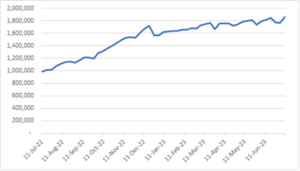

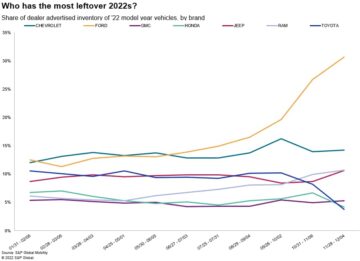

In the midst of the pandemic, global supply chains were pushed

well past the breaking point. Inventory and sales declined

industrywide. Yet General Motors won its eighth consecutive award

for Overall Loyalty to Manufacturer – a near-decade period during

which GM’s annual sales have declined sharply.

How is that possible?

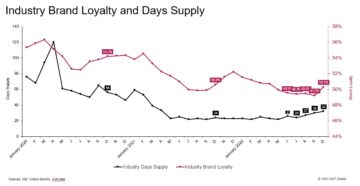

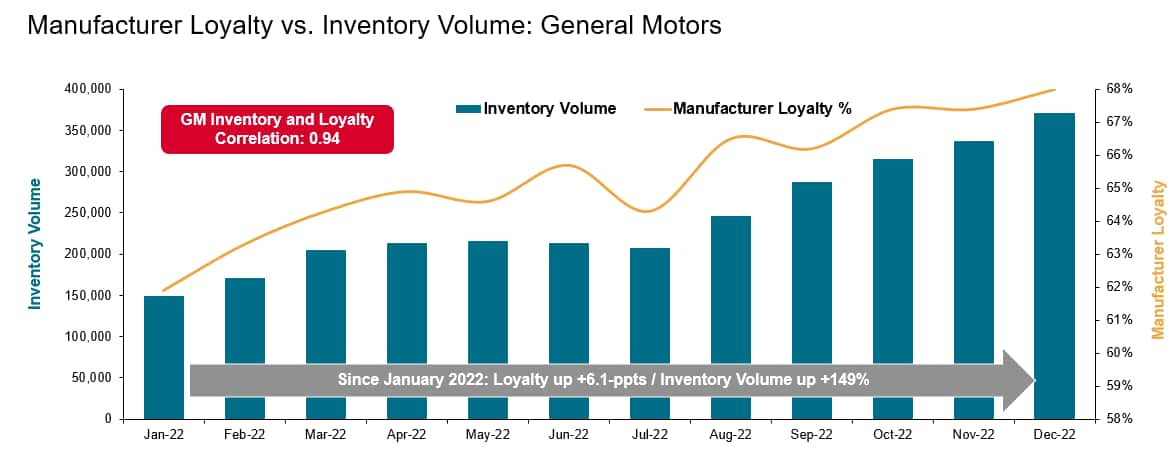

GM’s average manufacturer loyalty rate in 2022 was 65.4%, ahead

of Hyundai Motor Group at 62.3% and Ford Motor Co. at 60.3%.

However, that average hides a dramatic shift that played out over

the calendar year: In January 2022, GM’s loyalty rate was just 61%,

but it climbed to 67.9% by January 2023, according to loyalty

analysis from S&P Global Mobility.

What caused that rise? Return of inventory. Over those same 12

months, GM’s dealer advertised inventory soared from about 150,000

vehicles to nearly reaching 400,000, according to S&P Global

Mobility data analysis.

“As inventory levels start to return back to normal, we’re

starting to see those traditional loyalty patterns,” said Vince

Palomarez, associate director for Market Reporting for S&P

Global Mobility.

Source: S&P Global Mobility

But while inventory has allowed loyal customers to return, how has

GM maintained its manufacturer loyalty lead amid its sales slide?

It comes down to the breadth of its portfolio.

“There’s a very high direct correlation between the number of

available models and brand loyalty,” said Tom Libby, associate

director of loyalty solutions and industry analysis for S&P

Global Mobility. “Everything else being the same, the greater

number of models you have, the higher the brand loyalty will

be.”

GM today sells more than 45 models across four consumer brands,

plus fleet-specific options within GMC and BrightDrop. “With GM,

they offer products at every conceivable level available,”

Palomarez said.

“A family can start at a compact Chevrolet, move into a bigger

SUV by Chevy or Buick as their kids grow, then downsize as

empty-nesters into a more-luxurious Buick or Cadillac, and along

the way grab a Chevy or GMC truck if they want to work on their

house. The myriad choices across brands gives a GM loyalist a lot

of flexibility,” Palomarez added.

Source: S&P Global Mobility

This is the ideal of the “ladder of success” as put forth by

long-time GM President and Chairman Alfred Sloan, a model

subsequently emulated by competitors to varying degrees of

success.

“GM still benefits from this model. While the migration may not

always reach straight up to Cadillac, the manufacturer loyalty

results suggest the company is benefiting from having four brands,”

Libby said.

“A key differentiator is GMC, which is in a unique position to

benefit GM,” Libby added. “Other than Land Rover, there really

isn’t another true upscale light-truck/utility brand. GMC has done

a terrific job of creating an upscale, exclusive, ‘See-what-I’ve-got,’ image to lure SUV shoppers looking to move up

from Chevrolet, and the addition of the Denali and Ultimate trim

levels help further the image. We’re seeing that concept spread as

well to Buick with Avenir.”

Less successfully, brand-heavy Stellantis comes in behind Toyota

in fifth place with 52.9% loyalty. “Stellantis really is a mixture

of brands. Each is unique. There is not really an anchor brand that

a household would come into, and then move step-by-step up the

ladder,” Libby said. “GM is benefiting from having four brands more

than Stellantis is benefiting from having six or seven brands.”

However, Hyundai Motor Group (which includes Kia and Genesis)

has been extending its ladder, particularly with the addition of

the Genesis luxury brand in 2015. “Hyundai has really been on a

tear, in terms of their products that they’ve been offering –

primarily with a Hyundai Palisade and Kia Telluride being big

mainstream choices, and then the Genesis GV80 and GV70 being great

luxury SUVs. That’s really what that Genesis brand was missing,”

Palomarez said.

Source: S&P Global Mobility

Bolstered by the strength of consumer loyalty to its best-selling

F-Series pickup, Ford’s loyalty of 60.3% allowed it to hold on to

third place in 2022.

And what about Toyota Motor North America, which includes Lexus

and finished in fourth place behind Ford at 59.6% loyalty in 2022? “Toyota has a very broad product portfolio also, but the one thing

it does not have that Ford and General Motors do is a

volume-leading full-size pickup entry,” Libby said. “Then again,

Hyundai doesn’t have a full-size truck at all.”

Looking ahead, with Hyundai Motor Group rising from eighth place

in manufacturer loyalty in 2015 to second in 2022, GM’s biggest

threat now looks to come from South Korea.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/how-general-motors-maintains-its-loyalty-lead-amid-declining-s.html

- :has

- :is

- :not

- ][p

- $UP

- 000

- 12

- 2015

- 2022

- 2023

- 67

- a

- About

- According

- across

- added

- addition

- again

- ahead

- All

- along

- also

- always

- america

- Amid

- an

- analysis

- Anchor

- and

- annual

- Another

- article

- AS

- Associate

- At

- available

- average

- award

- back

- BE

- been

- behind

- being

- benefit

- benefiting

- benefits

- between

- Big

- bigger

- Biggest

- brand

- brand loyalty

- brands

- breadth

- Breaking

- broad

- but

- by

- Cadillac

- Calendar

- CAN

- caused

- chains

- chairman

- Chevrolet

- choices

- Climbed

- CO

- come

- comes

- company

- competitors

- concept

- consecutive

- consumer

- Correlation

- Creating

- Customers

- data

- data analysis

- dealer

- Declining

- differentiator

- direct

- Director

- Division

- do

- does

- done

- down

- dramatic

- during

- each

- Eighth

- else

- entry

- Ether (ETH)

- Every

- everything

- Exclusive

- extending

- family

- Flexibility

- For

- Ford

- forth

- four

- Fourth

- from

- further

- General

- General Motors

- Genesis

- gives

- Global

- GM

- grab

- great

- greater

- Group

- Grow

- Have

- having

- help

- High

- higher

- hold

- House

- household

- How

- However

- HTTPS

- Hyundai

- ideal

- if

- image

- in

- includes

- industry

- Industry Analysis

- into

- inventory

- isn

- IT

- ITS

- January

- Job

- just

- Key

- Kia

- kids

- korea

- ladder

- Land

- land rover

- lead

- Level

- levels

- lexus

- looking

- LOOKS

- Lot

- loyal

- loyalist

- Loyalty

- Luxury

- Mainstream

- maintains

- managed

- Manufacturer

- Market

- May..

- migration

- missing

- mixture

- mobility

- model

- models

- months

- more

- Motor

- Motors

- move

- nearly

- normal

- North

- north america

- now

- number

- of

- offer

- offering

- on

- ONE

- Options

- or

- Other

- out

- over

- overall

- pandemic

- particularly

- past

- patterns

- period

- Pickup

- Place

- plato

- Plato Data Intelligence

- PlatoData

- played

- plus

- Point

- portfolio

- position

- possible

- president

- primarily

- Product

- Products

- published

- pushed

- put

- Rate

- ratings

- RE

- reach

- reaching

- really

- Reporting

- Results

- return

- Rise

- rising

- rover

- s

- S&P

- S&P Global

- Said

- sales

- same

- Second

- see

- seeing

- Sells

- seven

- shift

- Shoppers

- SIX

- Slide

- Sloan

- soared

- Solutions

- South

- South Korea

- spread

- start

- Starting

- Still

- straight

- strength

- Subsequently

- success

- Successfully

- suggest

- supply

- Supply chains

- SUVs

- terms

- than

- that

- The

- their

- then

- There.

- they

- thing

- Third

- this

- those

- threat

- to

- today

- toyota

- traditional

- truck

- true

- ultimate

- unique

- Ve

- Vehicles

- very

- want

- was

- Way..

- we

- WELL

- were

- What

- which

- while

- will

- with

- within

- Won

- Work

- would

- year

- yet

- you

- zephyrnet