Report Insights | Sep 26, 2023

Dive into Citi's illuminating insights on the transformative landscape of cross-border payments for 2023

Based on the Citi's latest "Global Perspectives & Solutions: Future of Cross-Border Payments" report September 2023, here are 10 of the most insightful thought leadership points, statistics, or facts and figures that would be of interest to fintechs and banks.

The report is the culmination of insights gathered from prominent market infrastructure specialists both inside and outside of Citi, as well as from FinTechs and a broad spectrum of banks spread across four continents. Additionally, it encapsulates the primary discoveries from an exclusive survey conducted among over 100 financial institutions affiliated with Citi.

See: Understanding the Impact of Blockchain on Banking: Cross-Border Payments

1. Cross-Border Payments Inflection Point

- The world of cross-border payments is at a pivotal moment. As new competition and technologies emerge, there will be winners and losers.

- All players must adapt to maintain and grow their market share.

2. $250 Trillion Opportunity

- The value of cross-border payments is projected to reach $250 trillion by 2027.

- This massive growth presents a significant opportunity for both traditional banks and fintechs.

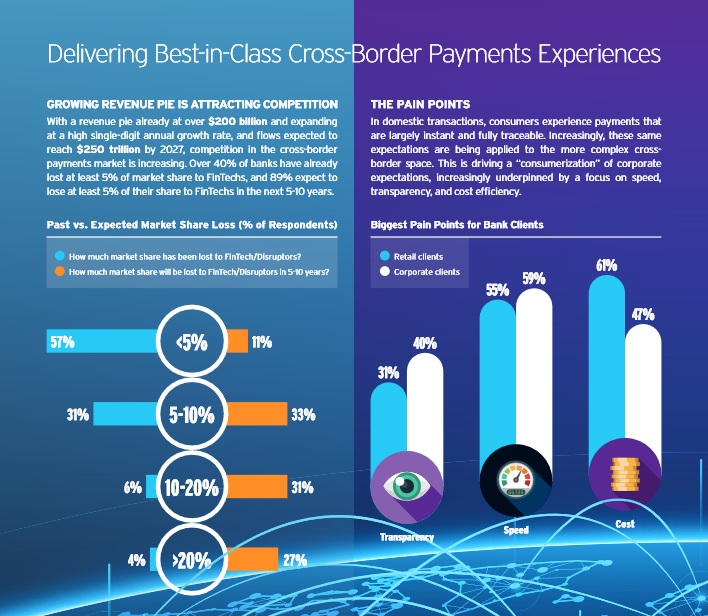

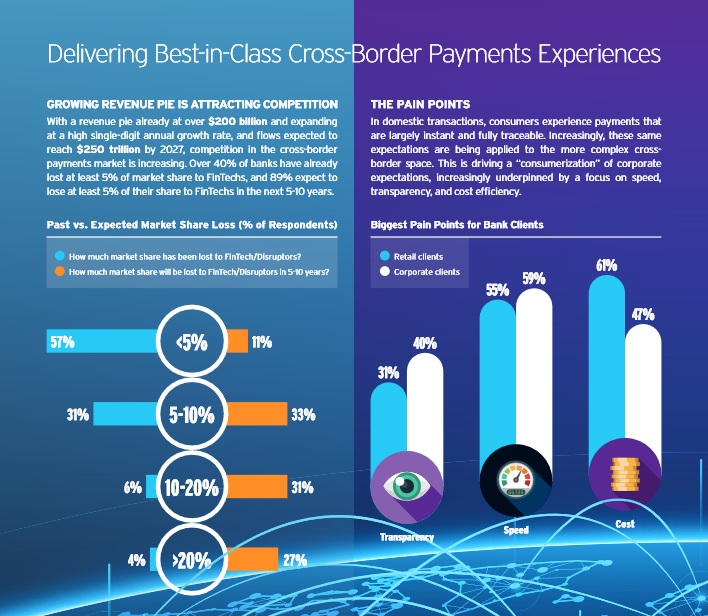

3. Market Share Shift to Fintechs

- Over 40% of banks have already lost at least 5% of their market share to fintechs.

- Additionally, 89% of banks anticipate losing at least another 5% of their share to fintechs in the next 5-10 years.

4. Consumer Expectations

- In domestic transactions, consumers now expect payments to be instant and fully traceable.

- These expectations are transitioning to the more complex cross-border space, leading to a "consumerization" of corporate expectations.

5. APIs as Key Enablers

- 83% of banks recognize application programming interfaces (APIs) as the primary technology to enhance the client experience. APIs allow banks to expand their networks through partnerships and elevate their capabilities.

See: Luge Capital Secures $71M in Second Fund’s First Close

6. Globalization and Cross-Border Payments

- Globalization, driven by the flow of goods, people, ideas, and capital, underpins the growth in cross-border payments revenues.

- These revenues have rebounded post-pandemic and are forecasted to grow at mid- to high-single digits over the next five years.

7. B2B Dominance and C2B Growth

- While B2B payments continue to dominate in size, the fastest growth area is expected in consumer-to-business (C2B) payment flows, driven by e-commerce and other innovations.

8. Digital Assets and AI

- Digital assets are emerging with interesting use cases, such as smart contracts and real-time liquidity.

- Additionally, artificial intelligence (AI) has captured significant attention in 2023 and could act as a catalyst for change in the payments market.

9. Client Experience Focus

- Over 50% of banks see the need to revamp their front ends to improve the client experience.

- Over 60% of respondents believe there's a need to upgrade their core infrastructure.

See: Lending Loop Launches ‘Loop Card’ for Small Business Cross-border Transactions

10. Changing Nature of Trade

- Trade in merchandise and services across borders has rebounded post-financial crisis. The value of exports amounted to almost 25% of global GDP in 2022, up from 23% in 2019.

- The mix of trade is also evolving, with increasing cross-border data and IP flows.

Image: Citi Cross-Border Payments Sep 2023 Report

Image: Citi Cross-Border Payments Sep 2023 ReportDownload the Report

The report contains statistics and insights from key stakeholders, and recognizes both the pain points that both banks and fintechs must overcome to compete for market share along with key areas of focus to win including delivering 'best in class' client experiences with unprecedented speed, transparency, and low cost.

The future of cross-border payments is undergoing a tectonic shift as stakeholders jostle for a piece of a projected $250 trillion market by 2027. Download the full 120 page PDF report here.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/citis-top-10-insights-on-cross-border-payments-2023/

- :has

- :is

- $UP

- 10

- 100

- 150

- 2018

- 2019

- 2022

- 2023

- 250

- 26

- 32

- a

- across

- Act

- adapt

- Additionally

- Affiliated

- affiliates

- AI

- allow

- almost

- along

- already

- also

- alternative

- alternative finance

- among

- an

- and

- Another

- anticipate

- APIs

- Application

- ARE

- AREA

- areas

- artificial

- artificial intelligence

- AS

- Assets

- At

- attention

- B2B

- B2B payments

- Banking

- Banks

- BE

- become

- believe

- BEST

- blockchain

- border

- borders

- both

- broad

- business

- by

- cache

- Canada

- capabilities

- capital

- captured

- cases

- Catalyst

- change

- changing

- Citi

- class

- client

- Close

- closely

- commission

- community

- compete

- competition

- complex

- conducted

- consumer

- Consumers

- contains

- continue

- contracts

- Corporate

- Cost

- could

- create

- crisis

- Cross

- cross-border

- cross-border payments

- Crowdfunding

- cryptocurrency

- data

- decentralized

- delivering

- digital

- Digital Assets

- digits

- distributed

- Domestic

- Dominance

- dominate

- download

- driven

- e-commerce

- ecosystem

- Education

- ELEVATE

- emerge

- emerging

- encapsulates

- ends

- engaged

- enhance

- Ether (ETH)

- evolving

- Exclusive

- Expand

- expectations

- expected

- experience

- Experiences

- exports

- facts

- fastest

- Figures

- finance

- financial

- financial innovation

- financial services

- fintech

- fintechs

- First

- first close

- five

- flow

- Flows

- Focus

- For

- four

- from

- front

- full

- fully

- funding

- funding opportunities

- future

- gathered

- GDP

- get

- Global

- globalization

- goods

- Government

- Grow

- Growth

- growth area

- Have

- helps

- here

- High

- How

- HTTPS

- ideas

- illuminating

- image

- Impact

- improve

- in

- Including

- increasing

- industry

- Inflection

- infographic

- information

- Infrastructure

- Innovation

- innovations

- innovative

- inside

- insightful

- insights

- instant

- Insurtech

- Intelligence

- interest

- interesting

- interfaces

- into

- investment

- Investopedia

- IP

- IT

- Jan

- jpg

- Key

- Key Areas

- landscape

- latest

- launches

- Law

- Leadership

- leading

- least

- legally

- lending

- Liquidity

- Losers

- losing

- lost

- Low

- maintain

- Market

- market share

- massive

- max-width

- member

- Members

- merchandise

- mix

- moment

- more

- most

- must

- Nature

- Need

- networking

- networks

- New

- next

- now

- of

- on

- opportunities

- Opportunity

- or

- Other

- outside

- over

- Overcome

- page

- Pain

- Pain points

- partners

- partnerships

- payment

- payments

- peer to peer

- People

- perks

- perspectives

- piece

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- players

- please

- points

- post-pandemic

- presents

- primary

- Programming

- projected

- projects

- provides

- reach

- real-time

- recognize

- recognizes

- Regtech

- report

- respondents

- revenues

- s

- Second

- Sectors

- Secures

- see

- September

- Services

- shaping

- Share

- shift

- significant

- Size

- small

- small business

- smart

- Smart Contracts

- Solutions

- Sound

- Space

- Spectrum

- speed

- spread

- stakeholders

- statistics

- Stewardship

- such

- Survey

- Technologies

- Technology

- Tectonic

- Tectonic Shift

- that

- The

- The Future

- their

- There.

- thought

- thought leadership

- thousands

- Through

- to

- today

- Tokens

- top

- Top 10

- trade

- traditional

- Transactions

- transformative

- transitioning

- Transparency

- Trillion

- Uk

- UK law

- undergoing

- understanding

- unprecedented

- upgrade

- use

- value

- vibrant

- Visit

- WELL

- will

- win

- winners

- with

- works

- world

- would

- years

- zephyrnet