엘론 머스크 뜨거운 행진을 이어가고 있었습니다.

2019년부터 2022년까지 머스크가 취한 모든 도박은 성과를 거두는 것처럼 보였습니다. Tesla는 지속적으로 수익성이 좋았습니다. 역사상 처음으로 그리고 그 주식이 급등했다 as its massive new Shanghai plant ramped up production. SpaceX rockets captivated the public’s attention — even when they blew up, everyone still clapped. Accusations of 부패와 자기 거래 slid right off Musk’s back. Musk could do and say anything he wanted and success followed: He was even named Time’s 2021 Person of the Year.

Then Musk did what every risk-addicted blackjack player inevitably does: pushed his luck too far. Overconfidence, confirmation bias, and delusions of control led to a string of bad decisions — and BOOM — Elon’s empire is in trouble again.

The change of fortune was apparent at The New York Times Dealbook Conference last week. During an interview with host Andrew Ross Sorkin, the recognizable tells that Musk’s hand had gone cold were everywhere. He raged at the very people who will dictate Twitter’s fate, seemed baffled by key questions about the future of his companies, and offered non-apologies for his unhinged, antisocial behavior online. Sorkin suggested Musk’s brain is like a storm, but it sounded more like two cats fighting to get out of a duffle bag.

This, ladies and gentlemen, is what it looks like when Musk realizes he’s in a jam entirely of his own making. I know, because we’ve seen it before, including back in 2018, when he nearly flew 테슬라 산으로. 그는 그때처럼 재난을 피할 수 있는 방법을 찾을 수도 있지만 이번 잼은 지난번 잼보다 훨씬 더 빡빡합니다. 머스크는 빠르게 침몰하는 트위터를 여전히 짓누르고 있는 13억 달러 이상의 부채와 싸워야 합니다. Tesla’s profits shrinking because of a lack of demand and new products, and a world that is generally sick of his schtick. In Muskland, everything is connected by money — problems at one business bleed into the others. That’s why Elon is being exceptionally obstinate. It’s not just your imagination — his luck has changed.

2018년, 첫 번째 annus horribilis

If you want to understand Musk’s latest unhinged behavior, it’s helpful to understand the reasons he’s lashed out in the past. So let me take you back to the wild ride that was 2018: Musk had bet Tesla’s future on the 모델 3. With an intended starting price of $30,000, the car was supposed to make EVs accessible to drivers who couldn’t afford luxury prices. But Tesla’s investors got increasingly restless as the model became trapped in what Musk called “production hell.”

The pressure to get the Model 3 out clearly weighed on Musk, and he was not subtle about it. On Tesla’s first-quarter earnings call, he cut off one analyst’s basic financial question, saying that “boring, bonehead questions are not cool.” He got so frustrated that he ditched the analysts entirely and started taking questions from fans posting on YouTube. Eventually, he even 회의적인 Tesla 투자자들에게 간청했습니다. to “please, sell our stock.” When Musk is at his most hungry for cash, he tends to 손을 물다 그게 먹이죠.

Musk also became more active on Twitter around this time, often with erratic results. When a professional diver complained that Musk was distracting from efforts to rescue a children’s soccer team that had been trapped in a cave in Thailand, 머스크는 다이버를 불렀다 a “pedo guy” and harassed him on Twitter. He used the platform to whine about the media, attack investors betting against Tesla’s stock, and even tweeted that he would be Tesla를 주당 420달러에 비공개로 전환 그런 거래가 없었을 때. 머스크가 나중에 인정했듯이 테슬라는 “near death,” and summer’s “production hell” was about to turn into autumn’s “logistics hell.”

Tesla’s salvation came in the form of the Chinese Communist Party. In 2019, as executives were fleeing Tesla and the company continued to bleed cash, Musk struck a deal to build a factory in Shanghai. From permitting to construction to opening, the Shanghai Gigafactory was built in just 168 일. Skeptical observers — myself included — were blindsided. What we failed to appreciate was the staggering power of the CCP when it’s aggressively pushing to meet a single goal. When the party said Tesla could build the factory there, that meant immediately.

일반적으로, 폐허에 가까운 수풀에서 살아남는 과정에서 사람이 얻을 수 있는 두 가지 교훈이 있습니다. 그들은 좀 더 조심하는 법을 배울 수도 있고, 자신이 파괴할 수 없고 운명을 유혹한다고 결정할 수도 있습니다.

없이 중국, Tesla would not have finally turned into a “real car company,” in Musk’s own words. He dodged destruction and started to settle down and focus on other projects, like Starlink. Sure, he was still wilding out on Twitter, but at least he wasn’t bawling 롤링스톤에 그가 행복해지려면 여자친구가 얼마나 절실히 필요한지. 마침내 머스크 세계는 일종의 광적인 균형을 찾은 것 같았습니다.

Generally, there are two different lessons a person can take from surviving a brush with near ruin. They can learn to be more cautious, or they can decide that they are indestructible and tempt fate. I don’t think I need to tell you which path Musk chose.

엘론의 세계는 모두 연결되어 있습니다

Say what you want about him, but Elon Musk has ambition. On top of the world in early 2022, Musk decided that he had the power to single-handedly “fix” the entire concept of free speech. And given that he is hopelessly addicted to the adulation he gets from Twitter, that’s where he figured he would start.

We all know this part of the story. Musk started building a stake in Twitter in early 2022, then offered to buy it outright. He offered such a ridiculously high price that the board couldn’t say no. A consortium of banks — led by 모건 스탠리 - 그에게 돈의 상당 부분을 빌려주었다.. 그리고 마침내, 거래를 어기려고 시도했지만 실패하고 나서, 그는 트위터를 샀다. 거래를 완료한 지 얼마 지나지 않아 머스크는 플랫폼을 되돌리기 위한 모든 아이디어를 소진했고 화가 난 전직 직원들과 회의적이었습니다. 광고주, 끔찍한 새 이름, 그리고 월스트리트의 보이스카우트에게 빚진 엄청난 빚더미입니다.

요즘에는 리서치 회사의 CEO인 Vicki Bryan과 같은 일부 분석가들이 본드 각도, suspect that Twitter is spending much more than it’s able to generate or borrow.

“With the company still burning cash and $1.3-1.5 billion in annual interest due over the past year, I had expected Twitter to live on borrowed time,” Bryan wrote in a note to clients. She said that even if Twitter tapped the loans available to it at the beginning of the year, the company may be almost out of options. “The year is over, so Twitter’s cash may be nearly if not already dried up — along with Elon Musk’s options,” Bryan wrote.

Because of the way that Musk operates, the social-media company’s troubles pose a threat to his whole business empire. Despite being the second-wealthiest person in the world, Musk is curiously cash poor. He doesn’t take a salary from Tesla, and while he owns about 20% of the EV maker, public documents filed in March show that about 그 주식의 63% are “pledged as collateral to secure certain personal indebtedness.” You know, like the private jets.

The year is over, so Twitter’s cash may be nearly if not already dried up—along with Elon Musk’s options리서치 회사 Bond Angle의 CEO Vicki Bryan

이 이유 Tesla 주식을 활용하여 현금 조달 all the time gets hairy. If Tesla shares fall below a certain level, the banks can call in those personal loans — leaving Musk on the hook. And the quickest way for Tesla’s stock to drop off a cliff is for investors to get wind of a big Musk sale. And of course, he needs to make sure that he still holds on to all the Tesla stock he’s pledged as collateral to the banks. Unfortunately, though, the easiest way for Musk to fill the gaping hole in Twitter’s balance sheet is 테슬라 주식을 팔려고 이것이 어떻게 문제가 될 수 있는지 알 수 있습니다.

Sometimes, when he’s really hard up, Musk borrows money from SpaceX — a private company that 총 1.5억 달러의 손실을 입었습니다. 2021년과 2022년에. 그는 1 억 달러를 빌렸다 트위터를 인수하고 한 달 만에 대출금을 갚았지만 이를 위해서는 4억 달러 상당의 테슬라 주식을 팔아야 했습니다. 머스크는 자신의 부와 권력을 사용하여 자신이 감수하는 위험에 대한 실질적인 결과가 없는 별도의 현실을 구축했지만 트위터에서 불을 켜는 것은(죄송합니다, X입니다) 날이 갈수록 그 한계를 점점 더 시험하고 있습니다.

지구상의 삶 1

All of this money-incinerating activity, from the beginning of the Twitter deal to this very moment, could not have come at a worse time. For decades, Musk has operated in a placid economy where interest rates were near zero. But Musk started buying Twitter right as central banks around the world began hiking rates in an effort to combat inflation. That means the cost of servicing his debt is getting more expensive, making it harder for him to get new loans. It’s a shift so dramatic that it could rip a hole in the universe through which Musk’s reality collapses into our own.

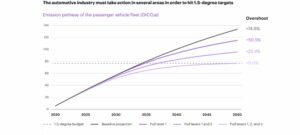

The outlook for Tesla’s business doesn’t help him much either. The company’s share of the EV market has fallen as competitors have swarmed in. The new entrants prompted Musk to start 그의 차 가격을 인하하다 2023년 초에, 그 결과, Tesla’s profitability 심각한 압박을 받고 있습니다. 회사는 제조 능력을 확장할 계획이 있지만 노후화된 차량을 갱신할 계획은 없습니다. 물론 Cybertuck을 포함하지 않는 한, 대부분은 그렇지 않습니다. 지난 달 Tesla는 10대의 사이버트럭 인도를 축하하기 위해 출시 이벤트를 열었습니다. 십. 회사에 따르면 가장 저렴한 모델인 60,000달러는 2025년까지 출시되지 않을 것이라고 합니다. 브라이언은 머스크가 계속해서 모호한 방식으로 Tesla로부터 돈을 빼돌릴 것으로 예상한다고 말했습니다. 그러나 문제는 이렇습니다. 정확히 얼마나 많은 돈을 빼돌릴 수 있을까요? 그리고 얼마나 오랫동안 그 일을 해야 합니까?

불타버린 돈은 다시 돌아오지 않는다비키 브라이언

“The only thing we’re waiting on is for Elon to cry uncle,” said Bryan. In her view — which is based on 30 years of investing in distressed assets — any equity in the company has already been erased by Musk’s antics. As for the debt, the banks have been unable to unload it at 85 cents on the dollar, and she thinks they’ll be lucky to get 40 cents. By all accounts, Twitter has a credit problem, and Bryan said that calls for a run-of-the-mill restructuring solution: bankruptcy. When Musk tires of robbing Peter to pay Paul, he will default on his Twitter loans. Then the consortium of banks that own the debt can accelerate it — standard debt agreements come with clauses that allow lenders to force a borrower to pay all of an outstanding loan back if certain requirements (like payment) are not met. Once that wire is tripped, Twitter can declare bankruptcy.

“There is money that has been set on fire that is never coming back,” Bryan said. “We’re in the salvage business with Twitter. In a restructuring, with Elon gone, you can have people looking at it. They can foresee that Elon didn’t do anything that can’t be reversed and offer instant relief.”

Will it be enough to save Twitter/X? Maybe not, but it’s the company’s only and best hope.

월스트리트는 철저히 당혹스러워야 한다. 에 따라 보고서에, the banks holding Twitter’s debt are already expecting to take a $2 billion hit when they can finally sell it off. It’s not hard to see why. I’ve said from the jump that there was 이 트위터 벤처에는 돈이 없어요, 원칙도 없습니다. 머스크는 항상 트위터로 돌릴거야 into a reflection of his limited view, his “Earth” — as he put it during his manic rambling at Dealbook — not a place for the average user. I never expected Musk’s fanboys to understand that, but I did expect bankers who are supposed to understand who pays for what in a media business to get it. In the end, there’s a real chance Wall Street investors will wind up owning the shambolic mess that is Twitter/X. One of the few blessings to come from this fiasco is that when that happens, at least they’ll know what 지원 그것과 관련이 있습니다.

리넷 로페즈 Business Insider의 선임 특파원입니다.

- SEO 기반 콘텐츠 및 PR 배포. 오늘 증폭하십시오.

- PlatoData.Network 수직 생성 Ai. 자신에게 권한을 부여하십시오. 여기에서 액세스하십시오.

- PlatoAiStream. 웹3 인텔리전스. 지식 증폭. 여기에서 액세스하십시오.

- 플라톤ESG. 탄소, 클린테크, 에너지, 환경, 태양광, 폐기물 관리. 여기에서 액세스하십시오.

- PlatoHealth. 생명 공학 및 임상 시험 인텔리전스. 여기에서 액세스하십시오.

- 출처: https://www.autoblog.com/2023/12/16/elon-musk-is-cracking-under-the-pressure-of-the-biggest-gamble-he-s-ever-taken-in-his-life/

- :있다

- :이다

- :아니

- :어디

- $UP

- 000

- 1

- 10

- 11

- 12

- 13

- 14

- 15%

- 16

- 17

- 19

- 20

- 2018

- 2019

- 2021

- 2022

- 2023

- 2025

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 40

- 7

- 8

- 9

- a

- 할 수 있는

- 소개

- IT에 대해

- 가속

- 얻기 쉬운

- 에 따르면

- 계정

- 비난

- 활동적인

- 활동

- 인정 된

- 후

- 다시

- 반대

- 공격적으로

- 노화

- 계약

- All

- 수

- 거의

- 따라

- 이미

- 또한

- 대지

- an

- 분석자

- 애널리스트

- 및

- 앤드류

- 앤드류 로스 소킨

- 연간

- 어떤

- 아무것도

- 명백한

- 감사

- 있군요

- 약

- 기사

- AS

- 자산

- At

- 공격

- 주의

- 가능

- 평균

- 뒤로

- 나쁜

- 심하게

- 가방

- 잔액

- 대차 대조표

- 은행

- 파산

- 은행

- 기반으로

- 기본

- BE

- 되었다

- 때문에

- 된

- 전에

- 시작

- 처음

- 행동

- 존재

- 이하

- BEST

- 베팅을

- 베팅

- 바이어스

- 큰

- 가장 큰

- 억원

- 블룸버그 게시물에서

- 판

- 증서

- 붐

- 지루한

- 빌다

- 빌린

- 차용인

- 구입

- 뇌

- 브라이언

- 빌드

- 건물

- 내장

- 굽기

- 사업

- 비자 면제 프로그램에 해당하는 국가의 시민권을 가지고 있지만

- 사기

- 구매

- by

- 전화

- 라는

- 통화

- 온

- CAN

- 능력

- 자동차

- 현금

- 고양이

- 조심성 있는

- 동굴

- ccp

- 축하

- 중심적인

- 중앙 은행

- 대표 이사

- 어떤

- 기회

- 이전 단계로 돌아가기

- 변경

- 어린이

- 중국말

- 중국 공산당

- 선택

- 명확하게

- 클라이언트

- 저온

- 붕괴하다

- 담보

- COM

- 싸우기

- 결합 된

- 왔다

- 오는

- 기업

- 회사

- 경쟁

- 완료

- 개념

- 컨퍼런스

- 확인

- 연결

- 결과

- 일관되게

- 협회

- 구조

- 계속

- 계속

- 제어

- 시원한

- 비용

- 수

- 할 수있는

- 코스

- 매우

- 신용

- 절단

- 일

- 거래

- 죽음

- 빚

- 수십 년

- 결정하다

- 결정된

- 결정

- 태만

- 배달

- 수요

- 무례

- 명령

- DID

- didn

- 다른

- 고민하는

- do

- 서류

- 하지

- 들린

- 달러

- 돈

- 아래 (down)

- 극적으로

- 드라이버

- 드롭

- 두

- ...동안

- 초기의

- 수입

- 수입 전화

- 지구

- 가장 쉬운

- 경제

- 노력

- 노력

- 중

- 느릅 나무

- 엘론

- 엘론 머스크

- 제국

- 직원

- end

- 충분히

- 전체의

- 전적으로

- 들어오는

- 평형

- 공평

- 에테르 (ETH)

- EV

- 조차

- 이벤트

- 있을뿐만 아니라

- EVER

- 모든

- 사람

- 모두

- 모든 곳

- 에반스

- 정확하게

- 예외적으로

- 임원으로 미국으로 이전하여 일할 수 있는 권리를 부여함

- 펼치기

- 기대

- 기대하는

- 기대

- ~을 기대하는

- 비싼

- 공장

- 실패한

- 실패

- 떨어지다

- 타락

- 팬

- 멀리

- 운명

- 를

- 싸움

- 문채 있는

- 제출

- 채우기

- 최종적으로

- 금융

- Find

- 화재

- 굳은

- 먼저,

- 처음으로

- 수정

- 함대

- 초점

- 다음에

- 럭셔리

- 투자자를위한

- 힘

- 예견하다

- 형태

- 이전

- 운

- 발견

- 무료

- 무료 연설

- 에

- 좌절

- 미래

- 도박을하다

- 일반적으로

- 생성

- 얻을

- 점점

- 주어진

- 골

- 가는

- 사라

- 있어

- 사람

- 했다

- 손

- 발생

- 행복한

- 하드

- 열심히

- 있다

- he

- 도움

- 도움이

- 그녀의

- 높은

- 하이킹

- 그를

- 그 자신

- 그의

- history

- 히트

- 보유

- 보유

- 구멍

- 기대

- 주인

- 뜨거운

- 방법

- HTTPS

- 배고픈

- i

- 아이디어

- if

- 상상력

- 바로

- in

- 포함

- 포함

- 더욱 더

- 필연적으로

- 인플레이션

- 소식통

- 즉시

- 예정된

- 관심

- 금리

- 인터뷰

- 으로

- 투자

- 법률

- IT

- 그

- 제트

- 도약

- 다만

- 유지

- 키

- 종류

- 알아

- 결핍

- 넓은

- 성

- 후에

- 최근

- 시작

- 배우다

- 가장 작은

- 출발

- 지도

- 왼쪽 (left)

- 대출

- 레슨

- 하자

- 레벨

- 생활

- 처럼

- 제한된

- 제한

- 살고있다

- ll

- 차관

- 융자

- 물류

- 긴

- 찾고

- 봐라.

- 운

- 럭셔리

- 확인

- 메이커

- 유튜브 영상을 만드는 것은

- 제조

- Mar

- 시장

- 거대한

- XNUMX월..

- 아마도

- me

- 방법

- 의미

- 미디어

- 소개

- 만나

- 모델

- 순간

- 돈

- 달

- 배우기

- 가장

- 산

- 많은

- 사향

- 자신

- name

- 이름

- 가까운

- 거의

- 필요

- 요구

- 못

- 신제품

- 새로운 제품

- 뉴욕

- 뉴욕 타임스

- 아니

- 주의

- 옵저버

- of

- 오프

- 제공

- 제공

- 자주

- on

- 일단

- ONE

- 온라인

- 만

- 열기

- 운영

- 운영

- 옵션

- or

- 실물

- 기타

- 기타

- 우리의

- 아웃

- Outlook

- 노골적인

- 두드러진

- 위에

- 과신

- 빚진

- 자신의

- 소유

- 소유하다

- 지급

- 부품

- 파티

- 과거

- 통로

- 폴

- 지불

- 지불하는

- 지불

- 국가

- 사람들

- 사람

- 확인

- 개인 융자

- 베드로

- 장소

- 계획

- 식물

- 플랫폼

- 플라톤

- 플라톤 데이터 인텔리전스

- 플라토데이터

- 플레이어

- 부디

- 가난한

- 일부

- PoS

- 힘

- 압박

- 가격

- 학비 안내

- 원칙

- 사설

- 문제

- 문제

- 생산

- 제품

- 링크를

- 이익

- 프로젝트

- 공개

- 밀

- 미는

- 놓다

- 문제

- 문의

- 가장 빠른

- 거주비용

- RE

- 읽기

- 현실

- 현실

- 정말

- 이유

- 반사

- 구조

- 요구조건 니즈

- 구출

- 연구

- 구조 조정

- 결과

- 결과

- 타기

- 연락해주세요

- 위험

- 구르는

- 파멸

- s

- 말했다

- 봉급

- 판매

- 찜하기

- 라고

- 속담

- SEC

- 안전해야합니다.

- 참조

- ~ 같았다

- 본

- 팔다

- 연장자

- 별도의

- 진지한

- 서비스

- 세트

- 해결하다

- 상하이

- 공유

- 공유

- 그녀

- 시트

- 변화

- 영상을

- 표시

- 단일

- 사이펀

- 회의적인

- So

- 축구

- 해결책

- 일부

- 소리를 냈다

- 출처

- 스페이스 엑스

- 연설

- 지출

- 비틀 거리는

- 말뚝

- 표준

- 스탠리

- 스타 링크

- 스타트

- 시작

- 시작 중

- 아직도

- 재고

- 폭풍

- 이야기

- 거리

- 끈

- 성공

- 이러한

- 여름

- 가정

- 확인

- 신속히

- T

- 받아

- 촬영

- 소요

- 복용

- 탭

- 팀

- 이야기

- 말하다

- 안색

- 경향이있다

- 무서운

- 테슬라

- 테슬라 주식

- 지원

- 태국

- 보다

- 그

- XNUMXD덴탈의

- 중국 공산당

- 미래

- 뉴욕 타임즈

- 세계

- 그때

- 그곳에.

- 그들

- 맡은 일

- 생각

- 생각

- 이

- 완전히

- 그

- 그래도?

- 위협

- 을 통하여

- 단단한

- 시간

- 시대

- 타이어

- 에

- 이야기

- 너무

- 했다

- 상단

- 갇혀

- 수고

- 노력

- 회전

- 돌린

- 트위터

- 트위터 거래

- 두

- 할 수 없는

- 아래에

- 이해

- 운수 나쁘게

- 우주

- 까지

- 익숙한

- 사용자

- 사용

- Ve

- 차량

- 대단히

- 관측

- 기다리는

- 벽

- 월가

- 필요

- 원

- 였다

- 이었다

- 방법..

- 방법

- we

- 재산

- 주

- 무게

- 했다

- 뭐

- 언제

- 어느

- 동안

- 누구

- 모든

- why

- 야생

- 의지

- 바람

- 철사

- 과

- 이내

- 말

- 일하는

- 세계

- 악화되는

- 가치

- 겠지

- 쓴

- WSJ

- X

- year

- 년

- 요크

- 당신

- 너의

- 유튜브

- 제퍼 넷

- 제로