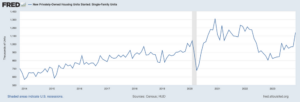

Median asking rents are beginning to dip in many markets, according to new data from Redfin, a turnaround from the skyrocketing rent prices observed last spring. The median national asking rent fell to $1,937 in March, a 0.4% year-over-year decline. Median asking rent prices are lower than they’ve been in over a year, and the days of 竞标战 for an apartment are coming to an end in many markets. It’s indicative of a correction from overinflated rent prices that resulted in part from a pandemic-driven demand for more space. But rents are still about 20% higher than they were when the pandemic began.

Why Are Rent Prices Cooling?

From the supply side, new housing construction has finally caught up to pandemic demand. In 2022, there were more multifamily housing starts with five units or more than in any year since 1986, according to 人口调查局数据. And the number of completed multifamily buildings with five units or more surged 72% in February, reaching one of the highest levels in decades.

Rental demand is also waning. Due to rapidly-rising rent prices in 2022 and fears of an upcoming recession, renters are discouraged from moving and incentivized to stay in their current leases. And housing affordability issues are causing more older folks to 搬进去 with their adult children, even before their health declines. More young people are renting with 室友 and parents as well. These factors are causing rental vacancy rates to rise, returning to their long-term average.

短租市场 paints a similar picture—investors rushed to meet the demand for vacation rentals during the pandemic, and the surplus of properties is leading to increased vacancy rates. That’s true even as demand remains 出奇的强大 amid inflation-strained budgets and recession fears.

Where Are Rent Prices Falling the Most?

- 德克萨斯州奥斯汀 (-11%)

- 伊利诺伊州芝加哥 (-9.2%)

- New Orleans, Louisiana (-3%)

- 阿拉巴马州伯明翰 (-2.9%)

- Cincinnati, Ohio (-2.9%)

- Sacramento, California (-2.8%)

- Las Vegas, Nevada (-2.4%)

- 佐治亚州亚特兰大 (-2.3%)

- Phoenix, Arizona (-2.1%)

- Baltimore, Maryland (-2%)

The largest declines in median asking rent prices were in Austin, where asking rents dropped 11%, and Chicago, where asking rents dropped 9.2% from the previous year. Last May, Austin had the highest year-over-year increase in rent prices, at 48%, according to 红鳍数据. This was a result of tech companies relocating to the area and attracting new high-earning residents at a time when mortgage rates were increasing. In the second quarter of 2022, 潜在客户数据 began to show renters looking to move out of Austin. Now, rent prices are normalizing in the city due to curbed demand.

Cincinnati saw a similarly significant year-over-year rent increase last May, so rents are normalizing there as well. In Chicago, the rental supply increased during the pandemic as new landlords tried to cash in on high rents, and many chose to rent rather than sell at the tail end as homebuying demand decreased, according to Chicago Redfin real estate agent Dan Close.

Where Are Rents Rising?

- Raleigh, North Carolina (16.6%)

- Cleveland, Ohio (15.3%)

- 北卡罗来纳州夏洛特 (13%)

- Indianapolis, Indiana (10.5%)

- Nashville, Tennessee (9.6%)

- 俄亥俄州哥伦布市 (9.4%)

- 密苏里州堪萨斯城 (8.1%)

- Riverside, California (7.2%)

- Denver, Colorado (7%)

- St. Louis, Missouri (4.2%)

In some metros, rents just keep rising, but even the 16.6% year-over-year growth in asking rent in Raleigh doesn’t come close to the increases shown in last year’s data. A thriving tech scene in cities like Raleigh, Charlotte, and Nashville continues to bring new residents in droves, keeping rent prices inflated even as new residential buildings are erected.

At the same time, high home prices and rising interest rates turned many would-be homebuyers into renters. For example, in Denver, skyrocketing home prices in recent years have led to a growing group of high-income renters who were priced out of homeownership.

Jennifer Bowers, a Redfin real estate agent in Nashville, says asking rents are also rising in the city because a huge influx of investors bought properties in the area. This contributed to soaring demand by increasing the competition for starter homes, thereby making it possible for investors to charge top-dollar rents. Investors accounted for 26% of home sales in Tennessee during 2021, according to 皮尤研究.

这对投资者意味着什么

This data doesn’t necessarily mean that investors should flock to multifamily investment opportunities in cities like Raleigh and Cleveland. After all, imagine if you had bought a home in Austin last March in an attempt to capture high rents up 同比增长38%. A year later, you’d be lowering your asking rent and waiting for an average 16.3% decline in year-over-year home values to turn around.

Thinking one step ahead could yield better results. If you can find a market where home values are still relatively low, and rent prices are likely to rise due to projected job growth in the area or overflow from nearby hubs, you’ll be in a better position to reap the rewards of local rent increases.

Still, there’s no crystal ball foretelling the perfect strategy. Real estate and rent prices will always fluctuate, though some markets are more stable than others. Maintaining flexibility and having patience may serve you even better than nailing the perfect timing for your purchase.

在几分钟内找到代理

与对投资者友好的代理人匹配,他们可以帮助您找到、分析和完成下一笔交易。

BiggerPockets 的注释: 这些是作者撰写的观点,并不一定代表 BiggerPockets 的观点。

- SEO 支持的内容和 PR 分发。 今天得到放大。

- 柏拉图区块链。 Web3 元宇宙智能。 知识放大。 访问这里。

- 与 Adryenn Ashley 一起铸造未来。 访问这里。

- Sumber: https://www.biggerpockets.com/blog/10-markets-where-rent-is-falling

- :具有

- :是

- :不是

- $UP

- 10

- 2%

- 2021

- 2022

- 7

- 8

- 9

- a

- 关于

- 根据

- 成人

- 后

- 经纪人

- 向前

- 阿拉巴马

- 所有类型

- 还

- 时刻

- 中

- an

- 分析

- 和

- 任何

- 公寓

- 保健

- 国家 / 地区

- 亚利桑那

- 围绕

- AS

- At

- 吸引

- 奥斯汀

- 作者

- 球

- BE

- 因为

- 很

- before

- 开始

- 开始

- 更好

- 更好的位置

- 阻止

- 边界

- 买

- 带来

- 预算

- 办公室

- 但是

- by

- 加州

- CAN

- 捕获

- 现金

- 抓

- 造成

- 人口调查

- 充

- 夏洛特

- 芝加哥

- 儿童

- 选择

- 城市

- 城市

- 克利夫兰

- 关闭

- 科罗拉多州

- 如何

- 未来

- 公司

- 竞争

- 完成

- 施工

- 继续

- 贡献

- 可以

- 水晶

- 电流

- data

- 一年中的

- 处理

- 几十年

- 拒绝

- 下降

- 需求

- 丹佛

- 蘸酱

- 泄气

- 不会

- 下降

- ,我们将参加

- 房地产

- 甚至

- 例子

- 因素

- 落下

- 恐惧

- 二月

- 终于

- 找到最适合您的地方

- 姓氏:

- 高度灵活

- 波动

- 针对

- 对于投资者

- 预言

- 止

- 团队

- 事业发展

- 哈佛

- 有

- 有

- 健康管理

- 帮助

- 老旧房屋

- 高

- 更高

- 最高

- 主页

- 家园

- 住房

- HTML

- HTTPS

- 巨大

- 伊利诺伊州

- 想像

- in

- 诱因

- 增加

- 增加

- 增加

- 增加

- 印地安那

- 辐辏

- 兴趣

- 利率

- 成

- 投资

- 投资机会

- 投资者

- 问题

- IT

- 工作

- 只是

- 保持

- 保持

- 最大

- 名:

- 领导

- 导致

- 各级

- LG

- 喜欢

- 容易

- 本地

- 长期

- 寻找

- 路易

- 路易斯安那州

- 低

- 降低

- 制作

- 许多

- 三月

- 市场

- 市场

- 马里兰州

- 可能..

- 手段

- 满足

- 更多

- 抵押

- 最先进的

- 移动

- 移动

- 纳什维尔

- National

- 一定

- 内华达州

- 全新

- 下页

- 北

- 北卡罗来纳州

- 现在

- 数

- of

- 俄亥俄州

- on

- 一

- 意见

- 机会

- or

- 其它

- 超过

- 流感大流行

- 父母

- 部分

- 忍耐

- 员工

- 柏拉图

- 柏拉图数据智能

- 柏拉图数据

- 位置

- 可能

- 以前

- 价格

- 预计

- 采购

- 季

- 最快

- 罗利

- 价格表

- 宁

- 达

- 真实

- 房地产

- 最近

- 不景气

- 雷德芬

- 相对

- 出租

- 出租

- 租房

- 代表

- 住宅

- 居民

- 导致

- 成果

- 返回

- 奖励

- 上升

- 上升

- 圆

- 销售

- 同

- 说

- 现场

- 其次

- 第二季度

- 出售

- 服务

- 应该

- 显示

- 如图

- 显著

- 类似

- 同样

- 自

- So

- 冲天

- 一些

- 太空

- 弹簧

- 稳定

- 启动

- 留

- 步

- 仍

- 策略

- 供应

- 激增

- 盈余

- 科技

- 高科技公司

- 德州

- 比

- 这

- 区域

- 其

- 那里。

- 从而

- 博曼

- 他们

- Free Introduction

- 熙

- 次

- 定时

- 至

- true

- 转

- 转身

- 单位

- 即将上市

- 假期

- 价值观

- VEGAS

- 等候

- 是

- 网页

- 井

- 为

- WHO

- 将

- 书面

- WSJ

- 年

- 年

- 产量

- 您

- 年轻

- 您一站式解决方案

- 和风网