As I outlined recently in my “e-Literate’s Changing Themes for Changing Times” post, I am shifting my coverage somewhat. I’ll be developing and calling out tags I use for these themes so that you can go to an archive page on each one. This one will be listed under the “changing enrollment” and “third-wave EdTech” tags.

Phil Hill recently tweeted out two slides from Coursera’s quarterly conference call. They made me sit up straight. Then they made me read the transcript from the call.

I haven’t been paying enough attention. Having watched the rise of the MOOCs closely and having watched 2U/EdX chase EdX’s inspiration and rival, I assumed I understood Coursera as well.

I was wrong. Coursera is evolving into a different and much more interesting company that is well-positioned to take advantage of the tectonic shifts I’m tracking.

Coursera as a marketplace

One of the two slides Phil shared out was further confirmation of a trend that everyone in higher education has already been struggling with:

Coursera, like US higher education institutions, has seen a decline in degree program enrollments. This seems like a significant drop relative to the drop across degree programs as a whole, particularly against primarily degree-granting institutions, which have fared better than their on-campus counterparts. So it’s curious.

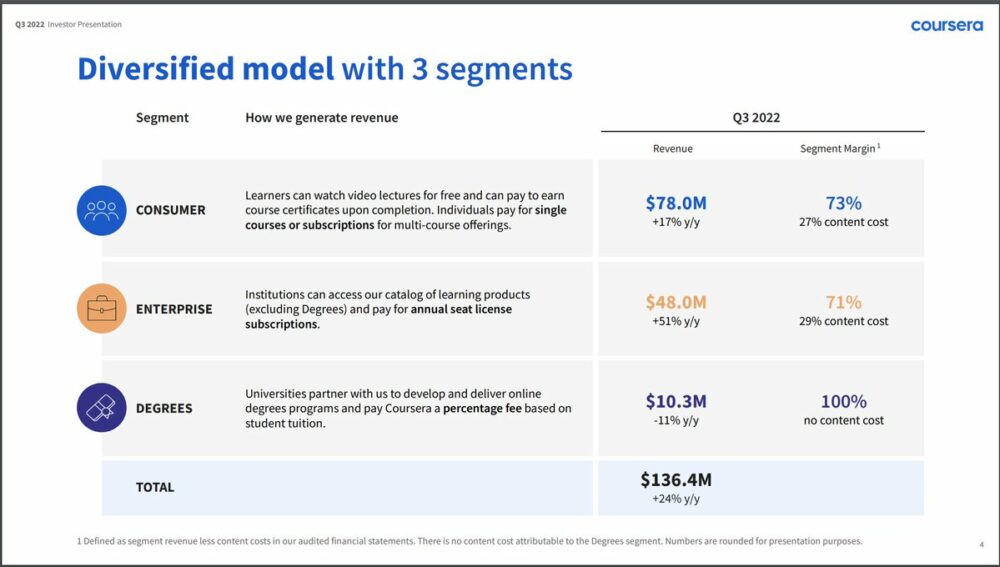

But this is the slide that attracted my full attention:

The point of this slide is to show the diversification of Coursera’s business. Degree programs may be down, but enterprise licenses and direct-to-consumer certificates are up. But it also indicates Coursera’s ability to diversify revenue streams for its university content providers. The enterprise business provides a distribution channel between universities and employers. From what I can tell, it’s a Guild competitor, even though the two companies look very different on the surface. The consumer segment started as the MOOC business and has expanded into the “tweener” space between courses and degrees: certificates, microdegrees, whatever.

On the surface, it may appear that Coursera and 2U/EdX are evolving toward each other, with Coursera having grown out its degree programs and 2U acquiring EdX to get into Coursera’s MOOC space. In reality, 2U/EdX is moving much more toward Coursera than the converse. And it’s easy to see why if we look at the economics of their original models.

2U historically made its money by helping premium-brand universities bring expensive graduate degree programs online. And they famously succeeded in attracting multiple premium university brands to offer the same degree through them by showing that, historically speaking, geographic brand reach is smaller than you might think. Students in the Northeast United States have been much more likely to apply for degrees from Harvard, Yale, or Princeton than from Stanford or even Duke, even if the degree programs are all online. The same is even more true, a notch or two down the reputation scale, where institutions may have strong regional brands but are not even broadly recognized nationally.

Roughly about the same time that it became apparent that the growth of expensive online graduate degree programs would inevitably slow—there’s only so much demand in the world for $40,000 MSW degrees—2U got into the short course business. And then the BootCamp business. And then they bought EdX. But, as I have written about in the past, 2U has tended to publicly imply that its “free to degree” product range is a sales funnel. Of course they’re interested in diversifying their revenue. But outwardly, at least, the mindset has appeared to be that of a diversifying OPM.

In contrast, Coursera has always thought of itself as a two-sided market. For those unfamiliar with the term, a two-sided market is one where the company’s primary business is to connect buyers with sellers. Amazon, Etsy, Airbnb, and Uber are all examples of this sort of business. Yes, they were attached in the early days to selling a particular form of MOOC as an individual product, much as Amazon only sold books in the early days. Much of the attention during the early years of MOOCs was on the pedagogical model of the MOOC itself, which is not very effective, and on the MOOC course delivery platforms, which directly translated lecture-model courses into an infinite lecture hall, with some relatively modest technological improvements. The innovation that got the least attention at the time was Coursera’s nature as a two-sided market. I remember talking to Daphne Koller about this circa 2014 (in front of one of those ridiculous fountains in the Swan and Dolphin Hotel at a Sloan-C conference).

I’m not sure that EdX ever fully grasped the implications of the two-sided market model. 2U might; it’s hard to tell right now. The company’s in-process rebranding is confusing and their clearest marketing point so far has been that MOOCs lower the advertising costs for degree programs. Coursera, on the other hand, understood the business model implications early on, one of which is that two-sided markets tend to produce one big winner in any given space. Who is the second-largest competitor to Amazon? Walmart? Wayfair? The distributed network of stores that Shopify powers? I don’t know. The answer isn’t obvious. It’s not like Coke and Pepsi.

Multi-sided platforms have unusual characteristics.

A market is a platform

We often use the term “platform” in tech conversations to narrowly mean the features and architecture of a kind of software. A platform is distinguished from an application in the sense that a platform encourages people to build other things on top of it. Mapping software that can only provide directions is an application. If the same software can be integrated into search and discovery applications like Yelp is a platform. In hardware, a flip phone is a device. An iPhone is a platform.

But platforms can enable building more than just software extensions. When Phil Hill and I worked together at MindWires, the company was heavily involved with helping the 114-campus California Community College System onto one common LMS instance.1 The point wasn’t just to get everybody using the same LMS but rather to use that common base to build up a course exchange that would enable campuses to help each other with over- and under-subscribed courses as while enabling students to take courses that they need to graduate but that are oversubscribed on their own campuses:

(Shameless plug: The webinar I’ll be facilitating about university/workplace partnerships for OpenLMS on Thursday, November 2nd at 1 PM ET will include a similar story about how a common LMS adoption facilitated teacher support and recertification amidst a state-wide teacher shortage.)

With these examples in mind, I found the following anecdote from Coursera CEO Jeff Maggioncalda to be very interesting:

In July, I highlighted the recent partnership with Louisiana Tech University and the University of Louisiana Systems. Our initial partnership with Louisiana Tech started as a social impact initiative with the office of student financial assistance via the Louisiana Board of Regions. [sic]

It was designed to provide low-income high school students and graduates access to Coursera’s entry-level Professional Certificates from Google in order to prepare them for college or to begin a digital career. This was followed by Louisiana Tech summer programming series open to faculty and staff that is banded to include professional development opportunities for employees across all campuses within the University of Louisiana Systems.

Now the Louisiana Workforce Commission, a state agency responsible for enhancing workforce growth and well-paying jobs for Louisiana residents, is partnered with Coursera to launch Tech Ready Louisiana, a statewide workforce development initiative providing training to thousands of Louisiana.

The centerpiece of the program is Career Academy, as our entry-level professional professor certificates were specifically designed to prepare workers without a college degree or prior work experience. Using Career Academy, Louisianians can explore careers develop key skills and competencies, build a portfolio of hands-on projects using actual workplace tools and earn industry-recognized credentials.

And many of these credentials have ACE Credit Recommendations, which make it easier for learners to earn credit towards a local or online degree program when they’re ready to continue their education.

Finally, in recognition of the connectivity challenges that present a real barrier today, the Workforce Commission is making reliable Internet access at nearly 60 sites across the state for learners to complete their Coursera courses.

Traditional university degree programs and workforce development initiatives often lack a solid connection to today’s in-demand jobs and are often not equipped to adapt to the fast-changing skilled landscape and evolving employer expectations.

By leveraging Coursera, an entire system of higher education in coordination with government institutions can foster stronger collaboration with industry by unlocking new development opportunities for students, faculty and staff by diversifying and expanding talent pipelines for employers and by building a more competitive workforce.

This is the vision of Coursera’s three-sided platform at scale, connecting learners, educators and institutions in a global learning ecosystem designed to keep pace with our rapidly changing world.

Notice he calls it a three-sided platform, although I count more than three sides here. The Coursera platform, writ large, connects universities, learners, government agencies, megacorporations, and local employers. It helps open up new opportunities for universities to reach students without falling afoul of the “dialing for dollars” problem that plagued for-profit universities and create ethical and legal complexities for OPMs.

A multi-sided market also offers some benefits to the educational mission relative to other models. If, for example, you’re an OPM that has heavily subsidized the creation of a degree program in exchange for a share of the revenues for ten years, then you need to make sure your up-front investment pays off. This is true of any business that invests up-front in building products, including textbook publishers. In a multi-sided market, depending on how the compensation is set up, the marketplace owner shouldn’t care much about whether the company sells 100,000 units of one product or 1,000 units each of 100 products. For education, some programs are essential for students, local economies, and important business niches, even if they don’t require a lot of trained individuals. So a well-functioning multi-sided market should, all else being equal, offer more educational opportunities within a scalable model.

(Side note: Somebody other than me should write an analysis the strategies and pricing for 2U/EdX, Coursera, Guild, and other evolving university sales channels.)

Coursera sees evolution ahead

Maggioncalda also had an interesting question on the inevitable future-of-the-college-degree question:

I’m in Bangalore right now and I spent the last 10 days here in India. There is a demand — the government is trying to shoot gross enrollment ratio up to 50% by 2035.

They need 3.3 million more professors to serve 35 million more students. And so a lot of the demographics that folks are seeing in the U.S. is not consistent with what some of the demographic trends are in other parts of the world. And we are seeing college degrees globally be as revered as they have been historically.

So when we look at this on a global basis, I think a lot of it is going to be driven by demographic trends. I think that especially when you have rising middle classes, with a real premium on education, you’re going to see — we’re going to see a lot of demand for this. So we’re very bullish on the future value of a college degree.

Another thing is colleges are not sitting still. I don’t know, there might have been five or six examples in the scripts about universities putting Career Academy literally into their curriculum, so that when someone graduates, they don’t just have a degree, they’ve got a degree and an industry certificate.

I think a lot of people think of college degrees as this static thing that’s not going to change. But really, the competition among job seekers is going to be those who have maybe micro credentials and those who have college degree and micro credentials. So I think it’s going to almost always be worth it.

And on the affordability side, we see affordability really being driven by technology and, frankly, competition. So I think degrees are going to come down in price. They’re going to be a lot more job relevant, they’ll be much more broadly available and especially because they’re online, open up to the working adult population, which is a much, much bigger market than just young people who are between the ages of 18 and 24.

So we’re still very bullish on the long-term opportunity for degrees.

This answer hits many of the themes in e-Literate’s Changing Themes for Changing Times: rising economic value of the post-traditional student, merging of traditional and post-traditional student preferences, lifelong education, and regional maturation of education markets around the globe. (The company’s international story is interesting enough that it merits its own post.)

Coursera is moving in the direction of becoming a uniquely horizontal EdTech company, not because of its MOOC pedagogical model but because of how it has leveraged the reach of the initial MOOC growth to become a successful multi-sided market. They haven’t completed this transition yet. But if they pull it off, they could become the first hyper-scaled EdTech company on the planet.

But what about…you know…learning?

I’ve come to realize that I don’t have a clear sense of how much the Coursera pedagogical platform has evolved in the way I do with EdX. Nor have I seen much in the way of efficacy research coming out of the company (or out of its university partners but publicized by the company). I’m skeptical about the platform. Once you’ve baked a particular set of assumptions into your platform design (e.g., video lectures plus assessments as a primary learning mode), it’s hard to change those later. But since I haven’t meaningfully explored that platform in years—I don’t count a couple of random, poorly designed MOOCs that I never completed over the years—I am making a conscious decision to set aside previous assumptions and acknowledge that I don’t know much about its current state. The same can be said for its underlying data architecture, suitability for research, and actual efficacy research being conducted. I haven’t personally seen evidence of significant progress on any of these fronts. But as the saying goes, absence of evidence is not evidence of absence.

One of the tricky aspects about evaluating Coursera is that it isn’t just a multi-sided market (like Teachers Pay Teachers) or just a learning platform (like an enterprise-licensed LMS). It’s a fusion of both. It’s a compound, complex platform. Its marketplace can reach and connect many different stakeholders. Buyers, sellers, and enablers. Is their content production, delivery, and analytics platform equally able to serve these disparate learning needs and contexts? That’s a vastly more complicated feat to pull off than it sounds.

From an economic perspective, Coursera is clearly evolving from a second-wave to a third-wave EdTech company. They’ve gone beyond direct-to-consumer and are demonstrating what it looks like to design a company for an environment of increasingly global, lifelong, and universal education. I have less clarity about whether their core teaching and learning capabilities are up to the task. But despite the hit their stock has taken in the current market, they may be the best-positioned player to crack that code.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://eliterate.us/coursera-is-evolving-into-a-third-wave-edtech-company/

- 000

- 1

- 10

- 100

- 2014

- 2022

- a

- ability

- Able

- About

- Academy

- access

- acknowledge

- acquiring

- across

- adapt

- Adoption

- Adult

- ADvantage

- Advertising

- against

- agencies

- agency

- Ages

- Airbnb

- All

- already

- Although

- always

- Amazon

- amidst

- among

- analysis

- analytics

- and

- answer

- apparent

- appear

- appeared

- Application

- applications

- Apply

- architecture

- Archive

- around

- aspects

- assessments

- Assistance

- assumed

- attention

- attracted

- attracting

- available

- barrier

- base

- basis

- because

- become

- becoming

- being

- benefits

- Better

- between

- Beyond

- Big

- bigger

- board

- Books

- bought

- brand

- brands

- bring

- broadly

- build

- Building

- Bullish

- business

- business model

- buyers

- california

- call

- calling

- Calls

- capabilities

- care

- Career

- careers

- ceo

- certificate

- certificates

- challenges

- change

- changing

- Channel

- channels

- characteristics

- chase

- clarity

- classes

- clear

- clearly

- closely

- code

- collaboration

- College

- Colleges

- come

- coming

- commission

- Common

- community

- community college

- Companies

- company

- Company’s

- Compensation

- competition

- competitive

- competitor

- complete

- Completed

- complex

- complexities

- complicated

- Compound

- Conference

- confusing

- Connect

- Connecting

- connection

- Connectivity

- connects

- conscious

- consistent

- consumer

- content

- contexts

- continue

- contrast

- conversations

- coordination

- Core

- Costs

- could

- Couple

- course

- courses

- coverage

- crack

- create

- creation

- Credentials

- credit

- curious

- Current

- Current state

- Curriculum

- data

- Days

- decision

- Decline

- Degree

- delivery

- Demand

- demographic

- Demographics

- demonstrating

- Depending

- Design

- designed

- Despite

- develop

- developing

- Development

- device

- DID

- different

- digital

- direction

- directly

- discovery

- disparate

- Distinguished

- distributed

- Distributed Network

- distribution

- diversification

- diversify

- Dolphin

- Dont

- down

- driven

- Drop

- Duke

- during

- each

- Early

- earn

- Earnings

- easier

- Economic

- economic value

- Economics

- economies

- ecosystem

- Education

- educational

- educators

- edx

- Effective

- embedded

- employees

- employers

- enable

- enabling

- encourages

- enhancing

- enough

- Enterprise

- Entire

- entry-level

- Environment

- equally

- equipped

- especially

- essential

- ethical

- Even

- EVER

- everyone

- evidence

- evolution

- evolved

- evolving

- example

- examples

- exchange

- expanded

- expanding

- expectations

- expensive

- experience

- explore

- Explored

- extensions

- facilitating

- Falling

- famously

- feat

- Features

- financial

- First

- Flip

- followed

- following

- form

- Foster

- found

- from

- front

- full

- fully

- fun

- further

- fusion

- future

- geographic

- get

- given

- Global

- Globally

- globe

- Go

- Goes

- going

- Government

- graduate

- gross

- grown

- Growth

- Hall

- hands-on

- Hard

- Hardware

- harvard

- having

- heavily

- help

- helping

- helps

- here

- High

- higher

- Higher education

- Highlighted

- historically

- Hit

- Hits

- Horizontal

- hotel

- How

- HTTPS

- I’LL

- Impact

- implications

- important

- improvements

- in

- In other

- include

- Including

- increasingly

- india

- indicates

- individual

- individuals

- industry

- inevitable

- inevitably

- initial

- Initiative

- initiatives

- Innovation

- Inspiration

- instance

- institutions

- integrated

- interested

- interesting

- International

- Internet

- internet access

- investment

- Invests

- involved

- iPhone

- IT

- itself

- Job

- Jobs

- July

- Keep

- Key

- Kind

- Know

- Lack

- landscape

- Last

- launch

- learning

- Lecture

- lectures

- Legal

- Legislature

- leveraging

- licenses

- likely

- Listed

- local

- long-term

- Look

- LOOKS

- Lot

- Louisiana

- made

- make

- Making

- many

- mapping

- Market

- Marketing

- marketplace

- Markets

- merging

- Middle

- might

- million

- mind

- Mindset

- Mission

- Mode

- model

- models

- money

- more

- moving

- multiple

- nationally

- Nature

- nearly

- Need

- needs

- network

- New

- November

- obvious

- offer

- Offers

- Office

- ONE

- online

- open

- opportunities

- Opportunity

- order

- original

- Other

- outlined

- own

- owner

- Pace

- Paper

- particular

- particularly

- partnered

- partners

- Partnership

- partnerships

- parts

- past

- Pay

- paying

- pays

- People

- Personally

- perspective

- PHIL

- phone

- plagued

- planet

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- player

- plus

- Point

- population

- portfolio

- Post

- powers

- preferences

- Premium

- Prepare

- present

- previous

- price

- pricing

- primarily

- primary

- Prior

- Problem

- produce

- Product

- Production

- Products

- professional

- Professor

- Program

- Programming

- Programs

- Progress

- projects

- provide

- provides

- providing

- publicly

- publishers

- Putting

- Q3

- q3 2022

- question

- random

- range

- rapidly

- ratio

- reach

- Read

- ready

- real

- Reality

- realize

- rebranding

- recent

- recently

- recognition

- recognized

- recommendations

- regional

- regions

- relatively

- relevant

- reliable

- remember

- reputation

- require

- research

- residents

- responsible

- revenue

- revenues

- Rise

- rising

- Rival

- Said

- sales

- same

- scalable

- Scale

- School

- scripts

- Search

- second-largest

- seeing

- seems

- sees

- segment

- Sellers

- Selling

- Sells

- sense

- Series

- serve

- set

- Share

- shared

- SHIFTING

- Shifts

- Shoot

- Short

- shortage

- should

- show

- Sides

- significant

- similar

- since

- Sites

- Sitting

- SIX

- skeptical

- skilled

- skills

- Slide

- Slides

- smaller

- So

- so Far

- Social

- Social impact

- Software

- sold

- solid

- some

- Someone

- somewhat

- Space

- speaking

- specifically

- spent

- Staff

- stakeholders

- started

- State

- States

- Still

- stock

- stores

- Story

- straight

- strategies

- streams

- strong

- stronger

- Struggling

- Student

- Students

- successful

- suitability

- summer

- support

- Surface

- swan

- system

- Systems

- Take

- Talent

- talking

- Task

- teachers

- Teaching

- tech

- technological

- Technology

- Tectonic

- ten

- textbook

- The

- The State

- the world

- their

- thing

- things

- thought

- thousands

- three

- Through

- time

- to

- today

- today’s

- together

- tools

- top

- toward

- towards

- Tracking

- traditional

- trained

- Training

- transition

- Trend

- Trends

- true

- u.s.

- Uber

- under

- underlying

- understood

- unfamiliar

- United

- United States

- units

- Universal

- Universities

- university

- unlocking

- us

- use

- value

- via

- Video

- vision

- Walmart

- wayfair

- webinar

- What

- whether

- which

- while

- white

- white paper

- WHO

- will

- within

- without

- Work

- worked

- workers

- Workforce

- Workforce Development

- working

- Workplace

- world

- worth

- would

- write

- written

- Wrong

- years

- young

- Your

- youtube

- zephyrnet