미국 기반 기업에 대한 2023억 달러 이상의 벤처 거래의 새로운 선별 목록을 통해 100년 최대 규모의 스타트업 자금 조달 거래를 추적하고 싶으십니까? 새로운 Megadeals 추적기를 확인하십시오 여기에서 지금 확인해 보세요..

이번 주 미국에서 발표된 상위 10개 펀딩 라운드를 소개하는 주간 특집입니다. 지난 주 가장 큰 펀딩 라운드를 확인하세요. 여기에서 지금 확인해 보세요..

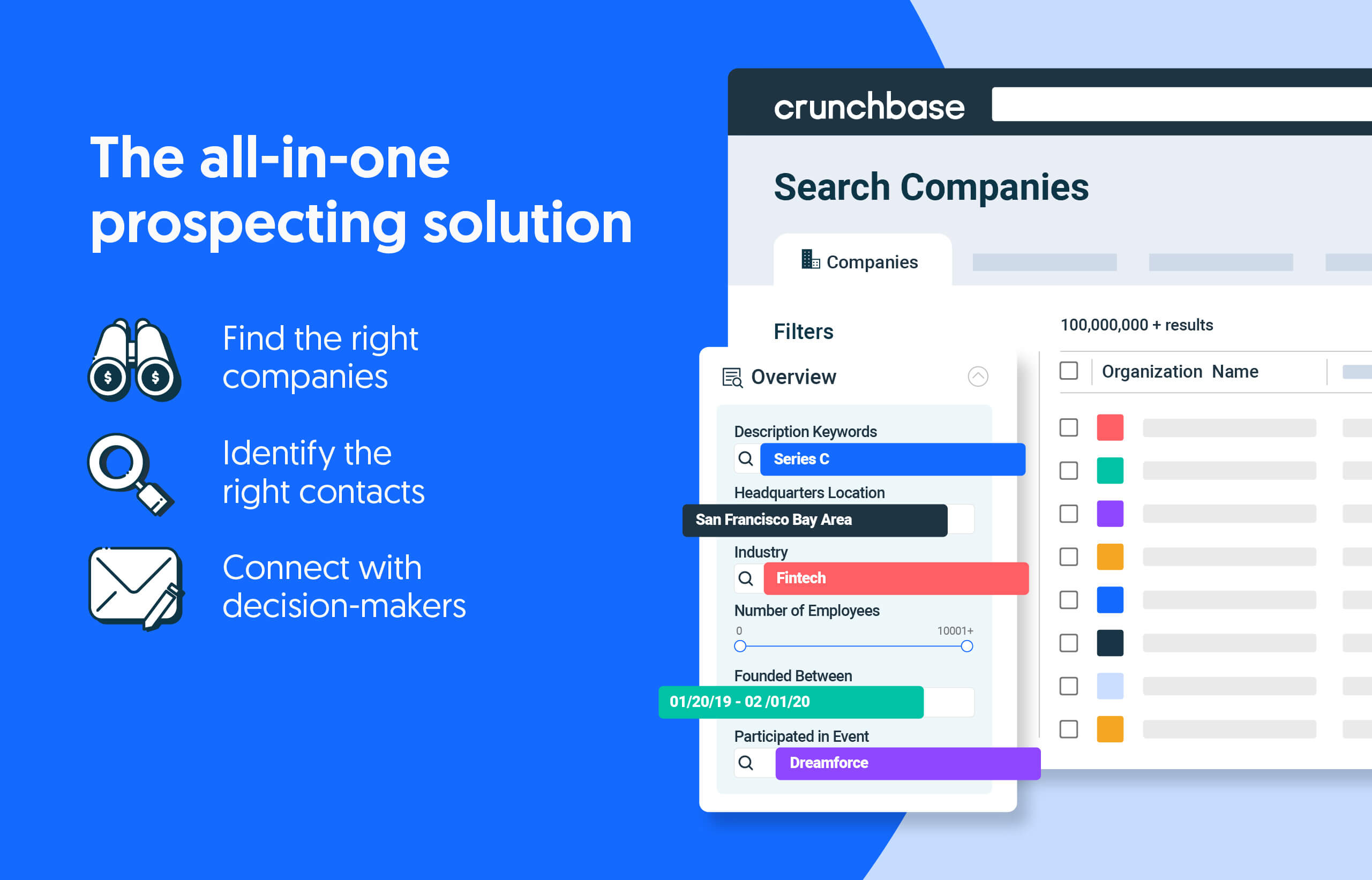

검색을 줄이세요. 더 닫으세요.

민간 기업 데이터 분야의 선두주자가 제공하는 올인원 전망 솔루션으로 수익을 늘리십시오.

After several weeks of just having one or two rounds of nine figures, this week saw an explosion. Eight rounds hit $100 million or more as big rounds seemed to pour in. No one sector cleaned up, as the money was spread around from cleantech to biotech to fintech to even restaurant-centric software.

1. 그라데이션, 225억 XNUMX만 달러, 청정 기술: Gradiant became one of the newest unicorns this week after raising a fresh 시리즈 D에서 225만 달러 주도 볼트락 홀딩스 및 센타우루스 캐피탈. 물 기술 스타트업의 가치는 현재 1억 달러로 평가됩니다. 이 스타트업은 제약, 반도체, 식음료 및 기타 물 수요가 많은 산업 분야의 기업을 위해 물 사용량을 줄이고 폐수 처리 시스템을 구축하는 기술을 개발합니다. 자금은 적어도 2022년 초 이후 폐수 처리 공간에서 가장 큰 규모입니다. 2013년에 설립된 기술 매사추세츠 공과 대학. The company has now raised more than $392 million, Crunchbase에 따르면.

2. 티 팔티, 150억 XNUMX만 달러, 핀테크: Automated payment solution Tipalti raised big this week with a $150 million “incremental growth financing” round, as the company called it. Back in 2021, the Foster City, California-based fintech raised a $270 million Series F funding led by G 제곱 at a valuation of $8.3 billion. No valuation was given this time around — although that is not unusual in this time of slowing venture funding and declining valuation. The latest round was from JPMorgan 체이스 뱅크 및 헤라클레스 캐피탈, which specializes in venture debt, although no distinction between debt and equity was announced by Tipalti. Founded in 2010, Tipalti has now raised about $700 million, according to the company’s 공개.

3. 레스토랑365, $135억 XNUMX만, 회계: It’s hard to run a restaurant — as anyone who has watched several reality shows based on doing so knows. Restaurant365 tries to make that a little easier and this week the Irvine, California-based startup added some big-named backers. The company nailed down a $135 million round co-led by KKR 및 패 터턴. 새로운 라운드는 회사를 1억 달러로 평가합니다. 공개. Restaurant365 offers enterprise management software for restaurants, helping them take care of accounting, payroll, supply chain and more. The company has surpassed $100 million in revenue and is used in more than 40,000 restaurant locations. Founded in 2011, the company has raised more than $260 million, Crunchbase 당.

4. (묶음) 애비뉴 원, $100M, property management: New York-based Avenue One also joined the unicorn herd this week with a $100 million raise led by 웨스트캡. The cash infusion gave the company a valuation of $1 billion. The startup, founded in 2020, provides a handful of services to single-family rental investors — such as finding their next property or financing. Institutional investors started buying up single-family homes during the pandemic as interest rates remained low and families sought more space. Even as interest rates have climbed back up, there clearly is still enough interest in the market to mint a property management startup as a unicorn.

4. (묶음) 무한 바이오, 100억 달러, 생명공학: It seems every week a biotech startup or two raise a huge round. This week is no different. First off is Boundless Bio, a clinical stage, next-generation precision oncology startup, which raised a $100 million Series C co-led by 바이엘의 도약 및 RA 자본 관리. The San Diego-based startup is developing therapeutics directed against extrachromosomal DNA for patients with oncogene amplified cancers. In the past, targeted therapies have been mostly ineffective in treating patients with oncogene amplified cancers, according to the company. Founded in 2018, the company has raised more than $250 million, Crunchbase 당.

4. (묶음) 이글 아이 네트워크, 100억 XNUMX천만 달러, 보안: When a security company raises a nine-figure round, it is normal to assume it is referring to cybersecurity. However, not in this case. Eagle Eye Networks is an actual physical security company — although with a tech twist. The company offers cloud-based video surveillance. Perhaps not the sexiest of industries, but still a significant market. The Austin, Texas-based startup locked up $100 million in a round led by Japan-based 세콤. Founded in 2012, the firm has now raised $195 million, Crunchbase에 따르면.

4. (묶음) 레이 테라퓨틱스, 100억 달러, 생명공학: Another biotech was able to raise a nine-figure round this week. San Francisco-based Ray Therapeutics locked up a $100 million Series A led by 노보홀딩스 A/S. The startup is looking to restore vision for people with the rare blinding disease retinitis pigmentosa. While some companies are looking to stop the disorder before it results in blindness, Ray differentiates itself by looking into therapeutics to actually bring back vision. Founded in 2021, the company has now raised $110 million, Crunchbase 당.

4.(공동) 지퍼, $100M, procurement: Procurement software certainly is not the sexiest of industries, but there is no denying the need for systems that help companies with the burdensome process of buying new software and hardware. San Francisco-based Zip helps companies do just that and this week it raised a 100 만 달러 시리즈 C 투자자로부터 Y Combinator, CRV 및 타이거 글로벌. The startup also bucked the trend of declining valuations. The new cash gives the procurement startup a $1.5 billion post-money valuation. While many companies are seeing stagnant or falling valuations, the new valuation represents a slight bump from its previous $1.2 billion valuation last May after the company raised a $43 million Series B. Zip helps companies with sourcing, approving and paying for needed business tools, ideally helping to streamline the process to make it less taxing. Founded in 2020, Zip has raised $181 million to date, per the company.

9. Nido Biosciences, 87억 달러, 생명공학: Watertown, Massachusetts-based Nido Biosciences, a biotech startup developing medicines for debilitating neurological diseases, announced it has raised a total of $109 million in seed, and Series A and B financings. Previous SEC filings (여기에서 지금 확인해 보세요. 및 여기에서 지금 확인해 보세요.) indicate the Series B — led by 생물발광 벤처 — likely was around $87 million.

10. 마르 멜로, 77억 XNUMX천만 달러, 전자 상거래: San Francisco-based luxury retailer Quince raised a $77 million Series B led by 웰링턴 경영. 2018년에 설립된 이 회사는 141.5억 XNUMX천만 달러를 모금했으며, Crunchbase에 따르면, positioning it for accelerated growth and expansion.

큰 글로벌 거래

Even though the U.S. saw some big funding rounds, none came close to the biggest this week.

방법론

우리는 13월 19일부터 XNUMX월 XNUMX일까지 XNUMX일 동안 미국 기반 회사에서 모집한 Crunchbase 데이터베이스에서 발표된 가장 큰 라운드를 추적했습니다. 대부분의 발표된 라운드가 데이터베이스에 표시되지만 일부 라운드는 주 후반에 보고됩니다.

추가 읽기

그림 : 돔 구즈만

Crunchbase Daily를 통해 최근 펀딩 라운드, 인수 등에 대한 최신 정보를 얻으십시오.

Hong Kong wants to strengthen its reputation as a forward-looking financial hub.

전자상거래 유니콘은 대유행 기간 동안 미국 소비자들의 마음을 빠르게 사로잡았지만 Shein은 이제 수많은 장애물에 직면해 있습니다.

SoftBank는 150주년을 앞두고 새로운 XNUMX억 XNUMX천만 달러 규모의 두 번째 펀드를 발표하면서 Opportunity Fund의 이름을 변경합니다.

올해 지금까지 여러 AI 중심 기업이 교육, 진단 및 데이터를 포함한 여러 부문에 걸친 SPAC와의 제휴를 발표했습니다.

- SEO 기반 콘텐츠 및 PR 배포. 오늘 증폭하십시오.

- PlatoAiStream. Web3 데이터 인텔리전스. 지식 증폭. 여기에서 액세스하십시오.

- 미래 만들기 w Adryenn Ashley. 여기에서 액세스하십시오.

- PREIPO®로 PRE-IPO 회사의 주식을 사고 팔 수 있습니다. 여기에서 액세스하십시오.

- 출처: https://news.crunchbase.com/venture/biggest-funding-rounds-gradiant-tipalti/

- :있다

- :이다

- :아니

- $ 1 억

- $ 100 만

- $UP

- 000

- 10

- 13

- 2011

- 2012

- 2013

- 2018

- 2020

- 2021

- 2022

- 2023

- 40

- a

- 할 수 있는

- 소개

- 가속 된

- 에 따르면

- 회계

- 인수

- 실제

- 실제로

- 추가

- 후

- 반대

- 앞으로

- 올인원

- 또한

- 이기는하지만

- 미국 사람

- 증폭

- an

- 및

- 기념일

- 발표

- 발표

- 다른

- 누군가

- 있군요

- 약

- AS

- At

- 오스틴

- 자동화

- 가로수 길

- 뒤로

- 후원자

- 기반으로

- BE

- 되었다

- 된

- 전에

- 처음

- 사이에

- 음료

- 큰

- 가장 큰

- 억원

- 생명 공학

- 맹목

- 무한한

- 가져

- 빌드

- 사업

- 비자 면제 프로그램에 해당하는 국가의 시민권을 가지고 있지만

- 구매

- by

- 라는

- 온

- 자본

- 한

- 케이스

- 현금

- 확실히

- 체인

- 변화

- 추적

- 검사

- City

- 클린턴

- 명확하게

- 올랐다

- 객관적인

- 닫기

- 기업

- 회사

- 회사

- 소비자

- 수

- 엄호

- CrunchBase에

- 기획

- 사이버 보안

- 매일

- 데이터

- 데이터베이스

- 날짜

- 패키지 딜

- 빚

- 감소하는

- 개발

- 개발

- 다른

- 질병

- 질병

- 무질서

- DNA

- do

- 하기

- 아래 (down)

- ...동안

- 전자 상거래

- 쉽게

- 교육

- end

- 충분히

- Enterprise

- 공평

- 조차

- 모든

- 확장

- 폭발

- 눈

- 얼굴

- 전도

- 가족

- 멀리

- 특색

- 도

- 서류

- 금융

- 자금 조달

- FINTECH

- 굳은

- 먼저,

- 흐름

- 식품

- 럭셔리

- 미래 지향적 인

- 기르다

- 설립

- 신선한

- 에

- 기금

- 자금

- 자금 거래

- 자금 조달

- 주어진

- 제공

- 글로벌

- 성장

- 줌

- 하드

- 하드웨어

- 있다

- 데

- 도움

- 도움이

- 도움이

- 히트

- 지주

- 주택

- 그러나

- HTML

- HTTPS

- 허브

- 거대한

- in

- 포함

- 표시

- 산업

- 주입

- 학회

- 기관

- 기관 투자자

- 관심

- 금리

- 으로

- 법률

- IT

- 그

- 그 자체

- 합류 한

- JPG

- 다만

- 유지

- 홍콩

- 가장 큰

- 성

- 늦은

- 최근

- 리더

- 가장 작은

- 지도

- 적게

- 아마도

- 명부

- 작은

- 위치

- 고정

- 찾고

- 낮은

- 럭셔리

- 확인

- 구축

- .

- 시장

- XNUMX월..

- 방법론

- 백만

- 박하

- 돈

- 배우기

- 가장

- 대개

- name

- 필요

- 필요

- 네트워크

- 신제품

- 뉴욕 기반

- 최신

- 다음 것

- 다음 세대

- 아니

- 표준

- 지금

- 다수의

- 장애물

- of

- 오프

- 제공

- on

- 종양학

- ONE

- 기회

- or

- 기타

- 우리의

- 아웃

- 세계적 유행병

- 과거

- 환자

- 지불하는

- 지불

- 결제 솔루션

- 급여

- 사람들

- 혹시

- 기간

- 제약

- 물리적

- 물리적 보안

- 플라톤

- 플라톤 데이터 인텔리전스

- 플라토데이터

- 위치

- powered

- Precision

- 너무 이른

- PRNewswire

- 방법

- 재산

- 제공

- 빨리

- 모집

- 높인

- 제기

- 인상

- 드문

- 거주비용

- RAY

- 현실

- 최근

- 최근 자금

- 감소

- 남은

- 보고

- 대표되는

- 대표

- 평판

- RESTAURANT

- 레스토랑

- 복원

- 결과

- 소매상 인

- 수익

- 반올림

- 회진

- 달리기

- s

- 산

- SEC

- 둘째

- 부문

- 부문

- 보안

- 씨

- 보고

- ~ 같았다

- 것

- 반도체

- 연속

- 시리즈 A

- 시리즈 B

- 시리즈 C

- 서비스

- 몇몇의

- 샤인

- 쇼

- 상당한

- 이후

- 둔화

- 작은

- So

- 소프트웨어

- 해결책

- 솔루션

- 일부

- 소싱

- 스페이스 버튼

- SPAC

- 전문적으로

- 전파

- 단계

- 시작

- 시작

- 스타트 업 자금

- 유지

- 아직도

- 중지

- 유선

- 강하게 하다

- 이러한

- 공급

- 공급망

- 돌파

- 감시

- 시스템은

- 받아

- 대상

- 기술

- 기술 시작

- Technology

- 보다

- 그

- XNUMXD덴탈의

- 그들의

- 그들

- 치료학

- 그곳에.

- 제삼

- 이

- 이번 주

- 올해

- 그래도?

- 묶여

- 시간

- 티 팔티

- 에

- 검색을

- 상단

- 최고 10

- 금액

- 선로

- 치료

- 치료

- 경향

- 트위스트

- 두

- 우리

- 일각수

- 유니콘

- 별난

- 용법

- 익숙한

- 평가

- 평가

- 가치

- 마케팅은:

- 벤처 기업

- 벤처 펀딩

- Video

- 비디오 감시

- 시력

- 원

- 였다

- 물

- 주

- 주간

- 주

- 했다

- 언제

- 어느

- 동안

- 누구

- 과

- 원

- XML

- year

- 너의

- 제퍼 넷

- 지퍼