Silicon Valley investing giant Mayfield1 has raised two funds totaling almost $1 billion targeted for early-stage investment.

The Menlo Park-based firm — known as an early backer of such startups as lyft, Marketo y — announced its $580 million Mayfield XVII and the $375 million Mayfield Select III funds.

The firm last announced new funds in March 2020, when it raised $750 million across two funds. The firm now has $3 billion in total assets under management.

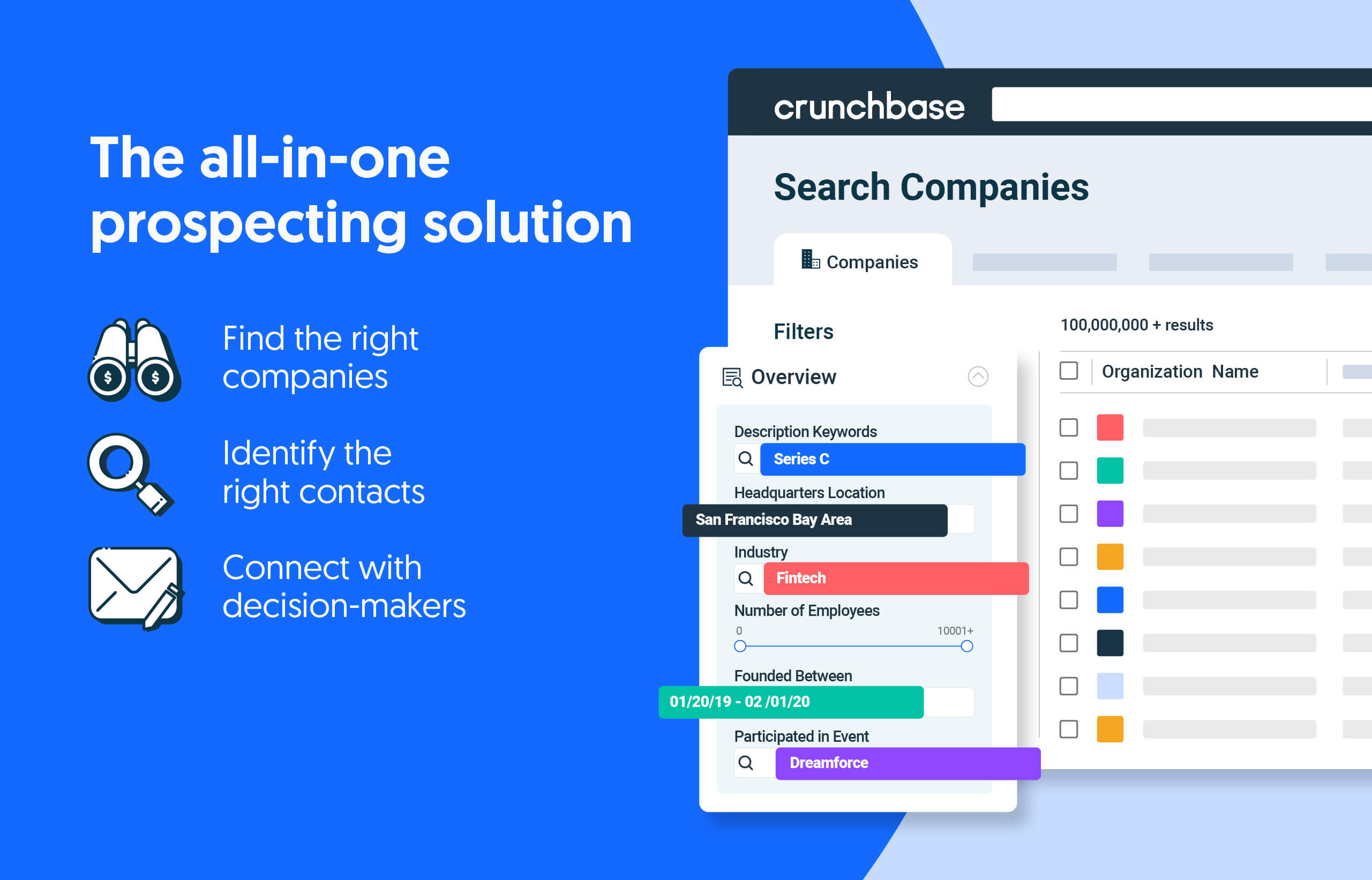

Busca menos. Cierra más.

Aumente sus ingresos con soluciones de prospección todo en uno impulsadas por el líder en datos de empresas privadas.

The Mayfield XVII fund will primarily be used for early-stage investing — mainly seed and Series A rounds. The Mayfield Select III will be for follow-on rounds, as well as investments in new companies, primarily at the Series B stage.

Some themes the firm is looking to invest in include human-centered AI, the developer-first technologies, semiconductors, cybersecurity and more.

“We are grateful for the continued support of our limited partners and for the fortitude of entrepreneurs which brings us to work every day,” said Managing Partner Navin Chadha in a statement. “We believe that the current economic uncertainty presents an opportunity for the bold and a time to lean forward into the next era of innovation. We are excited about partnering with inception and early-stage founders looking for a people-first investor to build a bright future together.”

Recent dealmaking

While some big-name firms such as Tiger Global, Insight Partners and many more significantly slowed their investment pace last year, Mayfield continued a deliberate and consistent cadence.

According to Crunchbase data, the firm completed 26 financing deals in the salad days of 2021, and 23 last year — when the venture and investing market was substantially easing.

So far this year, Mayfield’s pace has been a little slower, with just five deals announced. Those deals include participating in a $27 million Series A for India-based mobility platform Blu-Smart Mobility and a $51 million Series E for San Francisco-based database developer Influjo de datos.

ilustración: Dom Guzmán

Manténgase actualizado con las últimas rondas de financiación, adquisiciones y más con Crunchbase Daily.

En abril de 2022, 16 empresas realizaron al menos 10 inversiones o más en nuevas empresas con sede en EE. UU., lideradas por dos empresas: Y Combinator y Techstars, que combinaron...

El éxito continuo de los jugadores establecidos podría dificultar que las nuevas empresas ambiciosas se pongan al día con la manada de unicornios.

- Distribución de relaciones públicas y contenido potenciado por SEO. Consiga amplificado hoy.

- PlatoAiStream. Inteligencia de datos Web3. Conocimiento amplificado. Accede Aquí.

- Acuñando el futuro con Adryenn Ashley. Accede Aquí.

- Compra y Vende Acciones en Empresas PRE-IPO con PREIPO®. Accede Aquí.

- Fuente: https://news.crunchbase.com/venture/mayfield-early-stage-funding-seed-series-a/

- :posee

- :es

- 1 millones de dólares

- $3

- $ UP

- 10

- 2020

- 2021

- 2022

- 23

- 26

- a

- Sobre

- adquisiciones

- a través de

- AI

- dispositivo todo en uno

- ambicioso

- an

- y

- anunció

- Abril

- somos

- AS

- Activos

- At

- BE

- esto

- CREEMOS

- mil millones

- Brillante

- Trae

- build

- by

- Cadencia

- lucha

- Cerrar

- combinado

- Empresas

- Completado

- consistente

- continuado

- Protectora

- CrunchBase

- Current

- La Ciberseguridad

- todos los días

- datos

- Base de datos

- Fecha

- día

- Días

- Ofertas

- Developer

- e

- Temprano en la

- Etapa temprana

- aliviando

- Economic

- incertidumbre económica

- final

- empresarios

- Era

- se establece

- Cada

- diario

- excitado

- muchos

- financiamiento

- Firme

- empresas

- adelante

- fundadores

- fondo

- universidad

- rondas de financiación

- fondos

- futuras

- gigante

- agradecido

- HTTPS

- in

- comienzo

- incluir

- Innovation

- dentro

- Invertir

- metas de

- inversión extranjera

- Inversiones

- inversor

- IT

- SUS

- jpg

- solo

- conocido

- Apellido

- El año pasado

- líder

- menos

- LED

- menos

- Limitada

- pequeño

- mirando

- hecho

- principalmente

- para lograr

- Management

- administrar

- socio director

- muchos

- Marzo

- marcha 2020

- Mercado

- Mayfield

- podría

- millones

- movilidad

- más,

- hace casi

- Nuevo

- Nuevos fondos

- Next

- ahora

- of

- Oportunidad

- or

- nuestros

- Paz

- participativo

- Socio

- Asociación

- socios

- plataforma

- Platón

- Inteligencia de datos de Platón

- PlatónDatos

- players

- alimentado

- regalos

- las cuales

- elevado

- plantea

- reciente

- Fondos recientes

- ingresos

- rondas

- s

- Said

- San

- dispersores

- Semiconductores

- Serie

- Serie A

- Serie b

- significativamente

- Soluciones

- algo

- Etapa

- Startups

- Posicionamiento

- quedarse

- sustancialmente

- comercial

- tal

- SOPORTE

- afectados

- Tecnologías

- TechStars

- esa

- El

- su

- así

- este año

- aquellos

- equipo

- a

- juntos

- Total

- dos

- Incertidumbre

- bajo

- unicornio

- us

- usado

- Valle

- riesgo

- fue

- we

- WELL

- cuando

- que

- seguirá

- Actividades:

- Y Combinator

- año

- tú

- zephyrnet