According to Fenergo estimates “poor customer experience” is costing financial institutions $10 billion in revenue per year. 36% of financial institutions have lost customers due to inefficient or slow onboarding, and 81% believe poor data management lengthens

onboarding and negatively affects customer experience.

How do you encourage users to not only rank your app with 5 stars in the Apple Store and Google Play but also gain their loyalty and trust? It’s no secret that the digital customer experience today is what differentiates demanded financial brands. The main

struggle is keeping up by creating a digital banking customer experience that WOWs.

Financial services customer experience refers to customer interactions with their bank, typically including online and mobile banking services, visiting a physical branch, or speaking with customer service representatives. The digital banking customer experience

(digital banking CX or UX – user experience) consists of all the emotions, thoughts and behavior of a customer triggered in using a digital banking service. A banking customer experience is generated by all digital products and brand ecosystems, including

previous customer engagements and future expectations.

The goal of improving customer experience in financial services is to make banking services as convenient, efficient, and pleasant as possible for the customer. This can be achieved through various means, such as offering an appropriate range of services

and features, providing clear and helpful information and assistance, and ensuring that the customer’s interactions with the bank are smooth and hassle-free. Make sure that financial service customer experience aligns with brand identity and business strategy.

At the same time, remember that in the digital age, brand reputation is no longer a guarantee of loyalty and can be instantly damaged by a problem with a mobile application caused by poor CX / UX design since the customer experience is a highly dynamic process.

我想描述 5 年改善金融服务数字化 CX 的 2024 种方法:

1. 建立体验心态

The development of digital technology is disrupting all the industries. What has been proven to work for decades, like traditional marketing and product approach, has stopped working. The world is making new demands on businesses, and the financial industry

也不例外。

如今,由于低准入门槛和开放银行业务,客户每年都有数十种新的选择。这就是为什么为了在数字时代生存,金融品牌需要采用全新的思维和经营方式。

Social networks, information transparency and demand for sustainability challenge businesses to put the people first by becoming customer-centered and deliver experiences instead of manipulating customers to reap profits. That’s why the future of the banking

industry depends entirely on how the new generation of bankers can bring their mindset in line with the digital age to provide the best possible banking customer experience.

有五种关键态度可以融入公司的 DNA 中,旨在使团队思维以目标为导向,并将商业文化转变为数字时代的成功。

- 服务而不是销售。 The “sell” priority is all about focusing on marketing and looking at people as numbers behind conversion. Design, in this case, is only about using attractive packaging to sell more, and UX is just one more tool

to manipulate user behavior. To focus the business team on customer needs, feelings and behaviors, we need to prioritize “Serve.” In this case, conversion became just a metric to evaluate product clarity, because the main aim is to provide real benefit for

the customer. And, a lot of customers will appreciate it, using the digital space to express their gratitude and attract more users. - 情绪胜过信息。 People often forget information but remember experiences, and those are created from emotions. That’s why information should be integrated into a context of usage. It should become an organic part of the banking

user experience that is based on emotions, because emotions are the main language to communicate with the customers and understand their needs and expectations. - 解决方案而不是功能。 Don’t make your users have to think about how to use hundreds of offered features. Instead, provide them with an easy to use solution. According to psychology experiments, too many options can cause decision

paralysis. Users don’t come to you for the hundreds of options you can offer. They have a specific problem and goal in mind that your financial product has to help to achieve. - 破坏大于保护。 Traditional banks and other well-established businesses are focused on protecting their legacy and maintaining the corporate image. That’s why change comes slowly and painfully. Instead of thinking about how

to protect their products from the digital challenge and prevent customers from leaving, banks have to figure out how to stop self-deception and disrupt themselves and their competitors. In the experience age, self-disruption is the only way to provide meaningful

and pleasant products for users. - 创建流程,避免碎片化。 It is a common mistake to view services and products as separate parts. But, the human brain perceives experiences holistically – as a whole entity. Customers see the product as a continuous experience

flow, even lasting for years. Transition to the same thinking is the only way for businesses to ensure a delightful user journey. We need to detect links among user needs, emotions, behavior and service features, design and strategy. Separation of service

elements by different departments caused by organizational silos fills the customer experience with friction. We need to defragment business and ensure a frictionless flow that makes service pleasant.

2. 关注独特的产品价值主张

积极贯彻目标驱动思维工作原则的金融公司旨在为用户带来最大价值。作为交换,客户很乐意以忠诚度回报公司,并通过推荐他们的服务来支持公司的发展。

The central question in the creation of any financial product is WHY it is needed. What exactly makes the product valuable and unique to the users? What problems will it solve, and what benefits will it provide? By not treating all of these questions with

dignity, the financial company is risking its product quickly sinking into the “red ocean” of competition.

There are concrete product growth stages that depend on the level of competition and the demand from the customers. Understanding these stages helps to define and create the perfect match between the financial product’s value proposition and the market demand,

leading to success.

竞争要求金融企业家跳出框框,识别客户的期望。竞争越大,就越需要市场优势来征服竞争对手。

If financial product functionality is not enough to compete, provide usability. If all the competitors have the same functionality and usability, add aesthetics. If you need even more of an advantage, connect the product with the customer’s lifestyle by

personalizing it and making it a symbol of their status. And, finally, you can go even further and state the mission to deliver the ultimate value that will change the world and gain followers who look up to you.

通过使命、地位、美学和可用性来瞄准独特的产品价值主张,有助于通过以客户为中心的产品设计最大限度地满足用户的需求。

现代银行已经为客户提供了基本的服务功能。数字银行行业的创新已从功能阶段转向可用性和美观阶段,以与客户建立情感联系。

Despite that, there are still many traditional banks that struggle with Usability. Meanwhile, progressive FinTechs are quickly climbing up the ladder, reaching the Status stage by personalizing and providing digital financial services that are enjoyable,

attractive and serve the needs of specific audiences.

3. 整合各个层面的设计方法

By focusing on the usability, aesthetics and status of the product, you can engage digital users, but this is not enough. To ensure a long-term market need for your product, it is necessary to integrate customer-centricity into all levels and processes of

the company, putting the user at the forefront.

In many cases, incorrect design integration in the process of product creation leads to harmful consequences. It’s like in construction: a skyscraper can’t stand without a well-thought-out and grounded architectural plan. The financial product with amateur

UX will lack demand in the market, could be rejected by the users, often exceeds the development budget or doesn’t even get launched at all.

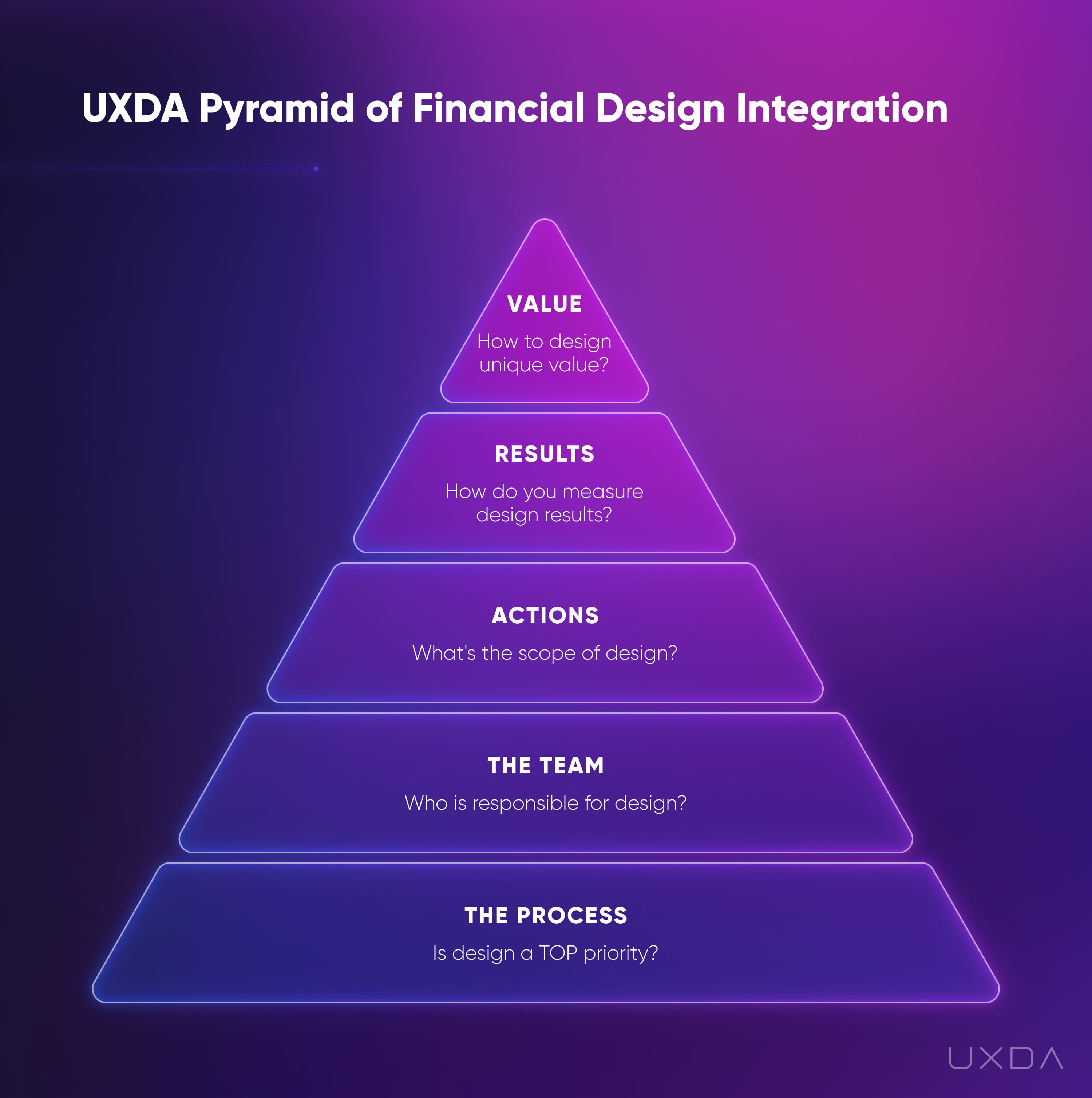

有五个相互关联的领域,可以在其中集成设计方法,以确保长期提供最佳的客户体验。总体而言,这五个领域与业务发展的主要要素相匹配。

当您有了可靠的商业想法时,您需要通过定义关键流程来创建商业模型,以帮助您实现预期目标。在这里,您可以制定一种设计方法,为所有财务业务流程提供动力。

下一步,您需要一支有资格执行您的想法的专家团队。此时,请确保添加掌握金融数字产品的人员的金融用户体验设计专业知识。

当您找到与您的挑战相匹配的专业人员时,您需要他们采取正确的行动,使您更接近产品实现。通过定义结果驱动的行动来加速设计影响。

为了确保您朝着正确的方向前进,您必须评估您的团队正在产生的结果。您应该通过设计为客户服务的方式来衡量设计的质量。

最后,如果前面的所有步骤都成功完成,您就可以掌握您的金融产品将为客户提供的独特价值,将数字产品变成一个成功的故事。

4. 使用正确的 CX 设计方法

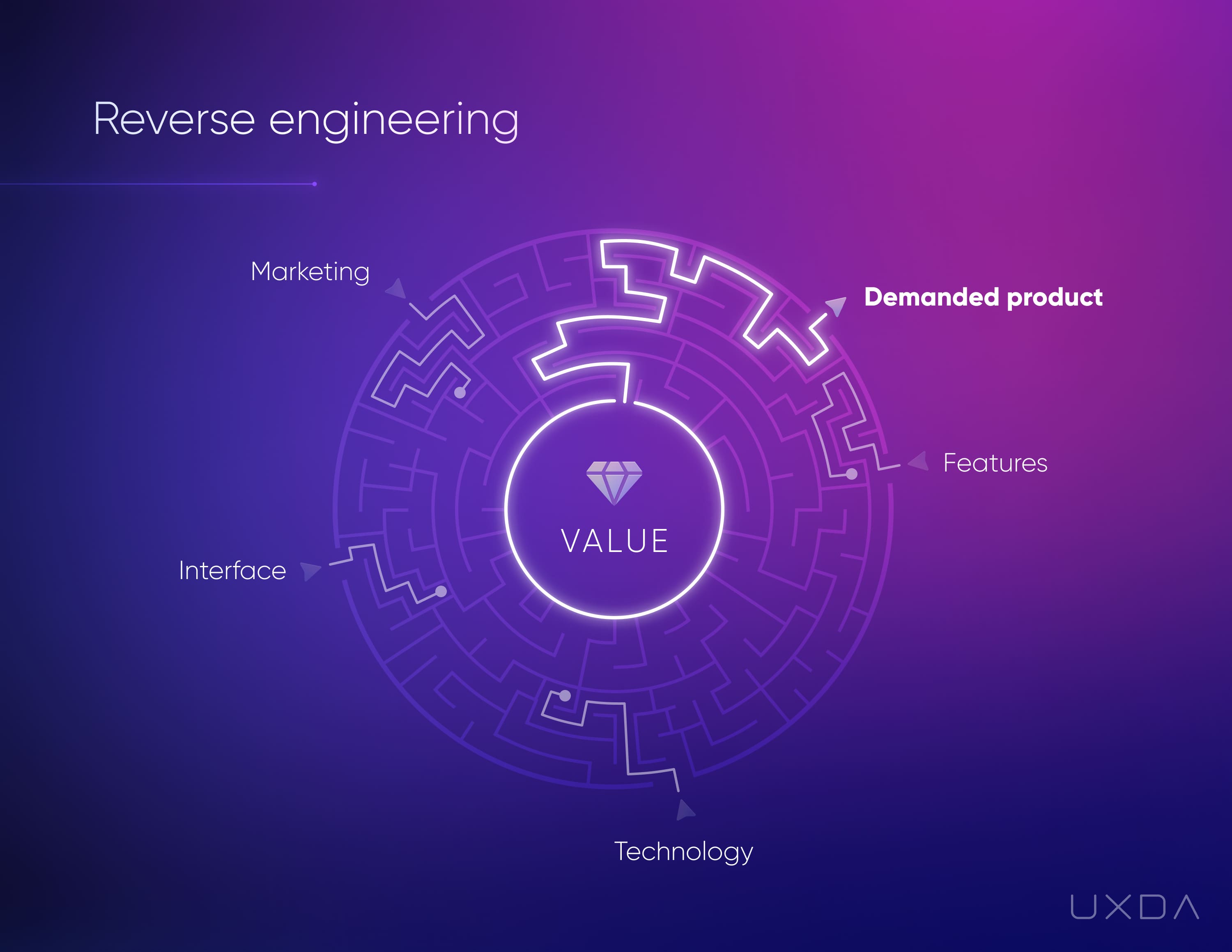

As a typical business delivery starts with Process and ends with Value to customer, then the easiest way to design the best possible digital experience is to do it in reverse. We should start with defining the ultimate Value for the customer and only then

move on to an action plan.

我们可以将逆向工程比作一个有多个入口、只有一个出口的迷宫。入口是不同类型的产品配置、功能和特性,出口是市场的高需求和成功。

Usually, entrepreneurs try to guess which configuration they should develop to gain success. They look around to identify what products are trending, code a lot of features to impress customers and finally pack all this into a vibrant design to grab attention.

Then they spend tons of money on advertising to convince consumers that they need this.

In reverse engineering, you significantly reduce uncertainty by starting from the maze exit and moving to the correct entry point. In this case, the exit of the maze is the point at which the product is highly demanded because of the value it provides to

customers. By using the CX / UX design approach, we are exploring the value that’s significant to customers and putting the focus of the product and the entire business on the needs of customers.

Though CX and UX design is trending today, only a few financial product experts are capable of successfully translating it into architecture and the user interface of a particular product because it requires knowledge in human psychology, behavior and design

arts. Perhaps this explains why most of the financial solutions around us still look outdated and amateur, despite the multiple designers involved in the product development teams.

设计一个以客户为中心、基于用户价值的金融产品由三个关键要素组成:设计思维、业务/用户/产品框架和用户体验设计工具。

设计思维是金融用户体验方法论的基础。它提供了一种有条不紊、迭代的方法,通过五个阶段——移情、定义、构思、原型和测试来探索和满足关键用户需求。

为了确保整体成功,我们必须从业务、用户和产品的角度实施设计思维过程的所有五个部分。通过这种方式,我们找到、定义并实现了每个人的最大价值和收益。

最后,用户体验设计工具提供了执行整个流程的最佳方式,确保有效的基于结果的金融产品转型。

5. 探索客户的背景

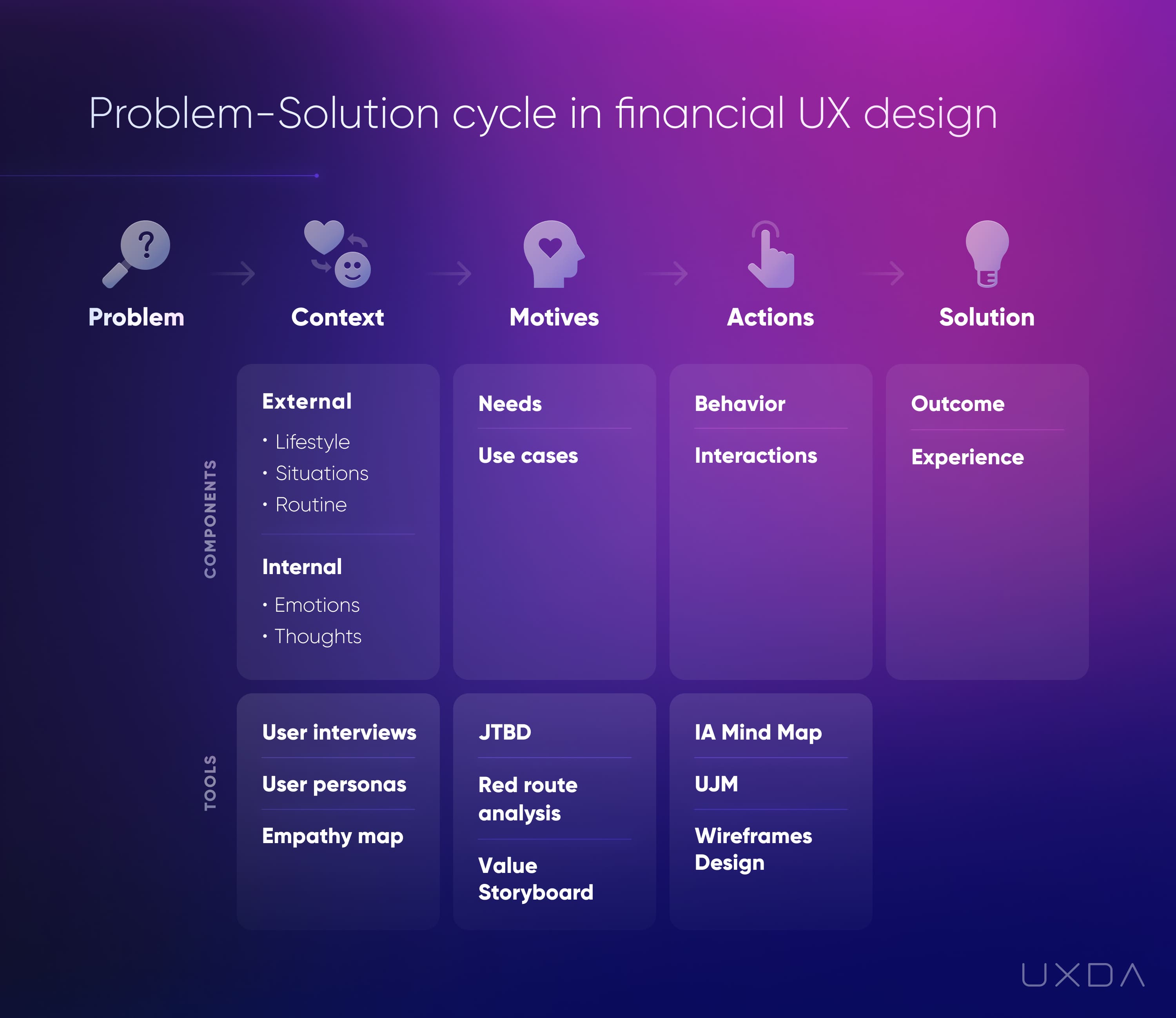

At this point, you might feel like you have enough powerful knowledge to go straight to addressing your customer problems with your financial service experience design. Yes, it all starts with a good solution to an important problem. But, between the problem

and the solution, there are three crucial conditions that differentiate whether or not a product will match real users’ needs.

为了打造受客户喜爱的数字金融服务,我们从问题入手。

为了清楚地定义问题和任务,我们通过创建用户角色并定义他们要完成的工作来探索问题解决周期对银行客户体验的影响。

在整个过程中,我们明确了问题发生的背景、决定操作的用户动机以及应用正确解决方案所需的人员。

在此过程中,使用了金融用户体验设计方法论以及移情图、红色路线图、UJM、用户流程、线框图、UI设计和测试等用户体验工具。

- SEO 支持的内容和 PR 分发。 今天得到放大。

- PlatoData.Network 垂直生成人工智能。 赋予自己力量。 访问这里。

- 柏拉图爱流。 Web3 智能。 知识放大。 访问这里。

- 柏拉图ESG。 碳, 清洁科技, 能源, 环境, 太阳能, 废物管理。 访问这里。

- 柏拉图健康。 生物技术和临床试验情报。 访问这里。

- Sumber: https://www.finextra.com/blogposting/25474/five-ways-to-improve-customer-experience-in-financial-services-in-2024?utm_medium=rssfinextra&utm_source=finextrablogs

- :具有

- :是

- :不是

- $UP

- 2024

- a

- 关于

- 绝对

- 加快

- 完成

- 根据

- 实现

- 横过

- 操作

- 行动

- 积极地

- 加

- 解决

- 采用

- 优点

- 广告

- 年龄

- 瞄准

- 对齐

- 所有类型

- 已经

- 还

- 替代品

- 业余

- 其中

- an

- 和

- 任何

- 应用

- Apple

- 应用领域

- 使用

- 欣赏

- 的途径

- 适当

- 建筑的

- 架构

- 保健

- 地区

- 围绕

- 艺术

- AS

- 帮助

- At

- 关注我们

- 生

- 吸引力

- 观众

- 避免

- 银行

- 银行家

- 银行业

- 银行业

- 银行

- 障碍

- 基于

- 基本包

- 基础

- BE

- 成为

- 因为

- 成为

- 成为

- 很

- 行为

- 背后

- 相信

- 得益

- 好处

- 最佳

- 之间

- 大

- 亿

- 键

- 盒子

- 大脑

- 分支机构

- 品牌

- 品牌

- 带来

- 预算

- 商业

- 业务发展

- 商业模式

- 业务流程

- 经营策略

- 企业

- 但是

- by

- CAN

- 能力

- 案件

- 例

- 原因

- 造成

- 中央

- 挑战

- 更改

- 明晰

- 清除

- 明确地

- 攀登

- 接近

- 码

- 认识

- 如何

- 购买的订单均

- 相当常见

- 通信

- 公司

- 公司

- 比较

- 竞争

- 竞争

- 竞争对手

- 具体

- 条件

- 配置

- 分享链接

- 已联繫

- 征服

- 后果

- 由

- 施工

- 消费者

- 上下文

- 连续

- 便捷

- 转化

- 说服

- 公司

- 正确

- 可以

- 创建信息图

- 创建

- 创造

- 创建

- 关键

- 文化塑造

- 顾客

- 客户体验

- 客户服务

- 合作伙伴

- CX

- 周期

- data

- 数据管理

- 几十年

- 决定

- 定义

- 定义

- 愉快

- 交付

- 交货

- 需求

- 要求

- 需求

- 部门

- 依赖

- 依靠

- 描述

- 设计

- 设计思想

- 设计师

- 期望

- 尽管

- 检测

- 开发

- 研发支持

- 开发团队

- 听写

- 不同

- 区分

- 数字

- 数字时代

- 数字银行

- 数字空间

- 数字技术

- 方向

- 破坏

- 的DNA

- do

- 不会

- 不

- 完成

- 几十个

- 两

- 动态

- 每

- 最简单的

- 易

- 生态系统

- 有效

- 高效

- 分子

- 情绪

- 移情

- 授权

- 鼓励

- 结束

- 结束

- 从事

- 订婚

- 工程师

- 愉快的

- 更多

- 确保

- 保证

- 整个

- 完全

- 实体

- 企业家

- 条目

- 建立

- 醚(ETH)

- 评估

- 甚至

- 所有的

- 究竟

- 超过

- 例外

- 交换

- 执行

- Exit 退出

- 期望

- 体验

- 体验

- 实验

- 专门知识

- 专家

- 介绍

- 探索

- 探索

- 特快

- 特征

- 感觉

- 情怀

- Fenergo

- 少数

- 数字

- 填充

- 终于

- 金融

- 金融

- 金融机构

- 金融服务

- 金融服务

- 找到最适合您的地方

- fintechs

- 姓氏:

- 五

- 流

- 流动

- 专注焦点

- 重点

- 聚焦

- 追随者

- 针对

- 第一线

- 发现

- 碎片

- FRAME

- 摩擦

- 无摩擦

- 止

- 汽油

- 功能

- 进一步

- 未来

- Gain增益

- 收益

- 其他咨询

- 产生

- 代

- 得到

- 乐意

- Go

- 目标

- 非常好

- 谷歌

- Google Play

- 抢

- 把握

- 感谢

- 更大的

- 事业发展

- 保证

- 有害

- 有

- 帮助

- 有帮助

- 帮助

- 此处

- 高

- 高度

- 创新中心

- How To

- HTTPS

- 人

- 数百

- 主意

- 鉴定

- 身分

- if

- 图片

- 影响力故事

- 实施

- 重要

- 改善

- 改善

- in

- 包含

- 行业

- 行业中的应用:

- 低效

- 信息

- 创新

- 即刻

- 代替

- 机构

- 整合

- 集成

- 积分

- 互动

- 接口

- 成

- 参与

- IT

- 它的

- 工作机会

- 旅程

- JPG

- 只是

- 只有一个

- 保持

- 键

- 知识

- 缺乏

- 阶梯

- 语言

- 持久

- 推出

- 领导

- 信息

- 离开

- 遗产

- Level

- 各级

- 生活方式

- 喜欢

- Line

- 链接

- 长

- 长期

- 不再

- 看

- 寻找

- 丢失

- 占地

- 爱

- 低

- 忠诚

- 主要

- 维持

- 使

- 制作

- 制作

- 颠覆性技术

- 操纵

- 许多

- 地图

- 市场

- 营销

- 匹配

- 物化

- 生产力

- 最多

- 有意义的

- 手段

- 与此同时

- 衡量

- 有条不紊

- 研究方法

- 公

- 可能

- 介意

- 思维定势

- 使命

- 错误

- 联络号码

- 手机银行

- 模型

- 钱

- 更多

- 最先进的

- 移动

- 移动

- 移动

- 多

- 相互

- 必要

- 需求

- 打印车票

- 需要

- 负

- 网络

- 全新

- 下页

- 没有

- 数字

- of

- 提供

- 最多线路

- 提供

- 经常

- on

- 前期洽谈

- 一

- 在线

- 仅由

- 打开

- 开放银行

- 操作

- 附加选项

- or

- 秩序

- 有机

- 组织

- 其他名称

- 输出

- 超过

- 最划算

- 类型

- 包装

- 部分

- 特别

- 部分

- 员工

- 为

- 也许

- 透视

- 的

- 地方

- 计划

- 柏拉图

- 柏拉图数据智能

- 柏拉图数据

- 播放

- 点

- 贫困

- 可能

- 强大

- 防止

- 以前

- 原则

- 优先

- 优先

- 市场问题

- 问题方案

- 问题

- 过程

- 过程

- 生产

- 产品

- 产品设计

- 产品开发

- 热销产品

- 专业人士

- 利润

- 进步

- 正确

- 主张

- 保护

- 保护

- 保护

- 原型

- 成熟

- 提供

- 提供

- 提供

- 优

- 心理学

- 放

- 把

- 金字塔

- 合格

- 质量

- 题

- 有疑问吗?

- 很快

- 范围

- 排名

- 达到

- 达

- 真实

- 实现

- 收割

- 建议

- 红色

- 减少

- 指

- 被拒绝..

- 纪念

- 代表

- 声誉

- 必须

- 需要

- 成果

- 收入

- 反转

- 奖励

- 右

- 冒着

- 路线

- s

- 同

- 秘密

- 看到

- 出售

- 分开

- 服务

- 服务

- 服务

- 特色服务

- 转移

- 应该

- 显著

- 显著

- 筒仓

- 自

- 摩天大楼

- 放慢

- 慢慢地

- 光滑

- 固体

- 方案,

- 解决方案

- 解决

- 太空

- 发言

- 专家

- 具体的

- 花

- 阶段

- 实习

- 站

- 明星

- 开始

- 开始

- 启动

- 州/领地

- Status

- 步

- 步骤

- 仍

- Stop 停止

- 停止

- 商店

- 故事

- 直

- 策略

- 奋斗

- 成功

- 成功的故事

- 顺利

- 这样

- 支持

- 肯定

- 生存

- 永续发展

- 符号

- T

- 采取

- 需要

- 任务

- 团队

- 队

- 专业技术

- 术语

- test

- 测试

- 这

- 未来

- 世界

- 其

- 他们

- 他们自己

- 然后

- 那里。

- 博曼

- 他们

- 认为

- 思维

- Free Introduction

- 那些

- 三

- 通过

- 次

- 至

- 今晚

- 音

- 也有

- 工具

- 工具

- 对于

- 传统

- 转型

- 过渡

- 用户评论透明

- 治疗

- 趋势

- 引发

- 信任

- 尝试

- 谈到

- 类型

- 普遍

- 一般

- ui

- 全功能包

- 不确定

- 理解

- 理解

- 独特

- us

- 可用性

- 用法

- 使用

- 用过的

- 用户

- 用户体验

- 用户界面

- 用户旅程

- 用户

- 运用

- ux

- UX设计

- 有价值

- 折扣值

- 价值主张

- 各个

- 充满活力

- 查看

- 方法..

- 方法

- we

- 什么是

- 是否

- 这

- WHO

- 全

- 为什么

- 将

- 也完全不需要

- 工作

- 加工

- 世界

- 将

- 年

- 年

- 含

- 您

- 您一站式解决方案

- 和风网