After a rough 2022, many people in venture were hoping 2023 would offer a reprieve.

While the year did see some steadying in the venture-backed startup world, it did not lack for big stories, big busts and big buzz.

From crypto contagion to a banking crisis that rocked the industry, to a CEO’s firing saga that was like a never-ending soap opera storyline, 2023 saw a lot — so let’s take a look back as we go forward.

Crypto contagion

The year started with many folks still trying to wrap their heads around one of the greatest startup implosions of all time: That of crypto exchange FTX. Company founder Sam Bankman-Fried was already facing criminal charges — including fraud — in the collapse of the highly valued company.

FTX and FTX US, its U.S.-based exchange, were valued at $32 billion and $8 billion, respectively, and were backed by some of of the biggest names in venture — including Sequoia Capital, NEA, Lightspeed Venture Partners, Insight Partners, Temasek, SoftBank Vision Fund, Thoma Bravo, SoftBank Vision Fund 2 and Coinbase Ventures.

Despite the crypto contagion that gripped the industry — with several startups declaring bankruptcy and/or announcing layoffs — crypto prices steadily rose through the year.

However, VC optimism was not as high and crypto and Web3 funding declined significantly.

Finally in November, a jury convicted Sam Bankman-Fried, commonly known by his initials SBF, on all seven criminal charges he faced, including two counts of fraud and five counts of conspiracy. The jury in Manhattan took just over four hours to decide the disgraced founder stole about $8 billion from customers on his cryptocurrency exchange. In total, the seven charges could bring a 115-year prison term, although legal experts have said Bankman-Fried, who has a sentencing hearing slated for March 2024, is unlikely to receive a sentence that long.

AI = big money

The seeds of this year’s AI craze were firmly planted in late 2022, when London-based AI-driven visual art startup Stability AI, San Francisco-based AI video and audio editing tool Descript, and Austin, Texas-based AI content platform Jasper all raised big rounds.

However, the even bigger news came in the first month of the new year, as Microsoft invested a reported $10 billion into AI goliath OpenAI, the company behind the artificial intelligence tools ChatGPT and DALL-E.

That, of course, was just the beginning. Dozens of AI startups in the sector — or at the very least claiming to be using AI — raised billions of dollars. Some of the biggest deals include:

- In June, Palo Alto, California-based Inflection AI locked up a huge $1.3 billion round led by Microsoft, Reid Hoffman, Bill Gates, Eric Schmidt and new investor Nvidia, which valued Inflection AI at $4 billion, according to Forbes. The startup is building what it says will be the “largest AI cluster in the world” and has created large language models to allow people to interact with its AI-powered assistant called Pi, or Personal AI.

- In September, San Francisco-based Anthropic inked a deal with Amazon for the e-commerce and cloud titan to invest up to $4 billion in the AI startup. The new investment gives Seattle-based Amazon a minority stake in Anthropic. The immediate investment is $1.25 billion, with either party having the right to trigger another $2.75 billion in funding, Reuters reported.

- In November, Germany-based Aleph Alpha raised a $500 million Series B as AI startups outside the U.S. continued to see bigger rounds as the year wore on. The round was led by Innovation Park Artificial Intelligence, Bosch Ventures and the companies of Schwarz Group. Founded in 2019, Aleph Alpha allows companies to develop and deploy large language and multimodal models.

The AI craze among investors included large corporations and their VC arms. Aside from Microsoft, others, including Google, Zoom Ventures, Nvidia, Oracle and Salesforce Ventures1 all found it hard to say no to big rounds in the AI space.

While money poured into AI, so did drama, but that’s for a little later.

Yet another crisis

Not even AI could stop what would come next, as the industry would suffer a most unexpected blow.

On March 9, the iconic startup bank Silicon Valley Bank — which had relationships with more than half of all venture-backed companies in the U.S. and countless VC firms — saw its stock price plunge after announcing it would sell $2.25 billion worth of stock to shore up its balance sheet.

Even as the bank sought to assure customers all was well, the announcement rocked the venture world and led to concerns about the bank’s liquidity and balance sheet strength.

Customers — including many startups — sought to get their deposits out of the failing bank, with many needing the money to make upcoming payrolls. The bank’s collapse forced Parker Conrad’s workforce management startup Rippling to raise $500 million in hours so its clients could pay employees as concerns about access to SVB-held funds swirled.

That soon led to a run on withdrawals and an end of what had become the dominant bank for VC-backed startups for the past 40 years, providing banking services for “up-and-coming” tech companies such as Cisco Systems and Bay Networks back in the day.

SVB’s collapse was in part due to the decline venture had witnessed through the past year-plus. During the 2021 venture capital boom, the bank was flush with cash as private companies raised huge sums of fresh capital at sky-high valuations. But the market slowed with rising interest rates, and that cash dried up as deposits by startups dipped. SVB simultaneously made the disastrous decision to invest in long-term, higher-yield bonds, which further hindered its liquidity.

On March 26, the Federal Deposit Insurance Corp. announced First Citizens BancShares had agreed to buy the loans and deposits of the failed Silicon Valley Bank.

Just like that, a vital pillar in the venture capital ecosystem — known for its vast venture lending practice for startups — was gone after four decades.

A report by the Federal Reserve Board said the collapse was a “textbook case of mismanagement by the bank” and that when the bank’s board and management realized its risks, it did not take the appropriate steps to fix those problems quickly.

Days after regulators issued a report on the historic collapse of Silicon Valley Bank, First Republic Bank — with its expanding technology division and serving as the bank of a growing number of startups — also fell into receivership and was quickly sold to JPMorgan Chase.

The two banks’ collapses — the second- (First Republic) and third- (SVB) largest in U.S. history — have changed, and likely will continue to change, the way startups bank, with many now looking to diversify where they put assets and how they are held.

The failures also will continue to affect how companies can secure venture debt — something more needed now in a slow venture market.

Tech layoffs mounted

The venture slowdown didn’t just affect banks. As cash became tighter in tech, companies both big and small continued to lay people off.

Since the start of the year, around 190,000 workers at U.S.-based tech companies — or tech companies with a large U.S. workforce — have been laid off in mass job cuts, according to Crunchbase News’ Tech Layoffs Tracker.

Those layoffs have happened everywhere, from big-name public companies including Alphabet, Oracle, Splunk, Qualcomm and Coinbase, to startups such as Navan, Pendo, Reddit and hundreds of smaller companies.

Those job cuts probably shouldn’t come as a surprise. VC and growth-equity giants including Andreessen Horowitz, SoftBank and Tiger Global have all substantially slowed their investment pace since the highs of 2021.

Along with companies shedding jobs, we’ve also seen some high-profile startups completely shutter in recent months, including Convoy and D2iQ.

Job cuts and total shutdowns could continue into the new year. Many companies have been able to live off the vast sums they raised in 2021 and 2022, but that money is likely dwindling. In addition, factors such as companies continuing to shift their focus back to profitability and away from growth, and the emergence of AI could mean more layoffs in 2024.

IPO market rebound?

That doesn’t mean there were not some positive economic signs in the market.

In August, after nearly two years, the tech IPO market finally opened back up.

Leading the way were two highly expected and heavily funded startups, Arm Holdings and Instacart.

The hope then, as it is now, for investors is that those IPOs — along with marketing email automation company Klaviyo’s — could help thaw out the frozen IPO pipeline. It was just two years ago when more than 350 venture-backed companies went public in the U.S.

Exit opportunities are vital to a healthy and robust venture market. VCs need the liquidity from IPOs or M&A events to show LPs returns — so they have money to invest in funds again and possibly at higher rates.

It’s still unclear if the flurry of activity will lead to increased IPO activity in 2024, but hopes are high that companies like Stripe will see the thawing of the stagnant market as an opportunity to finally give more employees a chance to make their fortune.

Altman drama

Of course, the year could not end without more drama, and this time it was AI darling OpenAI that would provide it.

On Nov. 17, news broke its co-founder and AI wunderkind Sam Altman was out as the company’s CEO. In a posting, the company said Altman’s departure comes after “a deliberative review process by the board, which concluded that he was not consistently candid in his communications with the board, hindering its ability to exercise its responsibilities. The board no longer has confidence in his ability to continue leading OpenAI.”

The news rocked the tech and venture world and became the only story for days as the saga dragged on.

Over the next few days, news around the shocking removal continued as nearly every OpenAI employees had signed a letter to the company’s board saying they would leave the generative AI startup unless the board resigned and brought back Altman and former President Greg Brockman.

In the meantime, Altman and Brockman agreed to join a new AI research venture at tech giant Microsoft — OpenAI’s biggest backer.

Finally, the soap opera ended five days later as Altman returned as CEO and the company agreed to revamp its board.

Oddly, very little has come out as to why Altman was fired. Microsoft CEO Satya Nadella has said in media interviews that there is no substantial smoking gun behind the firing.

“The board has not talked about anything that Sam did other than some breakdown in communications,” Nadella said in an interview with Bloomberg News.

Expect more on that to come out in the new year, as well as more of the fun, frivolity, drama and disappointment the venture world is known for.

Related reading:

Illustration: Dom Guzman

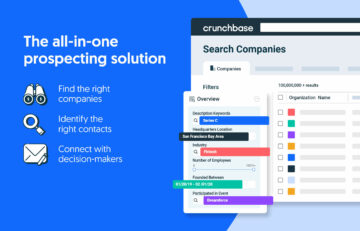

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://news.crunchbase.com/venture/svb-sbf-ai-ipos-timeline-eoy-2023/

- :has

- :is

- :not

- :where

- $UP

- 000

- 1

- 17

- 2019

- 2021

- 2022

- 2023

- 2024

- 25

- 26

- 350

- 40

- 75

- 9

- a

- ability

- Able

- About

- access

- acquisitions

- Acronyms

- Action

- activity

- addition

- affect

- After

- again

- ago

- agreed

- AI

- ai research

- ai video

- AI-powered

- All

- all-in-one

- allow

- allows

- along

- Alpha

- already

- also

- Although

- Amazon

- among

- an

- and

- Announcement

- Announcing

- Another

- Anthropic

- anything

- appropriate

- ARE

- around

- Art

- artificial

- artificial intelligence

- AS

- aside

- Assets

- Assistant

- assure

- At

- audio

- AUGUST

- austin

- Automation

- away

- back

- backed

- Balance

- Balance Sheet

- Bank

- Banking

- banking crisis

- Bankman-Fried

- Bankruptcy

- Banks

- BE

- became

- become

- been

- Beginning

- behind

- Big

- bigger

- Biggest

- Billion

- billions

- Bloomberg

- blow

- board

- Bonds

- both

- Breakdown

- bring

- Broke

- brought

- Building

- busts

- but

- buy

- by

- called

- came

- CAN

- capital

- case

- Cash

- ceo

- Chance

- change

- changed

- charges

- Citizens

- claiming

- clients

- Close

- Cloud

- Cluster

- Co-founder

- Collapse

- collapses

- come

- comes

- commonly

- Communications

- Companies

- company

- Company’s

- completely

- Concerns

- concluded

- confidence

- consistently

- Conspiracy

- Contagion

- content

- content platform

- continue

- continued

- continuing

- Corp

- Corporations

- could

- course

- created

- Criminal

- crisis

- CrunchBase

- crypto

- crypto exchange

- Crypto Prices

- cryptocurrency

- Cryptocurrency Exchange

- Customers

- cuts

- daily

- darling

- data

- Date

- day

- Days

- deal

- Deals

- decades

- decide

- decision

- Decline

- departure

- deploy

- deposit

- DEPOSIT INSURANCE

- deposits

- develop

- DID

- disappointment

- disastrous

- diversify

- Division

- Doesn’t

- dollars

- dominant

- dozens

- Drama

- due

- during

- e-commerce

- Economic

- ecosystem

- editing

- either

- email automation

- emergence

- employees

- end

- ended

- Even

- events

- Every

- everywhere

- exchange

- Exercise

- expanding

- expected

- experts

- faced

- factors

- Failed

- failing

- failures

- few

- Finally

- fired

- firing

- firmly

- firms

- First

- five

- Fix

- flurry

- Focus

- For

- For Investors

- For Startups

- Forbes

- forced

- Former

- Fortune

- Forward

- found

- Founded

- founder

- four

- fraud

- fresh

- from

- frozen

- fun

- fund

- funded

- funding

- funding rounds

- funds

- further

- generative

- Generative AI

- get

- giant

- giants

- Give

- gives

- Go

- gone

- greatest

- Growing

- Growth

- had

- Half

- happened

- Hard

- Have

- having

- he

- heads

- healthy

- hearing

- heavily

- Held

- help

- High

- high-profile

- higher

- highly

- Highs

- hindered

- his

- historic

- history

- hope

- hopes

- hoping

- HOURS

- How

- HTTPS

- huge

- Hundreds

- iconic

- if

- immediate

- in

- include

- Including

- increased

- industry

- Inflection

- inked

- insurance

- Intelligence

- interact

- interest

- Interest Rates

- Interviews

- into

- Invest

- invested

- investment

- investor

- Investors

- IPO

- IPOs

- Issued

- IT

- ITS

- Job

- job cuts

- Jobs

- join

- jpg

- june

- just

- known

- Lack

- language

- large

- largest

- Late

- later

- lay

- layoffs

- lead

- leader

- leading

- least

- Leave

- Led

- Legal

- legal experts

- lending

- less

- letter

- like

- likely

- Liquidity

- little

- live

- Loans

- locked

- Long

- long-term

- longer

- Look

- looking

- Lot

- LPs

- M&A

- made

- make

- management

- many

- many people

- March

- March 2024

- Market

- Marketing

- Mass

- mean

- meantime

- Media

- Microsoft

- million

- minority

- models

- money

- Month

- months

- more

- most

- names

- nearly

- Need

- needed

- needing

- New

- new investment

- new year

- news

- next

- no

- nov

- November

- now

- number

- of

- off

- offer

- on

- ONE

- only

- OpenAI

- opened

- Opera

- opportunities

- Opportunity

- Optimism

- or

- Other

- Others

- out

- outside

- over

- Pace

- Palo Alto

- Park

- part

- party

- past

- Pay

- Payrolls

- People

- personal

- Pillar

- pipeline

- platform

- plato

- Plato Data Intelligence

- PlatoData

- plunge

- positive

- possibly

- powered

- practice

- president

- price

- Prices

- prison

- private

- Private Companies

- probably

- problems

- process

- profitability

- provide

- providing

- public

- public companies

- put

- quickly

- raise

- raised

- Rates

- Reading

- realized

- rebound

- receive

- recent

- Recent Funding

- Regulators

- Relationships

- removal

- report

- Reported

- Republic

- research

- Reserve

- resigned

- respectively

- responsibilities

- returns

- Reuters

- revenue

- review

- right

- rising

- risks

- robust

- rocked

- ROSE

- round

- rounds

- Run

- s

- saga

- Said

- Sam

- Sam Bankman-Fried

- San

- saw

- say

- saying

- says

- sbf

- sector

- secure

- see

- seeds

- seen

- sell

- sentence

- September

- Series

- Services

- serving

- seven

- several

- sheet

- shift

- show

- shutdowns

- signed

- significantly

- Signs

- Silicon

- Silicon Valley

- silicon valley bank

- simultaneously

- since

- slow

- Slowdown

- small

- smaller

- Smoking

- So

- soap

- Solutions

- some

- something

- Soon

- sought

- Space

- stake

- start

- started

- startup

- Startups

- stay

- steadily

- Steps

- Still

- stock

- stole

- Stop

- Stories

- Story

- strength

- substantial

- substantially

- such

- sums

- surprise

- SVB

- Take

- tech

- tech companies

- Technology

- term

- than

- that

- The

- their

- then

- There.

- they

- this

- those

- Through

- tighter

- time

- titan

- to

- took

- tool

- tools

- Total

- trigger

- trying

- two

- u.s.

- unclear

- Unexpected

- unlikely

- upcoming

- using

- Valley

- Valuations

- valued

- Vast

- VC

- VCs

- venture

- venture capital

- very

- Video

- vision

- VISION FUND

- visual

- visual art

- vital

- was

- Way..

- we

- Web3

- web3 funding

- WELL

- went

- were

- What

- when

- which

- WHO

- why

- will

- with

- Withdrawals

- without

- witnessed

- workers

- Workforce

- world

- worth

- would

- wrap

- year

- years

- Your

- zephyrnet