USD

- Die Fed ließ die Zinsen wie erwartet unverändert

while dropping the tightening bias in the statement but adding a slight

pushback against a March rate cut. - Fed Chair Powell stressed that they want to see

more evidence of inflation falling back to target and that a rate cut in March

is not their base case. - The latest US GDP beat expectations by a big

Marge. - The US PCE came mostly in line with

expectations with the Core 3-month and 6-month annualised rates falling below

the Fed’s 2% target. - The US Job Openings surprised to the upside

although the hiring and quit rates remain below pre-pandemic levels. - The latest US PMIs beat expectations by a

big margin for both the Manufacturing and Services measures. - The US Retail Sales beat expectations

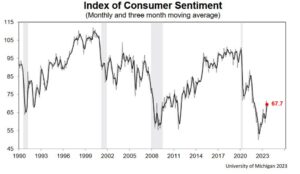

über die Grenze. - The US Consumer Confidence report came in

line with expectations, but the labour market details improved considerably. - Der Markt erwartet nun die erste Zinssenkung im Mai.

GBP (Faster Payments Service, Advcash, ZEN)

- The BoE left interest rates

unchanged as expected at the last meeting with no dovish language as they

reaffirmed that they will keep rates high for sufficiently long to return to

the 2% target. - The latest employment report showed

job losses in December and lower than expected wage growth. - The UK CPI beat expectations across

the board, which is going to reinforce the BoE’s neutral stance. - The latest UK PMIs showed the

Manufacturing sector improving but remaining in contraction while the Services

sector continues to expand. - The latest UK Retail Sales missed

Die Erwartungen auf breiter Front werden deutlich sinken, da die Verbraucherausgaben anhalten

schwach. - The market expects the BoE to start

cutting rates in May.

Technische Analyse des GBPUSD –

Täglicher Zeitrahmen

GBPUSD Täglich

Auf dem Tages-Chart können wir das sehen GBPUSD keeps trading inside the range

between the 1.2610 support and 1.2800 resistance. The price is currently

approaching the support level where we can expect the buyers to step in with a

defined risk below the level to position for another rally into the resistance.

Die Verkäufer hingegen möchten, dass der Preis nach unten sinkt

invalidate the bullish setup and position for a drop into the next support

around the 1.25 handle.

Technische Analyse des GBPUSD –

4 Stunden Zeitrahmen

GBPUSD 4 Stunden

Auf dem 4-Stunden-Chart können wir den Preis sehen

yesterday rallied into the downward trendline and got rejected as the sellers

stepped in to position for a drop into the support. The momentum then picked up

as the Fed resulted a bit more hawkish than expected and today, we can expect

some action around the support as we get the BoE rate decision and some key US

Daten.

Technische Analyse des GBPUSD –

1 Stunden Zeitrahmen

GBPUSD 1 Stunden

Auf dem 1-Stunden-Chart können wir sehen, dass wir

have a steep downward trendline defining the current bearish impulse. If we do

see a bounce from the support, we can expect even more buyers piling in on a

break above the trendline as a confirmation for a change in momentum.

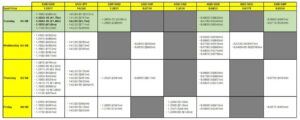

Nächste Events

Today we have the BoE rate

decision where the central bank is expected to keep everything unchanged and

later on, we will see the latest US Jobless Claims figures and the ISM

Manufacturing PMI. Tomorrow, we conclude the week with the US NFP report.

- SEO-gestützte Content- und PR-Distribution. Holen Sie sich noch heute Verstärkung.

- PlatoData.Network Vertikale generative KI. Motiviere dich selbst. Hier zugreifen.

- PlatoAiStream. Web3-Intelligenz. Wissen verstärkt. Hier zugreifen.

- PlatoESG. Kohlenstoff, CleanTech, Energie, Umwelt, Solar, Abfallwirtschaft. Hier zugreifen.

- PlatoHealth. Informationen zu Biotechnologie und klinischen Studien. Hier zugreifen.

- Quelle: https://www.forexlive.com/technical-analysis/gbpusd-technical-analysis-key-levels-in-play-ahead-of-the-boe-decision-20240201/

- :Ist

- :nicht

- :Wo

- $UP

- 1

- 2%

- 25

- a

- oben

- über

- Action

- Hinzufügen

- gegen

- voraus

- Obwohl

- Analyse

- machen

- Ein anderer

- Annäherung

- um

- AS

- At

- Zurück

- Bank

- Base

- bearish

- schlagen

- unten

- zwischen

- vorspannen

- Big

- Bit

- Tafel

- BoE

- BOE-Zinsentscheidung

- beide

- Prallen

- Break

- Bruch

- Bullish

- aber

- Käufer

- by

- kam

- CAN

- Häuser

- Hauptgeschäftsstelle

- Zentralbank

- Vorsitzende

- Übernehmen

- Chart

- aus aller Welt

- Schluss

- Vertrauen

- Bestätigung

- Verbraucher

- weiter

- Kontraktion

- Kernbereich

- CPI

- Strom

- Zur Zeit

- Schneiden

- Schneiden

- Unterricht

- technische Daten

- Dezember

- Entscheidung

- definiert

- Definition

- Details

- do

- Dovish

- nach unten

- Drop

- Abwurf

- Beschäftigung

- Sogar

- alles

- Beweis

- Erweitern Sie die Funktionalität der

- erwarten

- Erwartungen

- erwartet

- erwartet

- Falling

- Fed

- Zahlen

- Vorname

- Aussichten für

- für

- BIP

- bekommen

- gehen

- habe

- Wachstum

- Pflege

- Griff

- Haben

- Falke

- GUTE

- Verleih

- Stunde

- HTTPS

- if

- verbessert

- Verbesserung

- in

- Inflation

- innerhalb

- Interesse

- Zinsen

- in

- Job

- Arbeitslosenansprüche

- Behalten

- Wesentliche

- Schlüsselebenen

- Labour

- Sprache

- Nachname

- später

- neueste

- links

- Niveau

- Cholesterinspiegel

- Line

- Lang

- Verluste

- senken

- Herstellung

- Fertigungssektor

- März

- Marge

- Markt

- Kann..

- Maßnahmen

- Treffen

- vermisst

- Schwung

- mehr

- meist

- Neutral

- weiter

- NFP

- nicht

- jetzt an

- of

- on

- Öffnungen

- Andere

- Stück

- abgeholt

- Plato

- Datenintelligenz von Plato

- PlatoData

- Play

- pmi

- Position

- Powell

- Preis

- sammeln

- Angebot

- Bewerten

- Honorar

- bekräftigt

- verstärken

- Abgelehnt..

- bleiben

- verbleibenden

- bleibt bestehen

- berichten

- Robustes Design

- Folge

- Einzelhandel

- Retail Sales

- Rückkehr

- Risiko

- Vertrieb

- Bibliotheken

- sehen

- Sellers

- Dienstleistungen

- Setup

- zeigte

- einige

- Ausgabe

- Haltung

- Anfang

- Erklärung

- Schritt

- Support

- Unterstützungsstufe

- überrascht

- Target

- Technische

- Technische Analyse

- als

- zur Verbesserung der Gesundheitsgerechtigkeit

- Das

- die Fed

- ihr

- dann

- vom Nutzer definierten

- anziehen

- zu

- heute

- morgen

- Trading

- Uk

- UK CPI

- Britische Einkaufsmanagerindizes

- Einzelhandelsumsätze in Großbritannien

- Gedreht

- us

- US-BIP

- Stellenangebote in den USA

- US-Arbeitslosenansprüche

- uns NFP

- US-PMIs

- US-Einzelhandelsumsätze

- Lohn

- wollen

- we

- Woche

- welche

- während

- werden wir

- mit

- gestern

- Zephyrnet