- A new lower low activates more declines.

- Fed Chair Powell Testifies should bring sharp movements later.

- The UK reported higher inflation, so the BOE should take action tomorrow.

The GBP/USD price rebounded in the short term after reaching yesterday’s low of 1.2713. It has climbed as high as 1.2802 today.

-If you are interested in forex day trading then have a read of our guide to getting started-

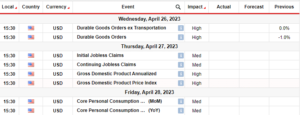

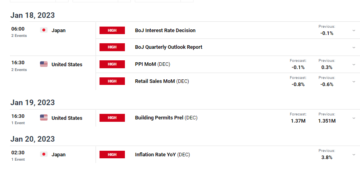

However, the price failed to stay above the 1.28 psychological level, signaling exhausted buyers. The pair is trading at 1.2764 at the time of writing. Yesterday, the USD received support from the US economic data. Building Permits came in at 1.49M above the 1.42M expected, while Housing Starts were reported higher at 1.63M versus 1.40M forecasted.

Today, the currency pair turned upside ahead of the United Kingdom inflation figures. The Consumer Price Index reported an 8.7% growth versus the 8.4% expected, while Core CPI came in at 7.1% compared to 6.8% estimates.

Furthermore, Public Sector Net Borrowing and RPI indicators reported positive data, while PPI Input and PPI Output came in worse than expected.

Later, the Canadian retail sales data could impact the USD. Still, the Fed Chair Powell Testifies represents the most important event. The GBP/USD pair could register sharp movements.

The BOE is expected to increase the Official Bank Rate from 4.50% to 4.75% tomorrow. Further hikes are natural after the UK reported higher inflation.

In addition, SNB, US Unemployment Claims, and Fed Chair Powell Testifies could bring high action.

GBP/USD price technical analysis: Psychological barrier at 1.2800

Technically, the GBP/USD pair found support on the weekly pivot point of 1.2720. It has bounced back but failed to approach the upper median line (UML), which is a dynamic resistance.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

The 1.2800 psychological level stopped the short-term rally.

The price printed only a false breakout with great separation through this upside obstacle, and now it has turned to the downside again.

The weekly pivot point (1.2720) represents a critical downside obstacle. A new lower low and a valid breakdown activate a broader downside movement.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/gbp-usd-price-overbought-on-hotter-than-expected-inflation/

- :has

- :is

- 1

- 167

- 28

- 30

- 300

- 7

- 8

- a

- above

- Accounts

- Action

- addition

- Adjustment

- After

- again

- ahead

- an

- analysis

- and

- approach

- ARE

- AS

- At

- back

- Bank

- Bank Rate

- barrier

- BEST

- BoE

- Borrowing

- Breakdown

- breakout

- bring

- broader

- Building

- but

- buyers

- came

- CAN

- Canadian

- Canadian Retail Sales

- CFDs

- Chair

- check

- claims

- Climbed

- compared

- Consider

- consumer

- consumer price index

- Container

- Core

- could

- CPI

- critical

- Currency

- data

- day

- Day Trading

- Declines

- detailed

- downside

- dynamic

- Economic

- estimates

- Event

- expected

- Failed

- false

- Fed

- Fed Chair

- Fed Chair Powell

- Figures

- For

- Forecast

- forex

- found

- from

- further

- GBP/USD

- getting

- great

- Growth

- guide

- Have

- High

- higher

- Hikes

- hopes

- housing

- However

- HTTPS

- Impact

- important

- in

- Increase

- index

- Indicators

- inflation

- inflation figures

- input

- interested

- Invest

- investor

- IT

- July

- Kingdom

- later

- Level

- Line

- looking

- lose

- losing

- Low

- lower

- max-width

- money

- more

- most

- movement

- movements

- Natural

- net

- New

- now

- obstacle

- of

- official

- on

- only

- our

- output

- pair

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- Point

- policy

- positive

- Powell

- ppi

- price

- provider

- psychological barrier

- public

- rally

- Rate

- reaching

- Read

- received

- register

- Reported

- represents

- Resistance

- retail

- Retail Sales

- Risk

- ROW

- sales

- sector

- sharp

- Short

- short-term

- should

- SNB

- So

- starts

- stay

- Still

- stopped

- support

- SVG

- Take

- Technical

- Technical Analysis

- term

- than

- The

- the Fed

- the UK

- the United Kingdom

- The Weekly

- then

- this

- Through

- time

- to

- today

- tomorrow

- trade

- Trading

- Turned

- Uk

- unemployment

- United

- United Kingdom

- Upside

- us

- US Unemployment Claims

- USD

- Versus

- weekly

- were

- when

- whether

- which

- while

- with

- worse

- writing

- yesterday

- you

- Your

- zephyrnet