Exactly one 12 months in the past, on Jan. 9, 2021, Cointelegraph launched its subscription-based information intelligence service, Markets Pro. On that day, Bitcoin (BTC) was trading at round $40,200, and at this time’s worth of $41,800 marks a year-to-year enhance of 4%. An automated testing technique based mostly on Markets Pro’s key indicator, the VORTECS Score, yielded a 20,573% return on funding over the identical interval. Here is what it means for retail merchants such as you and me.

Score, yielded a 20,573% return on funding over the identical interval. Here is what it means for retail merchants such as you and me.

How can I get my 20,000% a 12 months?

The quick reply is – you possibly can’t. Nor can every other human. But it doesn’t imply that crypto traders can’t massively improve their altcoin trading sport by utilizing the identical ideas that underlie this eye-popping ROI.

The determine within the headline comes from stay testing of assorted VORTECS -based trading methods that kicked off on the day of the platform’s launch. Here is the way it works.

-based trading methods that kicked off on the day of the platform’s launch. Here is the way it works.

The VORTECS Score is an AI-powered trading indicator whose job is to sift by means of every digital asset’s previous efficiency and establish multi-dimensional combos of trading and social sentiment metrics which might be traditionally bullish or bearish. For instance, contemplate a hypothetical scenario the place every time Solana (SOL) sees an additional 150% of constructive tweet mentions mixed with a 20% to 30% in trading quantity towards a flat worth, its worth spikes massively inside the subsequent two to 3 days.

Score is an AI-powered trading indicator whose job is to sift by means of every digital asset’s previous efficiency and establish multi-dimensional combos of trading and social sentiment metrics which might be traditionally bullish or bearish. For instance, contemplate a hypothetical scenario the place every time Solana (SOL) sees an additional 150% of constructive tweet mentions mixed with a 20% to 30% in trading quantity towards a flat worth, its worth spikes massively inside the subsequent two to 3 days.

Upon detecting a traditionally bullish association like this one in, say, SOL’s real-time information, the algorithm will assign the asset a powerful VORTECS Score. The typical cutoff for bullishness is 80, and the extra assured the mannequin is that the outlook is favorable, the upper the Score.

Score. The typical cutoff for bullishness is 80, and the extra assured the mannequin is that the outlook is favorable, the upper the Score.

In order to get a way of how the mannequin performs, ranging from day one the Markets Pro group live-tested plenty of hypothetical trading methods based mostly on “buying” all belongings that cross a sure VORTECS Score after which “selling” them after a set period of time.

Score after which “selling” them after a set period of time.

These transactions had been executed in a spreadsheet quite than an change (therefore no charges to eat off the features), 24/7, and concerned complicated algorithmic rebalancing to make sure that at any given second all belongings that hit a reference Score are held in equal shares within the portfolio. In quick, following these methods was one thing solely a pc might do.

The successful technique, “Buy 80, Sell 24 hours” entailed shopping for each asset that reached the Score of 80 and promoting it precisely 24 hours later. This algorithm yielded a hypothetical 20,573% of features over one 12 months. Even amongst different humanly unattainable methods, it’s an outlier: the second-best one, “Buy 80, Sell 12 hours,” generated 13,137%, and quantity three, “Buy 80, Sell 48 hours,” yielded a “mere” 5,747%.

Down to earth

What these insane numbers present is that the returns that high- VORTECS belongings generated compounded properly over time. But what’s the use if real-life merchants couldn’t replicate the compounding technique? A extra sensible approach to take a look at the VORTECS

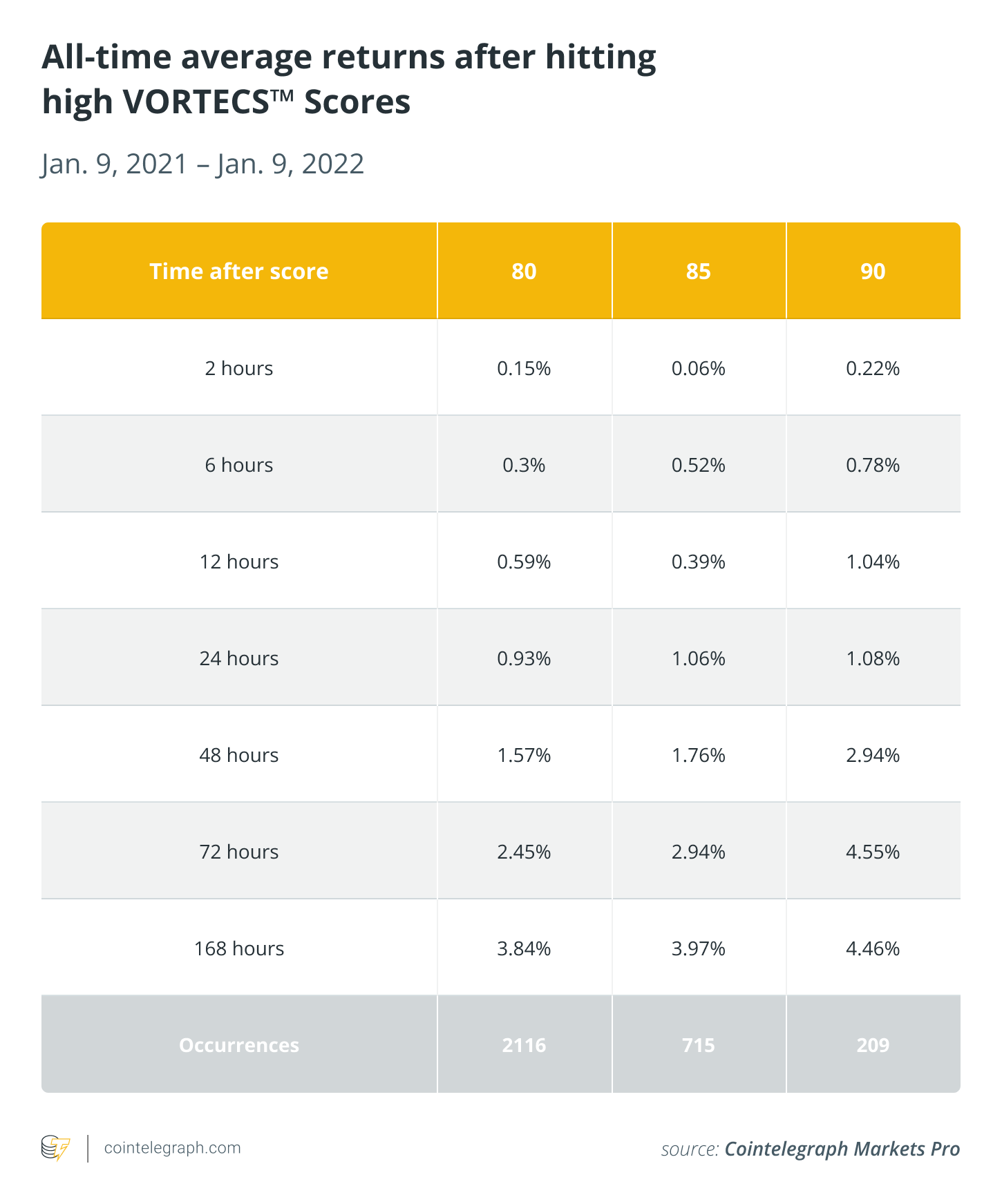

belongings generated compounded properly over time. But what’s the use if real-life merchants couldn’t replicate the compounding technique? A extra sensible approach to take a look at the VORTECS mannequin’s efficiency is thru common returns after excessive Scores. No fancy rebalancing, only a plain common worth change that every one high-scoring tokens demonstrated X hours after reaching the Score of Y. Here are the numbers:

mannequin’s efficiency is thru common returns after excessive Scores. No fancy rebalancing, only a plain common worth change that every one high-scoring tokens demonstrated X hours after reaching the Score of Y. Here are the numbers:

These look rather more modest, don’t they? However, in case you consider it, the image that these averages paint is not any much less highly effective than the mind-blowing hypothetical annual returns. The desk demonstrates robust positive price dynamics after high Scores, averaging throughout all forms of belongings and in all market conditions that occurred all year long.

The pattern is unmistakable: tokens that hit VORTECS Scores of 80, 85, and 90, have a tendency to understand inside the subsequent 168 hours. Higher Scores are related to better features: the algorithm’s stronger confidence within the bullishness of the noticed circumstances, certainly, comes with better yields (though greater Scores are additionally rarer). Another essential issue is time: the longer the wait after a reference threshold is reached, the better the common ROI.

Scores of 80, 85, and 90, have a tendency to understand inside the subsequent 168 hours. Higher Scores are related to better features: the algorithm’s stronger confidence within the bullishness of the noticed circumstances, certainly, comes with better yields (though greater Scores are additionally rarer). Another essential issue is time: the longer the wait after a reference threshold is reached, the better the common ROI.

In this sense, quite than making an attempt to observe the complicated “Buy 80, Sell 24 hours” algorithmic technique (which is, once more, a futile train), real-life merchants might maximize their fortunes by shopping for at greater Scores and holding for longer instances.

Varying predictability

A separate stream of inner Markets Pro analysis checked out whether or not some cash are extra susceptible than others to exhibit traditionally bullish trading circumstances earlier than dramatic worth will increase. This turned out to be the case, with tokens like AXS, MATIC, AAVE and LUNA main the pack when it comes to the most reliable positive price dynamics following traditionally favorable setups. Overall, the vast majority of frequent high-VORTECS performers delivered sturdy constructive returns.

performers delivered sturdy constructive returns.

After a full 12 months in operation, these disparate items of quantitative proof – the mind-bending ROIs of algorithmic live-testing methods, high-VORTECS belongings’ sound common features, and particular person cash’ regular common returns after excessive Scores – current a compelling case for the utility of the “history rhymes” method to crypto trading.

belongings’ sound common features, and particular person cash’ regular common returns after excessive Scores – current a compelling case for the utility of the “history rhymes” method to crypto trading.

Obviously, a positive historic outlook, captured by a powerful VORTECS Score, is rarely a assure of an impending rally. Yet, an additional pair of algorithmic eyes able to seeing by means of and evaluating throughout billions of historic information factors to warn you of digital belongings’ bullish setups earlier than they materialize might be an extremely highly effective addition to any trader’s toolkit.

Score, is rarely a assure of an impending rally. Yet, an additional pair of algorithmic eyes able to seeing by means of and evaluating throughout billions of historic information factors to warn you of digital belongings’ bullish setups earlier than they materialize might be an extremely highly effective addition to any trader’s toolkit.

Cointelegraph is a writer of economic info, not an funding adviser. We don’t present personalised or individualized funding recommendation. Cryptocurrencies are risky investments and carry vital threat together with the chance of everlasting and complete loss. Past efficiency shouldn’t be indicative of future outcomes. Figures and charts are appropriate on the time of writing or as in any other case specified. Live-tested methods will not be suggestions. Consult your monetary advisor earlier than making monetary selections.

The post Even after the pullback, this crypto trading algo’s $100 bag is now value $20,673 appeared first on Bitcoin Upload.

Source: https://btcupload.com/latest-cryptocurrency-news/even-after-the-pullback-this-crypto-trading-algos-100-bag-is-now-value-20673- "

- 9

- Additional

- advisor

- algorithm

- All

- Altcoin

- analysis

- asset

- Association

- Automated

- bearish

- Bitcoin

- Bullish

- Cash

- change

- charges

- Charts

- Cointelegraph

- Common

- confidence

- crypto

- crypto traders

- crypto trading

- cryptocurrencies

- Current

- day

- digital

- Display

- eat

- Economic

- Effective

- efficiency

- Features

- First

- fortunes

- full

- funding

- future

- Group

- here

- High

- How

- HTTPS

- image

- impending

- Increase

- info

- information

- Intelligence

- Investments

- IT

- Job

- Key

- launch

- LINK

- Long

- Majority

- Making

- Market

- Markets

- mentions

- Merchants

- Metrics

- mixed

- months

- numbers

- order

- Other

- Outlook

- Pattern

- PC

- Plenty

- portfolio

- present

- price

- Pro

- proof

- quantitative

- rally

- real-time

- retail

- returns

- sees

- sell

- sense

- sentiment

- set

- Shares

- Shopping

- Social

- Solana

- Sport

- stay

- successful

- Testing

- time

- Tokens

- Traders

- Trading

- Transactions

- tweet

- utility

- value

- W

- wait

- within

- works

- worth

- writer

- writing

- X

- year