What are flexitarians hungry for?

After Impossible Foods stunned the world with its Impossible Burger, the vegan burger that “bleeds,” in 2016, plant-based meat seemed like the natural next step in sustainable dietary consumerism — one that meat-eaters would happily flock to. Funding to plant-based meat startups between 2016 and 2019 saw a whopping 1,110% increase, and that percentage shot up during the pandemic.

Much of that success depended not on vegetarians and vegans, who only make up a small slice of the consumer market, but on omnivores and self-described “flexitarians,” who were looking to plant-based alternatives for the sake of their health and the environment.

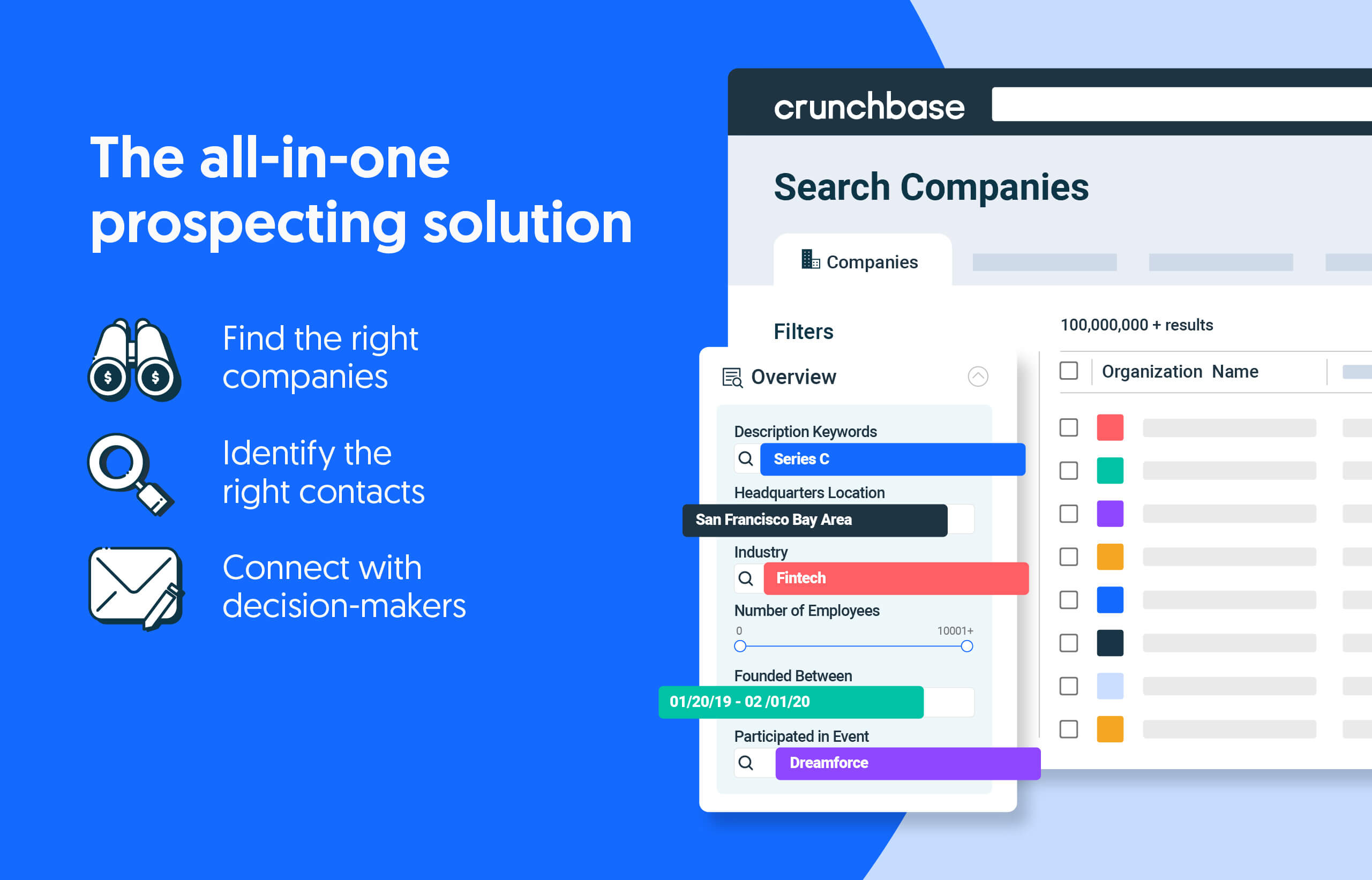

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

But it looks like flexitarians’ attitudes are changing. Inflation, supply chain issues and dwindling customer satisfaction has brought startup investment into plant-based meat to a standstill. Funding went from almost $2 billion in 2021 to around $800 million in 2022, according to Crunchbase data. And these challenges are likely to continue in 2023 as startups work to find ways to deliver healthy plant-based meat products at a reasonable price.

While the outlook for plant-based meat is dismal, the far quieter cell-grown meat industry saw some good news in 2022. California-based Upside Foods got word from the Food and Drug Administration in November that its lab-grown chicken is safe to eat.

For the first time in years, funding for plant-based and cultivated meat has nearly reached dollar parity. But investors aren’t putting all their eggs into a new basket. It’s clear that meat alternatives have not delivered on their promises to consumers.

“A lot of meat consumption is emotional,” said Lisa Feria, CEO of food venture firm Stray Dog Capital. “And a lot of the plant-based consumption and purchase is rational.”

An unforgiving market

In November, plant-based meat giant Beyond Meat shared some sobering news during its quarterly earnings call: The company posted net revenue of $82.5 million and losses of $101.7 million. The company said it would lower the amount of product it manufactured and revisit its marketing strategy to only certain consumers.

It’s a sharp descent for a company that went public in 2019 to nearly double its share price.

Other plant-based meat startups face the same reality, and new innovations in the sector will face more frostbite from the venture market than before.

“In the past two or three years, a lot of plant-based food companies got funded that should not have gotten funded,” Feria said. “So part of what you’re seeing in the market is an adjustment to that. The products are repetitive and not really great.”

According to a 2021 Good Food Institute report, health is the primary driver for plant-based meat purchases. But it turns out these early movers in ultraprocessed plant-based meat weren’t, on the whole, that much healthier than the real thing.

Nor were they any tastier, or cheaper. The cost of manufacturing these products have gone up 60% to 70%, and distribution costs have spiked as a result. Everything from plant-based cream cheese to plant-based eggs to plant-based meat have seen shelf prices soar. The GFI report found that more than 60% of consumers would eat more plant-based meat if it was cheaper or less processed.

All of this contributed to the sector’s economic decline in 2022.

“There was a lot of initial purchase and interest in plant-based meat products, but not as much repeat purchase as was expected,” Matthew Walker, managing director of agriculture-focused firm S2G Ventures, said in an email. “You have a consumer that purchased a product at a premium price and may not have felt that the taste, mouthfeel, or nutrition sufficiently justified making that product a staple item on their grocery list.”

Tall order for 2023

Plant-based meat startups will face a difficult task this year: to create products that taste just as good as (if not better than) the incumbent, while also being healthier and cheaper.

“The strategy we see as top of mind involves those solutions that make plant-based meats perform better for the consumer, have cleaner labels, and introduce nutritional benefits that go beyond the ‘halo effect’ that this recent wave of products enjoyed but seems to have declined,” Walker said.

Cultivated meat, which uses stem cells to grow proteins streaked with fat and tendons in petri dishes, has emerged as a possible alternative for those discerning flexitarians. But we won’t see them on the grocery shelves any time soon.

The industry is still working out how to scale its products in expensive labs. Singapore became the first country to approve cultured meat for sale in 2020 with Eat Just’s lab-grown chicken. (The startup has raised $225 million since then.) And following the FDA’s “safe to eat” letter for a lab-grown chicken startup, the U.S. is on its way to seeing cultivated meat reach small-scale distribution levels, like how Impossible Foods opened in a few select restaurants.

But investors are hesitant to promise too much too fast. Studies show that consumers will be far less forgiving of cultivated meat than they were of plant-based meat.

“[For plant-based meat], I’m going to give some space for that because I want a trade off, which is nutrition and health,” Feria said. “When it comes to [cultivated] meat, because you’re trying to deliver the same product you have to deliver the same experience or better.”

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

Although security needs around software development, applications and data remain, cybersecurity startups likely will continue to battle against a...

Venture and growth investors in private companies scaled back their investment pace significantly in the latter half of 2022, signaling a slower...

Layoff news quelled in the weeks leading up to the winter holidays. But it only took four days into the new year for enterprise cloud platform...

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://news.crunchbase.com/agtech-foodtech/forecast-2023-alternative-meat-startups/

- 2016

- 2019

- 2020

- 2021

- 2022

- 2023

- 7

- a

- According

- acquisitions

- Adjustment

- against

- All

- all-in-one

- alternative

- alternatives

- amount

- and

- applications

- approve

- around

- back

- basket

- Battle

- because

- before

- being

- benefits

- Better

- between

- Beyond

- Billion

- brought

- burger

- call

- Cells

- ceo

- certain

- chain

- challenges

- changing

- cheaper

- clear

- Close

- Cloud

- Cloud Platform

- Companies

- company

- consumer

- Consumers

- consumption

- continue

- contributed

- Cost

- Costs

- country

- cover

- Cream

- create

- CrunchBase

- customer

- Customer satisfaction

- Cybersecurity

- daily

- data

- Date

- Days

- Decline

- deliver

- delivered

- Development

- difficult

- Director

- distribution

- Dog

- Dollar

- double

- drug

- during

- Early

- Earnings

- earnings call

- eat

- Economic

- Eggs

- emerged

- Enterprise

- Environment

- everything

- expected

- expensive

- experience

- Face

- FAST

- Fat

- few

- Find

- Firm

- First

- first time

- following

- food

- foods

- Forecast

- found

- from

- funded

- funding

- funding rounds

- GFI

- giant

- Give

- Go

- going

- good

- great

- grocery

- Grow

- Growth

- Half

- Health

- healthier

- healthy

- Hesitant

- holidays

- How

- How To

- HTML

- HTTPS

- Hungry

- impossible

- in

- Increase

- Incumbent

- industry

- initial

- innovations

- interest

- introduce

- investment

- Investors

- issues

- IT

- Labels

- Labs

- leader

- leading

- letter

- levels

- likely

- List

- looking

- LOOKS

- losses

- Lot

- make

- Making

- managing

- Managing Director

- manufactured

- manufacturing

- Market

- Marketing

- Meat

- million

- mind

- more

- Movers

- Natural

- nearly

- needs

- net

- net revenue

- New

- new year

- news

- next

- November

- nutrition

- ONE

- opened

- order

- Outlook

- Pace

- pandemic

- parity

- part

- past

- percentage

- perform

- Petri

- platform

- plato

- Plato Data Intelligence

- PlatoData

- possible

- posted

- powered

- Premium

- price

- Prices

- primary

- private

- Private Companies

- Product

- Products

- promise

- promises

- Proteins

- public

- purchase

- purchased

- purchases

- Putting

- raised

- Rational

- reach

- reached

- real

- Reality

- reasonable

- recent

- Recent Funding

- remain

- repeat

- report

- Restaurants

- result

- Reuters

- revenue

- rounds

- safe

- Said

- sake

- sale

- same

- satisfaction

- Scale

- sector

- security

- seeing

- seemed

- seems

- Share

- shared

- Shelf

- shelves

- should

- show

- significantly

- since

- Singapore

- Slice

- small

- Software

- software development

- Solutions

- some

- Soon

- Space

- Starting

- startup

- Startups

- stay

- Stem

- stem cells

- Step

- Still

- Strategy

- studies

- success

- supply

- supply chain

- sustainable

- Task

- The

- the world

- their

- thing

- this year

- three

- time

- to

- too

- top

- trade

- u.s.

- ubs

- venture

- Wave

- ways

- Weeks

- What

- which

- while

- WHO

- will

- Winter

- Word

- Work

- working

- working out

- world

- would

- year

- years

- Your

- zephyrnet