- XAU/USD rallied as the DXY retreated.

- The US data should be decisive later today.

- 1,930 stands as a critical resistance.

The gold price registered a strong rally in the short term and is now at $1,927, well above yesterday’s low of $1,913. XAU/USD turned to the downside as the dollar retreated a little.

-If you are interested in social trading apps, check our detailed guide-

The yellow metal turned upside down after the SNB and BOE decided to keep the monetary policy unchanged, even if the specialists expected a 25-bps hike.

Furthermore, the US Existing Home Sales and Philly Fed Manufacturing Index were worse than expected yesterday.

Today, the Bank of Japan left the BOJ Policy Rate at -0.10%, as expected. In addition, the German, UK, and Eurozone manufacturing and services data came in mixed and confirmed contraction.

Later, Canadian Retail Sales are expected to report a 0.4% growth versus the 0.1% growth in the previous reporting period. In comparison, Core Retail Sales may register a 0.5% growth after the 0.8% drop in June.

Still, only the US manufacturing and services data could be decisive. Flash Services PMI could jump to 50.7 from 50.5, signaling expansion, while Flash Manufacturing PMI is expected to be higher at 48.2 versus 47.9 in the previous reporting period.

Better than expected, US data should force the USD to dominate the currency market and could push the XAU/USD down again.

Gold Price Technical Analysis: Bounce off

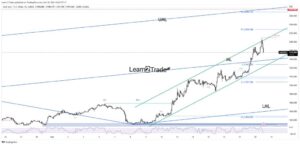

Technically, the gold price found support on the ascending pitchfork’s lower median line (LML), and now it has turned to the upside.

-If you are interested in brokers with Nasdaq, check our detailed guide-

After its strong sell-off, a bounce back was natural. It has reached the supply zone below the $1,930 key static resistance. Falling to make a new higher high could announce a new sell-off.

The lower median line (LML) and the weekly pivot point of $1,918 represent downside obstacles if the rate drops again. On the contrary, a valid breakout through $1,930 may announce further growth.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gold-price-aiming-for-1930-as-dollar-retreats/

- :has

- :is

- 50

- 7

- 9

- 913

- a

- above

- Accounts

- addition

- After

- again

- Aiming

- analysis

- and

- Announce

- ARE

- AS

- At

- back

- Bank

- bank of japan

- BE

- below

- BoE

- boj

- Bounce

- breakout

- came

- CAN

- Canadian

- Canadian Retail Sales

- CFDs

- check

- comparison

- CONFIRMED

- Consider

- contraction

- contrary

- Core

- could

- critical

- Currency

- data

- decided

- decisive

- detailed

- Dollar

- dominate

- down

- downside

- Drop

- Drops

- Dxy

- Eurozone

- Even

- existing

- expansion

- expected

- Falling

- Fed

- Flash

- For

- Force

- forex

- found

- from

- further

- German

- Gold

- gold price

- Growth

- High

- higher

- Hike

- Home

- HTTPS

- if

- in

- index

- interested

- Invest

- investor

- IT

- ITS

- Japan

- jump

- june

- Keep

- Key

- later

- left

- Line

- little

- lose

- losing

- Low

- lower

- make

- manufacturing

- Market

- max-width

- May..

- metal

- mixed

- Monetary

- Monetary Policy

- money

- Natural

- New

- now

- obstacles

- of

- on

- only

- our

- period

- Philly Fed Manufacturing Index

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- Point

- policy

- previous

- price

- provider

- Push

- rally

- Rate

- reached

- register

- registered

- report

- Reporting

- represent

- Resistance

- retail

- Retail Sales

- Risk

- sales

- sell-off

- Services

- Short

- should

- SNB

- specialists

- stands

- strong

- supply

- support

- Take

- Technical

- Technical Analysis

- term

- than

- The

- The Weekly

- this

- Through

- to

- today

- trade

- Trading

- Turned

- Uk

- Upside

- us

- US Existing Home Sales

- USD

- Versus

- was

- weekly

- WELL

- were

- when

- whether

- while

- with

- worse

- XAU/USD

- Yahoo

- yellow

- yesterday

- you

- Your

- zephyrnet