According to Fenergo estimates “poor customer experience” is costing financial institutions $10 billion in revenue per year. 36% of financial institutions have lost customers due to inefficient or slow onboarding, and 81% believe poor data management lengthens

onboarding and negatively affects customer experience.

How do you encourage users to not only rank your app with 5 stars in the Apple Store and Google Play but also gain their loyalty and trust? It’s no secret that the digital customer experience today is what differentiates demanded financial brands. The main

struggle is keeping up by creating a digital banking customer experience that WOWs.

Financial services customer experience refers to customer interactions with their bank, typically including online and mobile banking services, visiting a physical branch, or speaking with customer service representatives. The digital banking customer experience

(digital banking CX or UX – user experience) consists of all the emotions, thoughts and behavior of a customer triggered in using a digital banking service. A banking customer experience is generated by all digital products and brand ecosystems, including

previous customer engagements and future expectations.

The goal of improving customer experience in financial services is to make banking services as convenient, efficient, and pleasant as possible for the customer. This can be achieved through various means, such as offering an appropriate range of services

and features, providing clear and helpful information and assistance, and ensuring that the customer’s interactions with the bank are smooth and hassle-free. Make sure that financial service customer experience aligns with brand identity and business strategy.

At the same time, remember that in the digital age, brand reputation is no longer a guarantee of loyalty and can be instantly damaged by a problem with a mobile application caused by poor CX / UX design since the customer experience is a highly dynamic process.

Jeg vil gjerne beskrive 5 måter du kan forbedre digital CX for finansielle tjenester på i 2024:

1. Etabler erfaringstankegang

The development of digital technology is disrupting all the industries. What has been proven to work for decades, like traditional marketing and product approach, has stopped working. The world is making new demands on businesses, and the financial industry

er intet unntak.

I dag har kundene dusinvis av nye alternativer hvert år på grunn av lave inngangsbarrierer og åpen bank. Det er derfor, for å overleve i den digitale tidsalderen, må finansielle merkevarer ta i bruk en helt ny måte å tenke og drive virksomhet på.

Social networks, information transparency and demand for sustainability challenge businesses to put the people first by becoming customer-centered and deliver experiences instead of manipulating customers to reap profits. That’s why the future of the banking

industry depends entirely on how the new generation of bankers can bring their mindset in line with the digital age to provide the best possible banking customer experience.

Det er fem nøkkelholdninger som kan integreres i et selskaps DNA med sikte på å gjøre teamtankegangen måldrevet og endre forretningskulturen mot suksess i den digitale tidsalderen.

- Server i stedet for å selge. The “sell” priority is all about focusing on marketing and looking at people as numbers behind conversion. Design, in this case, is only about using attractive packaging to sell more, and UX is just one more tool

to manipulate user behavior. To focus the business team on customer needs, feelings and behaviors, we need to prioritize “Serve.” In this case, conversion became just a metric to evaluate product clarity, because the main aim is to provide real benefit for

the customer. And, a lot of customers will appreciate it, using the digital space to express their gratitude and attract more users. - Følelser over informasjon. People often forget information but remember experiences, and those are created from emotions. That’s why information should be integrated into a context of usage. It should become an organic part of the banking

user experience that is based on emotions, because emotions are the main language to communicate with the customers and understand their needs and expectations. - Løsning i stedet for funksjoner. Don’t make your users have to think about how to use hundreds of offered features. Instead, provide them with an easy to use solution. According to psychology experiments, too many options can cause decision

paralysis. Users don’t come to you for the hundreds of options you can offer. They have a specific problem and goal in mind that your financial product has to help to achieve. - Avbrudd over beskyttelse. Traditional banks and other well-established businesses are focused on protecting their legacy and maintaining the corporate image. That’s why change comes slowly and painfully. Instead of thinking about how

to protect their products from the digital challenge and prevent customers from leaving, banks have to figure out how to stop self-deception and disrupt themselves and their competitors. In the experience age, self-disruption is the only way to provide meaningful

and pleasant products for users. - Skap flyt, unngå fragmentering. It is a common mistake to view services and products as separate parts. But, the human brain perceives experiences holistically – as a whole entity. Customers see the product as a continuous experience

flow, even lasting for years. Transition to the same thinking is the only way for businesses to ensure a delightful user journey. We need to detect links among user needs, emotions, behavior and service features, design and strategy. Separation of service

elements by different departments caused by organizational silos fills the customer experience with friction. We need to defragment business and ensure a frictionless flow that makes service pleasant.

2. Fokuser på den unike produktverdien

Finansselskaper som aktivt implementerer arbeidsprinsippene for den formålsdrevne tankegangen har som mål å gi maksimal verdi for brukeren. I bytte belønner kunden gjerne selskapet med lojalitet og støtter utviklingen ved å anbefale deres tjenester.

The central question in the creation of any financial product is WHY it is needed. What exactly makes the product valuable and unique to the users? What problems will it solve, and what benefits will it provide? By not treating all of these questions with

dignity, the financial company is risking its product quickly sinking into the “red ocean” of competition.

There are concrete product growth stages that depend on the level of competition and the demand from the customers. Understanding these stages helps to define and create the perfect match between the financial product’s value proposition and the market demand,

leading to success.

Konkurransen er det som krever at finansgründere går ut av boksen og identifiserer kundenes forventninger. Jo større konkurransen er, desto større er behovet for markedsfordel for å erobre konkurrentene.

If financial product functionality is not enough to compete, provide usability. If all the competitors have the same functionality and usability, add aesthetics. If you need even more of an advantage, connect the product with the customer’s lifestyle by

personalizing it and making it a symbol of their status. And, finally, you can go even further and state the mission to deliver the ultimate value that will change the world and gain followers who look up to you.

Målretting av det unike produktverdiforslaget gjennom misjon, status, estetikk og brukervennlighet bidrar til å maksimere brukernes behov gjennom kundesentrert produktdesign.

Moderne banker har allerede gitt sine kunder grunnleggende tjenestefunksjonalitet. Innovasjoner i den digitale bankbransjen har flyttet seg fra funksjonalitetsstadiet til trinnene for brukervennlighet og estetikk for å skape et følelsesmessig bånd med kundene.

Despite that, there are still many traditional banks that struggle with Usability. Meanwhile, progressive FinTechs are quickly climbing up the ladder, reaching the Status stage by personalizing and providing digital financial services that are enjoyable,

attractive and serve the needs of specific audiences.

3. Integrer designtilnærmingen på tvers av alle nivåer

By focusing on the usability, aesthetics and status of the product, you can engage digital users, but this is not enough. To ensure a long-term market need for your product, it is necessary to integrate customer-centricity into all levels and processes of

the company, putting the user at the forefront.

In many cases, incorrect design integration in the process of product creation leads to harmful consequences. It’s like in construction: a skyscraper can’t stand without a well-thought-out and grounded architectural plan. The financial product with amateur

UX will lack demand in the market, could be rejected by the users, often exceeds the development budget or doesn’t even get launched at all.

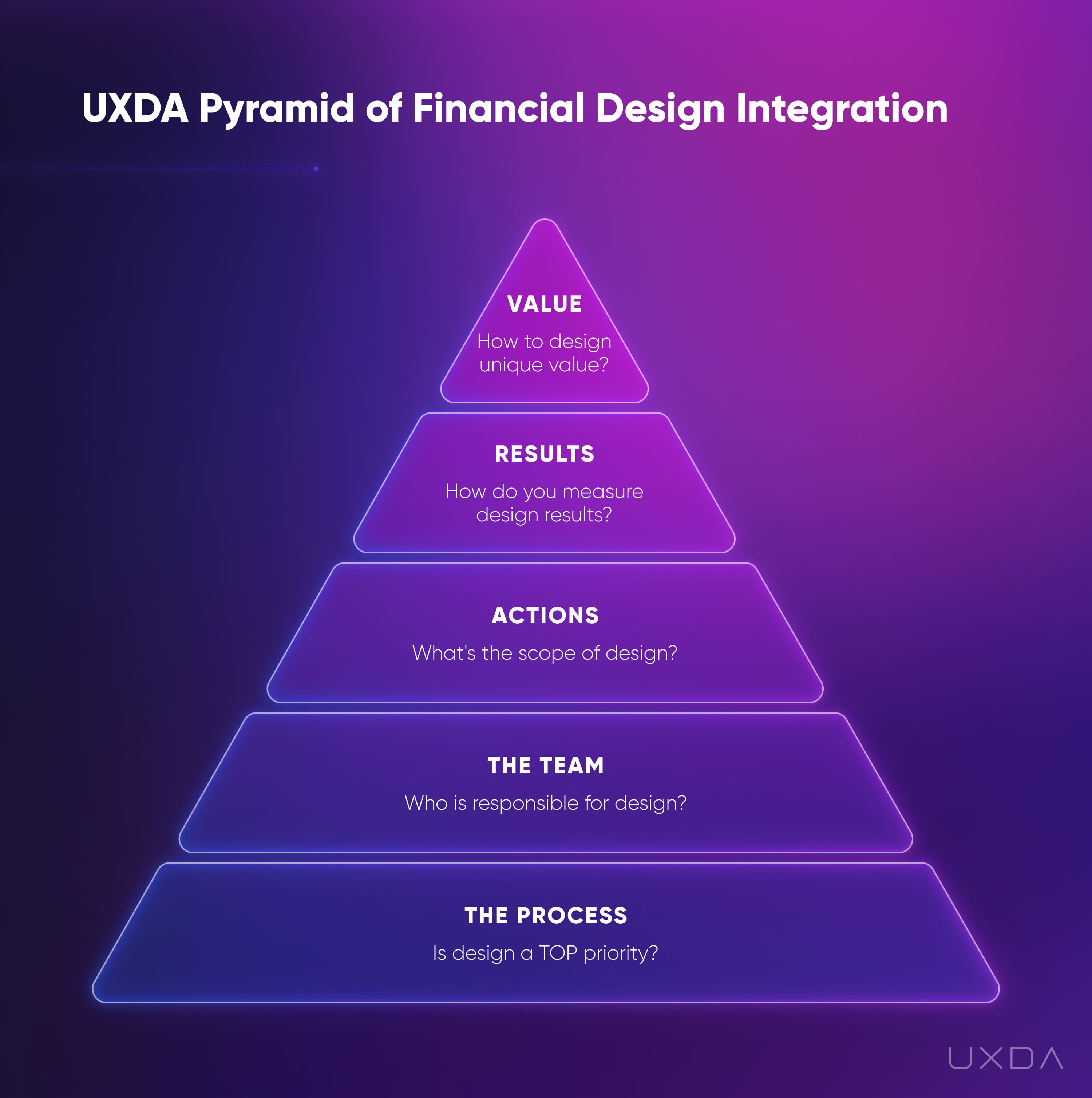

Det er fem gjensidig sammenhengende områder der designtilnærmingen kan integreres for å sikre best mulig kundeopplevelse på lang sikt. Generelt sett samsvarer disse fem områdene med hovedelementene i forretningsutvikling.

Når du har en solid forretningsidé, må du lage en forretningsmodell ved å definere nøkkelprosessene som vil hjelpe deg å nå ønsket mål. Her kan du lage en designtilnærming som styrker drivstoff i alle dine økonomiske forretningsprosesser.

I neste trinn trenger du et team med spesialister som er kvalifisert til å gjennomføre ideen din. På dette tidspunktet, sørg for å legge til økonomisk UX-designekspertise fra folk som har mestret digitale produkter innen finans.

Når du har funnet fagfolk som matcher utfordringen din, trenger du at de tar de riktige handlingene som flytter deg nærmere produktrealisering. Akselerer designeffekten ved å definere resultatdrevne handlinger.

For å være sikker på at du beveger deg i riktig retning, må du evaluere resultatene teamet ditt produserer. Du bør måle kvaliteten på design etter måten det betjener kundene dine på.

Til slutt, hvis alle de foregående trinnene er fullført, kan du forstå den unike verdien ditt finansielle produkt vil gi kundene, og gjøre det digitale produktet til en suksesshistorie.

4. Bruk riktig CX-designmetodikk

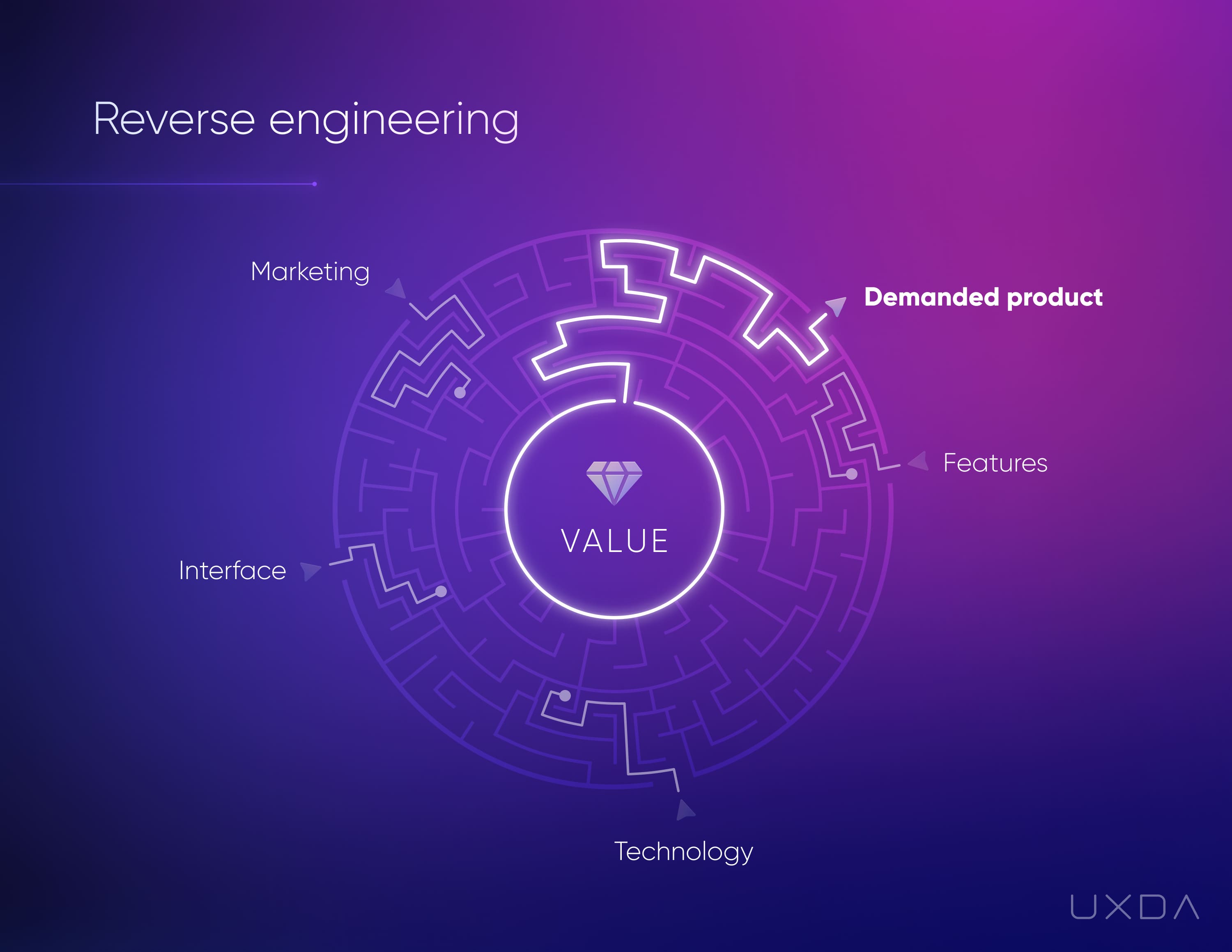

As a typical business delivery starts with Process and ends with Value to customer, then the easiest way to design the best possible digital experience is to do it in reverse. We should start with defining the ultimate Value for the customer and only then

move on to an action plan.

Vi kan sammenligne omvendt konstruksjon med en labyrint som har flere innganger og bare én utgang. Inngangene er forskjellige typer produktkonfigurasjon, funksjonalitet og funksjoner, og utgangen er den høye etterspørselen og suksessen i markedet.

Usually, entrepreneurs try to guess which configuration they should develop to gain success. They look around to identify what products are trending, code a lot of features to impress customers and finally pack all this into a vibrant design to grab attention.

Then they spend tons of money on advertising to convince consumers that they need this.

In reverse engineering, you significantly reduce uncertainty by starting from the maze exit and moving to the correct entry point. In this case, the exit of the maze is the point at which the product is highly demanded because of the value it provides to

customers. By using the CX / UX design approach, we are exploring the value that’s significant to customers and putting the focus of the product and the entire business on the needs of customers.

Though CX and UX design is trending today, only a few financial product experts are capable of successfully translating it into architecture and the user interface of a particular product because it requires knowledge in human psychology, behavior and design

arts. Perhaps this explains why most of the financial solutions around us still look outdated and amateur, despite the multiple designers involved in the product development teams.

Å designe et kundesentrert finansielt produkt som er basert på verdien for brukerne består av tre nøkkelelementer: Designtenkning, Business/Bruker/Produktramme og UX-designverktøy.

Designtenkning er grunnlaget for Financial UX Methodology. Det gir en metodisk, iterativ tilnærming for å utforske og betjene de viktigste brukerbehovene gjennom de fem stadiene – Empatize, Define, Ideate, Prototype og Test.

For å sikre total suksess, må vi implementere alle fem delene av designtenkeprosessen gjennom et forretnings-, bruker- og produktperspektiv. På denne måten finner, definerer og materialiserer vi maksimal verdi og gevinst for hver av dem.

Til slutt gir UX-designverktøy den beste måten å utføre hele prosessen på, og sikrer effektiv resultatbasert finansiell produkttransformasjon.

5. Utforsk konteksten til kundene dine

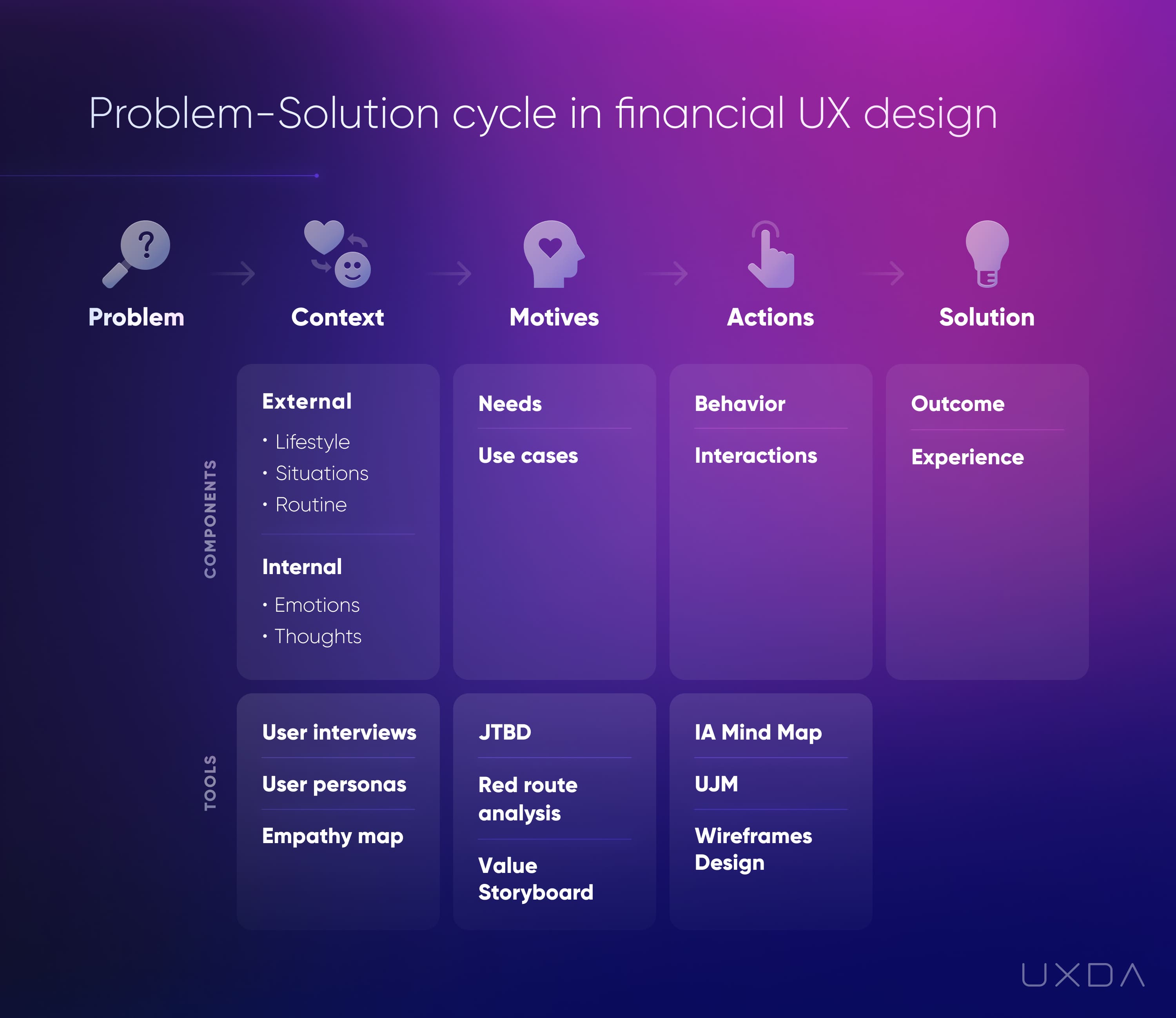

At this point, you might feel like you have enough powerful knowledge to go straight to addressing your customer problems with your financial service experience design. Yes, it all starts with a good solution to an important problem. But, between the problem

and the solution, there are three crucial conditions that differentiate whether or not a product will match real users’ needs.

For å skape en etterspurt digital finanstjeneste som vil bli elsket av kundene, starter vi med problemet.

For å tydelig definere problemet og oppgavene, utforsker vi problemløsningssyklusens innvirkning på bankkundeopplevelsen ved å lage brukerpersonas og definere jobbene deres som skal utføres.

Gjennom denne prosessen krystalliserer vi konteksten der problemet finner sted, motivene til brukerne som dikterer handlingene og personene det vil ta for å bruke den riktige løsningen.

Under denne prosessen brukes Financial UX Design Methodology og slike UX-verktøy som et Empathy-kart, Red Route Map, UJM, brukerflyter, wireframes, UI-design og testing.

- SEO-drevet innhold og PR-distribusjon. Bli forsterket i dag.

- PlatoData.Network Vertical Generative Ai. Styrk deg selv. Tilgang her.

- PlatoAiStream. Web3 Intelligence. Kunnskap forsterket. Tilgang her.

- PlatoESG. Karbon, CleanTech, Energi, Miljø, Solenergi, Avfallshåndtering. Tilgang her.

- PlatoHelse. Bioteknologisk og klinisk etterretning. Tilgang her.

- kilde: https://www.finextra.com/blogposting/25474/five-ways-to-improve-customer-experience-in-financial-services-in-2024?utm_medium=rssfinextra&utm_source=finextrablogs

- : har

- :er

- :ikke

- $OPP

- 2024

- a

- Om oss

- absolutt

- akselerere

- oppnådd

- Ifølge

- Oppnå

- oppnådd

- tvers

- Handling

- handlinger

- aktivt

- legge til

- adressering

- adoptere

- Fordel

- Annonsering

- alder

- sikte

- Justerer

- Alle

- allerede

- også

- alternativer

- amatør

- blant

- an

- og

- noen

- app

- eple

- Søknad

- Påfør

- verdsette

- tilnærming

- hensiktsmessig

- arkitektonisk

- arkitektur

- ER

- områder

- rundt

- Arts

- AS

- Assistanse

- At

- oppmerksomhet

- tiltrekke

- attraktiv

- publikum

- unngå

- Bank

- bankfolk

- Banking

- banknæringen

- Banker

- barrierer

- basert

- grunnleggende

- basis

- BE

- ble

- fordi

- bli

- bli

- vært

- atferd

- bak

- tro

- nytte

- Fordeler

- BEST

- mellom

- større

- Milliarder

- obligasjon

- Eske

- Brain

- Branch

- merke

- merker

- bringe

- budsjett

- virksomhet

- forretningsutvikling

- forretningsmodell

- forretningsprosesser

- forretningsstrategi

- bedrifter

- men

- by

- CAN

- stand

- saken

- saker

- Årsak

- forårsaket

- sentral

- utfordre

- endring

- klarhet

- fjerne

- klart

- klatring

- nærmere

- kode

- kognisjon

- Kom

- kommer

- Felles

- kommunisere

- Selskaper

- Selskapet

- sammenligne

- konkurrere

- konkurranse

- konkurrenter

- betong

- forhold

- Konfigurasjon

- Koble

- tilkoblet

- erobre

- Konsekvenser

- består

- konstruksjon

- Forbrukere

- kontekst

- kontinuerlig

- Praktisk

- Konvertering

- overbevise

- Bedriftens

- korrigere

- kunne

- skape

- opprettet

- Opprette

- skaperverket

- avgjørende

- Kultur

- kunde

- kundeopplevelse

- Kundeservice

- Kunder

- CX

- syklus

- dato

- Dataledelse

- tiår

- avgjørelse

- definere

- definere

- herlig

- leverer

- levering

- Etterspørsel

- krevde

- krav

- avdelinger

- avhenge

- avhenger

- beskrive

- utforming

- design tenkning

- designere

- ønsket

- Til tross for

- oppdage

- utvikle

- Utvikling

- utviklingsteam

- diktere

- forskjellig

- differensiere

- digitalt

- digital tidsalder

- digital bank

- digitalt rom

- digital teknologi

- retning

- Avbryte

- dna

- do

- doesn

- Don

- gjort

- dusinvis

- to

- dynamisk

- hver enkelt

- enkleste

- lett

- økosystemer

- Effektiv

- effektiv

- elementer

- følelser

- Empati

- myndiggjøring

- oppmuntre

- slutt

- slutter

- engasjere

- engasjementer

- Ingeniørarbeid

- hyggelig

- nok

- sikre

- sikrer

- Hele

- fullstendig

- enhet

- gründere

- entry

- etablere

- Eter (ETH)

- evaluere

- Selv

- Hver

- nøyaktig

- stiger

- unntak

- utveksling

- henrette

- Utgang

- forventninger

- erfaring

- Erfaringer

- eksperimenter

- ekspertise

- eksperter

- forklarer

- utforske

- Utforske

- ekspress

- Egenskaper

- føler

- følelser

- Fenergo

- Noen få

- Figur

- fyller

- Endelig

- finansiere

- finansiell

- Finansinstitusjoner

- økonomiske tjenester

- finansielle tjenester

- Finn

- fintechs

- Først

- fem

- flyten

- Flows

- Fokus

- fokuserte

- fokusering

- følgere

- Til

- teten

- funnet

- fragmentering

- RAMME

- friksjon

- friksjons

- fra

- Brensel

- funksjonalitet

- videre

- framtid

- Gevinst

- inntjening

- general

- generert

- generasjonen

- få

- gjerne

- Go

- mål

- god

- Google Play

- grip

- gripe

- takknemlighet

- større

- Vekst

- garantere

- skadelig

- Ha

- hjelpe

- nyttig

- hjelper

- her.

- Høy

- svært

- Hvordan

- Hvordan

- HTTPS

- menneskelig

- Hundrevis

- Tanken

- identifisere

- Identitet

- if

- bilde

- Påvirkning

- iverksette

- viktig

- forbedre

- bedre

- in

- Inkludert

- bransjer

- industri

- ineffektiv

- informasjon

- innovasjoner

- øyeblikkelig

- i stedet

- institusjoner

- integrere

- integrert

- integrering

- interaksjoner

- Interface

- inn

- involvert

- IT

- DET ER

- Jobb

- reise

- jpg

- bare

- bare én

- holde

- nøkkel

- kunnskap

- maling

- stigen

- Språk

- varig

- lansert

- ledende

- Fører

- forlater

- Legacy

- Nivå

- nivåer

- livsstil

- i likhet med

- linje

- lenker

- Lang

- langsiktig

- lenger

- Se

- ser

- tapte

- Lot

- elsket

- Lav

- Lojalitet

- Hoved

- opprettholde

- gjøre

- GJØR AT

- Making

- ledelse

- manipulere

- mange

- kart

- marked

- Marketing

- Match

- materialiserer

- Maksimer

- maksimal

- meningsfylt

- midler

- Mellomtiden

- måle

- metodisk

- metodikk

- metrisk

- kunne

- tankene

- Tankesett

- Oppdrag

- feil

- Mobil

- Mobile banking

- modell

- penger

- mer

- mest

- flytte

- flyttet

- flytting

- flere

- gjensidig

- nødvendig

- Trenger

- nødvendig

- behov

- negativt

- nettverk

- Ny

- neste

- Nei.

- tall

- of

- tilby

- tilbudt

- tilby

- ofte

- on

- onboarding

- ONE

- på nett

- bare

- åpen

- åpen bankvirksomhet

- drift

- alternativer

- or

- rekkefølge

- organisk

- organisasjons

- Annen

- ut

- enn

- samlet

- Pakk med deg

- emballasje

- del

- Spesielt

- deler

- Ansatte

- for

- perfekt

- kanskje

- perspektiv

- fysisk

- Sted

- fly

- plato

- Platon Data Intelligence

- PlatonData

- Spille

- Point

- dårlig

- mulig

- kraftig

- forebygge

- forrige

- prinsipper

- Prioriter

- prioritet

- Problem

- problemløsning

- problemer

- prosess

- Prosesser

- produserende

- Produkt

- produktdesign

- produktutvikling

- Produkter

- fagfolk

- fortjeneste

- progressiv

- ordentlig

- proposisjoner

- beskytte

- beskytte

- beskyttelse

- prototype

- utprøvd

- gi

- forutsatt

- gir

- gi

- Psykologi

- sette

- Sette

- Pyramid

- kvalifisert

- kvalitet

- spørsmål

- spørsmål

- raskt

- område

- rangerer

- å nå

- nå

- ekte

- realisering

- høste

- anbefale

- Rød

- redusere

- refererer

- Avvist..

- husker

- Representanter

- omdømme

- påkrevd

- Krever

- Resultater

- inntekter

- reversere

- Belønninger

- ikke sant

- risikere

- Rute

- s

- samme

- Secret

- se

- selger

- separat

- betjene

- serverer

- tjeneste

- Tjenester

- skift

- bør

- signifikant

- betydelig

- siloer

- siden

- skyskraper

- langsom

- Sakte

- glatter

- solid

- løsning

- Solutions

- LØSE

- Rom

- sett

- spesialister

- spesifikk

- bruke

- Scene

- stadier

- stå

- Stjerner

- Begynn

- Start

- starter

- Tilstand

- status

- Trinn

- Steps

- Still

- Stopp

- stoppet

- oppbevare

- Story

- rett

- Strategi

- Struggle

- suksess

- suksesshistorie

- vellykket

- slik

- Støtter

- sikker

- overleve

- Bærekraft

- symbol

- T

- Ta

- tar

- oppgaver

- lag

- lag

- Teknologi

- begrep

- test

- Testing

- Det

- De

- Fremtiden

- verden

- deres

- Dem

- seg

- deretter

- Der.

- Disse

- de

- tror

- tenker

- denne

- De

- tre

- Gjennom

- tid

- til

- i dag

- Tone

- også

- verktøy

- verktøy

- mot

- tradisjonelle

- Transformation

- overgang

- Åpenhet

- behandling

- trender

- utløst

- Stol

- prøve

- Turning

- typer

- typisk

- typisk

- ui

- ultimate

- Usikkerhet

- forstå

- forståelse

- unik

- us

- brukervennlighet

- bruk

- bruke

- brukt

- Bruker

- Brukererfaring

- Brukergrensesnitt

- brukerreise

- Brukere

- ved hjelp av

- ux

- UX utforming

- Verdifull

- verdi

- verdivurdering

- ulike

- levende

- Se

- Vei..

- måter

- we

- Hva

- om

- hvilken

- HVEM

- hele

- hvorfor

- vil

- med

- uten

- Arbeid

- arbeid

- verden

- ville

- år

- år

- ja

- du

- Din

- zephyrnet