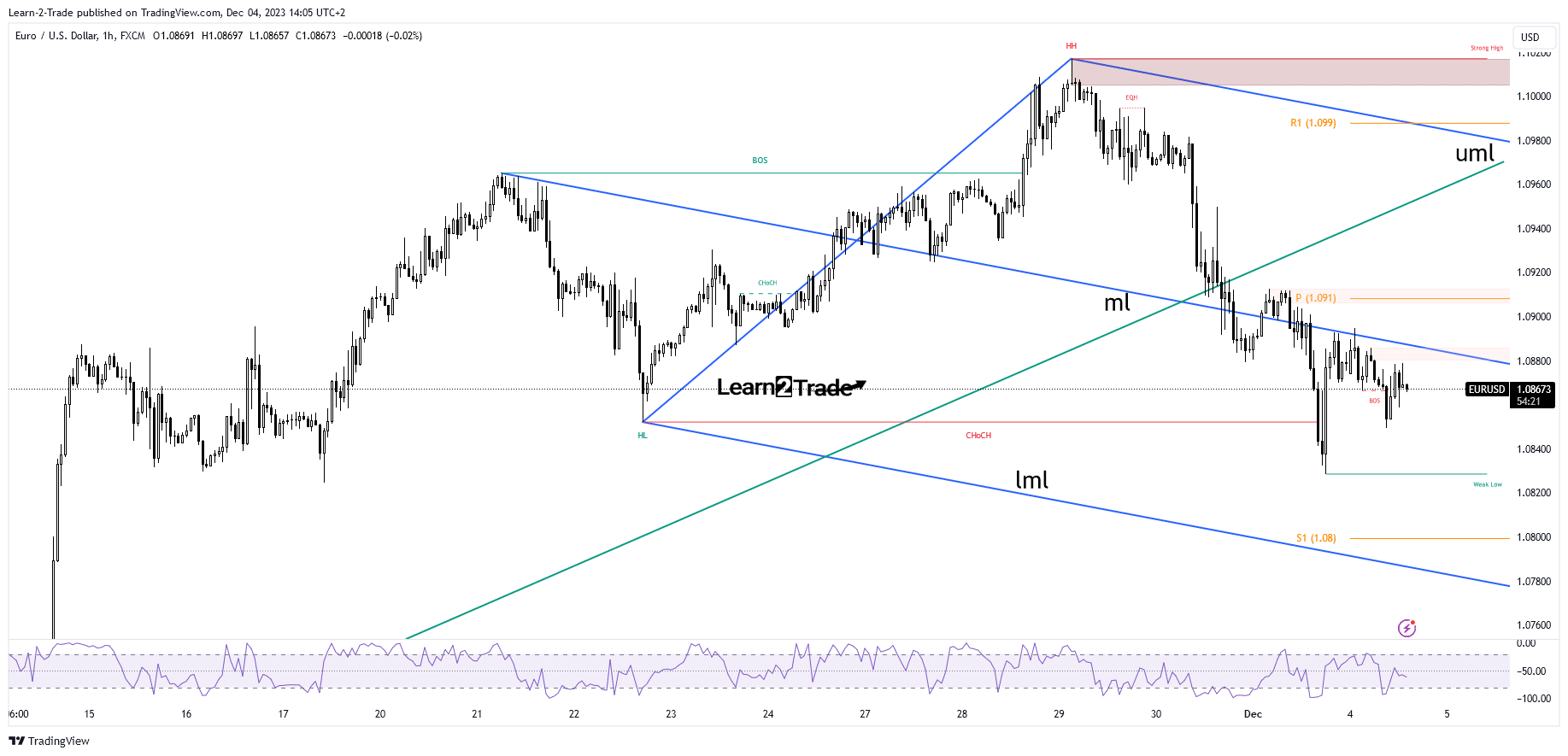

- The bias is bearish as long as it stays below the median line.

- Friday’s low stands as a downside target.

- The lower median line is seen as a major target.

The EUR/USD price was trading in red at 1.0865 at the time of writing. The pair seems ready to resume its downtrend. The Euro has rebounded after reaching Friday’s low of 1.0828. However, the bias remains bearish as the US dollar could jump higher.

–Are you interested to learn more about forex options trading? Check our detailed guide-

Fundamentally, the US and Eurozone published mixed data on Friday. The Greenback lost some ground versus its rivals in the short term as the US ISM Manufacturing PMI came in worse than expected.

Today, the US is to release the Factory Orders data. The economic indicator is expected to report a 2.7% drop versus the 2.8% growth in the previous reporting period.

On the other hand, the German Trade Balance and the Spanish Unemployment Change came in better than expected, while the Eurozone Sentix Investor Confidence came in worse than predicted.

Tomorrow, the US ISM Services PMI and JOLTS Job Openings represent high-impact events and could shake the markets. Positive US data should help Greenback dominate the currency market in the short term.

EUR/USD Price Technical Analysis: Minor Rebound

From the technical point of view, the EUR/USD price tumbled and ignored the uptrend line after failing to stabilize above the 1.1 psychological level.

It has also dropped below the descending pitchfork’s median line (ml), representing a support. After the impressive sell-off, the rate returned to retest the median line (support turned into resistance).

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

The price could resume its leg down as long as it stays below it. Friday’s low of 1.0828 represents a potential downside target. Still, the lower median line (LML) represents the next major downside target. The downside scenario could be invalidated if the rate jumps and stabilizes above the median line (ml).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/04/eur-usd-price-struggles-as-dollar-attempts-a-recovery/

- :has

- :is

- 1

- a

- About

- above

- Accounts

- After

- also

- analysis

- and

- ARE

- AS

- At

- Attempts

- Balance

- BE

- bearish

- below

- Better

- bias

- came

- CAN

- CFDs

- change

- check

- confidence

- Consider

- could

- Currency

- data

- detailed

- Dollar

- dominate

- down

- downside

- Drop

- dropped

- Economic

- EUR/USD

- Euro

- Eurozone

- Eurozone Sentix Investor Confidence

- events

- expected

- factory

- failing

- forex

- Friday

- German

- get

- Greenback

- Ground

- Growth

- guidelines

- hand

- help

- High

- higher

- However

- HTTPS

- if

- impressive

- in

- Indicator

- interested

- into

- Invest

- investor

- IT

- ITS

- Job

- JOLTS Job Openings

- jump

- jumps

- Knowing

- LEARN

- Level

- Line

- Long

- lose

- losing

- lost

- Low

- lower

- major

- manufacturing

- Market

- Markets

- max-width

- minor

- mixed

- ML

- money

- more

- next

- now

- of

- on

- openings

- Options

- orders

- Other

- our

- pair

- period

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- Point

- Point of View

- positive

- potential

- predicted

- previous

- price

- provider

- psychological

- published

- Rate

- reaching

- Read

- ready

- recovery

- Red

- release

- remains

- report

- Reporting

- represent

- representing

- represents

- Resistance

- resume

- retail

- Risk

- rivals

- scenario

- seems

- seen

- sell-off

- Services

- Short

- should

- some

- Spanish

- stabilize

- stands

- Still

- Struggles

- support

- Take

- Target

- Technical

- Technical Analysis

- term

- than

- The

- then

- this

- time

- to

- trade

- Trading

- Turned

- unemployment

- uptrend

- us

- US Dollar

- US ISM Manufacturing

- US ISM Manufacturing PMI

- US ISM Services PMI

- Versus

- View

- was

- when

- whether

- while

- with

- worse

- writing

- you

- Your

- zephyrnet