Global monetary markets and crypto markets had been pummeled over the previous 24-hours because the invasion of Ukraine by Russian forces despatched traders scrambling and sell-offs happened throughout most asset courses.

Data from Cointelegraph Markets Pro and TradingView reveals that the value of Bitcoin (BTC) hit a low of $34,333 within the early trading hours on Feb. 24, shortly after the Ukraine incursion started, and has since climbed its manner again to $38,500 after an surprising short-squeeze could have rapped bearish traders on the knuckles.

Here’s a have a look at what a number of analysts are saying about BTC value and the way the continued battle might affect crypto markets within the short-term.

BTC in a “great buy area”

Bitcoin’s collapse on the night time of Feb. 23 was not surprising by most merchants and in keeping with crypto trader Pentoshi, BTC value might get better the $40,000 mark within the quick time period.

Despite this constructive outlook, Pentoshi expressed wariness “of the overall macro environment,” which “looks pretty dire.”

In a follow-up tweet on Feb. 24, Pentoshi held agency with the projection that BTC will finally commerce larger from right here.

Pentoshi mentioned,

“BTC now in the blue value zone. Not exactly the path I’d hoped to take to get here. I think in time this will have been a great buy area.”

A milder correction than was seen in May 2021

A extra in-depth evaluation of the present scenario was supplied by David Lifchitz, managing director and chief funding officer at ExoAlpha, who famous that “Bitcoin and other cryptos have been moving up and down in tandem with the Russia/Ukraine news,” so the plunge in cryptos and different property was anticipated following “the first, even if surgical, strikes in Ukraine.”

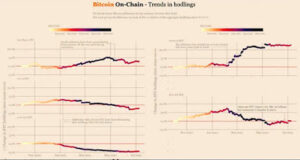

One constructive for the crypto market was that there was much less leverage at play than through the drawdown in May 2021, which resulted in “less liquidation of over-levered players and hence a milder correction vs. what was seen in May.”

Lifchitz pointed to the truth that Bitcoin’s current low at $34,300 “was near the low of the range it has been stuck in for weeks now,” and advised that “the direction of Bitcoin and other cryptos will be driven by what happens in the next couple of days with the Ukraine-Russia situation.”

Aside from the short-term affect of this battle, Lifchitz said that “the elephant in the room is the Central Banks rate hikes that won’t be as tough as they should be to tame inflation, but will be enough to put more pressure on the economy and the stock market.”

Lifchitz mentioned,

“A hard landing of the last 12 years of Central Banks lax monetary policy is in progress, and the Ukraine-Russia may just have been the pin the “everything bubble” was looking for…”

Related: Bitcoin rises above $36K as 24-hour crypto liquidations pass $500M

The preliminary panic is over

A closing little bit of perception into how the market will commerce within the days and weeks forward was offered by analyst and impartial market analyst Michaël van de Poppe, who posted the next tweet suggesting that the worst of the near-term weak point could also be over for now.

Honest view; panic is over for a couple of days/perhaps weeks.

Markets reacting in a way that #Gold goes to appropriate, risk-on property like equities and #Bitcoin are going up.

Potentially runs of 20-45% on #altcoins to occur.

— Michaël van de Poppe (@CryptoMichNL) February 24, 2022

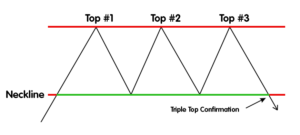

Analysis of what comes subsequent for BTC if the panic continues was additionally offered by crypto trader and pseudonymous Twitter consumer AngeloDOGE, who posted the next tweet pointing to assist at $25,000 within the occasion that bears break by the $33,000 stage.

Low probability #Bitcoin holds $33k on a second go to.

Sometimes issues have to worsen earlier than they’ll get higher.

Upon assist failure, $25k $BTC comes subsequent.

Hope for the very best, put together for the worst, and keep off the leverage.

— AngeloƉOGE (@AngeloBTC) February 24, 2022

The general cryptocurrency market cap now stands at $1.649 trillion and Bitcoin’s dominance price is 41.9%.

The views and opinions expressed listed below are solely these of the creator and don’t essentially mirror the views of Cointelegraph.com. Every funding and trading transfer includes danger, it’s best to conduct your personal analysis when making a call.

The post Bitcoin value spike to $39K leads merchants to say ‘the panic is over for a few days’ appeared first on Bitcoin Upload.

- Coinsmart. Europe’s Best Bitcoin and Crypto Exchange.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. FREE ACCESS.

- CryptoHawk. Altcoin Radar. Free Trial.

- Source: https://btcupload.com/latest-cryptocurrency-news/bitcoin-value-spike-to-39k-leads-merchants-to-say-the-panic-is-over-for-a-few-days

- 000

- 2021

- 7

- About

- analysis

- analyst

- appropriate

- AREA

- asset

- Banks

- Battle

- bearish

- Bears

- BEST

- Bit

- Bitcoin

- BTC

- buy

- call

- Central Banks

- chief

- closing

- Cointelegraph

- Commerce

- consumer

- continues

- could

- Couple

- creator

- crypto

- Crypto Market

- Crypto Markets

- cryptocurrency

- cryptocurrency market

- Cryptocurrency Market Cap

- Current

- different

- Director

- down

- driven

- Early

- economy

- elephant

- Environment

- Failure

- Finally

- First

- following

- Forward

- funding

- General

- going

- great

- here

- How

- HTTPS

- inflation

- issues

- IT

- keeping

- larger

- Leverage

- Liquidation

- liquidations

- looking

- Macro

- Making

- mark

- Market

- Market Cap

- Markets

- Merchants

- mirror

- more

- most

- Near

- news

- Officer

- Opinions

- Other

- Outlook

- Panic

- personal

- Play

- players

- policy

- present

- pressure

- pretty

- price

- probability

- property

- range

- Said

- So

- Stage

- stands

- started

- stock

- stock market

- Strikes

- Through

- throughout

- time

- together

- trader

- Traders

- Trading

- tweet

- Ukraine

- value

- View

- What

- WHO

- within

- years