February 2023 auto sales are expected to advance mildly from

the month-prior level, but not nearly enough movement to identify

any change to current demand dynamics.

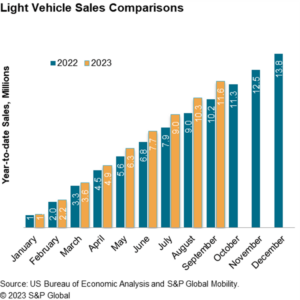

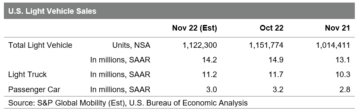

With US light vehicle sales volume for the month projected at

1.1 million units, we expect February 2023 to represent

year-over-year (y/y) growth of 5%, the seventh consecutive month of

y/y volume improvement. The tally would also be up more than 6%

compared to January volumes. February 2023 U.S. auto sales are

estimated to translate to an estimated sales pace of 14.4 million

units (seasonally adjusted annual rate: SAAR), a marked decline

from the month-prior figure, although the underlying sales rate, as

represented by the daily selling rate metric, should advance

mildly.

“Auto demand levels so far this year have sustained the trends

converging in the market at the end of 2022,” said Chris Hopson,

principal analyst at S&P Global Mobility. “Perhaps notably,

fleet sales as a portion of total monthly volume have escalated

over the past few months. While this could be an additional signal

that auto consumers continue to face an uncertain purchase

environment, fleet improvements are not unexpected, as auto

production and inventory levels continues to advance.”

Regarding the auto production environment, “While demand

destruction concerns remain pervasive, production levels are well

underway, which should improve vehicle availability by mid-2023,”

said Joe Langley, associate director of research and analysis for

S&P Global Mobility’s North American Light Vehicle Forecasting

& Analysis team. “Greatly improved vehicle availability may in

turn stimulate demand as incentive levels are expected to

increase.”

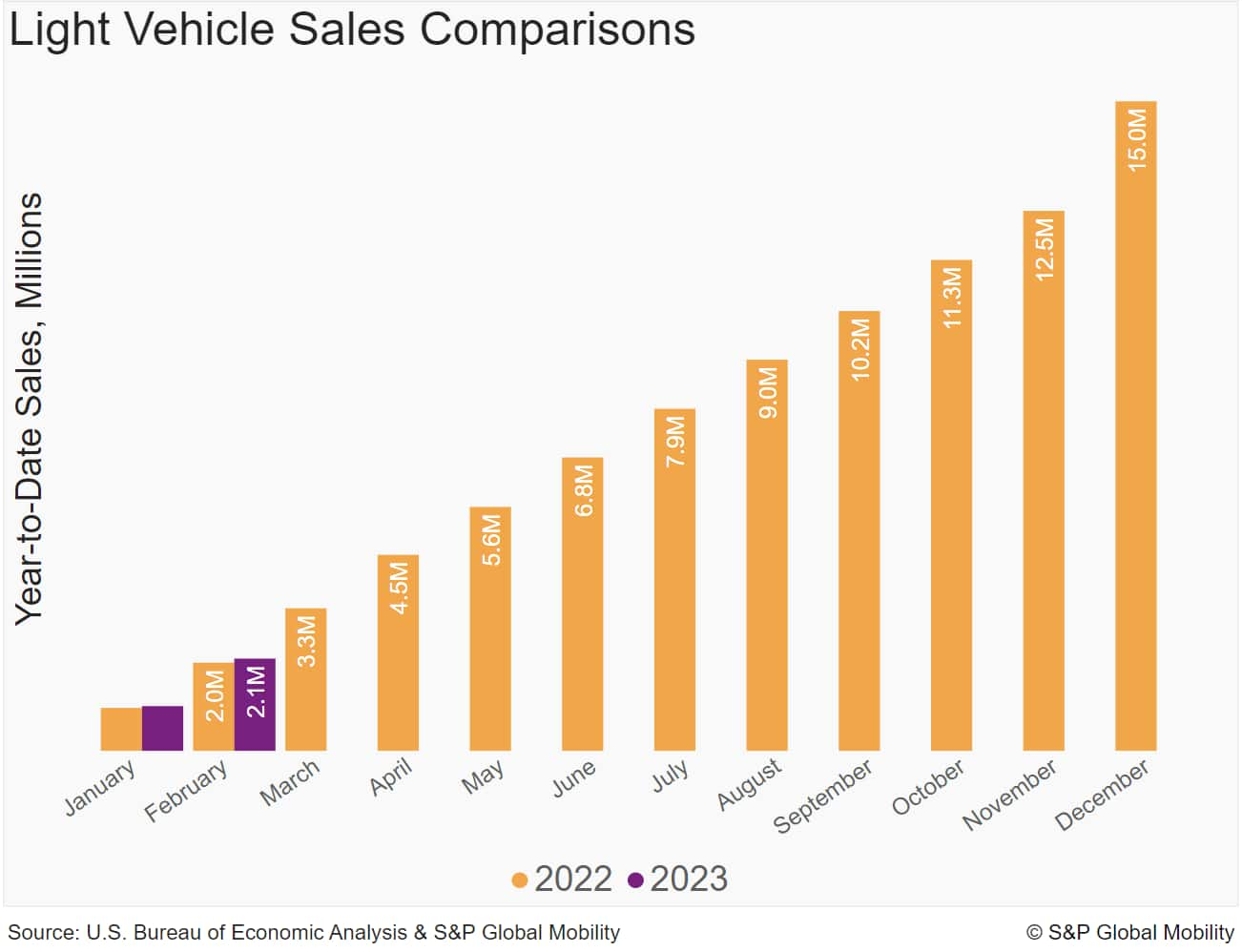

The S&P Global Mobility auto outlook for 2023 continues to

carry a countercyclical narrative: We expect production levels will

continue to improve even as economic conditions are worsening

through the early stages of the year. Together with improving

production volumes, reports of sustained retail orders, recovering

vehicle inventory, and more fleet demand we should see improvements

even with worries of an economic recession. S&P Global Mobility

forecasts calendar-year 2023 sales volume of 14.8 million units, a

7% increase from the 2022 tally.

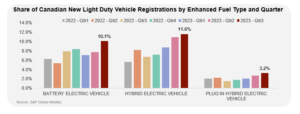

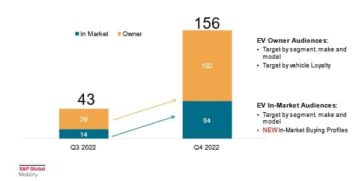

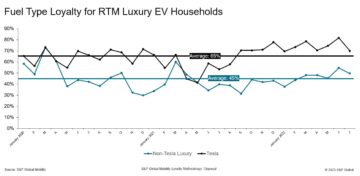

Sustained development of battery-electric vehicle (BEV) sales

remains a constant assumption for 2023. The Tesla and Ford price

adjustments should continue to boost the monthly BEV share to

record levels, as reports reflect that the downward price movement

for its products has boosted demand. BEV share in February is

estimated to reach 8.0%, continuing the momentum realized in

January. Whether these pricing adjustments will be matched by the

likes of Hyundai, Kia, and Volkswagen and become a BEV price war,

the reaction of other auto companies will determine whether the

gains in the BEV mix level will be a blip or a tipping point in the

electrification progress of the market.

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/february-2023-US-auto-sales-holding-the-line.html

- 1

- 2022

- 2023

- a

- Additional

- Adjusted

- adjustments

- advance

- Although

- American

- analysis

- analyst

- and

- annual

- article

- Associate

- assumption

- auto

- availability

- become

- boost

- Boosted

- carry

- change

- Chris

- Companies

- compared

- Concerns

- conditions

- consecutive

- constant

- Consumers

- continue

- continues

- continuing

- converging

- could

- Current

- daily

- Decline

- Demand

- Determine

- Development

- Director

- Division

- downward

- dynamics

- Early

- Economic

- Economic Conditions

- economic recession

- enough

- Environment

- estimated

- Ether (ETH)

- Even

- expect

- expected

- Face

- February

- few

- Figure

- FLEET

- Ford

- from

- Gains

- Global

- greatly

- Growth

- holding

- HTTPS

- Hyundai

- identify

- improve

- improved

- improvement

- improvements

- improving

- in

- Incentive

- Increase

- inventory

- January

- Kia

- Level

- levels

- light

- Line

- managed

- marked

- Market

- matched

- metric

- million

- mobility

- Momentum

- Month

- monthly

- months

- more

- movement

- NARRATIVE

- nearly

- North

- notably

- orders

- Other

- Outlook

- Pace

- past

- perhaps

- plato

- Plato Data Intelligence

- PlatoData

- Point

- price

- pricing

- Principal

- Production

- Products

- Progress

- projected

- published

- purchase

- Rate

- ratings

- reach

- reaction

- realized

- recession

- record

- recovering

- reflect

- remain

- remains

- Reports

- represent

- represented

- research

- retail

- S&P

- S&P Global

- Said

- sales

- Sales Volume

- Selling

- Share

- should

- Signal

- So

- so Far

- stages

- Tally

- team

- Tesla

- The

- this year

- Through

- Tipping

- Tipping point

- to

- together

- Total

- translate

- Trends

- TURN

- u.s.

- Uncertain

- underlying

- Underway

- Unexpected

- units

- us

- vehicle

- volkswagen

- volume

- volumes

- war

- whether

- which

- while

- will

- would

- year

- zephyrnet