- Prior 5.25%

- Bank rate vote 6-2-1 vs 8-1-0 expected (Haskel, Mann voted for 25 bps rate hike; Dhingra voted for 25 bps rate cut)

- Monetary policy will need to remain restrictive for sufficiently long

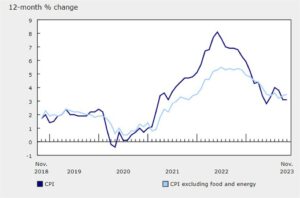

- Prepared to adjust monetary policy as warranted by economic data to return inflation to 2% target sustainably

- Labour market has continued to ease, but remains tight by historical standards

- GDP growth is expected to pick up gradually

- Risks to inflation are more balanced

- Risks around modal CPI inflation projection are skewed to the upside

- Although services price inflation and wage growth have fallen by somewhat more than expected, key indicators of inflation persistence remain elevated

- Full statement

As expected, the BOE removed this particular passage from the statement:

"Further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures."

That is to make room for a softer policy language, by replacing it with the following:

"The Committee will keep under review for how long Bank Rate should be maintained at its current level."

Besides that, it is a bit of a mixed bag as the BOE now sees lower wages growth forecasts but more sticky inflation in two years' time (2.3% vs 1.9% in November projection). Then, there is the fact that Haskel and Mann continues to vote for 25 bps rate hikes while the most dovish member, Dhingra, voted for a 25 bps rate cut.

At the balance, the pound is little changed with GBP/USD now at 1.2650 levels from around 1.2640 earlier.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexlive.com/centralbank/boe-leaves-bank-rate-unchanged-at-525-as-expected-20240201/

- :has

- :is

- $UP

- 1

- 2%

- 25

- a

- adjust

- and

- ARE

- around

- AS

- At

- bag

- Balance

- Bank

- Bank Rate

- BE

- Bit

- BoE

- but

- by

- changed

- CO

- committee

- continued

- continues

- CPI

- Current

- Cut

- data

- Dovish

- Earlier

- ease

- Economic

- evidence

- expected

- fact

- Fallen

- following

- For

- forecasts

- from

- further

- GBP/USD

- Growth

- Have

- Hikes

- historical

- How

- HTTPS

- if

- in

- Indicators

- inflation

- Inflationary

- Inflationary pressures

- IT

- ITS

- Keep

- Key

- language

- Level

- levels

- little

- Long

- lower

- maintained

- make

- Market

- member

- mixed

- Monetary

- Monetary Policy

- more

- most

- Need

- November

- now

- of

- particular

- passage

- persistence

- pick

- plato

- Plato Data Intelligence

- PlatoData

- policy

- pound

- price

- Projection

- Rate

- rate hikes

- remain

- remains

- Removed

- required

- Restrictive

- return

- review

- Room

- sees

- Services

- should

- somewhat

- Statement

- sticky

- Target

- than

- that

- The

- then

- There.

- this

- tightening

- time

- to

- two

- under

- Vote

- voted

- vs

- wage

- wages

- were

- while

- will

- with

- would

- years

- zephyrnet