- A new lower low activates more declines.

- The US inflation data should shake the price.

- False breakdowns may bring a new rally.

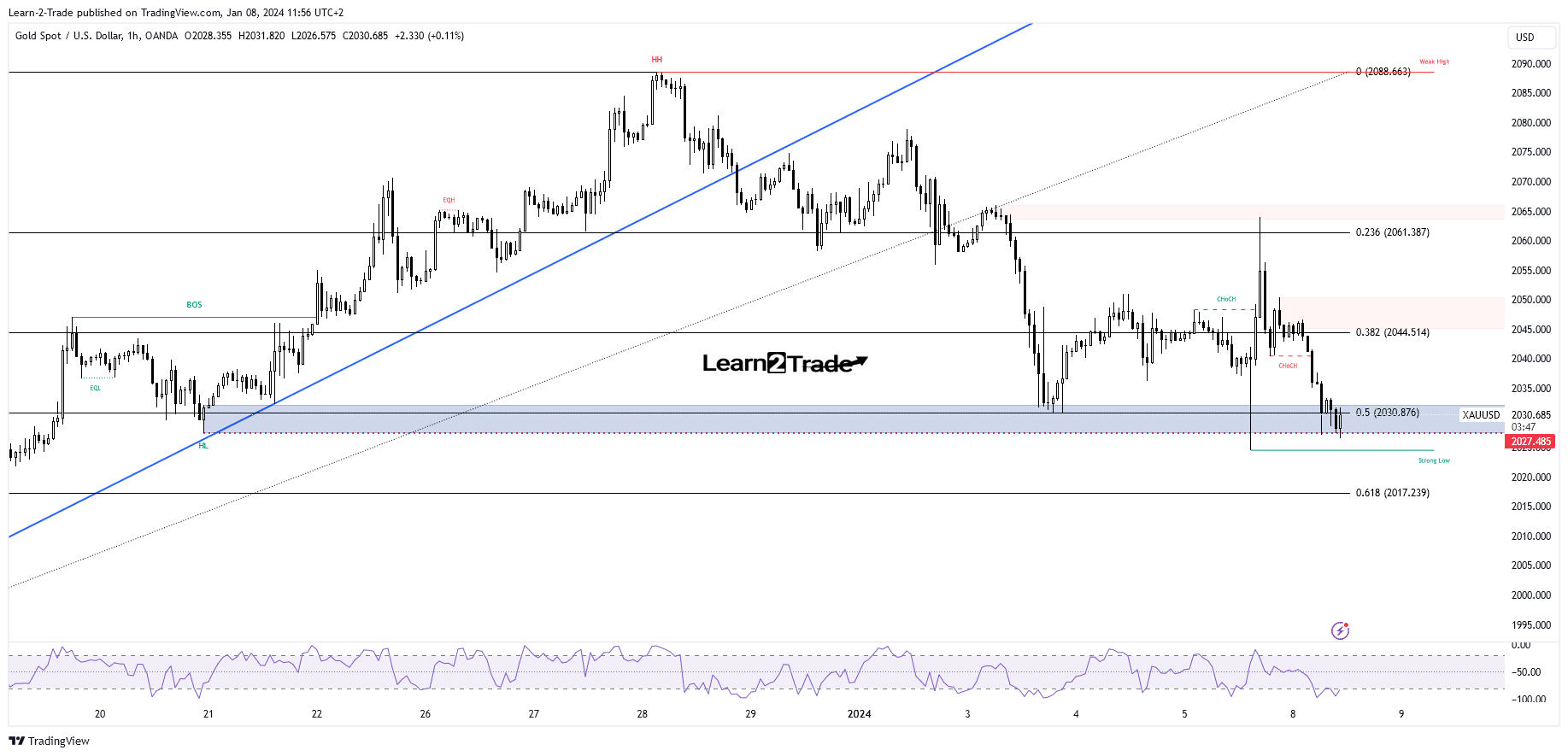

The gold price is trading in the green at $2,026 at the time of writing. Still, the downside pressure remains high in the short term despite Friday’s rally.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Surprisingly or not, the XAU/USD jumped higher in the last trading session even though the US reported positive data. However, the yellow metal edged higher only because the US dollar was overbought after its strong swing higher. Now, the greenback has turned to the upside again, so gold erased the latest gains.

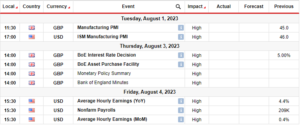

The Non-Farm Employment Change, Average Hourly Earnings, Unemployment Claims, and Factory Orders came in better than expected.

Gold price seems to be under pressure in the short term after Switzerland’s inflation data was released today. The Consumer Price Index reported a 0.0% growth compared to the 0.1% drop estimated after the 0.2% drop in the previous reporting period, while Retail Sales rose by 0.7%, beating the 0.0% growth forecasted.

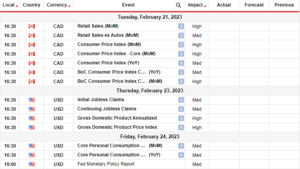

The week’s most important event is the publication of US inflation data. The CPI m/m may report a 0.2% growth versus the 0.1% growth in the previous reporting period, while CPI y/y is expected at 3.2%. Higher inflation in December compared to November could boost the USD.

Gold Price Technical Analysis: Strong Downside Pressure

Technically, the gold price dropped again after registering a false breakout through the 23.6% ($2,061). Now, it has dropped below the 50% (2,030) retracement level and challenges the $2,027 static support.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

The metal is trading in the demand zone. So, only making a new lower low could trigger more declines. False breakdowns and coming back above 61.8% may result in a new bounce back.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/08/gold-price-under-pressure-as-market-awaits-us-cpi-data/

- :has

- :is

- :not

- 1% drop

- 2%

- 23

- a

- About

- above

- Accounts

- After

- again

- analysis

- and

- AS

- At

- average

- back

- BE

- because

- below

- Better

- boost

- Bounce

- breakout

- bring

- by

- came

- CAN

- CFDs

- challenges

- change

- check

- claims

- coming

- compared

- Consider

- consumer

- consumer price index

- could

- CPI

- CPI data

- data

- December

- Declines

- Demand

- Despite

- detailed

- Dollar

- downside

- Drop

- dropped

- Earnings

- employment

- estimated

- Even

- Event

- expected

- factory

- false

- forex

- Gains

- Gold

- gold price

- Green

- Greenback

- Growth

- High

- higher

- However

- HTTPS

- important

- in

- index

- inflation

- interested

- Invest

- investor

- IT

- ITS

- Last

- latest

- learning

- Level

- lose

- losing

- Low

- lower

- Making

- Market

- max-width

- May..

- metal

- money

- more

- most

- New

- November

- now

- of

- only

- or

- orders

- our

- period

- plato

- Plato Data Intelligence

- PlatoData

- positive

- pressure

- previous

- price

- provider

- Publication

- rally

- registering

- released

- remains

- report

- Reported

- Reporting

- result

- retail

- Retail Sales

- retracement

- Risk

- ROSE

- sales

- seems

- session

- Short

- should

- signals

- So

- Still

- strong

- support

- Swing

- Take

- Technical

- Technical Analysis

- Telegram

- term

- than

- The

- this

- though?

- Through

- time

- to

- today

- trade

- Trading

- trigger

- Turned

- under

- unemployment

- Upside

- us

- US CPI

- US Dollar

- us inflation

- USD

- Versus

- was

- when

- whether

- while

- with

- writing

- XAU/USD

- yellow

- you

- Your

- zephyrnet