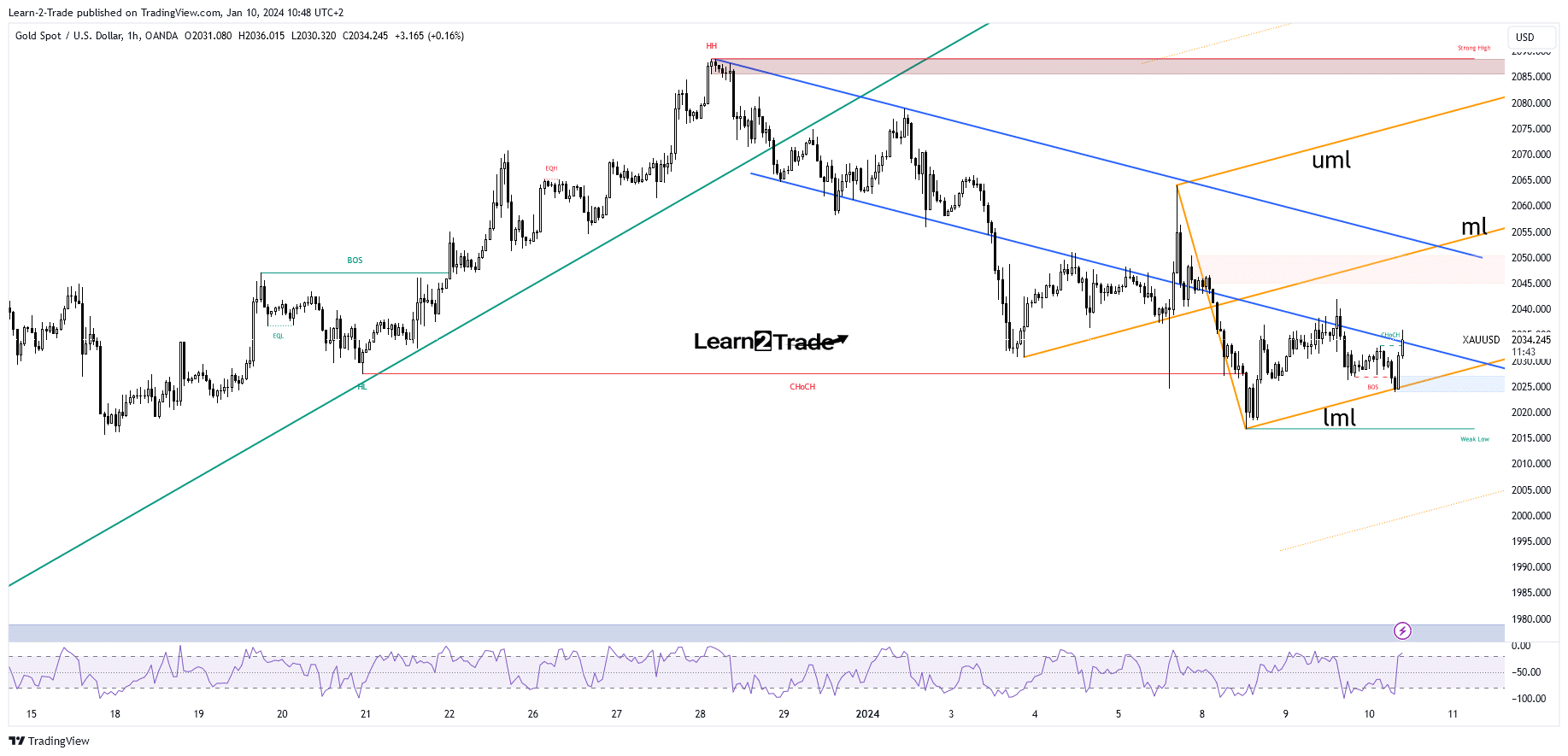

- XAU/USD seems determined to return higher as long as it stays above the lower median line.

- The US inflation data should bring sharp movements tomorrow.

- Only a new lower low invalidates a larger growth.

The gold price is trading in the green at $2,034 at the time of writing. The metal seems determined to hit new highs as the US dollar turned downside. The dollar’s sell-off should help the XAU/USD to come back higher and to erase some of the latest drops.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

Yesterday, the US Trade Balance and RCM/TIPP Economic Optimism came in better than expected, while the Canadian Trade Balance and Building Permits indicators reported poor data.

Today, the Australian CPI reported 4.3% growth, less compared to the 4.4% growth estimated and far below the 4.9% growth in the previous reporting period. Later, the BOE Gov Bailey Speaks, and the US Final Wholesale Inventories could bring some action.

Still, the traders are waiting for the US inflation data. The Consumer Price Index, CPI y/y, and the Core CPI data will be released tomorrow.

Higher inflation could punish the price of gold and lift the USD in the short term. Furthermore, the US PPI, Core PPI, the UK GPD, and the Chinese inflation figures could move the rate on Friday.

Gold Price Technical Analysis: Bullish Momentum

Technically, the yellow metal challenges the former channel’s downside line. The price has found strong support on the lower median line (LML) of the ascending pitchfork, and now it is trying to jump higher again. Its failure to take out the lower median line (LML) revealed sellers’ exhaustion and that the corrective phase could be over.

–Are you interested in learning more about forex signals telegram groups? Check our detailed guide-

The downtrend line, $2,050, and the median line (ml) of the ascending pitchfork represent potential upside targets. XAU/USD could develop a broader rebound as long as it stays above the lower median line (LML).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/01/10/gold-price-struggling-to-rebound-eyes-on-us-inflation/

- :has

- :is

- a

- About

- above

- Accounts

- Action

- again

- analysis

- and

- ARE

- AS

- At

- Australian

- Australian CPI

- back

- BAILeY

- Balance

- BE

- below

- Better

- BoE

- bring

- broader

- Building

- Bullish

- came

- CAN

- Canadian

- CFDs

- challenges

- check

- chinese

- come

- compared

- Consider

- consumer

- consumer price index

- Core

- could

- CPI

- CPI data

- data

- detailed

- determined

- develop

- Dollar

- downside

- Drops

- Economic

- estimated

- expected

- Eyes

- Failure

- far

- Figures

- final

- For

- forex

- Former

- found

- Friday

- Furthermore

- Gold

- gold price

- GPD

- Green

- Growth

- help

- High

- higher

- Highs

- Hit

- HTTPS

- in

- index

- Indicators

- inflation

- inflation figures

- interested

- Invest

- investor

- IT

- ITS

- jump

- larger

- later

- latest

- learning

- less

- Line

- Long

- lose

- losing

- Low

- lower

- max-width

- metal

- ML

- money

- more

- move

- movements

- New

- now

- of

- on

- Optimism

- our

- out

- over

- period

- permits

- phase

- plato

- Plato Data Intelligence

- PlatoData

- poor

- potential

- ppi

- previous

- price

- provider

- Rate

- rebound

- released

- Reported

- Reporting

- represent

- retail

- return

- Revealed

- Risk

- seems

- sell-off

- sharp

- Short

- should

- signals

- some

- Speaks

- strong

- Struggling

- support

- Take

- targets

- Technical

- Technical Analysis

- Telegram

- term

- than

- that

- The

- the UK

- this

- time

- to

- tomorrow

- trade

- Traders

- Trading

- trying

- Turned

- Uk

- Upside

- us

- US Dollar

- us inflation

- US PPI

- USD

- Waiting

- when

- whether

- while

- wholesale

- will

- with

- writing

- XAU/USD

- yellow

- you

- Your

- zephyrnet