IPO-vurdering (2.25 av 5.0 stjerner)

Copyright @ http: //lchipo.blogspot.com/

Copyright @ http: //lchipo.blogspot.com/

Dato

Åpent for å søke: 30/09/2019

Lukk for å søke: 11

Oppføringsdato: 26

Aksjekapital

Markedsverdi: RM136.718 mil

Totalt antall aksjer: 390.623 millioner aksjer (IPO 19.531 millioner, Company Insider/Miti/Privat plassering 79.297 millioner)

Virksomhet

Design & Sale of solar energy sevices (EPCC services), Operations & Maintenance of solar energy services , and Operate Solar Plant.

EPCC Services: 94.7%

Operations & Maintenance: 0.16%

Solar PV plant: 5.12%

Fundamental

Marked: Ace Market

Pris: RM0.35 (eps: RM0.028)

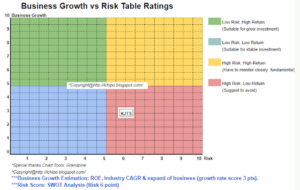

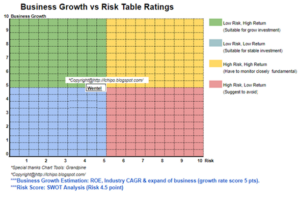

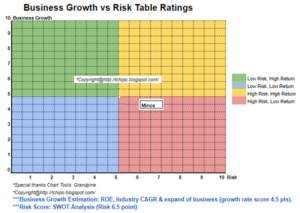

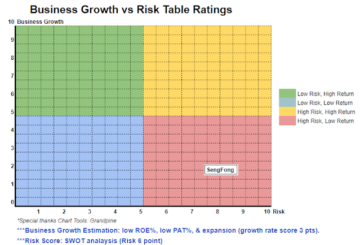

P/E & ROE: PE12.5, ROE17.43 %

Kontanter og fast innskudd etter børsnotering: RM0.1145 per aksje

NA etter børsnotering: RM0.16

Total gjeld til omløpsmidler etter børsnotering: 0.56 (gjeld: 51.111 millioner, anleggsmidler: 23.644 millioner, omløpsmidler: 91.273 millioner)

Utbyttepolitikk: Ingen formell utbyttepolitikk.

Økonomisk forhold

Kundefordring: 71 dager

Leverandørbetaling: 54 dager

Lageromsetning: 7 dager

Tidligere økonomiske resultater (inntekter, EPS)

2019: RM112.201 mil (EPS: 0.028)

2018: RM45.069 mil (EPS: 0.021)

2017: RM39.009 mil (EPS: 0.017)

2016: RM35.286 mil (EPS: 0.011)

Nettofortjenestemargin

2019: 9.9%

2018: 18.3%

2017: 16.7%

2016: 11.8%

Etter børsnotering

Lim Chin Siu: 41.1% (indirect)

Tan Chyi Boon: 41.1% (indirect)

Chiau Haw Choon 33.6% (indirect)

Direktør og nøkkelledere Godtgjørelse for FYE2019 (fra bruttoresultat 2018)

Dato’ Che Halin: RM66k

Lim Chin Siu: RM490k

Tan Chyi Boon: RM463k

Chiau Haw Choon: RM42k

Chang Kong Foo: RM42k

Fong Shin Ni: RM42k

Total director & key management remuneration from gross profit: RM1.145mil or 5.1%

Bruk av fond

Bedriftsutvidelse: 8.7 %

Investeringer: 11.5 %

Arbeidskapital: 55.5%

Repayment Debt: 14.5%

Noteringskostnader: 9.8%

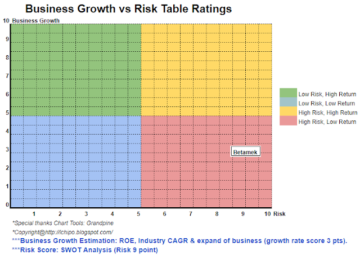

Konkurrenter (PE & ROE)

Solarvest: PE12.5 ROE17.43% GP9.9%

Cypark: PE8.76, ROE10.49%

Tekseng: Loss making

Gading Kencana: loss making

Helios PV: GP23.9%

Mattan: GP1.3%

Plus Solar: GP12.4%

Industry Analysis (Forecast)

Green energy is very clearly futures trend of energy. Solar is in sunrise industry with a lot competitors.

Konklusjoner

Bra er:

1. Co-founder Owners is young.

2. PE12.5 still acceptable, but a bit high in same industry & ROE17.43% is healthy.

3. Debt ratio is healthy.

4. Inntektene har økt de siste 4 årene.

5. In sunrise industry.

De dårlige tingene:

1. Net profit margin slowing down.

2. No clear dividend policy.

3. Director remuration is over 3% of gross revenue.

4. Bruk 14.5 % børsnoteringsfond til å betale gjeld.

5. Many competitors not making good profit in same industry.

6. Listing on Ace market.

7. Revenue highly depend on EPCC segment.

Konklusjoner

Green energy is a must in futures. However they are facing large competitors environment in same industry.

Will consider is an average IPO.

Børsnoteringspris: RM0.35

God tid: RM0.38 (PE13.5)

Dårlig tid: RM0.17 (PE6)

Source: http://lchipo.blogspot.com/2019/10/solarvest-holdings-berhad.html

- analyse

- eiendel

- Bit

- BP

- hovedstad

- Med-grunnlegger

- Selskapet

- konkurrenter

- Gjeldende

- Gjeld

- Regissør

- utbytte

- energi

- Miljø

- utvidelse

- utgifter

- vendt

- finansiell

- fond

- Futures

- god

- Økende

- Høy

- HTTPS

- industri

- IPO

- nøkkel

- stor

- oppføring

- Making

- ledelse

- marked

- nett

- Drift

- eiere

- P&E

- Betale

- politikk

- pris

- Profit

- inntekter

- salg

- Tjenester

- Aksjer

- bremse

- solenergi

- solenergi

- tid

- år