- Australia recorded a net increase of 6,700 jobs in September.

- Australia’s unemployment rate dropped to 3.6%.

- The RBA assessed that the labor market has reached a turning point.

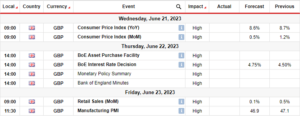

Australia’s September jobs missed expectations, casting a bearish shadow on the AUD/USD outlook. Nevertheless, the unemployment rate decreased slightly, indicating that the labor market remained highly competitive.

–Are you interested in learning more about STP brokers? Check our detailed guide-

This jobs report alone didn’t impact market expectations regarding a potential interest rate hike by the Reserve Bank of Australia next month. However, it does elevate the importance of the third-quarter inflation report. The report will play a pivotal role in the decision-making process. Notably, there was a net increase of 6,700 jobs in September, a decline from the previous month’s remarkable rise of 63,300. Meanwhile, market predictions had suggested an increase of approximately 20,000 jobs. On the other hand, the unemployment rate dropped to 3.6%, slightly below the expected 3.7%.

In the meantime, markets continued to factor in a roughly 25% probability of a quarter-point increase in the cash rate to 4.35% next month. The labor market displayed remarkable resilience, with a net addition of 394,300 jobs in the 12 months leading up to September.

Nonetheless, the Reserve Bank of Australia (RBA) assessed that the labor market has reached a turning point. The job growth in September was primarily driven by a surge of 46,500 part-time jobs, which more than offset a decline of 39,900 in full-time employment.

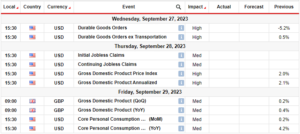

AUD/USD key events today

After Australia’s employment report, AUD/USD traders are awaiting major events from the US like:

- Fed chair Jerome Powell’s speech.

- The initial jobless claims report.

- The existing home sales report.

- The Philadelphia Fed Manufacturing Index.

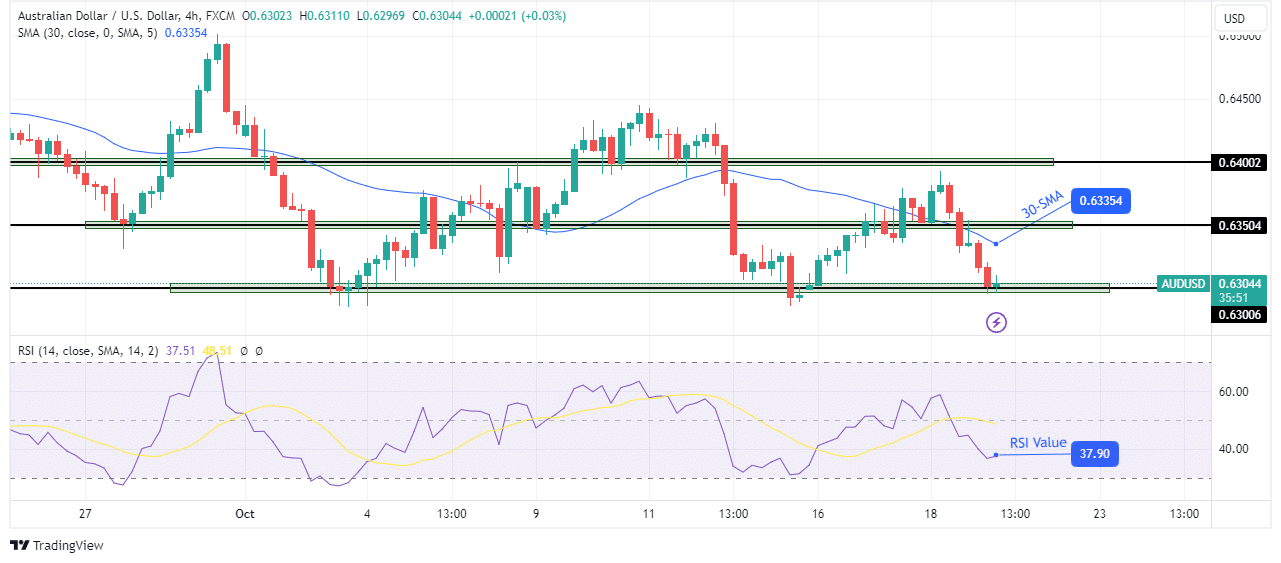

AUD/USD technical outlook: Bears poised to break below 0.6300.

The AUD/USD price is facing the 0.6300 support level again. This is the third time that bears are challenging this support level. Moreover, the price has failed to break below 0.6300 in the previous two attempts. Bulls are ever ready to push the price higher at this level.

–Are you interested in learning more about making money with forex? Check our detailed guide-

Still, looking at the price on a larger scale, it is clear that it is making lower highs. This is a sign that bulls are getting weaker with every push higher. Moreover, the price is well below the 30-SMA with the RSI nearly oversold. Therefore, there is a good possibility bears will break below 0.6300 to continue the decline.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/aud-usd-outlook-australias-employment-data-misses-the-mark/

- :has

- :is

- $UP

- 000

- 1

- 12

- 12 months

- 20

- 300

- 35%

- 39

- 46

- 500

- 700

- a

- About

- Accounts

- addition

- again

- alone

- an

- approximately

- ARE

- assessed

- At

- Attempts

- AUD/USD

- Australia

- awaiting

- Bank

- bearish

- Bears

- below

- Break

- Bulls

- by

- CAN

- Cash

- casting

- CFDs

- Chair

- challenging

- check

- claims

- clear

- competitive

- Consider

- continue

- continued

- data

- Decision Making

- Decline

- decreased

- detailed

- displayed

- does

- driven

- dropped

- ELEVATE

- employment

- events

- EVER

- Every

- existing

- expectations

- expected

- facing

- factor

- Failed

- Fed

- forex

- from

- getting

- good

- Growth

- had

- hand

- High

- higher

- highly

- Highs

- Hike

- Home

- However

- HTTPS

- Impact

- importance

- in

- Increase

- index

- indicating

- inflation

- initial

- interest

- INTEREST RATE

- interest rate hike

- interested

- Invest

- investor

- IT

- jerome

- Job

- jobless claims

- Jobs

- jobs report

- Key

- labor

- labor market

- larger

- leading

- learning

- Level

- like

- looking

- lose

- losing

- lower

- major

- Making

- manufacturing

- mark

- Market

- market predictions

- Markets

- max-width

- meantime

- Meanwhile

- missed

- misses

- money

- Month

- months

- more

- Moreover

- nearly

- net

- Nevertheless

- next

- notably

- now

- of

- offset

- on

- Other

- our

- Outlook

- philadelphia

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- Play

- Point

- poised

- possibility

- potential

- Powell’s

- Predictions

- previous

- price

- primarily

- probability

- process

- provider

- Push

- Rate

- Rate Hike

- RBA

- reached

- ready

- recorded

- regarding

- remained

- remarkable

- report

- Reserve

- reserve bank

- reserve bank of australia

- Reserve Bank of Australia (RBA)

- resilience

- retail

- Rise

- Risk

- Role

- roughly

- rsi

- s

- sales

- Scale

- September

- Shadow

- should

- sign

- speech

- support

- support level

- surge

- Take

- Technical

- than

- that

- The

- There.

- therefore

- Third

- this

- time

- to

- trade

- Traders

- Trading

- Turning

- turning point

- two

- unemployment

- unemployment rate

- us

- was

- WELL

- when

- whether

- which

- will

- with

- Yahoo

- you

- Your

- zephyrnet