TULEVAT TAPAHTUMAT:

- tiistai: Japani

Unemployment Rate, Eurozone Q4 GDP, US Job Openings, US Consumer

Luottamusta. - Keskiviikko: BoJ

Summary of Opinions, Japan Industrial Production and Retail Sales,

Australia CPI, Chinese PMIs, Switzerland Retail Sales, UST Quarterly

Refunding Announcement, US ADP, Canada GDP, US ECI, FOMC Policy Decision. - torstai: Kiina

Caixin Manufacturing PMI, Switzerland Manufacturing PMI, Eurozone CPI,

Eurozone Unemployment Rate, BoE Policy Decision, US Challenger Job Cuts,

US Jobless Claims, Canada Manufacturing PMI, US ISM Manufacturing PMI. - Perjantai:

Australia PPI, US NFP.

tiistai

The US December Job Openings are seen

falling to 8.750M vs. 8.790M prior. Job Openings have been falling steadily

since the peak in 2022 as the labour market continued to get into better

balance. As a reminder, the viime

raportti yllättynyt huonoista puolista sekä

the hiring and quits rate falling below the pre-pandemic levels. Se tulee olemaan

interesting to see how the Fed’s pivot and the aggressive easing in financial

conditions influenced the data.

USA:n avoimet työpaikat

Yhdysvaltain kuluttajien luottamus on ollut

falling steadily in the last quarter of 2023 amid a weakening labour market but

hyppäsi yllättäen joulukuussa tasolle, joka on viime heinäkuusta lähtien. Compared

to the University of Michigan Consumer Sentiment, which shows more how the

consumers see their personal finances, the Consumer Confidence shows how the

consumers see työmarkkinoilla.

The consensus sees the index increasing to 115.0 in January vs. 110.7 in joulukuu.

Yhdysvaltain kuluttajien luottamus

Keskiviikko

The Australian quarterly inflation

data is seen easing across all measures.

The CPI Y/Y is expected at 4.3% vs. 5.4% aikaisempi,

while the Q/Q reading is seen at 0.8% vs. 1.2% prior. The RBA is more

focused on the underlying inflation measures and those are expected to fall as

hyvin. In fact, the Trimmed Mean CPI Y/Y is seen at 4.4% vs. 5.2% prior,

while the Q/Q figure is expected at 0.9% vs. 1.2% prior. We will also get the

Monthly CPI indicator which is expected to ease further to 3.7% vs. 4.3% prior.

The data will have no bearing on the February RBA meeting, but it will

influence the market’s pricing which currently expects the central bank to

start cutting rates in August.

RBA:n leikattu keskimääräinen CPI vuositasolla

The US Q4 Employment Cost Index (ECI) is

expected at 1.0% vs. 1.1% aikaisempi.

This is the most comprehensive measure of labour costs, but unfortunately, it’s

not as timely as the Average Hourly Earnings data. The Fed though watches

this indicator closely. Wage growth has been easing in the past two years,

but it still remains relatively elevated.

Yhdysvaltain työvoimakustannusindeksi

The Fed is expected to keep the FFR

unchanged at 5.25-5.50%. Given that the 3-month and 6-month annualised rates

are now below the 2% target, the central bank might also acknowledge the

progress by changing the line in the statement from “any additional policy

firming” to something like “sufficiently restrictive”. Beyond that we shouldn’t

see many changes and the attention will turn to the Press Conference where Fed

Chair Powell will be certainly questioned about the aggressive easing in

financial conditions since the December meeting, the falling inflation rate and

the change for their quantitative tightening policy.

Federal Reserve

torstai

Euroalueen kuluttajahintaindeksin odotetaan olevan 2.8 %.

vs. 2.9 % aikaisempi,

while the Core Y/Y measure is seen at 3.2% vs. 3.4% prior. Marketti

continues to expect the ECB to cut rates in April although the central bank

keeps on pushing back against such forecasts seeing the first cut coming in

kesä. If the data continues to miss though, it will be very hard for the

ECB to maintain its patience. We will also see the latest Unemployment Rate

which is expected to remain unchanged at 6.4%.

Euroalueen ydinkuluttajahintaindeksi vuositasolla

The BoE is expected to keep the Bank Rate

unchanged at 5.25%. The data leading up to the meeting has been mixed with some

more cooling in the työvoima

markkinoida and wage growth but a surprisingly

kuuma CPI

raportti. Lisäksi, Vähittäiskaupan ja ravintola-alan konsultointi

Myynti saw a big plunge in December while

Ishayoiden opettaman PMI

parani tammikuussa. The central bank will likely maintain its patient

approach reaffirming that they will keep rates high for sufficiently long to

return to the 2% target.

BoE

Yhdysvaltain työttömyyskorvaukset ovat edelleen yksi

tärkeimmistä julkaisuista joka viikko, koska se on ajantasaisempi indikaattori

työmarkkinoiden tilasta. Alkuperäiset korvaukset jatkuvat syklin ympärillä

alhaisimmillaan, kun taas jatkuvat korvaukset saavutettuaan uuden syklin huipun alkoivat kehittyä

alentaa. Tällä viikolla konsensus näkee alkuperäisten vaateiden olevan 210 214 vs. XNUMX XNUMX aikaisempi,

Vaikka jatkuvista väitteistä ei ole yksimielisyyttä, vaikka aikaisempi julkaisu nähtiin

lisäys 1833 1806:aan verrattuna XNUMX XNUMX aiempaan.

Yhdysvaltain työttömyysvaatimukset

Yhdysvaltain ISM Manufacturing PMI on odotettavissa

at 47.3 vs. 47.4 aikaisempi.

Viime viikolla S & P:

Global Manufacturing PMI

for January jumped back into expansion at 50.3, which was the highest reading

2022. lokakuuta lähtien. Maybe the recent

aggressive easing in financial conditions after the Fed’s pivot triggered a

renewed growth impulse and if that’s so, it will be hard for the market to

justify the six rate cuts currently priced for this year.

Yhdysvaltain ISM-valmistus PMI

Perjantai

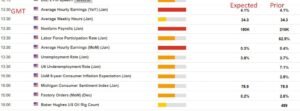

The US NFP is expected to show 173K jobs

added in January compared to 216K seen in joulukuu

and the Unemployment Rate to tick higher to 3.8% vs. 3.7% prior. The Average

Hourly Earnings Y/Y is expected at 4.1% vs. 4.1% prior, while the M/M measure

on 0.3 % vs. 0.4 % aiemmin. The last report had some notable underlying

heikkouksia with the household survey for example showing the largest jobs

decline since April 2020 lockdown, so some more weakness under the hood might

start to unnerve the market.

Yhdysvaltain työttömyysaste

- SEO-pohjainen sisällön ja PR-jakelu. Vahvista jo tänään.

- PlatoData.Network Vertical Generatiivinen Ai. Vahvista itseäsi. Pääsy tästä.

- PlatoAiStream. Web3 Intelligence. Tietoa laajennettu. Pääsy tästä.

- PlatoESG. hiili, CleanTech, energia, ympäristö, Aurinko, Jätehuolto. Pääsy tästä.

- PlatonHealth. Biotekniikan ja kliinisten kokeiden älykkyys. Pääsy tästä.

- Lähde: https://www.forexlive.com/news/weekly-market-outlook-29-02-february-20240128/

- :on

- :On

- :ei

- :missä

- ][s

- $ YLÖS

- 1

- 110

- 2%

- 2020

- 2022

- 2023

- 50

- 7

- 8

- a

- Meistä

- tunnustaa

- poikki

- lisä-

- lisä-

- ADP

- Jälkeen

- vastaan

- aggressiivinen

- Kaikki

- Myös

- Vaikka

- Keskellä

- an

- ja

- Ilmoitus

- lähestymistapa

- huhtikuu

- OVAT

- noin

- AS

- At

- huomio

- Elokuu

- Australia

- Australian kuluttajahintaindeksi

- Australian PPI

- australialainen

- keskimäärin

- takaisin

- Balance

- Pankki

- Pankkikurssi

- BE

- ollut

- alle

- Paremmin

- Jälkeen

- Iso

- BoE

- BOJ

- mutta

- by

- Kanada

- Kanadan BKT

- Kanadan valmistus PMI

- keskeinen

- Keskuspankki

- varmasti

- Tuoli

- haastaja

- muuttaa

- Muutokset

- muuttuviin

- Kiina

- kiinalainen

- Kiinan PMI:t

- vaatimukset

- tuleva

- verrattuna

- kattava

- olosuhteet

- Konferenssi

- luottamus

- Yhteisymmärrys

- kuluttaja

- kuluttajien mielipiteet

- Kuluttajat

- jatkaa

- jatkui

- jatkuu

- jatkuu

- Ydin

- Hinta

- kustannukset

- CPI

- Tällä hetkellä

- Leikkaus

- leikkaukset

- leikkaus

- sykli

- tiedot

- joulukuu

- päätös

- Hylkää

- alapuoli

- Tulot

- helpottaa

- keventäminen

- EKP: n

- korkea

- työllisyys

- Euroalue

- Euroalueen kuluttajahintaindeksi

- Joka

- esimerkki

- laajeneminen

- odottaa

- odotettu

- odottaa

- tosiasia

- Pudota

- Falling

- helmikuu

- Fed

- Kuva

- Talous

- taloudellinen

- Etunimi

- keskityttiin

- FOMC

- varten

- ennusteet

- alkaen

- edelleen

- BKT

- saada

- tietty

- Global

- Kasvu

- HAD

- Kova

- Olla

- Korkea

- korkeampi

- suurin

- Palkkaaminen

- huppu

- KUUMA

- talous

- Miten

- HTTPS

- if

- tärkeä

- parani

- in

- Kasvaa

- lisää

- indeksi

- Osoitin

- teollinen

- Teollisuustuotanto

- inflaatio

- inflaatio

- vaikutus

- vaikuttaneet

- ensimmäinen

- mielenkiintoinen

- tulee

- IT

- SEN

- tammikuu

- Japani

- Japanin teollisuustuotanto

- Job

- työpaikkojen leikkaukset

- työttömyysvaatimukset

- Työpaikat

- jpg

- Pitää

- Labour

- suurin

- Sukunimi

- uusin

- johtava

- tasot

- pitää

- Todennäköisesti

- linja

- Lockdown

- Pitkät

- Lows

- ylläpitää

- valmistus

- monet

- markkinat

- markkinanäkymät

- ehkä

- tarkoittaa

- mitata

- toimenpiteet

- kokous

- Michigan

- ehkä

- menettää

- sekoitettu

- kuukausittain

- lisää

- Lisäksi

- eniten

- Uusi

- KMO

- Nro

- merkittävä

- nyt

- lokakuu

- of

- on

- ONE

- aukot

- Lausunnot

- näkymät

- Ohi

- Kärsivällisyys

- potilas

- Peak

- henkilöstö

- Tappi

- Platon

- Platonin tietotieto

- PlatonData

- syöstä

- pm

- politiikka

- Powell

- ppi

- painaa

- hinnoittelu

- Aikaisempi

- tuotanto

- Edistyminen

- Työnnä

- määrällinen

- määrällinen tiukentaminen

- Neljännes

- neljännesvuosittain

- kyseenalaiseksi

- hinta

- Hinnat

- RBA

- päästäisiin

- Lukeminen

- vahvistavat

- äskettäinen

- suhteellisesti

- vapauta

- Tiedotteet

- jäädä

- jäännökset

- muistutus

- uusi

- raportti

- vähittäiskauppa

- Vähittäismyynti

- palata

- myynti

- näki

- nähdä

- koska

- nähneet

- näkee

- näkemys

- näyttää

- näyttää

- Näytä

- koska

- SIX

- So

- jonkin verran

- jotain

- Alkaa

- alkoi

- Osavaltio

- Lausunto

- tasaisesti

- Yhä

- niin

- YHTEENVETO

- yllättynyt

- Tutkimus

- Sveitsi

- Kohde

- että

- -

- heidän

- ne

- tätä

- tällä viikolla

- Tämä vuosi

- ne

- vaikka?

- rasti

- kiristys

- ajankohtainen

- että

- Trend

- laukeaa

- VUORO

- kaksi

- varten

- taustalla oleva

- työttömyys

- työttömyysaste

- valitettavasti

- yliopisto

- University of Michigan

- Michiganin yliopiston kuluttajamieli

- us

- Yhdysvaltain ISM-valmistus

- Yhdysvaltain ISM-valmistus PMI

- USA:n työpaikkoja

- Yhdysvaltain työttömyysvaatimukset

- meille NFP

- UST

- hyvin

- vs

- palkka

- oli

- Kellot

- we

- heikkous

- viikko

- viikoittain

- joka

- vaikka

- tulee

- with

- vuosi

- vuotta

- zephyrnet