- ECB policymakers emphasized that the bank should lean towards further rate hikes.

- The ECB’s new forecasts indicate that inflation will remain above its 2% target through 2025.

- Investors will get the building permits report from the US.

Today’s EUR/USD price analysis is bullish. The euro gained against the dollar, supported by the European Central Bank maintaining a hawkish stance. On Monday, two policymakers emphasized that the bank should lean towards further rate hikes.

-If you are interested in forex day trading then have a read of our guide to getting started-

Over the past year, the ECB has already raised rates by four percentage points to combat a historic surge in inflation. Still, the bank’s new forecasts indicate that price growth will remain above its 2% target through 2025, leading to the likelihood of additional rate increases in July.

ECB board member Isabel Schnabel is known for her conservative stance. She stated in a speech that it is crucial to prioritize data and take proactive measures, erring on the side of doing more rather than less.

Moreover, she shared concerns with Slovak central bank governor Peter Kazimir. He highlighted the risk of inflation becoming entrenched in the economy if not addressed promptly.

However, the ECB’s chief economist, Philip Lane, presented a slightly different perspective. He suggested that being data-dependent could also mean deferring rate hikes for one or more meetings, resuming them when appropriate based on merit.

Additionally, he anticipated that the ECB would likely raise interest rates again next month but emphasized that it is too early to predict the outcome of the September meeting.

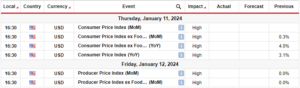

EUR/USD key events today

Investors will get the building permits report from the US. The government issues building permits to measure the fluctuations in the number of newly authorized construction projects. Notably, building permits play a crucial role as they are a significant indicator of the level of demand within the housing market.

EUR/USD technical price analysis: Imminent new high above 1.0950.

EUR/USD is rising in the 4-hour chart and will likely make a second attempt at the 1.0950 resistance level. The first time the price reached this level, it paused and consolidated lower. However, it has stayed above the 30-SMA with the RSI above 50, showing bulls are in charge.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

A break above the 1.0950 resistance would strengthen the bullish bias as the price would make a higher high. However, the price will likely fall back to the 30-SMA if the resistance holds strong.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-price-analysis-bulls-applaud-ecbs-hawkish-stance/

- :has

- :is

- :not

- 1

- 167

- 2%

- 2025

- 30

- 50

- a

- above

- Accounts

- Additional

- again

- against

- already

- also

- analysis

- and

- Anticipated

- appropriate

- ARE

- AS

- At

- authorized

- back

- Bank

- based

- becoming

- being

- BEST

- bias

- board

- board member

- Break

- Building

- Bullish

- Bulls

- but

- by

- CAN

- central

- Central Bank

- CFDs

- charge

- Chart

- check

- chief

- combat

- Concerns

- conservative

- Consider

- construction

- Container

- could

- crucial

- data

- day

- Demand

- detailed

- different

- doing

- Dollar

- Early

- ECB

- Economist

- economy

- emphasized

- entrenched

- EUR/USD

- Euro

- European

- European Central Bank

- events

- Fall

- First

- first time

- fluctuations

- For

- forecasts

- forex

- four

- from

- further

- gained

- get

- getting

- Government

- Governor

- Growth

- guide

- Have

- Hawkish

- he

- her

- High

- higher

- Highlighted

- Hikes

- historic

- holds

- housing

- housing market

- However

- HTTPS

- if

- in

- Increases

- indicate

- Indicator

- inflation

- interest

- Interest Rates

- interested

- Invest

- investor

- issues

- IT

- ITS

- July

- Key

- known

- Lane

- leading

- less

- Level

- likely

- looking

- lose

- losing

- lower

- maintaining

- make

- Market

- max-width

- mean

- measure

- measures

- meeting

- meetings

- member

- Merit

- Monday

- money

- Month

- more

- New

- newly

- next

- notably

- now

- number

- of

- on

- ONE

- or

- our

- Outcome

- past

- percentage

- perspective

- Peter

- plato

- Plato Data Intelligence

- PlatoData

- Play

- points

- policymakers

- predict

- presented

- price

- Price Analysis

- Prioritize

- Proactive

- projects

- provider

- raise

- raised

- Rate

- rate hikes

- Rates

- rather

- reached

- Read

- remain

- report

- Resistance

- retail

- rising

- Risk

- Role

- ROW

- rsi

- Second

- September

- shared

- she

- should

- showing

- side

- significant

- slightly different

- speech

- stated

- stayed

- Still

- Strengthen

- strong

- Supported

- surge

- SVG

- Take

- Target

- Technical

- than

- that

- The

- Them

- then

- they

- this

- Through

- time

- to

- too

- towards

- trade

- Trading

- two

- us

- when

- whether

- will

- with

- within

- would

- year

- you

- Your

- zephyrnet