Bank of England og Bank for International Settlements har vellykket gjennomført en DLT-basert pilot for å vurdere bruken av synkront oppgjør i sentralbankpenger.

The ‘Project Meridian’ prototype demonstrates how to orchestrate synchronised settlement in central bank money using housing transactions as an exploratory use case.

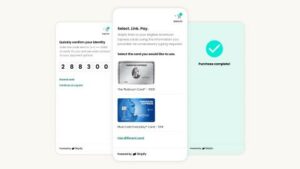

In this instance, transactions settle using central bank money in an RTGS system. Funds are transferred from a buyer to a seller only if a corresponding asset on another ledger – a real estate registry in the project’s use case – moves at the same time in the opposite direction, reducing transaction costs and risks and increasing efficiency.

This is achieved via a new entity, the synchronisation operator, which in the experiment uses distributed ledger technology (DLT) to interlink the central bank’s settlement system with other financial market infrastructures and ledgers, automatically orchestrating the exchange in ownership of funds and assets.

Bank of England og BIS sier at det generiske grensesnittet kan tilby en standard måte for synkroniseringsoperatører å koble flere typer aktiva, som valuta, aksjer og obligasjoner, til et RTGS-system og gjøre opp i sentralbankpenger, og eliminere motpartsrisiko og redusere likviditetskostnadene.

Francesca Hopwood Road, head of the BIS Innovation Hub London Centre, says: “Project Meridian demonstrates the potential to improve the functioning of existing financial market infrastructures with new technologies such as DLT. As central banks periodically update their settlement systems, the project’s insights will support the analysis of synchronisation’s benefits and shape how that service should be designed.”

- SEO-drevet innhold og PR-distribusjon. Bli forsterket i dag.

- Platoblokkkjede. Web3 Metaverse Intelligence. Kunnskap forsterket. Tilgang her.

- Minting the Future med Adryenn Ashley. Tilgang her.

- kilde: https://www.finextra.com/newsarticle/42175/bank-of-england-finds-new-use-cases-for-dlt-in-synchronised-setttlement?utm_medium=rssfinextra&utm_source=finextrafeed

- :er

- 2023

- a

- Om oss

- oppnådd

- an

- analyse

- og

- En annen

- April

- ER

- AS

- eiendel

- Eiendeler

- At

- automatisk

- Bank

- Bank for internasjonale oppgjør

- Bank of England

- Banker

- BE

- Fordeler

- til

- BIS Innovation Hub

- Obligasjoner

- saken

- saker

- sentral

- Central Bank

- Sentralbanker

- senter

- Terminado

- Koble

- Tilsvarende

- Kostnader

- kunne

- motparts~~POS=TRUNC

- demonstrerer

- designet

- retning

- distribueres

- Distribuert Ledger

- distribuert ledgerteknologi

- Distribuerte Ledger Technology (DLT)

- DLT

- effektivitet

- eliminere

- England

- enhet

- Aksjer

- eiendom

- utveksling

- eksisterende

- eksperiment

- finansiell

- Finansmarkedet

- funn

- Finextra

- Til

- utenlandske

- utenlandsk valuta

- fra

- funksjon

- midler

- Ha

- hode

- bolig

- Hvordan

- Hvordan

- HTTPS

- Hub

- forbedre

- in

- økende

- infrastruktur

- Innovasjon

- innsikt

- f.eks

- Interface

- internasjonalt

- internasjonale oppgjør

- jpg

- LÆRE

- Ledger

- regnskapsbøker

- Likviditet

- London

- marked

- penger

- mer

- trekk

- flere

- Ny

- Ny teknologi

- Norden

- of

- tilby

- on

- bare

- operatør

- operatører

- motsatt

- Annen

- eierskap

- betalinger

- pilot

- Sted

- plato

- Platon Data Intelligence

- PlatonData

- potensiell

- prosjekt

- prototype

- ekte

- eiendomsmegling

- redusere

- registrere

- registret

- risikoer

- vei

- RTGS

- s

- samme

- sier

- tjeneste

- bosette

- bosetting

- Settlements

- Form

- bør

- Standard

- vellykket

- slik

- støtte

- system

- Systemer

- Ta

- Technologies

- Teknologi

- Det

- De

- deres

- denne

- tid

- til

- Transaksjonen

- transaksjons kostnader

- Transaksjoner

- overføres

- typer

- Oppdater

- bruke

- bruk sak

- ved hjelp av

- av

- Vei..

- hvilken

- vil

- med

- zephyrnet