Vil du holde styr på de største finansieringsavtalene for oppstart i 2023 med vår nye kuraterte liste over ventureavtaler på 100 millioner dollar til USA-baserte selskaper? Sjekk ut vår nye Megadeals Tracker her..

Dette er en ukentlig funksjon som kjører ned ukens topp 10 annonserte finansieringsrunder i USA Sjekk ut forrige ukes største finansieringsrunder her..

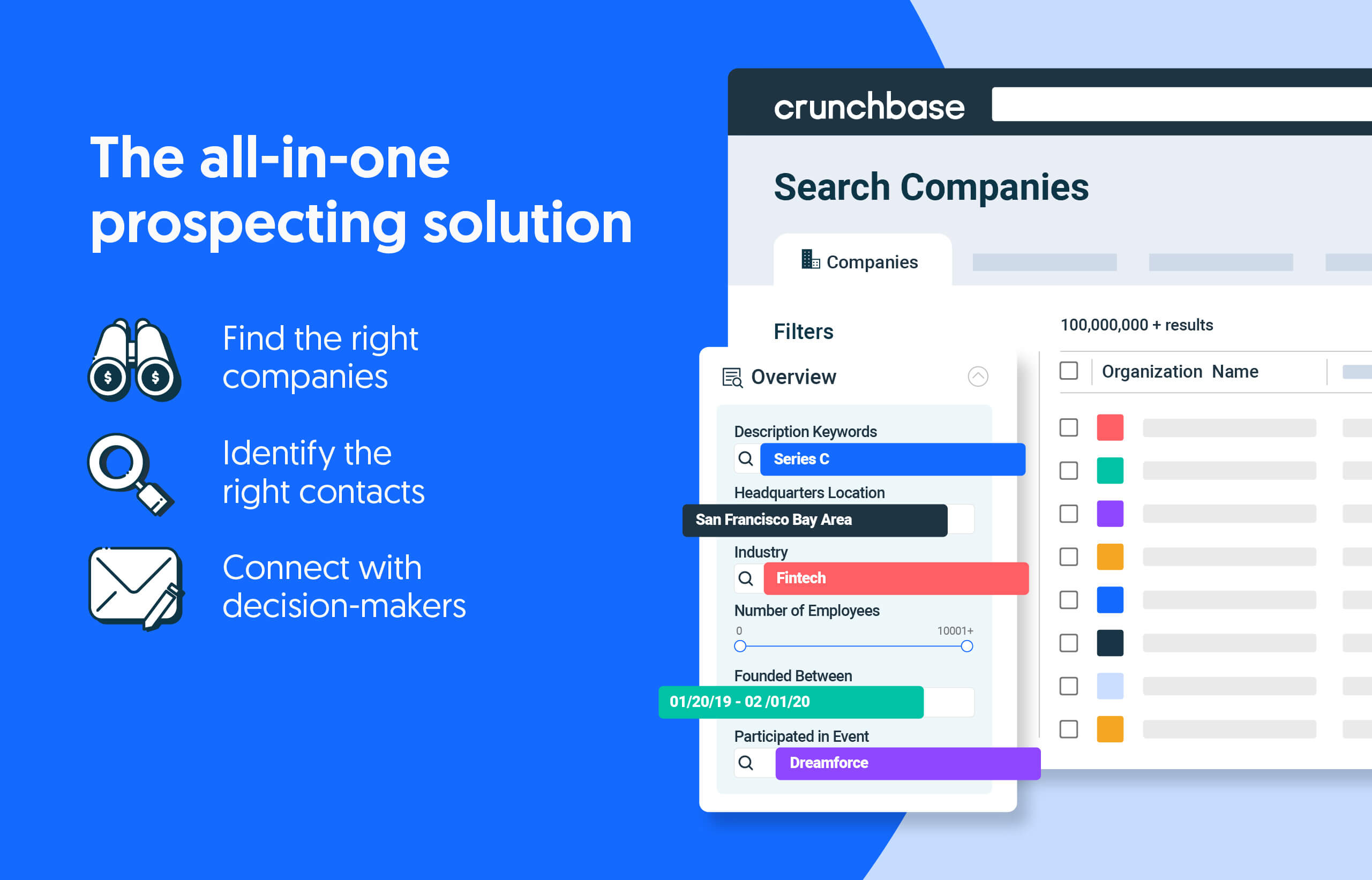

Søk mindre. Lukk mer.

Øk inntektene dine med alt-i-ett-prospekteringsløsninger drevet av ledende innen private bedriftsdata.

After several weeks of just having one or two rounds of nine figures, this week saw an explosion. Eight rounds hit $100 million or more as big rounds seemed to pour in. No one sector cleaned up, as the money was spread around from cleantech to biotech to fintech to even restaurant-centric software.

1. Gradient, $225 millioner, cleantech: Gradiant became one of the newest unicorns this week after raising a fresh 225 millioner dollar i en serie D ledet av BoltRock Holdings og Centaurus hovedstad. Oppstarten av vannteknologien er nå verdsatt til 1 milliard dollar. Oppstarten utvikler teknologi for å redusere vannbruk og bygge avløpsvannbehandlingssystemer for selskaper innen farmasøytisk, halvledere, mat og drikke og andre vannkrevende industrier. Finansieringen er den største innen avløpsrenseområdet, i alle fall siden begynnelsen av 2022. Grunnlagt i 2013 ved Massachusetts Institute of Technology. The company has now raised more than $392 million, ifølge Crunchbase.

2. Tipalti, $150 millioner, fintech: Automated payment solution Tipalti raised big this week with a $150 million “incremental growth financing” round, as the company called it. Back in 2021, the Foster City, California-based fintech raised a $270 million Series F funding led by G Kvadrat at a valuation of $8.3 billion. No valuation was given this time around — although that is not unusual in this time of slowing venture funding and declining valuation. The latest round was from JPMorgan Chase Bank og Herkules hovedstad, which specializes in venture debt, although no distinction between debt and equity was announced by Tipalti. Founded in 2010, Tipalti has now raised about $700 million, according to the company’s slipp.

3. Restaurant365, $135M, regnskap: It’s hard to run a restaurant — as anyone who has watched several reality shows based on doing so knows. Restaurant365 tries to make that a little easier and this week the Irvine, California-based startup added some big-named backers. The company nailed down a $135 million round co-led by KKR og L Catterton. Den nye runden verdsetter selskapet til 1 milliard dollar per dens slipp. Restaurant365 offers enterprise management software for restaurants, helping them take care of accounting, payroll, supply chain and more. The company has surpassed $100 million in revenue and is used in more than 40,000 restaurant locations. Founded in 2011, the company has raised more than $260 million, per Crunchbase.

4. (uavgjort) Avenue One, $100M, property management: New York-based Avenue One also joined the unicorn herd this week with a $100 million raise led by WestCap. The cash infusion gave the company a valuation of $1 billion. The startup, founded in 2020, provides a handful of services to single-family rental investors — such as finding their next property or financing. Institutional investors started buying up single-family homes during the pandemic as interest rates remained low and families sought more space. Even as interest rates have climbed back up, there clearly is still enough interest in the market to mint a property management startup as a unicorn.

4. (uavgjort) Grenseløs bio, $100 millioner, bioteknologi: It seems every week a biotech startup or two raise a huge round. This week is no different. First off is Boundless Bio, a clinical stage, next-generation precision oncology startup, which raised a $100 million Series C co-led by Sprang av Bayer og RA Kapitalforvaltning. The San Diego-based startup is developing therapeutics directed against extrachromosomal DNA for patients with oncogene amplified cancers. In the past, targeted therapies have been mostly ineffective in treating patients with oncogene amplified cancers, according to the company. Founded in 2018, the company has raised more than $250 million, per Crunchbase.

4. (uavgjort) Eagle Eye Networks, $100 millioner, sikkerhet: When a security company raises a nine-figure round, it is normal to assume it is referring to cybersecurity. However, not in this case. Eagle Eye Networks is an actual physical security company — although with a tech twist. The company offers cloud-based video surveillance. Perhaps not the sexiest of industries, but still a significant market. The Austin, Texas-based startup locked up $100 million in a round led by Japan-based Hvis med. Founded in 2012, the firm has now raised $195 million, ifølge Crunchbase.

4. (uavgjort) Ray Therapeutics, $100 millioner, bioteknologi: Another biotech was able to raise a nine-figure round this week. San Francisco-based Ray Therapeutics locked up a $100 million Series A led by Novo Holdings A/S. The startup is looking to restore vision for people with the rare blinding disease retinitis pigmentosa. While some companies are looking to stop the disorder before it results in blindness, Ray differentiates itself by looking into therapeutics to actually bring back vision. Founded in 2021, the company has now raised $110 million, per Crunchbase.

4.(uavgjort) Zip, $100M, procurement: Procurement software certainly is not the sexiest of industries, but there is no denying the need for systems that help companies with the burdensome process of buying new software and hardware. San Francisco-based Zip helps companies do just that and this week it raised a 100 millioner dollar serie C from investors Y Kombinator, CRV og Tiger Global. The startup also bucked the trend of declining valuations. The new cash gives the procurement startup a $1.5 billion post-money valuation. While many companies are seeing stagnant or falling valuations, the new valuation represents a slight bump from its previous $1.2 billion valuation last May after the company raised a $43 million Series B. Zip helps companies with sourcing, approving and paying for needed business tools, ideally helping to streamline the process to make it less taxing. Founded in 2020, Zip has raised $181 million to date, per the company.

9. Nido Biosciences, $87 millioner, bioteknologi: Watertown, Massachusetts-based Nido Biosciences, a biotech startup developing medicines for debilitating neurological diseases, announced it has raised a total of $109 million in seed, and Series A and B financings. Previous SEC filings (her. og her.) indicate the Series B — led by Bioluminescence Ventures — likely was around $87 million.

10. Quince, $77 millioner, e-handel: San Francisco-based luxury retailer Quince raised a $77 million Series B led by Wellington Management. Selskapet ble grunnlagt i 2018 og har samlet inn 141.5 millioner dollar, ifølge Crunchbase, positioning it for accelerated growth and expansion.

Store globale avtaler

Even though the U.S. saw some big funding rounds, none came close to the biggest this week.

metodikk

Vi sporet de største annonserte rundene i Crunchbase-databasen som ble hentet inn av USA-baserte selskaper for syvdagersperioden 13. mai til 19. mai. Selv om de fleste annonserte rundene er representert i databasen, kan det være en liten tidsforsinkelse ettersom noen runder rapporteres sent i uken.

Videre lesing

illustrasjon: Dom Guzman

Hold deg oppdatert med nylige finansieringsrunder, oppkjøp og mer med Crunchbase Daily.

Hong Kong wants to strengthen its reputation as a forward-looking financial hub.

E-handel-enhjørningen vant raskt hjertene til amerikanske forbrukere under pandemien, men Shein møter nå en rekke hindringer.

SoftBank endrer navnet på Opportunity Fund i forkant av sitt tredje jubileum, og akkurat som det kunngjør et nytt andre fond på 150 millioner dollar.

Så langt i år har flere AI-fokuserte selskaper annonsert bindinger med SPAC-er som spenner over sektorer inkludert utdanning, diagnostikk og data...

- SEO-drevet innhold og PR-distribusjon. Bli forsterket i dag.

- PlatoAiStream. Web3 Data Intelligence. Kunnskap forsterket. Tilgang her.

- Minting the Future med Adryenn Ashley. Tilgang her.

- Kjøp og selg aksjer i PRE-IPO-selskaper med PREIPO®. Tilgang her.

- kilde: https://news.crunchbase.com/venture/biggest-funding-rounds-gradiant-tipalti/

- : har

- :er

- :ikke

- $ 1 milliarder

- $ 100 millioner

- $OPP

- 000

- 10

- 13

- 2011

- 2012

- 2013

- 2018

- 2020

- 2021

- 2022

- 2023

- 40

- a

- I stand

- Om oss

- akselerert

- Ifølge

- Regnskap og administrasjon

- oppkjøp

- faktiske

- faktisk

- la til

- Etter

- mot

- fremover

- All-in-One

- også

- Selv

- amerikansk

- Amplified

- an

- og

- Anniversary

- annonsert

- kunngjør

- En annen

- noen

- ER

- rundt

- AS

- At

- austin

- Automatisert

- Avenue

- tilbake

- støttespillere

- basert

- BE

- ble

- vært

- før du

- Begynnelsen

- mellom

- DRIKKE

- Stor

- Biggest

- Milliarder

- bioteknologi

- Blindhet

- Grenseløst

- bringe

- bygge

- virksomhet

- men

- Kjøpe

- by

- som heter

- kom

- hovedstad

- hvilken

- saken

- Kontanter

- Gjerne

- kjede

- endring

- chase

- sjekk

- City

- cleantech

- klart

- klatret

- Klinisk

- Lukke

- Selskaper

- Selskapet

- Selskapets

- Forbrukere

- kunne

- dekke

- Crunchbase

- kuratert

- Cybersecurity

- daglig

- dato

- Database

- Dato

- Tilbud

- Gjeld

- fallende

- utvikle

- utvikler

- forskjellig

- sykdom

- sykdommer

- lidelse

- dna

- do

- gjør

- ned

- under

- e-handel

- enklere

- Kunnskap

- slutt

- nok

- Enterprise

- egenkapital

- Selv

- Hver

- utvidelse

- eksplosjon

- øye

- ansikter

- Falling

- familier

- langt

- Trekk

- tall

- registreringer

- finansiell

- finansiering

- fintech

- Firm

- Først

- Flows

- mat

- Til

- fremtidsrettet

- Foster

- Stiftet

- fersk

- fra

- fond

- finansiering

- finansieringsavtaler

- finansieringsrunder

- gitt

- gir

- Global

- Vekst

- håndfull

- Hard

- maskinvare

- Ha

- å ha

- hjelpe

- hjelpe

- hjelper

- hit

- Holdings

- Hjem

- Men

- HTML

- HTTPS

- Hub

- stort

- in

- Inkludert

- indikerer

- bransjer

- infusjon

- Institute

- institusjonell

- institusjonelle investorer

- interesse

- Renter

- inn

- Investorer

- IT

- DET ER

- selv

- ble med

- jpg

- bare

- Hold

- Kong

- største

- Siste

- Late

- siste

- leder

- minst

- Led

- mindre

- Sannsynlig

- Liste

- lite

- steder

- låst

- ser

- Lav

- Luksus

- gjøre

- ledelse

- mange

- marked

- Kan..

- metodikk

- millioner

- mynte

- penger

- mer

- mest

- for det meste

- navn

- Trenger

- nødvendig

- nettverk

- Ny

- New York-basert

- Nyeste

- neste

- neste generasjon

- Nei.

- normal

- nå

- mange

- hindringer

- of

- off

- Tilbud

- on

- onkologi

- ONE

- Opportunity

- or

- Annen

- vår

- ut

- pandemi

- Past

- pasienter

- betalende

- betaling

- betalingsløsning

- lønn

- Ansatte

- kanskje

- perioden

- Pharmaceutical

- fysisk

- Fysisk sikkerhet

- plato

- Platon Data Intelligence

- PlatonData

- posisjonering

- powered

- Precision

- forrige

- PRNewswire

- prosess

- eiendom

- gir

- raskt

- heve

- hevet

- hever

- heve

- SJELDEN

- priser

- RAY

- Reality

- nylig

- Nylig finansiering

- redusere

- forble

- rapportert

- representert

- representerer

- omdømme

- Restaurant

- restauranter

- gjenopprette

- Resultater

- forhandler

- inntekter

- runde

- runder

- Kjør

- s

- San

- SEK

- Sekund

- sektor

- sektorer

- sikkerhet

- seed

- se

- syntes

- synes

- halvledere

- Serien

- Serie A

- Serie B

- Serie C

- Tjenester

- flere

- Shein

- Viser

- signifikant

- siden

- bremse

- liten

- So

- Software

- løsning

- Solutions

- noen

- Sourcing

- Rom

- SPAC-er

- spesialisert

- spre

- Scene

- startet

- oppstart

- oppstartsfinansiering

- opphold

- Still

- Stopp

- effektivisere

- Forsterke

- slik

- levere

- forsyningskjeden

- gått

- overvåking

- Systemer

- Ta

- målrettet

- tech

- teknisk oppstart

- Teknologi

- enn

- Det

- De

- deres

- Dem

- terapeutika

- Der.

- Tredje

- denne

- denne uka

- dette året

- selv om?

- Tied

- tid

- Tipalti

- til

- verktøy

- topp

- Top 10

- Totalt

- spor

- behandling

- behandling

- Trend

- vri

- to

- oss

- enhjørning

- enhjørninger

- uvanlig

- bruk

- brukt

- Verdivurdering

- verdivurdering

- verdsatt

- Verdier

- venture-

- venture-finansiering

- video

- videoovervåkning

- syn

- ønsker

- var

- Vann

- uke

- ukentlig

- uker

- var

- når

- hvilken

- mens

- HVEM

- med

- Vant

- XML

- år

- Din

- zephyrnet

- Zip