Peringkat IPO (1.75 dari 5.0 Bintang)

Hak Cipta@http://lchipo.blogspot.com/

Ikuti kami di facebook: https://www.facebook.com/LCH-Trading-Signal-103388431222067/

Tanggal

Terbuka untuk melamar: 27/02/2020

Tutup untuk melamar: 06/03/2020

Tanggal daftar: 18/03/2020

Modal Saham

Kapitalisasi Pasar: RM84 juta

Total Shares: 300mil shares (Public :15 mil, Company Insider/Miti/Private Placement: 43 mil)

Bisnis

Distribution of electrical products and accessories.

Industrial User: 74.46%

Reseller: 25.54%

Mendasar

Pasar: Pasar Ace

Harga: RM0.28 (EPS:0.0247)

P/E & ROE: PE11.34 (Buku Prospektus) ROE13%

Tunai & setoran tetap setelah IPO: RM0.05 per saham

NA setelah IPO: RM0.19

Total debt to current asset after IPO: 1.644 (Debt: 63.657 mil, Non-Current Asset: 38.712 mil, Current asset: 81.368mil)

Kebijakan dividen: Tidak ada kebijakan dividen yang pasti.

Rasio Keuangan

Piutang usaha: 80 hari

Hutang Dagang: 103 hari

Perputaran persediaan: 105 hari

Kinerja Keuangan Masa Lalu (Pendapatan, EPS)

2019 (until Nov): RM104.084 mil (EPS: 0.0237)

2019: RM134.373 juta (EPS: 0.0275)

2018: RM124.193 juta (EPS: 0.0173)

2017: RM114.509 juta (EPS: 0.0153)

Margin Laba Bersih

2019: 5.52%

2018: 4.03%

2017: 3.89%

Setelah IPO Kepemilikan Saham

Ir. Tang Pee Tee @ Tan Chang Kim: 62.79%

Jin Siew Yen: 7.85%

Tan Yushan: 7.85%

Remunerasi Direksi untuk FYE2021 (dari laba kotor 2019)

Ir.Tang Pee Tee: RM0.502 mil

Tan Yushan: RM0.437 mil

Chai Poh Choo: RM0.218 mil

Yap Koon Roy: RM68k

Dr.Tee Chee Ghee: RM68k

Ir. Dr.Ng Kok Chiang: RM56k

Total remunerasi direktur dari laba kotor: RM1.349 juta atau 6.07%

Remurasi Manajemen Kunci Tahun Fiskal 2021 (dari laba kotor 2019)

Ooi Gin Hui: RM250k-300k

Chong Su Yee: RM150k-200k

Lim Lee Hua: RM150k-200k

Low Swee Ching: RM150k-200k

Foong Kah Hong: RM150k-200k

key management remuneration from gross profit: RM0.85mil-RM1.1 mil or 3.83%-4.95%

penggunaan dana

New Sales Outlet: RM4.2 mil (25.86%)

New head office & distribution in Johor: RM2.5 mil (15.39%)

Purchase new trucks & upgrade IT system: RM2 mil (12.32%)

Modal Kerja: RM4.24 juta (26.11%)

Biaya pencatatan: RM3.3 juta (20.32%)

CAGR% Industri

Cables & wires CAGR: 0.4% (2015-2019)

Electrical Distribution, Protection, & Control Devices: 16.5% (2015-2019, *2019 drop -5.8%)

Lighting Equipment: -0.6% (2015-2019)

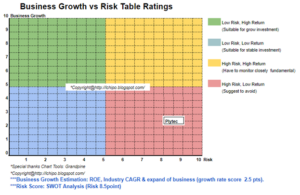

Kesimpulan

Hal yang baik adalah:

1. PE11.34 & ROE13% is reasonable.

2. Set up new sales outlet & office will impove sales but will not have fast impact on revenue.

Hal-hal buruk:

1. Debt to currnet asset ratio is high.

2. No fix dividend policy.

3. Revenue grwoing around 8% per year, but after deduct inflation will have only little improvement.

3. Net profit margin is low than 10%.

4. Director fee is expensive.

5. CAGR% of their industry grow rate is not at healthy level.

6. Listing expenses 20.32% is too expensive.

7. Doesn’t explain more on how to improve business line with online sales, because business should not too depend on normal distribution method.

Kesimpulan

Is not a attractive IPO. Unable to expect high grow in the company revenue in 1-2 year.

Harga IPO: RM0.28

Waktu yang baik: RM0.32 (PE13)

Waktu buruk: RM0.19 (PE8)

*Penilaian hanya berlaku hingga hasil kuartal baru dirilis. Pembaca harus mengerjakan pekerjaan rumahnya sendiri untuk menindaklanjuti hasil setiap kuartal untuk menyesuaikan perkiraan nilai fundamental perusahaan.

Source: http://lchipo.blogspot.com/2020/03/aco-group-berhad.html

- aksesoris

- sekitar

- aset

- BP

- bisnis

- CAGR

- modal

- perusahaan

- terbaru

- Hutang

- Devices

- Kepala

- dividen

- Menjatuhkan

- peralatan

- biaya

- FAST

- keuangan

- Memperbaiki

- mengikuti

- Kelompok

- Tumbuh

- kepala

- High

- pekerjaan rumah

- Seterpercayaapakah Olymp Trade? Kesimpulan

- How To

- HTTPS

- Dampak

- industri

- inflasi

- IPO

- IT

- Tingkat

- baris

- daftar

- pengelolaan

- bersih

- secara online

- penjualan online

- kebijaksanaan

- harga pompa cor beton mini

- Produk

- Keuntungan

- perlindungan

- publik

- Pembaca

- pendapatan

- penjualan

- set

- saham

- sistem

- waktu

- truk

- us

- nilai

- tahun

- Yen