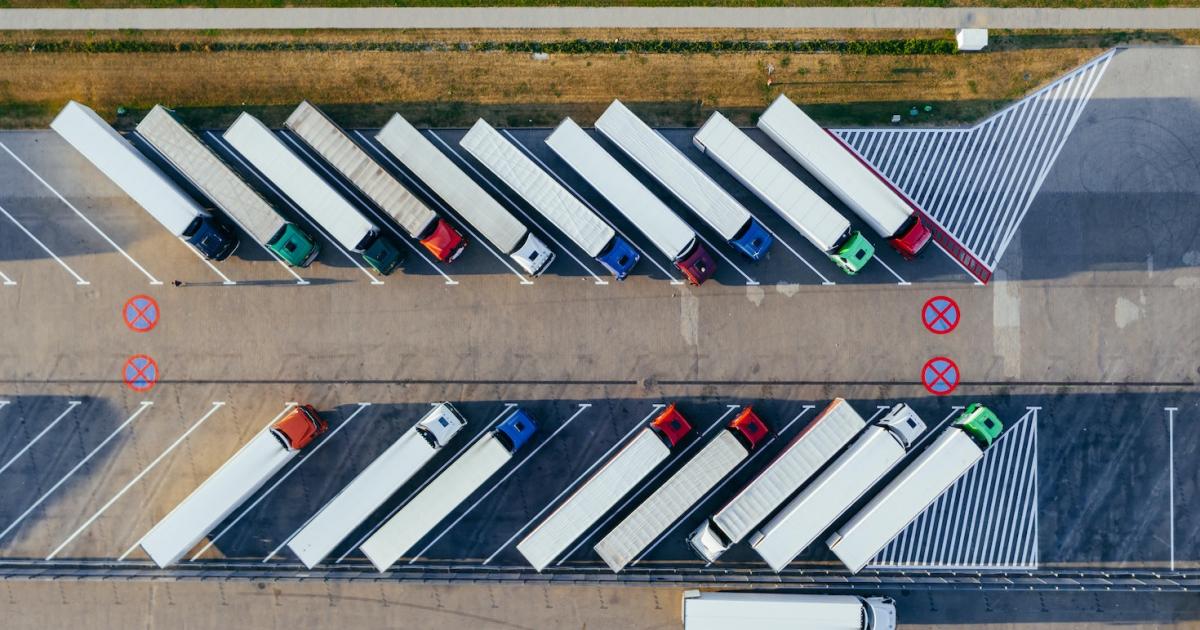

What’s more, V2G technology could provide cost savings when companies have electric vehicles parked unused in a lot. Instead of providing power from the grid to the company’s building at a peak time in the middle of the day, the EVs could supply cheaper power to the building, Swickard said.

And finally, she explained, if fleet vehicles can export power to the grid when it needs it, the utility can provide compensation for that, which also brings down the total cost of ownership of electrifying a fleet.

Is your company ready for V2G?

The experts at Electrify 23 agreed that V2G is not a one-size-fits-all consideration, and they encouraged thinking closely about a fleet’s specific needs and composition. For instance, Melissa Chan, director of grid solutions and strategic partnerships at Fermata Energy, said to pay close attention to the “mobility cycle requirements” of a fleet vehicle , such as the specific times and places that it drives during a typical shift and how long it parks on a daily basis.

“What we talk about with our fleet partners, our customers, it’s (about) how can we balance the time that’s needed to fuel your vehicles, so that you have them ready to go and do the things that you want them to do — whether it’s moving children or goods or beverages around and providing power to your own site or even back to electric utility?” she said.

Make sure to explore installation costs, and contact your utility to ensure its service can accommodate handling a V2G setup, Langton said. In a previous role for the California Public Utilities Commission, helping fleet operators to install EV fleets, he witnessed how the large power draw of even unidirectional charging systems resulted in large upgrade costs and other unanticipated expenses for companies.

Can your fleet management team find the tools to seamlessly manage energy in a cost-effective way, both when vehicles are taking in power and discharging power? Who or what is helping fleet managers navigate whether or when to charge from the grid or discharge power to it? Software providers and fleet managers will be critical to help your company’s fleet unlock the benefits of V2G, Swickard said.

Is V2G right for the needs of your fleet?

Among the bidirectional charging projects that Fermata Energy is operating, those deriving the most value tend to involve either municipal fleets, fleets with a lot of downtime or fleets with downtime that coincides with the energy grid’s peak, according to Chan.

“So for example, within municipal fleets — these are actually really a great use case — often the building’s peak, maybe in the morning when everyone is arriving and putting on the coffeemaker and the lights and booting up their computers for the day, the cars probably go out in the midmorning, come back around lunchtime and can recharge or go out again, midday, middle of the afternoon,” she said.

Fermata Energy is developing projects with V2G schoolbuses, which are a great fit because their hulking batteries of up to 300 kilowatt-hours can be connected to the grid with a 60-kilowatt-hour charger, Chan said. “So this is a lot of power that can be delivered to the grid, say, for demand response or emergencies, for resilience to a building.”

Fleets that tend to have predictable vehicle routes are also solid V2G contenders, she said, adding that interstate trucks would not apply as a practical use case. Think of a hub-to-spoke delivery system with vehicles taking beverages or food from a warehouse out to restaurants and supermarkets. Municipal trash pickup vehicles are another good example, Chan described.

How does V2G provide value in your location?

The value of V2G for a fleet operator varies geographically, especially according to state policies and utility practices. Fermata Energy is involved in V2G projects across the U.S. and Canada, including New Hampshire, Massachusetts, Vermont and Rhode Island; those locations will be followed soon by Connecticut, New York, Virginia, North Carolina, Colorado, California and the Maritimes of Canada, she said.

Chan noted that V2G can provide everyday savings on electric bills but especially where a utility imposes demand charges, the higher rates for electricity that some utilities charge during peak usage times in order to reduce overload on the overall grid. “So with a vehicle to grid charger installed behind the meter, if that customer has demand charges, we’re able to reduce demand charges by just charging the battery on your vehicle in order to reduce demand at the site,” she said.

PG&E’s Emergency Load Reduction Program (ELRP) pays $2 for each kilowatt-hour that customers reduce during a grid emergency or other event, Chan said. In other places, utilities have demand response programs or programs where they buy power back from batteries, either freestanding or within cars.

Under New York’s State Public Service Commission’s (PSC) Value of Distributed Energy Resources (VDER) tariff, a utility buys and sells electricity at different prices depending on time and location on the network, she said. In addition, several New England states have demand response programs that buy power back from customers’ batteries.

Langton pointed out the benefits of using renewable or low-carbon energy within a V2G system. “If you have solar panels, you can … charge up during those times and then discharge at times that the sun is not out, and help allow you to get more solar panels at your facility and use that energy for your other facility loads,” he said, adding that this can help to achieve sustainability goals in a cheaper way.

How will the value of V2G change as the market matures?

The cost of V2G technology needs to come down, and options need to expand for fleets shopping for bidirectional vehicles and chargers, according to Swickard and others.

On a positive note, Garrett Fitzgerald, senior director of electrification at the Smart Electric Power Alliance (SEPA), noted a recent shift among automotive OEMs who a few years ago tended to talk down the technology because it might degrade a battery or void a warranty. A SEPA report, State of Bidirectional Charging in 2023, released Thursday, noted that widespread adoption of V2G technologies hinges upon customer demand.

Other signs of change: General Motors earlier this month announced expanding bidirectional, vehicle-to-home charging technology for all its EVs by model year 2026, including Chevrolet Silverados and Cadillac Escalades. Last September, Nissan approved for its LEAF vehicles a bidirectional charger produced by Fermata Energy. In February, the U.S. Patent and Trademark Office published a patent, filed by Ford Motor Company in 2021, for unattended bidirectional charging tech. And in March 2022 the company announced the bidirectional Ford Charge Station Pro for its F-150 Lightning pickups.

Langton mentioned a pilot by BMW in 2022 that modified i3 electric sedans for bidirectional charging in Europe, which will come to the U.S. However, questions remain for automakers and OEMs about the impacts on battery life and health of two-way charging, which also affects the value for customers, he said.

Another big question mark is when utilities will be ready for vehicle-grid integration. Langton suggested that fleet operators might embrace some of the uncertainty by oversizing their infrastructure in the short term, which they can potentially reduce later when V2G is up and running.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.greenbiz.com/article/your-fleet-ready-vehicle-grid-ask-these-5-questions-first

- :has

- :is

- :not

- :where

- $UP

- 10

- 20

- 2021

- 2022

- 2026

- 2031

- 23

- 300

- 5 Questions

- 700

- a

- Able

- About

- accommodate

- According

- Achieve

- across

- actually

- Adam

- added

- adding

- addition

- adopt

- Adoption

- advocates

- again

- ago

- All

- Alliance

- allow

- along

- also

- among

- an

- and

- announced

- Another

- anything

- Apply

- approved

- ARE

- around

- arriving

- article

- AS

- aspect

- At

- attention

- AUGUST

- automakers

- automotive

- back

- Balance

- basis

- batteries

- battery

- Battery life

- BE

- because

- behind

- benefit

- benefits

- between

- Beverages

- Big

- Billion

- Bills

- BMW

- both

- bring

- Brings

- Building

- business

- but

- buy

- Buys

- by

- Cadillac

- california

- CAN

- Canada

- Carolina

- cars

- case

- Catch

- chan

- change

- charge

- charges

- charging

- cheaper

- Chevrolet

- Children

- climb

- Close

- closely

- Colorado

- come

- commission

- Companies

- company

- Compensation

- composition

- computers

- connected

- Connecticut

- Consider

- consideration

- contact

- Corporate

- Cost

- cost savings

- cost-effective

- Costs

- could

- countries

- coverage

- critical

- customer

- Customers

- cycle

- daily

- Database

- Date

- day

- definitely

- delivered

- delivery

- delivery system

- Demand

- demand response

- Depending

- described

- detail

- Developer

- developing

- different

- Director

- distributed

- do

- does

- down

- downtime

- draw

- drives

- during

- e

- each

- Earlier

- either

- Electric

- electric vehicle

- electric vehicles

- electricity

- electrifying

- embrace

- emergency

- Emissions

- enable

- encouraged

- end

- energy

- England

- ensure

- especially

- Ether (ETH)

- Europe

- EV

- Even

- Event

- everyday

- everyone

- evs

- example

- Expand

- expanding

- expected

- expects

- expenses

- experts

- explained

- explore

- export

- facilities

- Facility

- February

- few

- filed

- Finally

- Find

- First

- fit

- Fitzgerald

- FLEET

- fleet management

- flow

- followed

- food

- For

- Ford

- Ford Motor Company

- forms

- from

- Fuel

- future

- GAS

- get

- GM

- Go

- Goals

- good

- goods

- great

- Grid

- Hampshire

- Handling

- Have

- he

- Health

- help

- helping

- higher

- hinges

- How

- However

- HTML

- HTTPS

- i

- i3

- if

- Impacts

- in

- In other

- include

- Including

- Infrastructure

- install

- installation

- instance

- instead

- integration

- into

- involve

- involved

- island

- IT

- ITS

- jpg

- just

- large

- Last

- later

- Life

- lightning

- load

- loads

- location

- locations

- Long

- Lot

- Low

- low-carbon

- manage

- managed

- management

- Management Team

- manager

- Managers

- March

- mark

- Market

- massachusetts

- matures

- maybe

- means

- Middle

- might

- mobility

- model

- modified

- Month

- more

- morning

- most

- mostly

- Motor

- Motors

- moving

- municipal

- Navigate

- Need

- needed

- needs

- network

- New

- New York

- New York’s

- Nissan

- node

- North

- north carolina

- note

- noted

- now

- NY

- of

- offer

- Office

- often

- on

- only

- operating

- operator

- operators

- Options

- or

- order

- Other

- Others

- our

- out

- outage

- overall

- own

- ownership

- Pacific

- page

- panels

- parks

- partners

- partnerships

- patent

- Pay

- pays

- Peak

- percent

- Pickup

- pilot

- Places

- plato

- Plato Data Intelligence

- PlatoData

- plug

- policies

- positive

- potential

- potentially

- power

- Practical

- practices

- Predictable

- previous

- price

- Prices

- probably

- Produced

- Program

- Programs

- projects

- provide

- providers

- providing

- public

- published

- Putting

- question

- Questions

- Rates

- RE

- ready

- really

- recent

- Recharge

- reduce

- Reduced

- reduction

- reductions

- released

- remain

- Renewable

- report

- representing

- Requirements

- resilience

- Resources

- response

- Restaurants

- resulted

- revenue

- right

- Role

- routes

- running

- s

- Said

- Savings

- say

- seamlessly

- sedans

- Sells

- senior

- Sepa

- September

- seriously

- service

- Services

- setup

- several

- she

- shift

- Shopping

- Short

- should

- Signs

- site

- smart

- So

- Software

- solar

- solar panels

- solid

- Solutions

- some

- something

- Soon

- speaking

- specific

- State

- States

- station

- Strategic

- Strategic Partnerships

- streams

- structure

- such

- Sun

- supply

- sure

- Sustainability

- system

- Systems

- taking

- Talk

- team

- tech

- Technologies

- Technology

- term

- that

- The

- The Future

- their

- Them

- then

- There.

- These

- they

- thing

- things

- think

- Thinking

- this

- those

- thursday

- time

- times

- to

- tools

- Total

- trademark

- Transparency

- Trucks

- typical

- typically

- u.s.

- Uncertainty

- unlock

- unlocks

- unused

- upgrade

- upon

- Usage

- use

- use case

- using

- utilities

- utility

- value

- vehicle

- Vehicles

- Vermont

- virginia

- Virtual

- want

- Warehouse

- Way..

- we

- What

- What is

- when

- whether

- which

- WHO

- widespread

- will

- with

- within

- witnessed

- worked

- would

- year

- years

- york

- you

- Your

- zephyrnet