Automotive Monthly Newsletter &

Podcast:

It’s fall again, which only means one thing…attention is turned

to the aftermarket! S&P Global Mobility participated in two

events recently—Automechanika Frankfurt, a five-day event on

the Frankfurt exhibition grounds in September, self-heralded as the

world’s leading trade fair for the automotive service industry, and

AAPEX in Las Vegas on 1-3 November, with total visitor numbers

expected to be over 160,000 for AAPEX and SEMA combined.

On the opening day of AAPEX, our resident expert Todd Campau

presented our insights into the emerging top-five aftermarket

trends we can see within the automotive industry.

Top-five aftermarket trends

- Cars getting older, aftermarket stakeholders remain

cool about it.

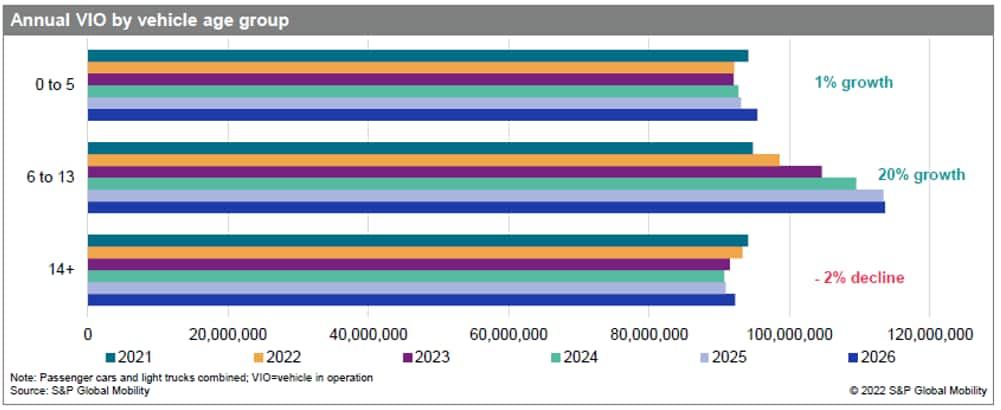

Augmented by the lack of new car supply, as well the concerns over

economic stability and the constrained new car supply, vehicles are

being kept longer and therefore the rates of car parc scrappage are

falling. With these historically low levels of scrappage, even with

the softer new car sales, the trend is showing that the vehicles in

operation (VIO) are continuing to rise. The executives we

interviewed at both shows did not seem too concerned about this as

the effect will not be perceived before five or six years.

Meanwhile, for their cousins in the aftersales segment, which

typically depend on the 1-4-year-old segment vehicles, the feedback

we gathered was quite the opposite.The aging fleet, with vehicles being retained longer, the average

age has now risen from just over 11 years in 2012 to 12.2 years in

2022. The most significant growth sector of the fleet is among the

6-13-year-old vehicles, a cohort that was already poised for

significant growth in volume prior to the current economic climate,

and is showing the most annual miles traveled, marking it an

aftermarket sweet spot. These more-traveled vehicles may be on

their second or third owner and likely to already be a prime

aftermarket customer.

- Mileage has returned but is different

Annual miles traveled has returned and even exceeded prior pandemic

totals, but the composition of the miles traveled have changed as

we have emerged from the pandemic. Insights derived from congestion

data have indicated that rush hours have not returned to

pre-pandemic levels in all locales, while in many locales

congestion throughout the day has displayed a slight uptick as

drivers are spreading trips throughout the day.The aggregated effect of the changing vehicle miles traveled is

expected to add about 1 percentage point to the overall VMT for

2022, increasing to 3.5 trillion miles for passenger cars and light

trucks, which will fall within the range of typical year-on-year

VMT change prior to the pandemic. That said, the regional change is

expected to vary greatly year on year, ranging from a 1.2% decline

in Mississippi to a 5.4% increase in New York. Likewise, demand for

aftermarket maintenance and repair opportunities based on miles

traveled is expected to see varied growth from region to

region.

- Digitization of the workshop as connectivity

rises

With vehicle connectivity now enabled with longer serviceable

connections, we expect that one-third of the VIO will be connected

by 2024 and 5G connectivity will be the dominate service for new

vehicles in 2027. By the end of the decade, it is expected that

over one-third of the VIO will be connected, and 95% of them will

be capable of receiving manufacturer-driven software with

over-the-air (OTA) updates.From Automechanika, and the conversation with diagnostic providers,

OTA updates were expected to lead to fewer warranty visits and

could reduce revenue opportunities for OEMs. Focus has been on

successfully developing relationships with OEMs and securing access

to their secure gateways to enable the aftermarket’s ability to

complete all repairs. This has given many providers the ability to

offer this level of connectivity on a subscription or

pay-per-repair basis and also offer technical repair solutions and

guidance. - Autonomy opportunities

Increased adoption of automatic driver assist systems

(ADAS) will continue to penetrate the vehicle fleet at pace. As an

example, in 2022, more than 60% of new models have adaptive cruise

control compared with about 15% just five years ago. As a share of

VIO, the significance of vehicles enabled with adaptive cruise

control has risen from 0% in 2015 to 12% in 2022.To the body repair industry, as the technology continues to

penetrate the VIO, it could influence the rates of collision and

the increased adoption of cosmetic and smart repair service

offerings.The main opportunities that were presented at AAPEX and

Automechanika were that ADAS systems are a focal point as they were

vulnerable to the effects from poor roads conditions and wheel

impacts. The importance of ADAS provides an opportunity to service

offerings around calibration and safety checks, as well as the

associated need to ensure that wheel alignment was checked and

adjusted to ensure all ADAS systems remained operational and safe.

These services offered a significant revenue and upsell

opportunity. - Transition to electrification

With VIO of 1.4 million electric vehicles (EVs) in the US

currently, a conservative estimate puts that total to be close to

17 million VIO by 2030 as new models will increase from 26 in 2021

to more than 250 in 2030. Conservative and aggressive outlooks lead

to overall share of the vehicle fleet of less than 15% in

2030—even as EVs show significant growth in new registrations,

transformation of the fleet will take years.

More states in the US are proposing regulations to restrict new

registrations to either zero- or low-emission vehicles, and similar

trends are following in Europe, which is creating additional

influencing factors as to why we have seen customers choosing to

adopt EVs sooner. However, recent surveys show continued reticence

in consumer acceptance. In 2021, 81% of those surveyed would have

considered purchasing a battery-electric vehicle (BEV); however, in

2022, only 58% shared that view. The reason for this change seems

to be skepticism toward EV technology, pricing, charging

infrastructure, and battery technology being barriers. Pragmatism

is strongly encouraged in developing and implementing an EV

strategy because while the transition will take time, preparation

will be key to a successful future.Of the new vehicle registrations in 2022 in the US, the light truck

sector dominated the electric segment, representing 60% of all EVs

registered.Although there will be challenges, the future of the aftermarket

still presents an aging car parc with increased repair

opportunities. This aging is likely to continue as the economic

influences have a destructive effect on new car sales while the

constraints on new car supply are likely to continue through 2024.

Although BEV growth is good, the proportion against total VIO

indicates there is still caution, with many waiting to gain

confidence in the technology and infrastructure before switching to

fully electric.

——————————————-

Dive Deeper — Check out our automotive

insights

Download Presentation: 5 Automotive

Trends Impacting the North America Aftermarket

Webinar Replay: Digitization of the

automotive aftermarket through connectivity

Subscribe to

AftermarketInsight

Top 5 Replacement Parts for

Commercial Vehicles. Learn more

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/fuel-for-thought-top-5-global-automotive-aftermarket-trends.html

- 000

- 1

- 11

- 15%

- 17 million

- 2%

- 2012

- 2021

- 2022

- 2024

- 5G

- 7

- 95%

- a

- ability

- About

- about IT

- acceptance

- access

- According

- ADAs

- Additional

- Adjusted

- adopt

- Adoption

- against

- aggressive

- Aging

- All

- already

- Although

- america

- among

- analysis

- and

- and infrastructure

- annual

- around

- article

- associated

- Automatic

- automotive

- automotive industry

- available

- average

- barriers

- based

- basis

- battery

- because

- before

- being

- Blog

- body

- capable

- car

- cars

- challenges

- change

- changing

- charging

- check

- Checks

- choosing

- Climate

- Close

- Cohort

- combined

- commercial

- compared

- complete

- concerned

- Concerns

- conditions

- confidence

- connected

- Connections

- Connectivity

- considered

- constraints

- consumer

- continue

- continued

- continues

- continuing

- control

- Conversation

- Cool

- could

- Creating

- cruise

- Current

- Currently

- customer

- Customers

- data

- day

- decade

- Decline

- deeper

- Demand

- Derived

- developing

- DID

- digitization

- Division

- dominate

- driver

- drivers

- Economic

- effect

- effects

- either

- Electric

- electric vehicles

- emerged

- emerging

- enable

- encouraged

- ensure

- estimate

- Ether (ETH)

- Europe

- EV

- Even

- Event

- events

- example

- executives

- exhibition

- expect

- expected

- expert

- factors

- fair

- Fall

- Falling

- feedback

- FLEET

- Focus

- following

- from

- Fuel

- fully

- future

- Gain

- getting

- given

- Global

- good

- greatly

- Growth

- historically

- HOURS

- However

- HTML

- HTTPS

- Impact

- Impacts

- implementing

- importance

- in

- Increase

- increased

- Increases

- increasing

- indicates

- industry

- influence

- influencing

- Infrastructure

- insights

- interviewed

- IT

- Key

- Lack

- Las Vegas

- lead

- leading

- LEARN

- Level

- levels

- light

- likely

- longer

- Low

- low levels

- Main

- maintenance

- managed

- many

- means

- Meanwhile

- million

- mobility

- models

- monthly

- more

- most

- Need

- New

- New York

- Newsletter

- North

- north america

- November

- numbers

- offer

- offered

- Offerings

- ONE

- One-third

- opening

- operation

- operational

- opportunities

- Opportunity

- opposite

- overall

- owner

- Pace

- pandemic

- participated

- parts

- perceived

- percentage

- plato

- Plato Data Intelligence

- PlatoData

- podcast

- Point

- poor

- presentation

- presented

- presents

- pricing

- Prime

- Prior

- providers

- provides

- published

- purchasing

- Puts

- range

- ranging

- Rates

- ratings

- reason

- receiving

- recent

- reduce

- region

- regional

- registered

- regulations

- Relationships

- remain

- remained

- repair

- representing

- restrict

- revenue

- Rise

- Risen

- rush

- S&P

- S&P Global

- safe

- Safety

- Said

- sales

- Second

- sector

- secure

- securing

- seems

- segment

- September

- service

- Services

- Share

- shared

- show

- Shows

- significance

- significant

- similar

- SIX

- Skepticism

- smart

- Software

- Solutions

- Spot

- Spreading

- Stability

- stakeholders

- States

- Still

- Strategy

- strongly

- subscription

- successful

- Successfully

- supply

- surveyed

- sweet

- Systems

- Take

- Technical

- Technology

- The

- their

- therefore

- Third

- thought

- Through

- throughout

- time

- to

- too

- top

- top 5

- Total

- toward

- trade

- Transformation

- transition

- traveled

- Trend

- Trends

- Trillion

- truck

- Trucks

- Turned

- typical

- typically

- Updates

- us

- VEGAS

- vehicle

- Vehicles

- View

- Visits

- volume

- Vulnerable

- Waiting

- Wheel

- which

- while

- will

- within

- workshop

- world

- would

- year

- years

- zephyrnet