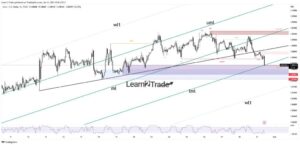

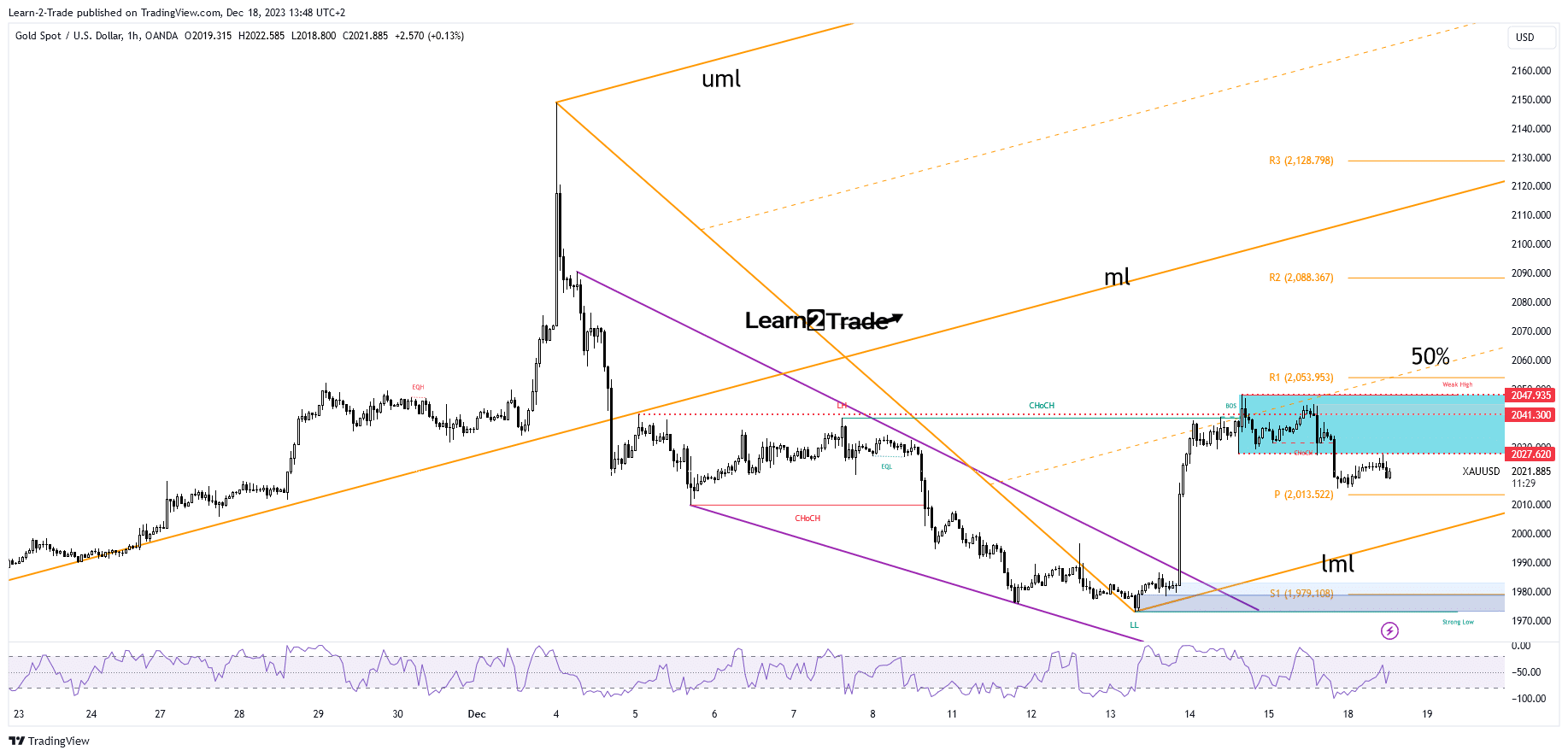

- XAU/USD retreated after registering only false breakouts through the immediate resistance levels.

- The lower median line (LML) stands as a major support.

- The Canadian CPI could change the sentiment tomorrow.

The gold price turned to the downside as the US dollar struggled to resume its current swing higher. The metal is trading at $2,022 at the time of writing. It has changed little today, so we must wait for fresh opportunities.

–Are you interested to learn more about forex options trading? Check our detailed guide-

The price dropped even though the US reported mixed economic data on Friday. Flash Services PMI came in better than expected, confirming further expansion. Meanwhile, Flash Manufacturing PMI, Capacity Utilization Rate, Industrial Production, and Empire State Manufacturing Index came in worse than expected.

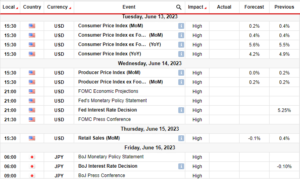

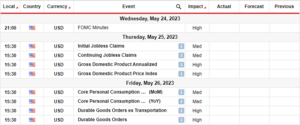

Today, only the US NAHB Housing Market Index and the New Zealand Trade Balance could bring some action. Still, the traders for tomorrow’s economic data and high-impact events before taking action.

The Australian Monetary Policy Meeting Minutes and the BOJ could shake the markets in the morning. The BoJ Policy Rate is expected to remain steady at -0.10%. Furthermore, the Canadian inflation data could change the sentiment in the short term.

The Consumer Price Index is expected to report a 0.2% drop after the 0.1% growth in the previous reporting period. Also, the US will release the Building Permits and the Housing Starts data.

Gold Price Technical Analysis: Downtrend Intact

As you can see on the hourly chart, the price found resistance right above the $2,041 static resistance and beyond the 50% Fibonacci line of the ascending pitchfork. The false breakouts revealed buyers’ exhaustion, and the price turned to the downside, escaping from the range between $2,047 and $2,027.

–Are you interested to learn more about forex tools? Check our detailed guide-

Now, it has retested the broken range’s support and it could resume its downside movement. The weekly pivot point of $2,013 stands as the immediate downside obstacle. The major support is represented by the lower median line (lml).

Technically, the retreat could be temporary after the last rally. It could test the near-term support levels before developing a new leg higher. As long as it stays above the lower median line (LML), the XAU/USD could give birth to a larger leg higher.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/18/gold-price-aiming-for-2000-as-selling-intensifies/

- :has

- :is

- 000

- 2%

- a

- About

- above

- Accounts

- Action

- After

- Aiming

- also

- analysis

- and

- AS

- At

- Australian

- Balance

- BE

- before

- Better

- between

- Beyond

- birth

- boj

- breakouts

- bring

- Broken

- Building

- by

- came

- CAN

- Canadian

- Canadian inflation

- Capacity

- CFDs

- change

- changed

- Chart

- check

- Consider

- consumer

- consumer price index

- could

- CPI

- Current

- data

- detailed

- developing

- Dollar

- downside

- Drop

- dropped

- Economic

- Empire

- Even

- events

- expansion

- expected

- false

- Fibonacci

- Flash

- For

- forex

- found

- fresh

- Friday

- from

- further

- Furthermore

- Give

- Gold

- gold price

- Growth

- High

- higher

- housing

- housing market

- HTTPS

- immediate

- in

- index

- industrial

- Industrial Production

- inflation

- Intensifies

- interested

- Invest

- investor

- IT

- ITS

- larger

- Last

- LEARN

- levels

- Line

- little

- Long

- lose

- losing

- lower

- major

- manufacturing

- Market

- Markets

- max-width

- Meanwhile

- meeting

- metal

- minutes

- mixed

- Monetary

- Monetary Policy

- money

- more

- morning

- movement

- must

- New

- New Zealand

- now

- obstacle

- of

- on

- only

- opportunities

- Options

- our

- period

- permits

- Pivot

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- Point

- policy

- previous

- price

- Production

- provider

- rally

- range

- Rate

- registering

- release

- remain

- report

- Reported

- Reporting

- represented

- Resistance

- resume

- retail

- Retreat

- Revealed

- right

- Risk

- see

- Selling

- sentiment

- Services

- Short

- should

- So

- some

- stands

- starts

- State

- steady

- Still

- support

- support levels

- Swing

- Take

- taking

- Technical

- Technical Analysis

- temporary

- term

- test

- than

- The

- The Weekly

- this

- though?

- Through

- time

- to

- today

- tomorrow

- trade

- Traders

- Trading

- Turned

- us

- US Dollar

- US NAHB Housing Market Index

- wait

- we

- weekly

- when

- whether

- will

- with

- worse

- writing

- XAU/USD

- you

- Your

- Zealand

- zephyrnet