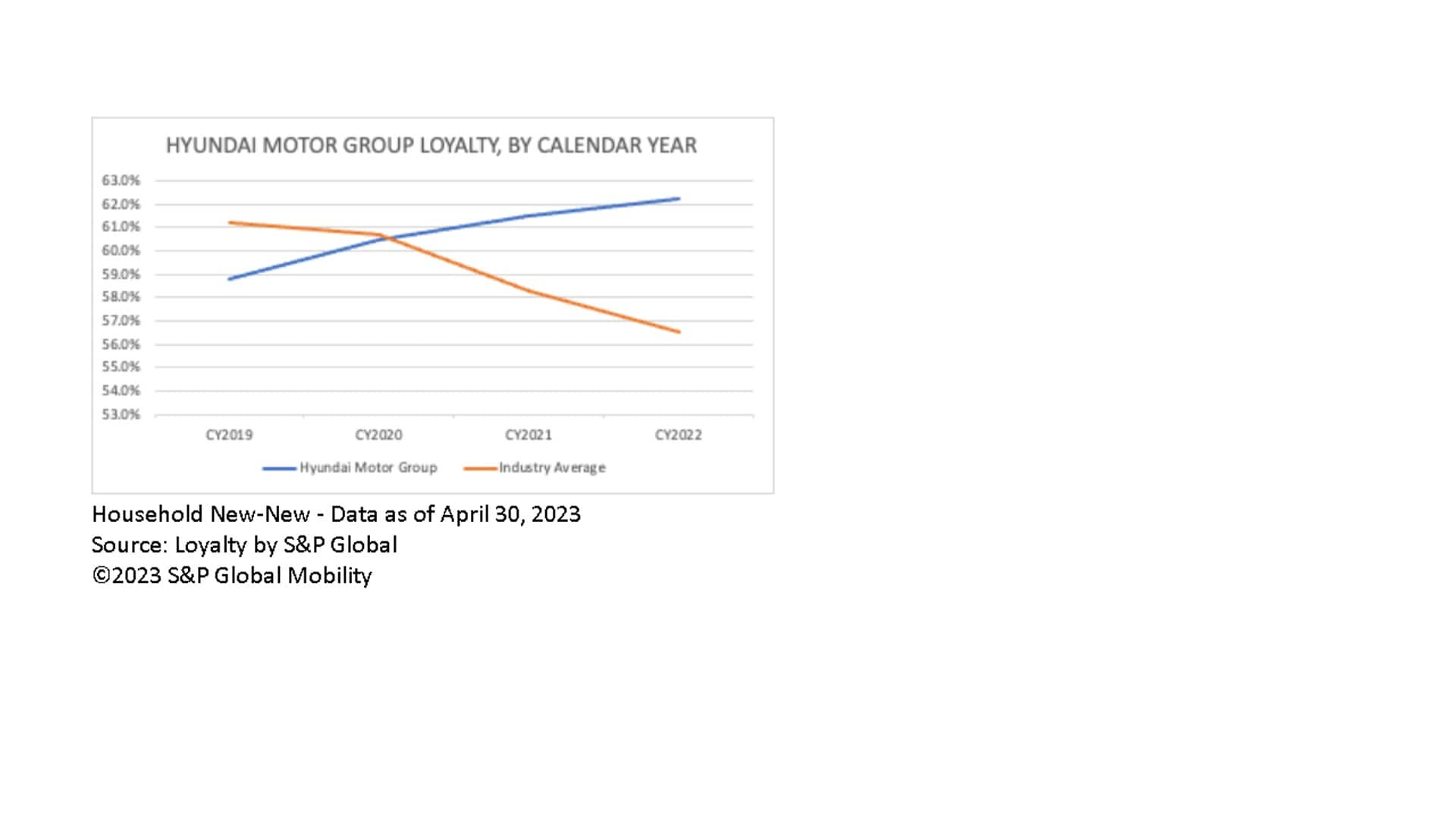

With the Korean automaker’s product portfolio

expanding, its popularity among repeat buyers is growing –

especially those in the luxury market.

S&P Global

Mobility’s 27th annual Customer Loyalty Awards earlier this

year highlighted Hyundai Motor Group’s leapfrogging of its rival

multi-line automakers into second place – hot on the heels of

perennial front-runner General

Motors. A key reason for Hyundai’s success: Its surging Genesis

luxury brand. And that second-place standing has continued through

the first half of 2023.

In 2015, though the Hyundai and Kia brands’

combined U.S. registrations were strong at 1.39 million, its

customer loyalty was a middling 55.2 percent. The Genesis brand had

just launched, with no SUVs in the lineup. Fast forward to calendar

2022 and not only had Hyundai-Kia U.S. sales increased to 1.45

million – despite pandemic-related shortages affecting all

automakers – you can tack on another 56,140 sales for Genesis. This

combination of brands has resulted in loyalty skyrocketing to 62.3

percent in calendar 2022, while industry average loyalty has fallen

during the recent pandemic period.

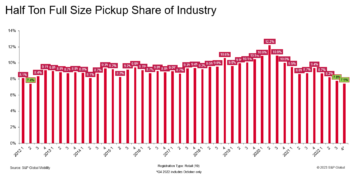

Hyundai Motor Group has been able to do this

without a full-size pickup truck that is a traditional loyalty

stronghold, said Vince Palomarez, product management principal for

market reporting with S&P Global Mobility.

When it comes to customer loyalty, the quality

and appeal of cars is a huge factor. However, the breadth and depth

of the product portfolio is equally important. As customers’ needs

change, any brand with enough selection to support that evolution

will find greater success at retaining loyalty. Hyundai Motor Group

is doing so, even though it has only recently moved into areas like

luxury vehicles and the Large SUV segment – segments where rival

Asian automakers have competed for decades.

“By offering Hyundai, Kia, and now Genesis,

Hyundai Motor Group has shown it can attract new owners and keep

them,” said Tom Libby, associate director of loyalty solutions and

industry analysis for S&P Global Mobility. “This opens up more

options for a household that has the means to move up to a luxury

vehicle, to stay within the corporation in a way that did not exist

before Genesis.”

The name “Genesis” first appeared on a Hyundai

product in 2003, on the Concept Genesis, and then was applied to a

production car on the Hyundai Genesis Coupe in 2007. However, the

Genesis brand didn’t appear as a standalone until the 2016 Genesis

G90 sedan, followed by the G70 and G80 sedans, and more recently

the GV60, GV70, and GV80 SUVs – with MSRPs stretching up to $98,700

for the G90 E-Supercharger.

“The credibility and competitiveness of Genesis

has really gone way up, I think partially because of the

competitiveness of the Kia and Hyundai brands,” Libby said.

“You can really see the evolution of this brand

as they’ve sold that initial product, brought those customers in,

and kept improving the quality,” added Palomarez. “The Genesis

brand should only help them going forward, increasing that loyalty

and presence in the industry.”

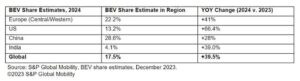

Add to that existing corporate lineup a series

of compelling EVs across all three brands based on the company’s

E-GMP platform – including the Hyundai Ioniq 6 sedan and the

Genesis GV60 SUV – and Hyundai has the product picture to ensure

its loyalty will stay on the rise.

Can Hyundai Motor Group keep it up? Through the

first half of 2023, Hyundai was still in second place behind GM,

with its loyalty dipping slightly to 60.5%, just a shade ahead of

Ford Motor at 60.4%.

2022 AUTOMOTIVE LOYALTY

AWARD WINNERS

MEASURING VEHICLE

LOYALTY, CONQUEST, AND DEFECTION

HOW GENERAL MOTORS

MAINTAINS ITS LOYALTY LEAD AMID DECLINING SALES

SUBSCRIBE TO THE TOP 10

INDUSTRY TRENDS NEWSLETTER

LOYALTY TO FINANCE

COMPANIES FELL SHARPLY DURING PANDEMIC

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/genesis-crucial-in-boosting-hyundai-motor-loyalty-.html

- :has

- :is

- :not

- :where

- ][p

- $UP

- 1

- 10

- 2015

- 2016

- 2022

- 2023

- 27th

- 39

- 60

- 700

- a

- Able

- across

- added

- affecting

- ahead

- All

- Amid

- among

- analysis

- and

- annual

- Another

- any

- appeal

- appear

- appeared

- applied

- areas

- article

- AS

- asian

- Associate

- At

- attract

- automakers

- automotive

- average

- award

- based

- because

- been

- before

- behind

- boosting

- brand

- brands

- breadth

- brought

- buyers

- by

- Calendar

- CAN

- car

- cars

- change

- combination

- combined

- comes

- Companies

- company

- compelling

- competed

- competitiveness

- concept

- continued

- Corporate

- CORPORATION

- Credibility

- crucial

- customer

- Customer Loyalty

- Customers

- decades

- Declining

- depth

- Despite

- DID

- didn

- Director

- Division

- do

- doing

- during

- Earlier

- enough

- ensure

- equally

- especially

- Ether (ETH)

- Even

- evolution

- evs

- exist

- existing

- expanding

- factor

- Fallen

- FAST

- finance

- Find

- First

- followed

- For

- Ford

- Forward

- General

- General Motors

- Genesis

- Global

- GM

- going

- gone

- greater

- Group

- Growing

- had

- Half

- Have

- help

- Highlighted

- HOT

- household

- However

- HTML

- HTTPS

- huge

- Hyundai

- i

- important

- improving

- in

- Including

- increased

- increasing

- industry

- Industry Analysis

- initial

- into

- IT

- ITS

- jpg

- just

- Keep

- kept

- Key

- Kia

- Korean

- large

- launched

- lead

- like

- lineup

- Loyalty

- Luxury

- maintains

- managed

- management

- Market

- means

- million

- mobility

- more

- Motor

- Motors

- move

- moved

- MSRPs

- name

- needs

- New

- no

- now

- of

- offering

- on

- only

- opens

- Options

- owners

- pandemic

- percent

- period

- Pickup

- picture

- Place

- platform

- plato

- Plato Data Intelligence

- PlatoData

- popularity

- portfolio

- presence

- Principal

- Product

- product management

- Production

- published

- quality

- ratings

- really

- reason

- recent

- recently

- repeat

- Reporting

- resulted

- retaining

- Rise

- Rival

- s

- S&P

- S&P Global

- Said

- sales

- Second

- sedans

- see

- segment

- segments

- selection

- Series

- shortages

- should

- shown

- So

- sold

- Solutions

- standalone

- stay

- Still

- strong

- Stronghold

- success

- support

- surging

- SUVs

- T

- that

- The

- Them

- then

- they

- think

- this

- those

- though?

- three

- Through

- to

- tom

- top

- Top 10

- traditional

- Trends

- truck

- u.s.

- until

- Ve

- vehicle

- Vehicles

- was

- Way..

- were

- which

- while

- will

- with

- within

- without

- XML

- year

- you

- zephyrnet