- The dollar rose as investors lowered their bets for Fed rate cuts this year.

- The BOE plans to increase borrowing costs on Thursday for the 12th consecutive time.

- The Fed and the ECB hiked rates by 25bps last week.

Today’s GBP/USD forecast is slightly bearish. The pound fell as the dollar rose as investors lowered their bets for Fed rate cuts this year. This came after inflation data revealed a continued increase in price pressures despite a decline in the annual figure.

-Möchten Sie mehr darüber erfahren? Forex Boni? Sehen Sie sich unsere ausführliche Anleitung an-

The Bank of England plans to increase borrowing costs on Thursday for the 12th consecutive time. UK inflation is double those in the United States and much higher than in the Eurozone, and market participants have already factored in a quarter-of-a-percentage point rise in Bank Rate.

The BOE’s benchmark rate will be 4.5% after today’s meeting. However, the market’s primary concern will be whether the BOE indicates the likelihood of further rate increases in the months ahead.

Economists earlier this month suggested that the BOE would maintain rates at 4.5% for the rest of the year after a May hike. However, Goldman Sachs predicts that Britain’s borrowing costs will continue to rise to a peak of 5% in August. This is because recent data indicate that price pressures remain high and the economy is outperforming recession expectations.

Last week, the US Federal Reserve and European Central Bank increased their benchmark borrowing rates by 25bps. While Fed Chair Jerome Powell suggested a pause, ECB President Christine Lagarde stated it was too soon to stop.

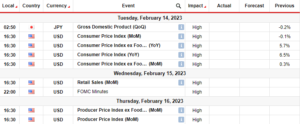

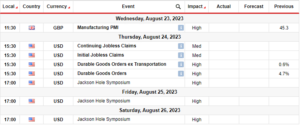

Wichtige GBP/USD-Ereignisse heute

Investors anxiously await the BOE meeting and will look out for the outlook for rate hikes. They will also pay attention to more inflation data from the US.

GBP/USD technical forecast: Shift in sentiment

The pound is declining in the 4-hour chart and has reached the 1.2575 support level. The price has crossed below the 30-SMA, and the RSI has crossed below 50, showing a bearish sentiment shift. Bears showed strength at the 1.2675 resistance level when they made a strong bearish candle. This led to a bearish takeover.

-Möchten Sie mehr darüber erfahren? KI-Handelsmakler? Sehen Sie sich unsere ausführliche Anleitung an-

However, to confirm a reversal in the trend, bears must break below the 1.2575 support level and start making lower lows and highs. A break below the support would also allow them to target the next support at 1.2451.

Möchten Sie jetzt mit Forex handeln? Investieren Sie bei eToro!

68% der Privatanlegerkonten verlieren beim Handel mit CFDs bei diesem Anbieter Geld. Sie sollten überlegen, ob Sie es sich leisten können, das hohe Risiko einzugehen, Ihr Geld zu verlieren

- SEO-gestützte Content- und PR-Distribution. Holen Sie sich noch heute Verstärkung.

- PlatoAiStream. Web3-Datenintelligenz. Wissen verstärkt. Hier zugreifen.

- Die Zukunft prägen mit Adryenn Ashley. Hier zugreifen.

- Kaufen und verkaufen Sie Anteile an PRE-IPO-Unternehmen mit PREIPO®. Hier zugreifen.

- Quelle: https://www.forexcrunch.com/gbp-usd-forecast-dollar-rebounds-investors-await-boe/

- :hast

- :Ist

- 1

- 30

- 50

- a

- Über Uns

- Trading Konten

- Nach der

- voraus

- erlauben

- bereits

- ebenfalls

- und

- jährlich

- AS

- At

- Aufmerksamkeit

- AUGUST

- – warten auf Sie!

- Bank

- Bank of England

- Bankrate

- BE

- bearish

- Bären

- weil

- unten

- Benchmark

- Benchmark-Rate

- Wetten

- BoE

- Boni

- Ausleihen

- Break

- by

- kam

- CAN

- Hauptgeschäftsstelle

- Zentralbank

- CFDs

- Vorsitzende

- Chart

- aus der Ferne überprüfen

- Christine

- CHRISTINE LAGARDE

- Hautpflegeprobleme

- Schichtannahme

- aufeinanderfolgenden

- Geht davon

- Container

- fortsetzen

- weiter

- Kosten

- Crossed

- Schnitte

- technische Daten

- Ablehnen

- Sinkend

- Trotz

- detailliert

- Dollar

- doppelt

- Früher

- EZB

- EZB-Präsident

- Wirtschaft

- England

- Europäische

- Europäische Zentralbank

- Eurozone

- Veranstaltungen

- Erwartungen

- Fed

- Fed-Vorsitzender

- Fed-Vorsitzender Jerome Powell

- Bundes-

- federal reserve

- Abbildung

- Aussichten für

- Prognose

- Forex

- für

- weiter

- GBP / USD

- goldman

- Goldman Sachs

- Haben

- GUTE

- höher

- Highs

- Wandern

- Wanderungen

- aber

- HTTPS

- in

- Erhöhung

- hat

- Steigert

- zeigen

- zeigt

- Inflation

- interessiert

- Investieren

- Investor

- Investoren

- IT

- jerome

- Jerome Powell

- Wesentliche

- Lagarde

- Nachname

- lernen

- geführt

- Niveau

- aussehen

- verlieren

- verlieren

- gesenkt

- Lows

- gemacht

- halten

- Making

- Markt

- max-width

- Kann..

- Treffen

- Geld

- Monat

- Monat

- mehr

- viel

- sollen

- weiter

- jetzt an

- of

- on

- UNSERE

- Outlook

- outperforming

- Teilnehmer

- Pause

- AUFMERKSAMKEIT

- Haupt

- Pläne

- Plato

- Datenintelligenz von Plato

- PlatoData

- Points

- Pfund

- Powell

- sagt voraus,

- Präsident

- Preis

- primär

- Versorger

- Bewerten

- Zinserhöhungen

- Honorar

- erreicht

- kürzlich

- Rezession

- bleiben

- RESERVE

- Robustes Design

- REST

- Einzelhandel

- Revealed

- Umkehrung

- Rise

- Risiko

- ROSE

- REIHE

- rsi

- Sachs

- Gefühl

- verschieben

- sollte

- zeigte

- Bald

- Anfang

- angegeben

- Staaten

- Stoppen

- Stärke

- stark

- Support

- Unterstützungsstufe

- SVG

- Nehmen

- Übernahme

- Target

- Technische

- als

- zur Verbesserung der Gesundheitsgerechtigkeit

- Das

- die Fed

- Die US-Notenbank

- ihr

- Sie

- vom Nutzer definierten

- fehlen uns die Worte.

- dieses Jahr

- diejenigen

- Donnerstag

- Zeit

- zu

- heutigen

- auch

- Handel

- Trading

- Trend

- Drehungen

- Uk

- UK-Inflation

- Vereinigt

- USA

- us

- US-Bundes

- uns Federal Reserve

- wurde

- Woche

- wann

- ob

- während

- werden wir

- mit

- würde

- Jahr

- U

- Ihr

- Zephyrnet