City A.M. | Jonny Fry | Dec 19, 2022

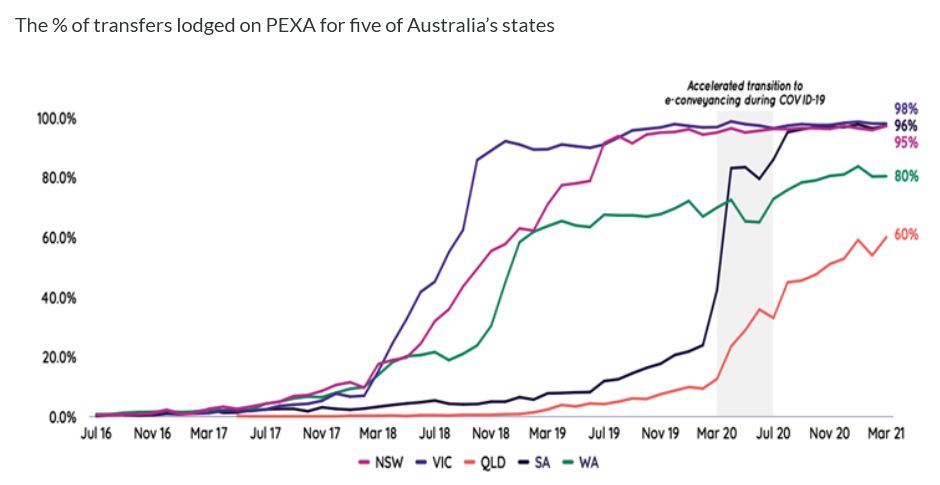

Blockchain technology has already been successfully used for a number of years in Australia by a company called PEXA, which has recorded over 11million property transactions with enhanced protections, transparency of ownership process, and real-time settlement for a more efficient process for everyone involved.

- Proof of ownership: Ordinarily, the buying and selling of real estate is recorded on a central register known as the Land Registry, but the World Bank estimates that “70 per cent of the world’s population still lacks access to proper land titling…”

- So-called sophisticated jurisdictions such as the UK, 15% of property is not recorded on the Land Registry. For example, if someone has owned a property before 1990 and not taken out a mortgage since, the property may not be registered.

See: How Proptech Is Changing the Real Estate Game

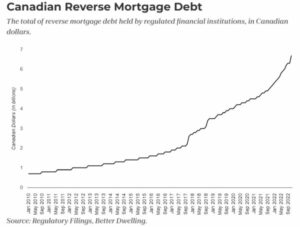

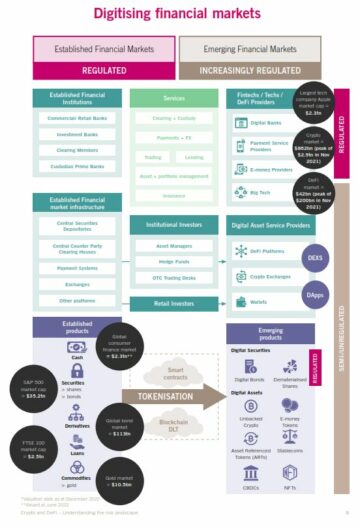

- Payment options: Traditional banks, lenders, lawyers, escrow agents, etc, are increasingly facing a choice as to how money is transferred from both lender to borrower and from the buyer to the seller of a property. The use of digital assets means that it is now cheaper to transfer money between different parties, and the amount of money to be saved using a digital currency pegged to the $ or € or £ etc could be quite considerable.

- Reducing fees: Very few real estate transactions involve transferring money directly from buyer to seller as the monies customarily go via the buyers’ and sellers’ respective lawyers.

- UK: Once the seller’s lawyers have deducted their fees the residual capital is transferred to the seller. i.e., at least three transactions/messages are generated: £25*3= £75 for the sale of one home in SWIFT messaging fees alone. This equates to £75million p.a. just for UK mortgages.

- US: the cost to deposit and receive money (wire transfer fees) is typically $15 to receive and $25 to send. Given that last year there were 6million property transactions, the cost to move money from the buyer to seller equates to approximately $240million.

- A large proportion of these real estate money transfer fees in the US and in the UK could actually be eradicated using a CBDC or a stablecoin – i.e., a digital currency pegged to a fiat currency.

See: Fintech Fridays EP43: Taking the Mortgage Process From 40 Days to Minutes

- Digitalization: In 2011, the Australians introduced legislation called the Electronic Conveyancing National Law Agreement enabling registered “subscribers” (lawyers, conveyancers and lenders) to use the system on behalf of buyers and sellers of real estate, so avoiding delays in requesting additional authorisation and signatures.

- Using blockchain technology, one secure data base that relevant parties can have access to has, in effect, been created and it has been so successful that, according to Legal Futures, “80% of conveyancing completions in Australia” are now run via the PEXA platform

- Faster: The property exchange has, itself, handled over 11million real estate transactions in Australia to date, reporting that “in Australia, re-mortgaging times have dropped from an average of 42 to 15 days, with some re-mortgages even completing in one day.”

Continue to the full article --> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://ncfacanada.org/blockchain-and-the-digitalization-of-real-estate-australian-company-with-11-million-transactions/

- 11

- 15%

- 2011

- 2018

- a

- access

- According

- actually

- Additional

- affiliates

- agents

- alone

- already

- alternative

- amount

- and

- approximately

- article

- Assets

- Australia

- Australian

- Australian company

- authorisation

- average

- avoiding

- Bank

- Banks

- base

- become

- before

- between

- blockchain

- blockchain technology

- buyers

- Buying

- cache

- called

- Canada

- capital

- CBDC

- central

- changing

- cheaper

- choice

- closely

- community

- company

- completing

- considerable

- Cost

- could

- create

- created

- Crowdfunding

- cryptocurrency

- Currency

- data

- Date

- Days

- decentralized

- delays

- deposit

- different

- digital

- Digital Assets

- digital currency

- digitalization

- distributed

- dropped

- ecosystem

- Education

- effect

- efficient

- engaged

- enhanced

- equates

- escrow

- estate

- estimates

- etc

- Ether (ETH)

- Even

- everyone

- example

- exchange

- facing

- Fees

- few

- Fiat

- Fiat currency

- finance

- financial

- fintech

- Fridays

- from

- full

- funding

- Futures

- game

- get

- given

- Global

- Go

- Government

- helps

- Home

- How

- HTTPS

- in

- increasingly

- industry

- information

- Innovation

- innovative

- Insurtech

- Intelligence

- introduced

- investment

- involve

- involved

- IT

- itself

- Jan

- jurisdictions

- known

- Land

- large

- Last

- Last Year

- Law

- Lawyers

- Legal

- lender

- lenders

- Market

- max-width

- means

- member

- Members

- messaging

- million

- minutes

- money

- more

- more efficient

- Mortgage

- Mortgages

- move

- National

- networking

- number

- ONE

- opportunities

- Options

- owned

- ownership

- parties

- partners

- payments

- peer to peer

- perks

- plato

- Plato Data Intelligence

- PlatoData

- please

- population

- process

- projects

- proper

- property

- PropTech

- provides

- real

- real estate

- real-time

- receive

- recorded

- register

- registry

- Regtech

- relevant

- Reporting

- respective

- Run

- sale

- Sectors

- secure

- Sellers

- Selling

- Services

- settlement

- Signatures

- since

- So

- some

- Someone

- sophisticated

- stablecoin

- stakeholders

- States

- Stewardship

- Still

- successful

- Successfully

- such

- SWIFT

- system

- taking

- Technology

- The

- the UK

- the world

- their

- thousands

- three

- times

- to

- today

- Tokens

- traditional

- Transactions

- transfer

- transferred

- Transferring

- Transparency

- typically

- Uk

- us

- use

- via

- vibrant

- which

- Wire

- works

- world

- World Bank

- world’s

- year

- years

- zephyrnet