Få alle viktige markedsnyheter og ekspertuttalelser på ett sted med vårt daglige nyhetsbrev. Motta en omfattende oppsummering av dagens topphistorier direkte i innboksen din. Meld deg på her!

(Kitco News) – Little changed in the macro picture for the crypto market on Tuesday as Bitcoin continued to trade above support at $26,000, and as the U.S. Congress entered “crisis mode” ahead of an anticipated government shutdown that will start on Sunday, Oct. 1.

(Kitco News) – Little changed in the macro picture for the crypto market on Tuesday as Bitcoin continued to trade above support at $26,000, and as the U.S. Congress entered “crisis mode” ahead of an anticipated government shutdown that will start on Sunday, Oct. 1.

The impending shutdown had a notable impact on stocks, which traded lower at the open and remained deep in the red throughout the trading day as the realization that the Federal Reserve won’t be cutting interest rates anytime soon finally set in on Wall Street, leading to a broad sell-off in equities.

Treasury yields further complicated matters as the 10-year note hit 4.564%, its highest level since October 2007, prompting traders to adopt a risk-off approach and instead opt for guaranteed yields. At the close of markets, the S&P, Dow, and Nasdaq were all in the red, down 1.47%, 1.14%, and 1.57%, respectively.

Data provided by TradingView shows that Bitcoin’s (BTC) price continues to experience compression, with the top crypto trading in a range between $26,085 and $26,400 on Tuesday.

BTC / USD Diagram av TradingView

“October Bitcoin futures prices [were] weaker in early U.S. trading Tuesday,” according to Kitco senior technical analyst Jim Wyckoff, who said otherwise, there’s “Not much new.”

Bitcoin futures 1-dagers diagram. Kilde: Kitco

“Bears have the overall near-term technical advantage,” Wyckoff said. “That means the path of least resistance for prices is sideways to lower in the near term – until a solid, bullish technical clue emerges to suggest a near-term market bottom is in place.”

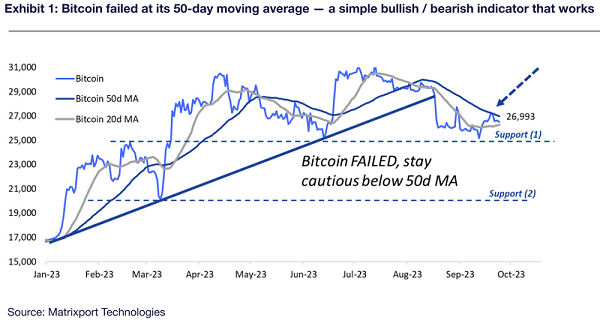

Markus Thielen, head of research at Matrixport, said the current Bitcoin price of $26,197 is “below the 50d MA [moving average], which is bearish.

BTC vs. 50-day MA vs. 20-day MA. Source: Matrixport

“Overall, the market shows a prevailing downtrend, with the outlook staying bearish,” Thielen said. “Although Bitcoin attempted to break its 50d MA, it failed, which could potentially lead to further downside. While October typically exhibits a bullish trend for Bitcoin, we advise caution unless a break over the 50d MA occurs.”

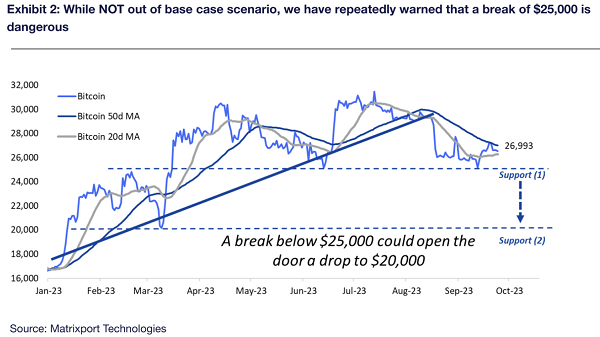

Thielen said that from a technical chart perspective, “Bitcoin’s failure to maintain a level above $27,000 last week necessitates marketing the breaking attempt as unsuccessful. Should Bitcoin trade below $26,000, the market may make another attempt to break lower.”

BTC vs. 50-day MA vs. 20-day MA. Source: Matrixport

Markedsanalytiker Rekt Capital advarte that “History suggests we could get a revisit of the Macro Higher Low in early 2024.”

BTC/USD 1-week chart. Source: Twitter

Altcoins i rødt

Roughly 80% of the tokens in the top 200 traded in the red on Tuesday as the looming government shutdown in the U.S. and high Treasury yields pushed traders to elect for risk-free yields.

Daglig markedets ytelse. Kilde: Coin360

Bone ShibaSwap (BONE) led the gainers with an increase of 9.9%, followed by an 8.95% gain for Terra (LUNA) and an 8.5% increase for Kyber Network (KNC). Astar (ASTR) led the losers with a decline of 5.05%, followed by a 4.5% loss for tomiNet (TOMI) and Immutable (IMX).

Den samlede markedsverdi for kryptovaluta ligger nå på $ 1.04 billioner, og Bitcoins dominansrate er 48.9%.

Ansvarsfraskrivelse: Synspunktene som er uttrykt i denne artikkelen er forfatterens og gjenspeiler kanskje ikke de fra Kitco Metals Inc. Forfatteren har gjort alt for å sikre nøyaktigheten av gitt informasjon; imidlertid verken Kitco Metals Inc. eller forfatteren kan garantere slik nøyaktighet. Denne artikkelen er kun ment for informasjonsformål. Det er ikke en anmodning om å bytte varer, verdipapirer eller andre finansielle instrumenter. Kitco Metals Inc. og forfatteren av denne artikkelen godtar ikke skyld for tap og / eller skader som følge av bruken av denne publikasjonen.

#Bitcoin #trades #flat #U.S #Treasury #yields #surge #government #shutdown #looms

- SEO-drevet innhold og PR-distribusjon. Bli forsterket i dag.

- PlatoData.Network Vertical Generative Ai. Styrk deg selv. Tilgang her.

- PlatoAiStream. Web3 Intelligence. Kunnskap forsterket. Tilgang her.

- PlatoESG. Karbon, CleanTech, Energi, Miljø, Solenergi, Avfallshåndtering. Tilgang her.

- PlatoHelse. Bioteknologisk og klinisk etterretning. Tilgang her.

- kilde: https://cryptoinfonet.com/bitcoin-news/bitcoin-trades-flat-as-u-s-treasury-yields-surge-and-government-shutdown-looms/

- : har

- :er

- :ikke

- ][s

- $OPP

- 000

- 1

- 10

- 11

- 12

- 13

- 14

- 15%

- 200

- 2024

- 400

- 700

- 8

- 9

- 95%

- a

- ovenfor

- Aksepterer

- Ifølge

- nøyaktighet

- adoptere

- Fordel

- råde

- fremover

- Alle

- an

- analytiker

- og

- En annen

- forventet

- noen

- tilnærming

- ER

- Artikkel

- AS

- underull

- At

- forsøk

- forsøkt

- forfatter

- gjennomsnittlig

- BE

- bearish

- under

- mellom

- Bitcoin

- Bitcoin Futures

- Bitcoin Price

- BEIN

- Bunn

- Break

- Breaking

- bred

- BTC

- Bullish

- by

- CAN

- lokk

- hovedstad

- forsiktighet

- endret

- Figur

- Lukke

- Commodities

- komplisert

- omfattende

- Kongressen

- fortsette

- fortsatte

- fortsetter

- kunne

- krypto

- Kryptomarked

- kryptohandel

- cryptocurrency

- cryptocurrency markedet

- Markedsverdi for kryptovaluta

- CryptoInfonet

- Gjeldende

- skjæring

- daglig

- dag

- Avslå

- dyp

- direkte

- do

- dominans

- dow

- ned

- ulempen

- Tidlig

- innsats

- framgår

- sikre

- kom inn

- Aksjer

- avgjørende

- Hver

- utveksling

- utstillinger

- erfaring

- Expert

- uttrykte

- Mislyktes

- Failure

- Federal

- føderal reserve

- Endelig

- finansiell

- Finansielle instrumenter

- flate

- fulgt

- Til

- fra

- videre

- Futures

- Gevinst

- gainers

- få

- Regjeringen

- garantere

- garantert

- HAD

- Ha

- hode

- Høy

- høyere

- høyest

- hit

- Men

- HTML

- HTTPS

- uforanderlige

- Påvirkning

- forestående

- IMX-utvidelse

- in

- Inc.

- Øke

- informasjon

- Informativ

- i stedet

- instrumenter

- interesse

- Renter

- IT

- DET ER

- Jim

- jpg

- Kitco

- KNC

- Kyber

- Kyber Network

- Kyber Network (KNC)

- Siste

- føre

- ledende

- minst

- Led

- Nivå

- LINK

- lite

- truende

- Tapere

- tap

- tap

- Lav

- lavere

- Luna

- Makro

- laget

- vedlikeholde

- gjøre

- marked

- Market Cap

- markeds~~POS=TRUNC

- markedsytelse

- Marketing

- Markets

- Matrixport

- Saker

- Kan..

- midler

- Metaller

- flytting

- glidende gjennomsnitt

- mye

- Nasdaq

- Navigasjon

- Nær

- Ingen

- nettverk

- Ny

- nyheter

- Nyhetsbrev

- eller

- bemerkelsesverdig

- note

- nå

- oktober

- oktober

- of

- on

- ONE

- bare

- åpen

- Meninger

- or

- Annen

- ellers

- vår

- Outlook

- enn

- samlet

- banen

- ytelse

- perspektiv

- bilde

- Sted

- plato

- Platon Data Intelligence

- PlatonData

- potensielt

- pris

- Prisene

- forutsatt

- Utgivelse

- formål

- presset

- område

- Sats

- priser

- Lesning

- realisering

- oppsummering

- motta

- Rød

- reflektere

- RECT

- rekt kapital

- forble

- forskning

- Reserve

- Motstand

- henholdsvis

- s

- S & P

- Sa

- Verdipapirer

- selge ut

- senior

- sett

- bør

- Viser

- nedleggelse

- side

- sidelengs

- siden

- oppfordring

- solid

- Snart

- kilde

- står

- Begynn

- blir

- aksjer

- Stories

- gate

- slik

- foreslår

- foreslår

- Søndag

- støtte

- bølge

- Teknisk

- begrep

- Earth

- Jorden (MOON)

- Det

- De

- denne

- De

- hele

- til

- tokens

- topp

- oppslag

- handel

- handles

- Traders

- handler

- trading

- TradingView

- treasury

- Treasury avkastning

- Trend

- Trillion

- tirsdag

- typisk

- oss

- oss kongress

- US Treasury

- til

- bruke

- visninger

- vs

- Wall

- Wall Street

- we

- uke

- var

- hvilken

- mens

- HVEM

- vil

- med

- rentene

- Din

- zephyrnet