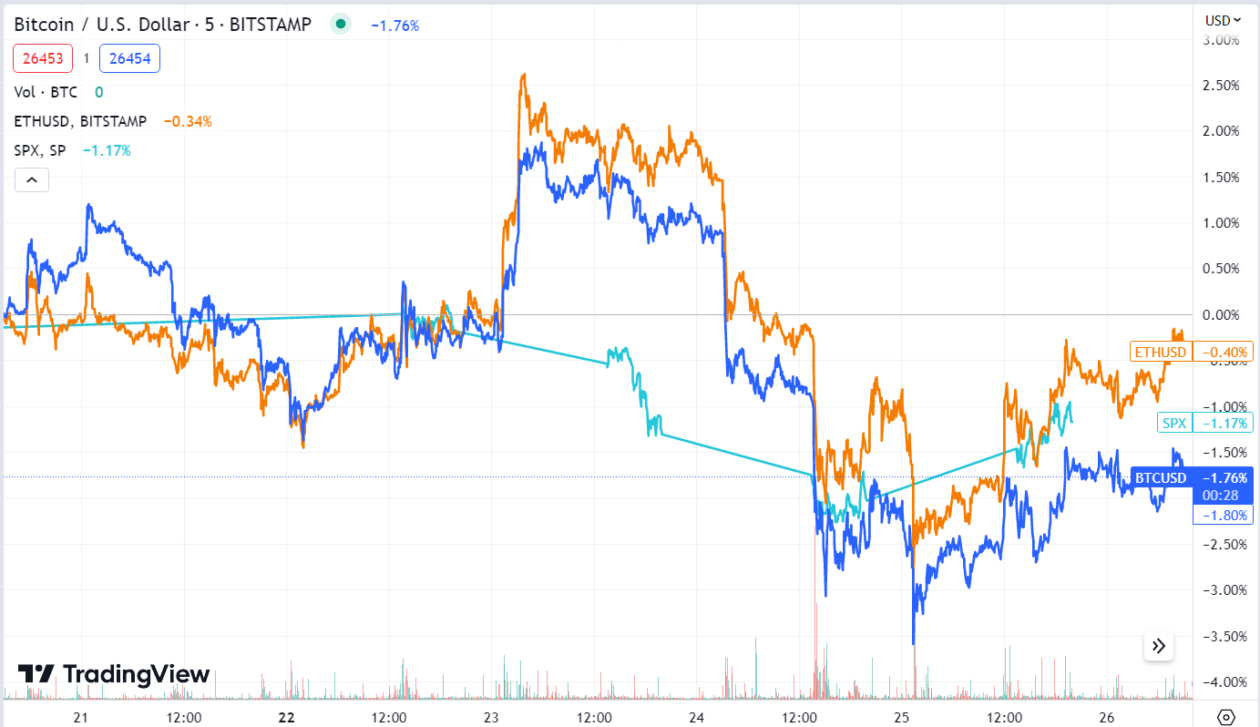

Bitcoin fell 1.40% from May 19 to May 26 to trade at US$26,451 at 7:00 p.m. Friday in Hong Kong. The world’s largest cryptocurrency by market capitalization has been trading under US$30,000 since April 19. Ether rose 0.34% over the week to US$1,813 recapturing US$1,800 on Thursday.

The lack of progress in U.S. debt ceiling negotiations continued to erode risk appetite as the June 1 deadline neared. On Wednesday, Fitch Ratings placed the U.S.’ AAA rating on a negative rating watch, saying that debt ceiling negotiations raised the risks of the government missing payments on some of its obligations.

“Bitcoin and Ether have shrugged off the U.S. debt ceiling negotiations and the potential ripple effects for crypto. President Biden has already declared the country will not default on its debt,” Lucas Kiely, the chief investment officer of digital asset platform Yield App , said . “With liquidity tight, the crypto market doesn’t seem to be too concerned over these macro events. It will take something much more substantial to move these markets.”

Johnny Louey, a crypto research analyst at trading platform LiquidityTech Protocol , disagreed, saying that the debt ceiling negotiations are the main factors weighing down Bitcoin price.

“Although the debt ceiling has been raised and revised 78 times since 1960, investors are aware of the default risk if negotiations fail. This is the first time Bitcoin encountered such an economic incident and it’s reasonable to assume a risk-off approach would be appropriate,” said Louey .

The global crypto market capitalization stood at US$1.11 trillion on Friday at 7:00 p.m. in Hong Kong, down 0.89% from US$1.12 trillion a week ago, according to CoinMarketCap data. With a market cap of US$512 billion, Bitcoin represented 46.1% of the market, while Ether, valued at US$218 billion, accounted for 19.6%.

Kiely는 “암호화폐의 전체 시가총액은 기본적으로 2024년 동안 변하지 않은 상태를 유지했습니다. “비트코인 보유량을 늘리려는 테더의 계획은 일시적으로 가격을 올릴 수 있지만 전반적으로 큰 영향을 미칠 것 같지는 않습니다. 비트코인의 XNUMX년 반감기는 가격 상승으로 이어질 수 있지만 아직 그 효과를 보기 시작하지 않았습니다.”

On May 17, Tether , the company behind the world’s largest stablecoin USDT, revealed its plans to “regularly allocate” as much as 15% of its net operational profits to buy Bitcoin, aiming to boost its reserves portfolio. Tether held approximately US$1.5 billion in Bitcoin reserves, at the time of the announcement.

휴면 비트코인 사상 최고치 기록

The amount of Bitcoin that has been inactive for at least a year rose to an all-time high of 68.46% on Wednesday, according to data aggregator MacroMicro .

“It could mean short-term selling pressure decreases if the Bitcoin holdings in short-term holdings shift to longer-term holders. However, we will not be able to tell whether the addresses belong to institutional investors or not,” Tom Wan, a research analyst at 21.co , the parent company of 21Shares, an issuer of crypto exchange-traded products, said.

Yield App의 Kiely에 따르면 이는 전 세계적으로 점점 더 많은 투자자들이 비트코인을 장기적으로 보유할 의향이 있음을 시사합니다.

Kiely는 "진화하는 규제 환경과 관련된 불확실성과 비트코인이 가치 저장 수단으로 인식되고 있는 점을 고려할 때 이러한 추세는 계속되고 심지어 잠재적으로 하이퍼비트코인화 지점까지 가속화될 가능성이 있습니다."라고 말했습니다.

"Hyperbitcoinization"은 비트코인이 궁극적으로 세계 유비쿼터스 형태의 화폐가 될 것으로 추측하는 개념입니다.

주목할만한 움직임: RNDR & KAVA

The Render Network’s native cryptocurrency was this week’s biggest gainer among the top 100 coins by market capitalization listed on CoinMarketCap, rallying 16.55% to US$2.83. The token started picking up momentum last Saturday, after the announcement of the new Render Foundation website. This is Render’s second consecutive week as the biggest gainer in the top 100 cryptos.

The Render Network leverages idle graphics processing units for digital rendering purposes, catering to areas such as 3D modeling, gaming imagery, and virtual reality.

Kava, the governance token of a layer-1 blockchain of the same name, was this week’s second-biggest gainer, rising 10.70% to US$1.09. The coin started picking up momentum on Monday, following the launch of the Kava mainnet last week.

다음 주: 부채 한도 거래가 비트코인의 크랩워크를 깨뜨릴 수 있을까요?

U.S. President Joe Biden and House Speaker Kevin McCarthy are reportedly closing in on a deal that would raise the government’s debt ceiling for two years while capping spending on most items. Yet, the June 1 deadline is fast approaching, causing investor concerns about a potential default.

WuuTrade의 Kenjaev에 따르면 부채 한도 협상을 둘러싼 불확실성은 거래가 성사될 때까지 암호화폐 시장을 압박할 것입니다.

“The sideways [movement] of Bitcoin is very much related to the current market risks and the fear. Investors’ activity during any economic risk talks is rather cautious. Hence the sideways in US$26,000 – US$30,000,” wrote Kenjaev, adding that positive news surrounding the U.S. economy will break the crab walk .

투자자들은 중요한 비농업 고용지표가 포함된 미국 195,000월 일자리 보고서의 다음 주 발표를 기다리고 있습니다. 이 정보는 종종 금리 조정에 관한 연방준비제도의 다음 단계를 예측하는 바로미터 역할을 합니다. ING Economics는 3.5월 비농업 고용이 3.4명 증가할 것으로 예상했습니다. 또한 그들은 지난 달의 XNUMX%에 비해 XNUMX월 실업률이 XNUMX%로 소폭 상승할 것으로 예상합니다.

암호화 공간에서 Ethereum 레이어 2 네트워크인 Optimism은 코인 출시 XNUMX년 후인 다음 주 수요일에 거버넌스 토큰(OP)의 순환 공급을 늘릴 계획입니다. 이러한 확장은 거버넌스 문제에 대한 제안 및 투표를 담당하는 OP 보유자 그룹인 토큰 하우스 내에서 투표 가능한 토큰 풀을 늘리기 위한 Optimism 전략의 일부입니다.

See related article: Big buys fail to lift NFT markets as regulatory uncertainty weighs heavy on crypto

- SEO 기반 콘텐츠 및 PR 배포. 오늘 증폭하십시오.

- PlatoAiStream. Web3 데이터 인텔리전스. 지식 증폭. 여기에서 액세스하십시오.

- 미래 만들기 w Adryenn Ashley. 여기에서 액세스하십시오.

- PREIPO®로 PRE-IPO 회사의 주식을 사고 팔 수 있습니다. 여기에서 액세스하십시오.

- 출처: https://bitrss.com/news/309885/weekly-market-wrap-bitcoin-weighed-down-by-debt-ceiling-uncertainty

- :있다

- :이다

- :아니

- ][피

- $UP

- 000

- 1

- 10

- 100

- 11

- 12

- 15%

- 17

- 195

- 2024

- 21 주식

- 26

- 3d

- 3D 모델링

- 7

- a

- AAA

- 할 수 있는

- 소개

- 에 따르면

- 활동

- 첨가

- 또한

- 구애

- 조정

- 후

- 애그리 게이터 (aggregator)

- ...전에

- 조준

- 이미

- 중

- 양

- an

- 분석자

- 와

- 강의자료

- 예상

- 어떤

- 앱

- 식욕

- 접근

- 접근하는

- 적당한

- 대략

- XNUMX월

- 있군요

- 지역

- 약

- 기사

- AS

- 유산

- At

- 대기

- 인식

- BE

- 가

- 된

- 뒤에

- biden

- 큰

- 가장 큰

- 억원

- 비트코인

- 비트 코인 가격

- 비트 코인 준비금

- blockchain

- 후원

- 흩어져

- 비자 면제 프로그램에 해당하는 국가의 시민권을 가지고 있지만

- 사기

- 비트 코인을 사다.

- 구매

- by

- 캡

- 자본화

- 일으키는

- 조심성 있는

- 천장

- 주요한

- 순환하는

- 폐쇄

- CO

- 동전

- CoinMarketCap

- 코인

- 회사

- 비교

- 개념

- 관심

- 우려 사항

- 연속적인

- 계속

- 계속

- 수

- 국가

- 결정적인

- 암호화는

- 암호화 시장

- 암호 공간

- 크립토 통화를

- 암호 화폐

- 암호

- Current

- 데이터

- 거래

- 빚

- 감소하다

- 태만

- 디지털

- 디지털 자산

- 하지 않습니다

- 아래 (down)

- ...동안

- 간결한

- 경제적

- 경제

- 효과

- 전체의

- 본질적으로

- 에테르

- 에테르 (ETH)

- 이더리움

- 조차

- 이벤트

- 최후의

- 진화하는

- 거래소

- 펼치기

- 확장

- 요인

- 실패

- FAST

- 무서움

- 연방

- 연방 준비 은행

- 먼저,

- 처음으로

- fitch

- 수행원

- 럭셔리

- 형태

- Foundation

- 금요일

- 에

- 노름

- 주어진

- 글로벌

- 글로벌 암호화폐

- 통치

- Government

- 그래픽

- 그룹

- 성장하는

- 이등분

- 있다

- 무거운

- 개최

- 금후

- 높은

- 조회수

- 보유

- 홀더

- 지주

- 홍콩

- 香港

- 집

- 그러나

- HTTPS

- 과다 핵 생성

- 유휴

- if

- 영향

- in

- 비활성

- 사건

- 포함

- 증가

- 더욱 더

- 정보

- ING

- 기관

- 기관 투자자

- 의도

- 관심

- 이자율

- 으로

- 투자

- 투자자

- 법률

- 발급자

- 문제

- IT

- 항목

- 그

- 작업

- 직업 보고서

- 조 바이든

- 유월

- KAVA

- 유지

- 홍콩

- 결핍

- 경치

- 넓은

- 가장 큰

- 성

- 시작

- 리드

- 가장 작은

- 레버리지

- 아마도

- 유동성

- 상장 된

- 긴

- 매크로

- 본관

- 메인 넷

- 시장

- 시총

- 시가 총액

- 시장 포장

- 시장

- XNUMX월..

- 평균

- 누락

- 모델링

- 기세

- 월요일

- 돈

- 달

- 배우기

- 가장

- 움직임

- 운동

- 발동기

- 많은

- name

- 출신

- 부정

- 협상

- 그물

- 네트워크

- 신제품

- news

- 다음 것

- NFT

- NFT 시장

- 비 농장

- 비농업 급여

- 의무

- of

- 오프

- 장교

- 자주

- on

- OP

- 운영

- 낙천주의

- or

- 위에

- 전체

- 모회사

- 부품

- 결제

- 급여

- 계획

- 계획

- 계획

- 플랫폼

- 플라톤

- 플라톤 데이터 인텔리전스

- 플라토데이터

- 포인트 적립

- 풀

- 유가 증권

- 긍정적인

- 가능성

- 잠재적으로

- 예측

- 대통령

- 비든 대통령

- 조 비든 대통령

- 압박

- 가격

- 학비 안내

- 처리

- 제품

- 이익

- 진행

- 돌출한

- 프로토콜

- 목적

- 모집

- 높인

- 율

- 차라리

- 평가

- 평가

- 도달

- 현실

- 합리적인

- 인식

- 에 관한

- 규정하는

- 규제 환경

- 관련

- 공개

- 남은

- 렌더링

- 신고

- 대표되는

- 연구

- 준비금

- 책임

- 공개

- 리플

- 상승

- 상승

- 위험

- 위험 식욕

- 위험

- ROSE

- s

- 말했다

- 같은

- 토요일

- 속담

- 둘째

- 보고

- 보다

- 판매

- 봉사하다

- 변화

- 단기간의

- 옆으로

- 이후

- 일부

- 무언가

- 스페이스 버튼

- Speaker

- 지출

- stablecoin

- 스테이블코인 USDT

- 스타트

- 시작

- 단계

- 저장

- 가치 창고

- 전략

- 실질적인

- 이러한

- 제안

- 공급

- 주변

- 받아

- 회담

- 이야기

- 기간

- Tether

- 그

- XNUMXD덴탈의

- 그들의

- Bowman의

- 그들

- 이

- 목요일

- 시간

- 시대

- 에

- 토큰

- 토큰

- 너무

- 상단

- 교환

- 트레이딩

- 다운로드

- 경향

- 일조

- 두

- 우리

- 미국 경제

- 어디에나 있는

- 불확실성

- 아래에

- 실업

- 실업률

- 단위

- 까지

- USDT

- 가치

- 가치

- 대단히

- 온라인

- 가상 현실

- 투표

- 였다

- 손목 시계

- we

- 웹 사이트

- 수요일

- 주

- 주간

- 무게

- 무게를다는

- 여부

- 어느

- 동안

- 의지

- 과

- 이내

- 세계

- 전세계적인

- 겠지

- 싸다

- year

- 년

- 아직

- 수율

- 수익 앱

- 제퍼 넷