- A new lower low activates more declines.

- The median line (ml) is seen as a potential target.

- The Canadian retail sales data could shake the markets.

The gold price tumbled in the short term as the US dollar appreciated. It has dropped as low as $1,965 and found strong demand.

-Are you interested in learning about forex tips? Click here for details-

The metal is trading at $1,971 at the time of writing and is fighting hard to come back higher. After its strong growth, temporary retreats are natural.

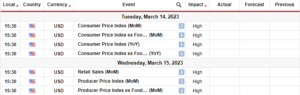

However, the bias remains bullish in the short term. Fundamentally, the XAU/USD plunged right after the US Unemployment Claims economic indicator came in at 228K versus 239K expected.

The yellow metal failed to stay higher even if the Australian Employment Change and Unemployment Rate came in better than expected.

Now, it attempts to rebound and recover as the US Existing Home Sales, CB Leading Index, and Philly Fed Manufacturing Index indicators reported poor data.

Earlier, the United Kingdom Retail Sales and Public Sector Net Borrowing came in better than expected. Still, only the Canadian retail sales data could have a big impact. Retail Sales are expected to report a 0.5% growth, whereas Core Retail Sales could register a 0.2% growth.

Gold Price Technical Analysis: Corrective Downside

From the technical point of view, the XAU/USD found resistance at the 150% Fibonacci line. It has retested this dynamic resistance.

-Are you interested in learning about the forex basics? Click here for details-

Now it has dropped below the upper median line (uml). The 1,967 historical level stopped the sell-off. The weekly R1 (1,975) and the upper median line (uml) represent near-term resistance levels.

A new lower low, a valid breakdown below $1,967, validates more declines. If this scenario takes shape, the median line (ml) is seen as a potential downside target and obstacle. Only staying above 1,967 and jumping above the upper median line (uml) signals an upside continuation.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexcrunch.com/gold-price-tumbles-below-1970-as-greenback-gains-ground/

- :has

- :is

- 1

- 167

- 2%

- 202

- 30

- 300

- 970

- 971

- a

- About

- above

- Accounts

- After

- Amid

- an

- analysis

- and

- ARE

- AS

- At

- Attempts

- Australian

- Australian Employment

- back

- below

- Better

- bias

- Big

- Borrowing

- Breakdown

- Bullish

- came

- CAN

- Canadian

- Canadian Retail Sales

- CB

- CFDs

- change

- claims

- click

- come

- Consider

- Container

- continuation

- Core

- could

- data

- Declines

- Demand

- Dollar

- downside

- dropped

- dynamic

- Economic

- employment

- Even

- existing

- expected

- Failed

- Fed

- Fibonacci

- fighting

- For

- forex

- found

- fundamentally

- Gains

- Gold

- gold price

- Greenback

- Ground

- Growth

- Hard

- Have

- here

- High

- higher

- historical

- Home

- However

- HTTPS

- if

- Impact

- in

- index

- Indicator

- Indicators

- interested

- Invest

- investor

- IT

- ITS

- Kingdom

- leading

- learning

- Level

- levels

- Line

- lose

- losing

- Low

- lower

- manufacturing

- Markets

- max-width

- metal

- ML

- money

- more

- Natural

- net

- New

- now

- obstacle

- of

- only

- Outlook

- Philly Fed Manufacturing Index

- plato

- Plato Data Intelligence

- PlatoData

- Point

- Point of View

- poor

- potential

- pound

- price

- Price Analysis

- provider

- public

- Rate

- rebound

- Recover

- Recovers

- register

- remains

- report

- Reported

- represent

- Resistance

- retail

- Retail Sales

- right

- Risk

- ROW

- sales

- scenario

- sector

- seen

- sell-off

- Shape

- Short

- should

- signals

- stay

- Still

- stopped

- strong

- SVG

- Take

- takes

- Target

- Technical

- Technical Analysis

- temporary

- term

- than

- The

- the United Kingdom

- The Weekly

- this

- time

- tips

- to

- trade

- Trading

- Tumbles

- unemployment

- unemployment rate

- United

- United Kingdom

- Upside

- us

- US Dollar

- US Existing Home Sales

- US Unemployment Claims

- Versus

- View

- weekly

- when

- whereas

- whether

- with

- writing

- XAU/USD

- yellow

- you

- Your

- zephyrnet